- Last Energy Books $40 Million Series B Funding

- Data Center Demand Expected to Grow in Asia, Nuclear Reactors Will Follow

- Ghana Plans to Build a 77 MWe NuScale SMR

- Switzerland Announces Plans To Overturn Ban On New Nuclear Construction

- Russia / Pilot Fuel Elements For MBIR Research Reactor Pass Acceptance Tests

Last Energy Books $40 Million Series B Funding

Last Energy, a nuclear reactor startup based in Washington, DC, revealed this week that earlier in 2024 it booked $40 million in Series B funding for development of its 20 MWe microreactor. Prior Series A and seed funding brought total investment to $64 million since the firm was founded in 2019.

According to Matt Fossen, Vice President of Communications, Last Energy, investors for the Series B round include Gigafund, the Autodesk Foundation, and private equity capital. He added that the firm raised $20 million for our Series A, which was closed in 2021. That round was led by Gigafund with participation from Quiet Capital, Armada Investments, and David Marquardt. Seed funding was provided by First Round Capital.

Last Energy’s Series B funding will enable the company to continue expanding its team and invest in project development as it works to deploy its first plant. The firm is targeting markets in the UK and European Union countries including the Netherlands,, Poland and Romania. It has no plans, for now, to license nor offer the microreactor in the US.

In terms of market penetration for data center power needs in the UK and European Union countries, Fossen said the firm has nonbinding commercial agreements for 80 units of the 20 MWe microreactor in target markets. Of that number 39, or just under 50% of the units, are for data centers. Fossen declined to name the parties involved in these agreements with Last Energy or the maturity of the deals.

The focus on these countries will require Last Energy to establish its supply chains and sourcing of engineering and skilled trades staffs to build and deploy the microreactors at multiple locations. It would have to build a factory in the UK and at least one in the EU region.

Fossen added, “This round, our Series B, has been directed toward project development-related activities, including land acquisition and navigating the licensing and permitting processes. The funding also enables us to continue growing the team.”

Fossen told Neutron Bytes in an email the firm is particularly interested in serving the power needs of data centers.

“Our data center demand is most pronounced in the United Kingdom, where companies are looking for scalable energy solutions that can provide on-site 24/7 baseload power while putting them on a path toward decarbonization. We’re actively engaging with British regulators, including holding workshops and submitting documentation.”

In the class of “never say never,” Fossen said recent legislation passed by congress and signed by President Biden may open the door to reforms of the NRC’s licensing process. But the near term focus remains on Europe.

“Our goal is to establish a proven track record in Europe over the next few years and ultimately deploy multiple units across the continent within the 2020s. As that happens, we will continue to monitor the reforms that Congress and the NRC are implementing in the U.S. As those two processes play out, we will reassess our plans. But, in the meantime, we’ve been engaging with the NRC around Part 110 export licensing.”

In terms of time to market in the UK, and other countries, everything depends on completing the regulatory requirements of the UK generic design assessment (GDA). The Office of Nuclear Regulation (ONR) has a multi-part process that can take up to four years even for a design with off the shelf PWR type components. For instance, the Westinghouse AP300, based on the AP1000, a PWR that completed the GDA, is expected to take up to four years for the review despite being based on a previously approved reactor.

It follows that the earliest the fleets of 20 MWe PWRs Last Energy has in mind would deploy by the end of this decade and more likely in the 2030s. The company has incredibly ambitious goals, aiming to build 10,000 units in the next 15 years.

The firm plans to invest the proceeds of its Series B funding in its reactor design with plans to build two new prototypes in the next 12 months. Hiring has expanded recently with 31 new hires in past year bringing the total to 70 employees.

The firm has displayed a mock up of its 20 MW design at several trade shows. It has a web page with frequently asked questions about technical specifications addressing basic design, fabrication, and operating characteristics of the reactor. Also new on the firm’s web page are a series of fact sheets about the company, the reactor, and potential customers.

Bret Kugelmass, Founder and CEO of Last Energy, said in a press statement, “Last Energy differentiates itself within the nuclear sector by focusing all technological innovation on high throughput manufacturability, rather than the industry’s historical focus on novel reactor core physics.”

