In June, the Energy Institute released the 2024 Statistical Review of World Energy. The Review provides a comprehensive picture of supply and demand for major energy sources on a country-level basis. Each year, I do a series of articles covering the Review’s findings.

In two previous articles, I discussed the trends in global carbon dioxide emissions, as well as the overall highlights of the Review. Today, I want to cover the production and consumption of petroleum.

Defining Oil

The Review lists several categories of oil production. When the Energy Information Administration (EIA) reports U.S. oil production, they are reporting crude oil plus lease condensate. The latter consists of light liquid hydrocarbons recovered in the field at natural gas wells. These are mostly hydrocarbons in the gasoline and higher range, and they normally enter the crude oil stream after production.

Another category that may be lumped into oil production is natural gas liquids (NGLs). These are hydrocarbons that are separated at natural gas processing plants. These hydrocarbons do overlap with the lease condensate hydrocarbons, but they include lighter hydrocarbons like ethane, propane, and butane, whereas lease condensate consists of primarily pentane and higher hydrocarbons.

The Review reports oil production as the total of crude oil, lease condensate, NGLs, and oil sands. However, they report a separate category of crude oil plus condensate, which would be consistent with the EIA’s definition of oil production. The differences in definitions are why the oil production numbers and oil consumption numbers may seem inconsistent.

Overview

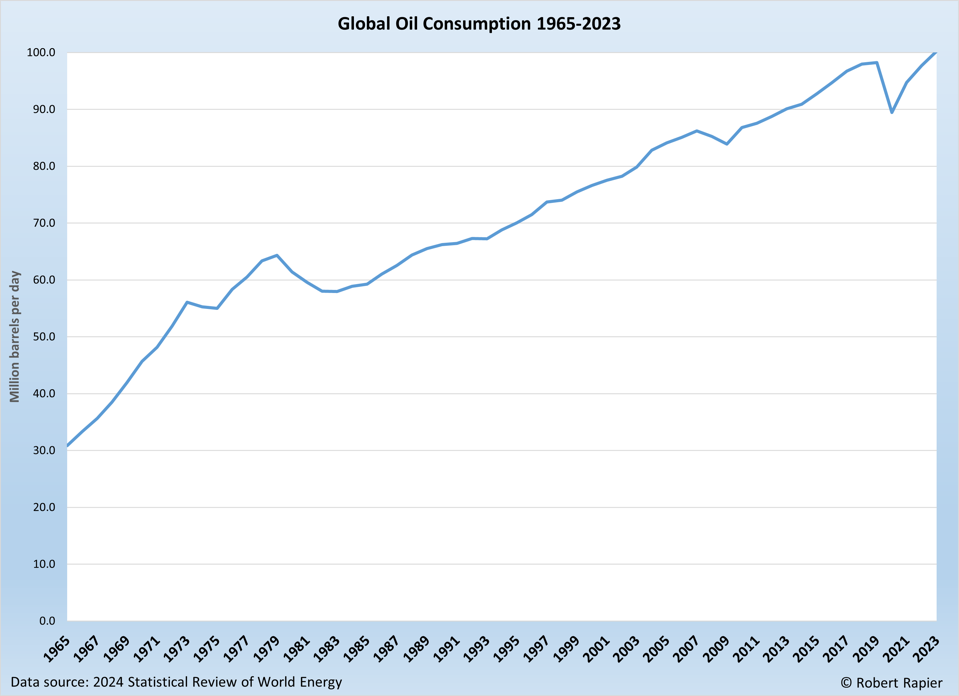

For the first time, global oil consumption surpassed 100 million barrels per day in 2023. The demand for gasoline, diesel, and kerosene has returned to or exceeded pre-2019 levels, although there are variations across different regions. Global gasoline consumption slightly exceeded its pre-COVID level at 25 million barrels per day, while kerosene, despite showing strong growth of 17.5% in 2023, has not yet returned to its peak levels from 2019.

