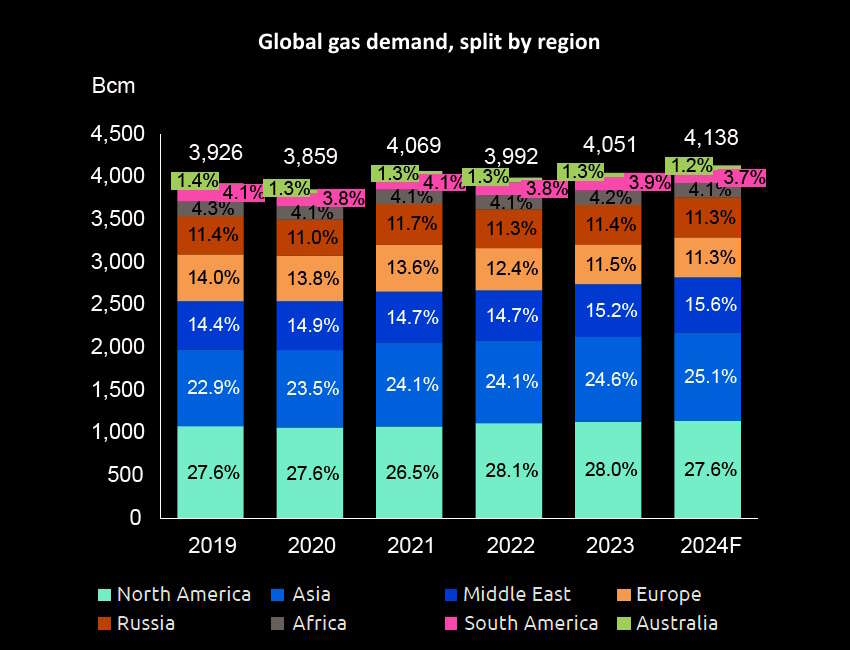

Global gas demand sustained its growth in 2023, increasing 59 Bcm (1.5%) from 2022. This trend is expected to continue in 2024 with a further estimated ~87 Bcm (2.1%) rise in demand. Asia’s strong demand growth continues to drive growth in global gas imports, while growth in exports from North America and the Middle East have been in the driving seat of the global supply growth. Although global gas markets have stabilised from record volatility and prices seen in 2022, they remain fragile as concerns about energy security persist. As 2023 became another record emissions and coal use year, it is important to highlight that shifting from coal to natural gas is a readily available, cost-effective, and affordable way to cut emissions by around 50% immediately. It is crucial to emphasize that this step should be taken alongside, not instead of, ongoing efforts to expand renewable energy, enhance efficiency, and scale up all emission-free energy sources that are technologically and economically viable.

It is also crucial to underline the importance of low-CO2 gas technologies such as biomethane, zero- and low-CO2 hydrogen, and CCUS. Currently, biomethane production is concentrated in North America and Europe, with emerging production markets in China and India. Zero- and low-CO2 hydrogen production, albeit small in scale, is poised for a rapid annual growth of 45% from 2023 to 2030, if pre-FID projects currently in the pipeline materialise. Today, both biomethane and hydrogen volumes are small, with biomethane constituting roughly 1% of global natural gas supply volume and hydrogen not yet sufficiently present in the energy use market. Similarly, CO2 capture capacity (CCUS) is set to grow by 42% annually, with 86% of the 2030 pipeline dependent on pre-FID projects.