He added, “More than ever, data centers need technologies that can simultaneously provide energy abundance, ensure energy security, and enable decarbonization.”

Ryan Macpherson, Director of Climate Innovation & Investment at the Autodesk Foundation, said, “We are excited to support Last Energy as they trailblaze a new era in clean and reliable energy. By drastically simplifying the design-construction-operations process, leveraging technology and talent from Autodesk, Last Energy’s approach to micro-modular nuclear power has the potential to fundamentally change how we think about energy production — offering a rapid, scalable, and economically viable solution to decarbonize heavy industry.”

About Last Energy and Its Reactor

Last Energy is a spin-off of the Energy Impact Center, a research institute devoted to accelerating the clean energy transition through innovation. Its small modular reactor (SMR) technology is based on a pressurized water reactor (PWR) with a capacity of 20 MWe or 60 MWt. Power plant modules would be built off-site in a factory and assembled in modules.

A Last Energy plant, referred to as the PWR-20, is comprised of a few dozen modules that, it says, “will snap together like a Lego kit.” The PWR-20 is designed to be fabricated, transported, and assembled within 24 months, and is sized to serve private industrial customers.

The firm may find it necessary tighten up its production schedule if it wants to build in fleet mode. Claiming factory production as a competitive factor requires proof that the production facility has the inventory of components on hand and the throughput of production of finished units to keep customers happy.

Under its development model, Last Energy owns and operates its plug-and-play power plant on the customer’s site, bypassing the decade-long development timelines of electric transmission grid upgrade requirements.

The placement of the microreactors on a data center site, adjacent to it, or connected by private wire may turn out to be a gold standard for microreactors and SMRs given the tangled red tape that ties up new grid capacity in bureaucratic knots not only in the US but also in the UK and EU countries. People want their power but NIMBY values clash with keeping the lights on and the bits and bytes flowing in an increasingly digitized world.

The Competitive Landscape for Microreactors

Speaking to the issue of competition from wind and solar power projects to provide power to data centers, Fossen said, “Microreactors offer a significantly higher energy capacity than renewables at a lower cost, with minimal land requirements, and without any of the necessary investments in storage capabilities.”

Last Energy is positioned in a highly competitive sector of the nuclear startup world. The US Defense Department’s Project Pele intends to deploy a fleet of transportable advanced nuclear reactors for military applications. Eventually, the Project Pele designs will also find their way to the commercial side of the industry. Separately, there are more than a dozen microreactor startups globally working to reach the market segment of 1-25 MWe of power.

Last Energy literally stands alone in terms of being a light water design in the microreactor class. There are no PWRs in this power range listed in the IAEA ARIS DBMS.

Almost all the other microreactors under development globally and especially in the US, are advanced designed which require special fuels, e.g., HALEU, TRISO, etc. at enrichment levels of 9-19% U235. A short list includes BWXT, Radiant, Ultra Safe, Oklo, Aalo, and Westinghouse (eVinci). Sourcing of HALEU fuels has become a bottleneck for deployment of some of these designs.

By comparison, the PWR-20 uses low-enriched uranium (LEU), the industry’s most widely utilized and readily available fuel, sourced from a standard fuel supply chain. The reactor will use industry-standard uranium dioxide (UO2) pellets in a 17×17 configuration, enriched up to 4.95%.

In the US, Oklo in California is one of the leading firms with a new sodium cooled, HALEU fueled, design that is planned to scale from 15-50 MW depending on customer requirements. The firm has booked a nonbinding order with a data center among others.

Another recent entry is Aalo based in Austin, TX, which recently announced it raised $27M in Series A funding from US equity investors. Also, Earth VC, based in Vietnam, announced a $6 million investment in the Series A funding for Aalo Atomics’ in a $27M funding round, bringing the total raised by Aalo to over $33M.

Both Oklo and Aalo are working on plans to build first of a kind units at the Idaho National Laboratory. Oklo plans to acquire its HALEU fuel from the legacy materials fabricated for EBR-II. Oklo also has a fuel contract with CENTRUS that includes building one of its reactors at the firm’s uranium enrichment plant to provide power for it. The Department of Energy has a contract with CENTRUS for HALEU fuel which is in production.

