Hate paying that expensive monthly energy bill? You’re not alone.

Over the past year nearly 33% of United States households had to forego basic necessities to pay energy bills, and nearly 25% couldn’t keep their home at a safe temperature because of high bills.

Most Americans have been shocked by electricity bills in recent years, especially during record heat waves when air conditioning is a necessity.

The culprit is fossil fuels, and the climate change impacts they create. New Energy Innovation research shows volatile natural gas prices, uneconomic coal plants, and the cost of hardening our power grid against extreme weather are primary reasons electricity bills keep rising.

Utility business models that reward large investments even when they’re more expensive for customers aren’t helping — 2023 was the most profitable year in the last decade for investor-owned utilities.

Fortunately, clean energy’s fast-falling prices can lower bills. States with the highest increases in wind power and solar energy since 2010 — Iowa, Kansas, New Mexico, Oklahoma, and Texas — have all seen customer rates rise slower than inflation because they reduced exposure to fossil fuel costs.

Government officials and utility regulators must protect customers from electricity price spikes and ensure households don’t have to choose between groceries and paying their bills. Clean energy can help, along with smart utility reform that prioritizes customers.

Electricity bills are on the rise. Clean energy prices aren’t.

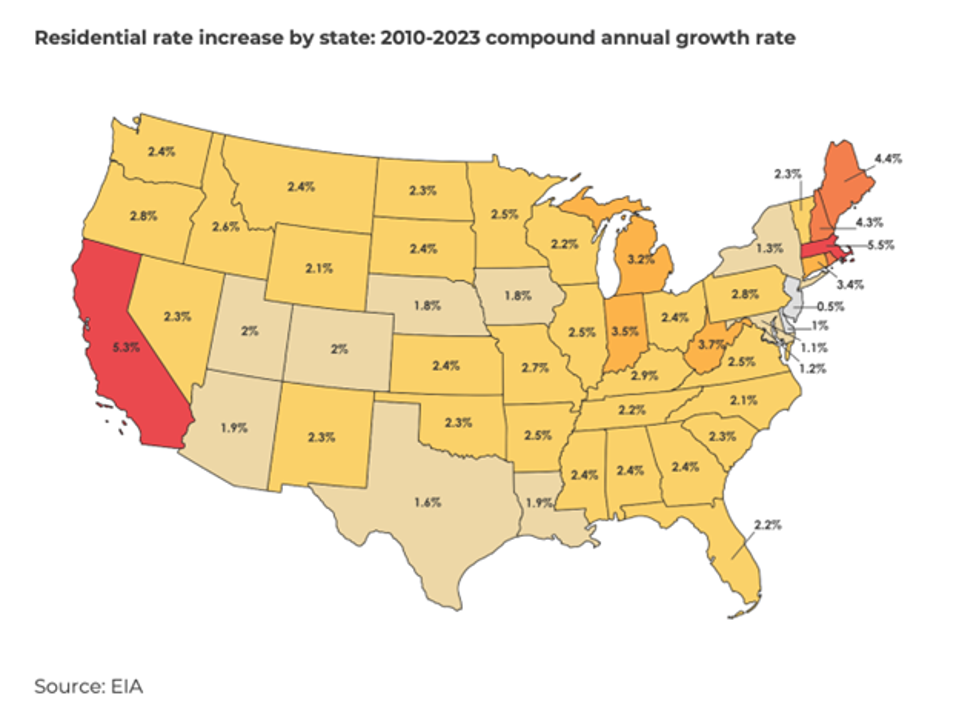

Rising bills unfortunately aren’t a new problem. Since 2010 the consumer price index, which measures economywide prices for goods and services, has risen 40% – over that same time the average U.S. residential customer’s electricity rates have also risen nearly 40%.

However, the average U.S. residential electricity consumer’s bill has only risen 24%, significantly lower than inflation. This difference is largely due to increasing energy efficiency and rooftop solar deployment in individual homes and businesses, as well as fast-falling clean energy prices.

Over the past decade solar energy prices have fallen 90%, wind energy by 70%, and batteries more than 90%. By 2030 solar prices are expected to fall another 30%, wind by 20%, and energy storage by 25% according to the National Renewable Energy Laboratory.

That’s showing up in most of the states leading in clean energy deployment, where electricity rates rise below the rate of inflation.

Consider Iowa, where wind energy increased from 15% of the state’s total electricity mix in 2010 to nearly 60% in 2023. Over that time average residential electricity rates only rose 1.8% per year, slower than 42 other states.

Or ruby-red Texas, where researchers estimate soaring wind and solar energy deployment reduced wholesale electricity costs by $31.5 billion between 2010-2022, and by $11 billion in 2022.

So, if clean energy is keeping electricity affordable, what’s behind the big price spikes overall?

