Commercial Solar panels for large New Jersey businesses are a no brainer, as these businesses consume large amounts of electricity for lighting, temperature control, and operations. With the high amounts of energy these facilities consume electricity usage is a significant contributor to higher operating expenses. Corporate environmental, social, and governance (ESG) is also driving solar for New Jersey companies. There is an abundance of Federal and state incentives for both commercial solar panels and commercial battery storage, making it the perfect fit for commercial solar projects. After factoring in all Federal and local incentives, some businesses are paying .20 on the dollar for their commercial solar projects!

Incentives

Federal Incentives: Under the Inflation Reduction Act, New Jersey corporations can now choose in between the Investment Tax Credit (ITC) and Production Tax Credit (PTC). Direct pay options may be available for certain tax-exempt entities, and new transferability possibilities can provide increased flexibility around financing. Adders are also available if the project meets certain criteria. For more details, you may refer to the Inflation Reduction Act: Solar Energy and Energy Storage Provisions Summary provided by the Solar Energy Industries Association (SEIA).

- Investment Tax Credit (ITC): Base ITC of 30% through 2033

- Production Tax Credit (PTC): PTC currently set at $0.026/kWh, adjusted each year for inflation by the IRS

Modified Accelerated Cost Recovery System (MACRS) Business owners can depreciate solar electric systems over a five-year schedule. There is currently a bonus of 40% in year one for systems placed in service in 2025.

Renewable Energy Certificates (RECS)

The environmental attributes of solar energy are monetized through marketable units called Renewable Energy Certificates (RECs) – with a single REC created with each MWh of electricity generated.

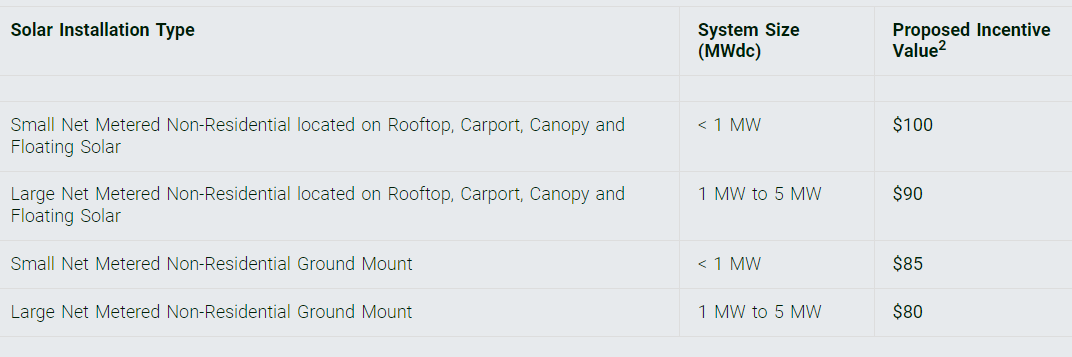

In New Jersey, RECs are valued currently in what is referred to as the Successor Solar Incentive (SuSI) program, with a fixed 15 year-long value depending on the project type and size (see table below). For example, businesses that install a large net metered solar system on their rooftop or carport receive $90 per MWh, while a large net metered ground mounted solar system only receives $80 per MWh. The NJ SuSI program funding will continue until the capacity allocation is used up, so businesses should not wait to get started with a solar investment.

Other New Jersey Incentives

Sales Tax Exemption – 100% sales tax exemption on solar equipment.

Property Tax Exemption – 100% local property tax (no state property tax) exemption.

Assessment of Farmland Hosting Renewable Energy Systems – Assesses solar on agricultural land as farmland (no change in taxes).

Cost and Performance

The cost of buying a commercial solar electric system in New Jersey can vary based on system size, location, equipment used and other factors. BCSC LLC can help your organization run a competitive RFP for a fee or provide an RFQ on a brokerage basis. If your company needs to re-roof it’s facilities prior to the solar installations, we have preferred commercial roofers to provide you a quote. Wrapping these projects into one solar EPC contract may provide additional tax savings. Be sure to discuss all tax incentives with your licensed CPA as we are not tax advisers.

Commercial Solar + Commercial Battery Storage

Commercial energy storage, or batteries, can be a great complementary technology to install with commercial solar PV. The pairing of solar PV system with energy storage is often referred to as solar + storage. With recent updates to state policies and incentive programs, combined with the potential electric bill savings and resilience benefits, solar + storage has become an increasingly attractive option for commercial property owners in New Jersey.