& & &

Data Center Demand Expected to Grow in Asia,

Nuclear Reactors to Power Them Will Follow

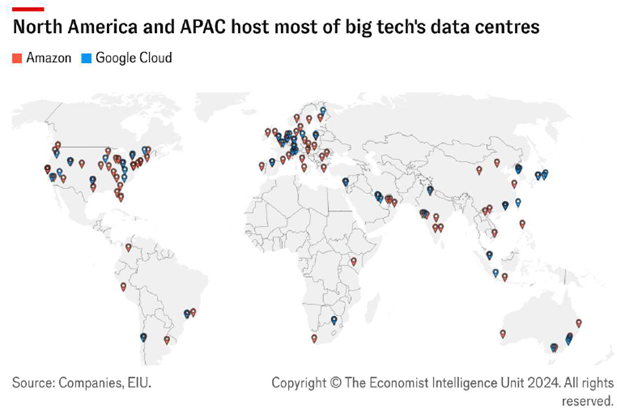

The Economist Intelligence Unit (EIU) released an analysis this month on the impact of data centers. The analysis includes a map that identifies cities that will become the next data center hotspots for big tech and outlines expectations for the policy landscape.

The Economist Intelligence Unit (EIU) released an analysis this month on the impact of data centers. The analysis includes a map that identifies cities that will become the next data center hotspots for big tech and outlines expectations for the policy landscape.

In response to an inquiry from Neutron Bytyes, the EIU said that for SMR developers, the word is go east to Asia because the nations and mega cities there have huge demands for data centers. It follows that their economies will lean toward affordable SMRs rather than the big iron of 1,000 MW reactors.

Key points of the EIU report include:

- Data centers will exert more pressure on national grids as AI usage increases

- Data center companies look for three things when they invest: reliable power, land availability and data policy

- Big tech’s investment plans show that most of the new data centers will be built in Asia (the report identifies cities)

Data Centers Worldwide

Image: The Economist Intelligence Unit. Used by permission.

According to the EIU report, the exploration of nuclear energy supply for data centers in Asia is at a very nascent stage. This also reflects the first few announcements the EIU has recorded in the West where big tech has only just begun signing long-term power purchase agreements with nuclear energy suppliers. According to the EIU, Asia will lead the nuclear energy revival.

According to the EIU report, new data center construction will take place in Singapore, Hong Kong, China, South Korea, Japan, India, and Australia. In addition to these expansion plans, the EIU report said new data center infrastructure is expected to be built in Thailand, Malaysia, Taiwan, and New Zealand. Some of the mega cities in South East Asia are reported to be offering subsidies to data centers to build energy efficient facilities and along with them is pressure to get off fossil fuels to provide the power. Nuclear energy is one obvious answer to this need.

Following close behind Asia, the EIU report noted that Israel, the United Arab Emirates (UAE), and Saudi Arabia are major hubs for data centers. The UAE and Saudi Arabia are investing billions in development of artificial intelligence businesses and facilities to support them. Microsoft has a major contract with Saudi Arabia to build a new data center.

Data Center hotspots in Europe are Germany, Spain, Norway, and Sweden. In South America Brazil and Chile are the leading markets for data centers. In Africa Nigeria and Kenya are the data center hot spots.

The EIU notes that companies will sign long-term power purchase agreements (PPAs) around clean energy projects to reduce reliance on the grid and comply with emissions policies

The adoption of nuclear power to fuel data centers, in particular via the small modular reactor approach, will require capital that deep-pocketed tech companies can offer. Currently data centers in the West, North America being the biggest market, are more likely to become testing grounds in the early days.

It is unknown how much capital the massive IT platforms of Google, Amazon, Microsoft, Facebook and others will be willing to commit to fund SMRs to power data centers. These firms have made it clear in the US that while they want to see SMRs being built to power data centers, they don’t want to pay for them.

EIU Report:“Big Tech Will Expand Data Center Capacity in Asia

This analysis was produced by the Economist Intelligence Unit (EIU), the research arm of The Economist. Its production was led by the EIU’s Technology & Telecoms analysts including Laveena Iyer.

& & &

Ghana Plans to Build a 77 MWe NuScale SMR

Ghana nuclear power plant owner/operator Nuclear Power Ghana and U.S. nuclear technology project developer Regnum Technology Group, with offices in Ashland, OR, have reached an agreement to deploy a single NuScale VOYGR-12 small modular reactor plant in Ghana to deliver clean, reliable electricity.