Volatile natural gas prices drive dangerous electricity cost increases

Unlike wind and solar, which essentially produce power for free after they’re built and get cheaper as their technologies improve, natural gas generation depends on inherently volatile commodities whose price swings on geopolitical conflicts, extreme weather, and boom-and-bust supplies.

Because natural gas is traded on a global market and sellers seek the highest possible prices, even “American energy independence” doesn’t protect consumers. When Russia invaded Ukraine in 2021, Europe scrambled to replace Russian gas supplies and U.S. suppliers sent gas abroad, quadrupling domestic natural gas prices within months.

This volatility impacts every part of the economy – soaring fossil fuel costs caused a third of recent U.S. inflation.

In fact, increasing liquefied natural gas exports from the U.S. to international markets could increase consumer gas prices up to 14% per year, and approving all pending LNG export terminals could increase natural gas costs for U.S. households, businesses, and industry by up to $18 billion per year.

Massachusetts, which has suffered the country’s largest electricity rate increases since 2010 at nearly double the rate of inflation, is the poster child for how natural gas affects consumer costs. In 2023, 64% of the state’s electricity generation came from gas, and significant gas price spikes in 2010-2014 and 2021-2022 increased retail electricity prices.

In North Carolina, natural gas price spikes drove 46-67% of Duke Energy’s total residential electricity bill increases since 2017. In Oklahoma, Winter Storm Uri pushed natural gas prices past $300 per MMBtu, more than 100 times higher than normal prices, and regulators approved $4.5 billion in higher utility rates for consumers.

The list goes on and on.

Expensive coal plants mean expensive electricity bills

And then there’s coal-fired power plants. Even though coal hit a record-low 15% of total U.S. electricity supply at the end of 2023, it’s still costing consumers billions.

99% of America’s remaining coal plants cost more to keep running than replacing them with new local wind and solar, and swapping in clean energy for uneconomic coal would save enough money to finance more than 150 gigawatts’ worth of energy storage – roughly ten times total planned and operational utility-scale battery capacity as of 2023.

But many utilities ignore the economic reality of coal power. Instead of paying off these clunkers they’re investing new capital to keep the plants running, increasing utility debt on increasingly uncompetitive assets, and forcing customers to bear the costs.

RMI reports the average amount owed on remaining coal plants per increased from $560 per kilowatt of capacity in 2010 to $745 per kW in 2020. These sunk costs and a rate of return for utility investments are added into the bills that electricity customers pay.

Running coal plants when cheaper power is available from other sources has cost consumers more than $17 billion since 2015, hitting states that rely on coal. In West Virginia, residential electricity rates rose more than twice as fast as rates for other customers and state regulators have pushed utilities to make significant investments to keep the state’s coal plants online – at consumers’ expense.

Climate change is accelerating extreme weather, raising grid costs

The cost of climate change is hiding in plain sight on our electricity bills. Power generation costs have remained flat or fallen over time, but that’s more than offset by the cost of wildfires and rising grid infrastructure costs to deal with extreme weather.

Since 2010 the cost of maintaining existing power lines, hardening the grid’s resilience against extreme weather, and meeting growing demand has risen from 20% of total utility electricity revenue requirements to 33%. Most of this investment isn’t going toward expanding the grid to cut costs and increase reliability. Instead, we’re fixing what’s broken and upgrading local power lines.

Wildfires are hitting electricity customers hard, especially in California. Even though it’s one of the country’s leading clean energy states, wildfire-related costs including grid investments, vegetation management, and insurance have grown to 16% of total electricity costs paid by customers of the state’s three primary investor-owned utilities.

States across the Western U.S. suffering from wildfires, extreme drought, and rising temperatures like Colorado, Oregon, and Texas face similar challenges. Texas already has the second-highest wildfire risk of any state after California and will be the most at-risk state by 2050. And climate change could increase nationwide grid infrastructure impacts and costs by up to 25%.

High electricity costs can be cut through utility business model reform

Across the U.S., utilities earn a regulated rate of return on capital investments, paid for by customer electricity bills. This rewards utility shareholders and management for making large capital investments that ignore cheaper alternatives.

For instance, a utility can earn more by doubling down on an uneconomic coal plant or purchasing top-of-the-line equipment for a substation than by investing in energy efficiency or a portfolio of distributed energy resources that obviate the need for that large investment.

Those high regulated returns compound external factors like expensive fossil fuels and extreme weather impacts, but it doesn’t have to be that way.

Utility regulators and government officials can protect consumers from unnecessary costs with smart policy like competitive procurement of power supplies, getting more out of the existing grid by reconductoring existing transmission lines, refinancing coal debt, or sharing power supplies across a larger region.

Clean energy costs keep falling, and deploying more renewable energy can cut costs, cut exposure to volatile fossil fuel prices, and cut the fossil fuel emissions that accelerate extreme weather.

Americans don’t have to bear the burden of high power prices if utilities and their regulators address the root causes of skyrocketing electricity bills.