As the world pivots towards cleaner energy solutions, renewable diesel (RD) has emerged as a game-changer in the transportation fuel sector. A recent webinar hosted by DTN and presented by Argus Media experts Louise Burke and Jackie Reigle offered a deep dive exploration into this rapidly evolving market—revealing challenges and opportunities on the horizon.

The rise of renewable diesel

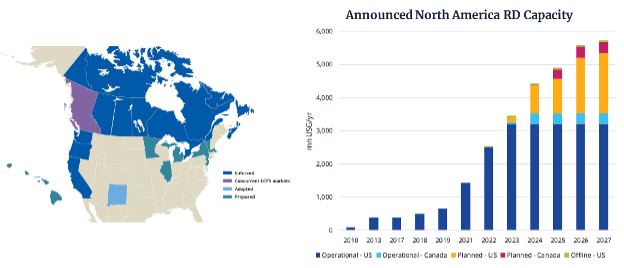

Unlike its cousin, biodiesel, renewable diesel is chemically identical to petroleum diesel making it a true “drop-in” fuel. This characteristic has catapulted RD into the spotlight—with production capacity in North America projected to reach a staggering six billion gallons annually.

Caption: Production of renewable diesel is expected to grow across North America.

California: The renewable diesel powerhouse

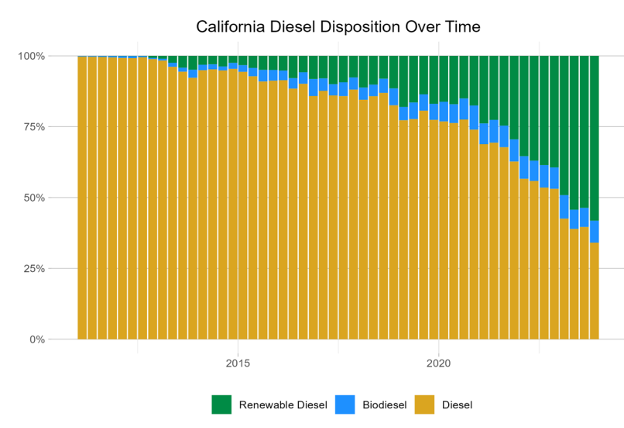

California has quickly become the epicenter of RD demand with over 50% of its diesel pool now comprised of this “cleaner” alternative. The surge has been largely driven by the state’s Low Carbon Fuel Standard (LCFS) program, which incentivizes the use of lower-carbon fuels.

However, as Louise Burke pointed out, “This is not just a domestic market.” International players, particularly from Singapore, are making their presence felt in the California market.

Caption: Over the past two decades, renewable diesel has quietly become the largest percentage of diesel fuel in California.

A complex web of incentives

The renewable diesel market is underpinned by an intricate system of federal and state incentives. The Renewable Fuel Standard (RFS), blenders tax credit, and state-level LCFS programs create a complex landscape that industry players must navigate.

Jackie Reigle highlighted the impending changes in these incentives, and particularly the transition from the blenders tax credit to a new producer tax credit in 2025, which could significantly reshape the market dynamics.

Market challenges and price pressures

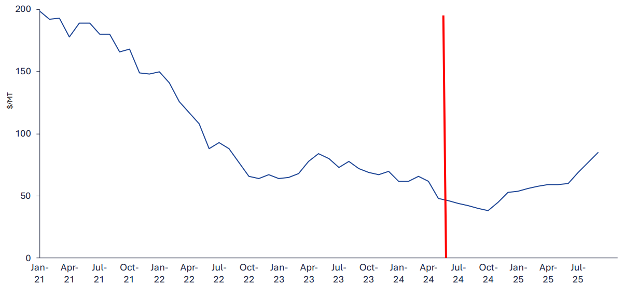

Despite rapid growth, the RD market faces headwinds. Recent declines in margins and credit values (RINs and LCFS credits) are putting pressure on producers. Vertex Energy’s recent decision to pause their RD business underscores these challenges. Conversely, Reigle expects a recovery in credit prices by 2025, offering hope for producers.

Caption: California LCFS credit price: Forecasted to begin recovering in 2025—after a four-year decline.

Logistics: The unsung hero

For many, one of the webinar’s most intriguing insights was the complex logistics involved in moving RD from production centers to key markets. The presenters detailed an intricate dance of rail lines, terminals, and pipelines required to transport RD from Gulf Coast producers to California consumers, highlighting an often-overlooked aspect of the industry.

Looking ahead

As the industry matures, new challenges and opportunities are emerging. With the expiration of the blenders tax credit in 2024 and the introduction of new policy measures, the competitive landscape will likely take new shape. Additionally, the potential expansion of LCFS-like programs to other states could open new markets for RD producers.

In conclusion, the webinar’s experts made very clear that while the renewable diesel revolution is well underway, the journey is far from over.

As Burke aptly put it, “It’s an exciting time to be in this market.” For industry participants and observers alike, staying informed about these rapidly evolving market dynamics will be crucial in the years to come.

To stay on top of RD market trends and new opportunities, discover the market information that DTN ProphetX® delivers every day.

.visualmodo-related-posts-title {

font-size:1.5rem;

border-top: 1px solid gray;

padding-top:1rem;

}

.visualmodo-related-post {background-color:#FFFFFF; }

.visualmodo-related-post:hover {background-color:#FFFFFF; }

.visualmodo-related-post:hover .visualmodo-related-post-body-title {color:#1964aa; }

.visualmodo-related-post:hover .visualmodo-related-post-body-content {color:#000; }