Ghana nuclear power plant owner/operator Nuclear Power Ghana and U.S. nuclear technology project developer Regnum Technology Group, with offices in Ashland, OR, have reached an agreement to deploy a single NuScale VOYGR-12 small modular reactor plant in Ghana to deliver clean, reliable electricity.

The two companies plan to form a subsidiary company in the near future to own and operate Africa’s first commercial advanced light-water small modular reactor plant.

The press statement about the project did not indicate a timeline for licensing and development nor how the single SMR would be financed by Nuclear Power Ghana. The country’s finances are affected by inflation, poverty, and youth unemployment. Key challenges for the project are establishing a reliable supply chain and hiring a qualified workforce for the project.

Yet, confidence in the SMR effort seems to be present in abundance even if it is for only one unit. NuScale usually markets its SMR in multiples of 4, 6 or 12 units.

Robert Sogbadji, deputy director for power in charge of nuclear and alternative energy, said in a press statement last May that Ghana aims to add about 1,000 MWe of power from nuclear to its electricity mix by 2034. Sogbadji said the government has already secured a site with capacity to accommodate up to five reactors. He added that it would prefer a “build, own, operate and transfer” arrangement with room for local equity holding.

“Signing this agreement will position Ghana as a leader in the deployment of small modular reactors in Africa, catalyzing economic development and job creation in the region,” said Under Secretary for Arms Control and International Security Bonnie Jenkins.

“Ghana and many other African countries are pursuing nuclear energy to achieve their economic development, energy security, and decarbonization goals,” said Deputy Assistant Secretary for International Cooperation Aleshia Duncan.

“It’s imperative that the United States remain a strong and engaged partner, offering technical expertise and resources to ensure the successful deployment of nuclear energy across the continent.”

In a press statement the U.S. State Department said the NPG-Regnum agreement builds on existing U.S.-Ghana civil nuclear cooperation, including under the U.S. Foundational Infrastructure for the Responsible Use of Small Modular Reactor Technology (FIRST) Program that is helping Ghana to establish itself as a SMR Regional Hub and center of excellence.

In addition to technical training, advisory services, and study tours, the FIRST Program is providing a NuScale Energy Exploration (E2) Center SMR control room simulator to serve as a regional training center for nuclear power technicians and operators and is establishing a welding certification program to support jobs and supply chain development for the region. Through this dedicated workforce development focus, Ghana will be positioned to establish a skilled nuclear workforce.

& & &

Switzerland Announces Plans To Overturn Ban On New Nuclear Construction

(NucNet) The Swiss government said on August 28th it plans to overturn a ban on building new power plants as part of efforts to strengthen domestic energy supplies at a time of increased geopolitical tension and population growth. Energy minister Albert Rösti said the government would submit a proposal to amend nuclear legislation by the end of 2024 so it can be debated in parliament next year. The public would have to vote in a referendum.

“Over the long term, new nuclear power plants are one possible way of making our supply more secure in a geopolitically uncertain time,” Rösti told a press conference.

Despite a long tradition of nuclear power production, Switzerland voted in 2017 to ban construction of new nuclear power plants. That law was initiated after the 2011 Fukushima-Daiichi nuclear accident in Japan. However, there is no clear timetable for shutdowns and its four nuclear units can remain operational as long as deemed they meet legal safety requirements. Switzerland’s nuclear operators have said they are considering keeping nuclear plants in use longer than previously expected over fears of electricity shortages.

Rosti said that since 2017, the situation on the electricity market has “changed radically. He said new nuclear power was “not an option in the short or even medium term. But to be ready, if it is necessary in the long term, in the next 15 years I would say, we must start now.”

“We are not saying that in 10 years there will be a new power plant… but we are responsible for leaving the door open to all possible technologies,” Rösti said, stressing that if the process was not initiated now, it will “perhaps be too late in 20 years.”

The move was welcomed by the Swiss Nuclear Forum, which said the lifting of the ban on new nuclear power plants would mark an important step towards a safe and climate-friendly electricity supply.

But the industry group said, “this step alone is not enough. Simplifying the approval procedures and legal certainty during the planning and construction phase are also necessary in order to make new construction projects in Switzerland possible again.”

The forum said certainty with regard to the legal framework is important for potential investors. Constantly changing requirements during the planning and construction phase lead to high additional costs and delays.

“Lifting the ban on new construction also supports the long-term operation of existing nuclear power plants, as intact supply chains are maintained and investments in training and research continue.”

Forum president Hans-Ulrich Bigler said: “The lifting of the ban on new construction is long overdue and a step towards greater technological openness. It gives Switzerland more room for maneuvers in terms of [energy] security of supply and climate protection.”

Switzerland has four commercial nuclear plant units: Beznau-1, Beznau-2, Gösgen and Leibstadt. They provided 36% of the country’s electricity in 2022, according to International Atomic Energy Agency data.

& & &

Russia / Pilot Fuel Elements For MBIR Research Reactor Pass Acceptance Tests

- Generation IV nuclear unit scheduled for completion in 2026

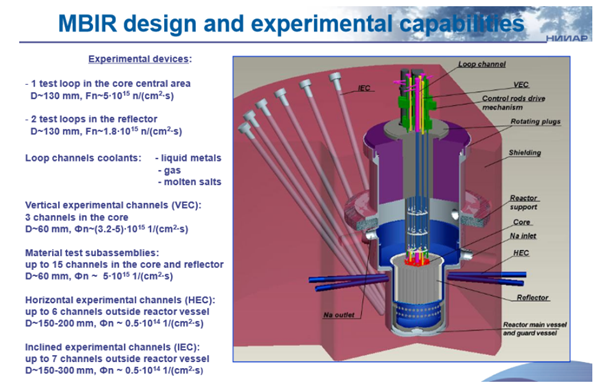

(NucNet) Pilot fuel elements for the Generation IV MBIR multipurpose fast neutron research reactor under construction in Russia have passed acceptance tests, allowing state nuclear corporation Rosatom researchers to move on to production of fuel for the initial loading of the reactor core.

Rosatom said the pilot fuel elements had been manufactured by researchers in the fuel technology department of the Research Institute of Atomic Reactors (NIIAR), part of its scientific division. The MBIR will primarily use sodium as a coolant and vibro-packed mixed-oxide (VMOX) fuel. VMOX is a Russian variant of MOX fuel in which blended uranium-plutonium oxide powders and fresh uranium-oxide powder are loaded directly into the cladding tube of the fuel assembly instead of first being manufactured into pellets.

The MBIR is being built at NIIAR, in Dimitrovgrad, about 600 miles due east of Moscow, as part of a Russian government program to develop nuclear science and technology. It is scheduled for completion in 2026 and physical startup for 2027.

Conceptual rendering of the MBIR. Image: Rosatom

The reactor will be used for the development of materials for Generation IV fast neutron reactors. Scientists will use it for experiments on the operating parameters of core components under normal and emergency conditions when using sodium, lead, lead-bismuth, gaseous and molten salt coolants.

According to earlier reports, the total cost of the project could be up to $1.5bn (€1.35bn), but no recent figures have been made public.

US Falls Behind in Access to Research Reactors

The US squandered its opportunity to compete head-to-head with the Russian initiative by cancelling all funding for the Versatile Test Reactor (VTR). The reason is the US still needs the VTR and its testing capabilities to certify that advanced fuels, materials, sensors, and components will work in the demanding conditions that these commercial nuclear plants with advanced designs are designed to operate in. There is no other way to do it. Self-certification either directly or with fuel and component vendors, is not a viable strategy.

Real-time measurements and post-irradiation examination techniques will provide valuable information on how fuels, materials, components and instrumentation withstand the extreme conditions inside nuclear power plants. This is crucial information needed to design, license, and build successful implementations of advanced nuclear reactors.

Congressional penny pinching is turning out to be pound foolish. While some in Congress have pointed to the funding provided for the Advanced Test Reactor at the Idaho National Laboratory, together with defense related commitments, and a backlog of requests by US nuclear technology developers, some firms have gone to Europe to test fuels and materials. This is not a sustainable strategy for US firms to achieve timely competitive technology advantage in global markets.

# # #