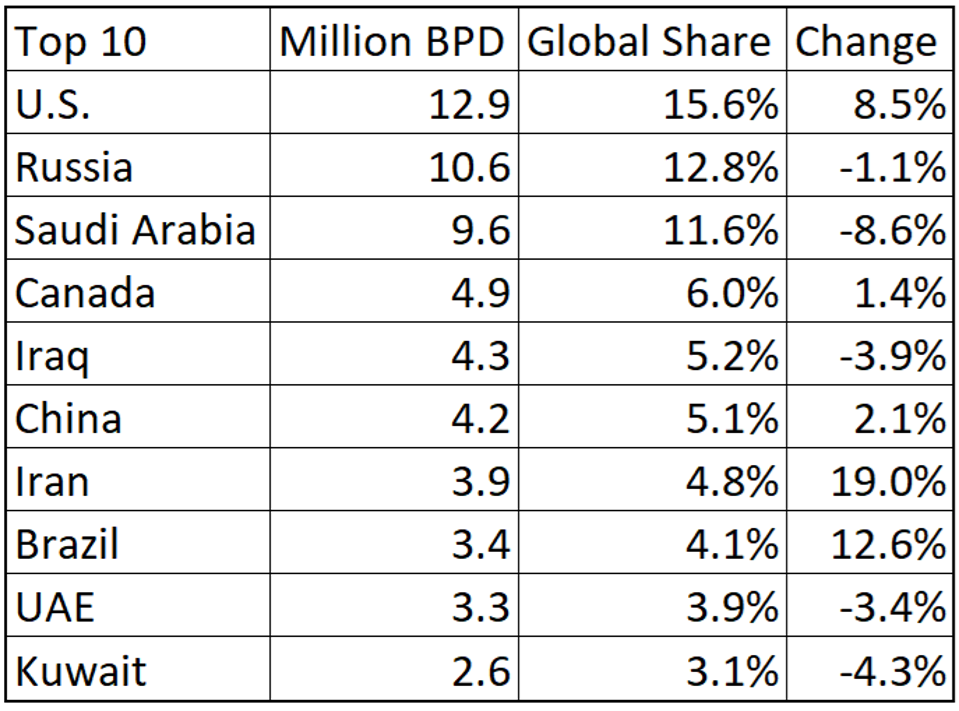

Global oil production reached a record high of over 96 million BPD in 2023. The United States retained its position as the top producer, with an output increase exceeding 8.5%. This was a new record for U.S. oil production, smashing the previous record set in 2022.

However, Russia experienced a decline in production by more than 1% due to the ongoing impact of international sanctions. Saudi Arabia, the other major global oil producer besides the U.S. and Russia, experienced an 8.6% decline from the previous year. This was attributed to ongoing voluntary production cuts from OPEC members.

The Southern and Central American regions saw significant growth in their oil production, with an 11% increase, marking the highest growth rate of any region in the year as they continued to recover from the effects of the COVID-19 pandemic.

In the Asia-Pacific region, China’s oil production grew by 2%, contributing to about 57% of the total production in the region. China surpassed the U.S. as the largest oil refining market by capacity, reaching 18.5 million barrels per day, although its refinery utilization rate of nearly 82% was still lower than the U.S. rate of around 87%.

The Top Producers

In both the conventional categories of crude plus condensate — as well as the category that includes NGLs — the United States was the world’s top oil producer in 2023. The U.S. produced 15.6% of the world’s oil in 2023, extending its lead over Saudi Arabia and Russia.

Here were the Top 10 producers of crude oil plus condensate in 2023:

“Change” reflects the percentage change from 2022.

The countries in the Top 10 are the same as a year ago.

Although the U.S. enjoys a lead over Saudi Arabia and Russia of more than 2.4 million BPD, that lead is far greater when NGLs are considered. With NGLs included U.S. production in 2023 was 19.4 million BPD. That’s 8.0 million BPD ahead of Saudi Arabia and 8.3 million BPD ahead of Russia’s numbers in that category. Those are massive leads driven by the increase in U.S. natural gas production over the past two decades, which substantially boosted U.S. NGL production.

The Top Consumers

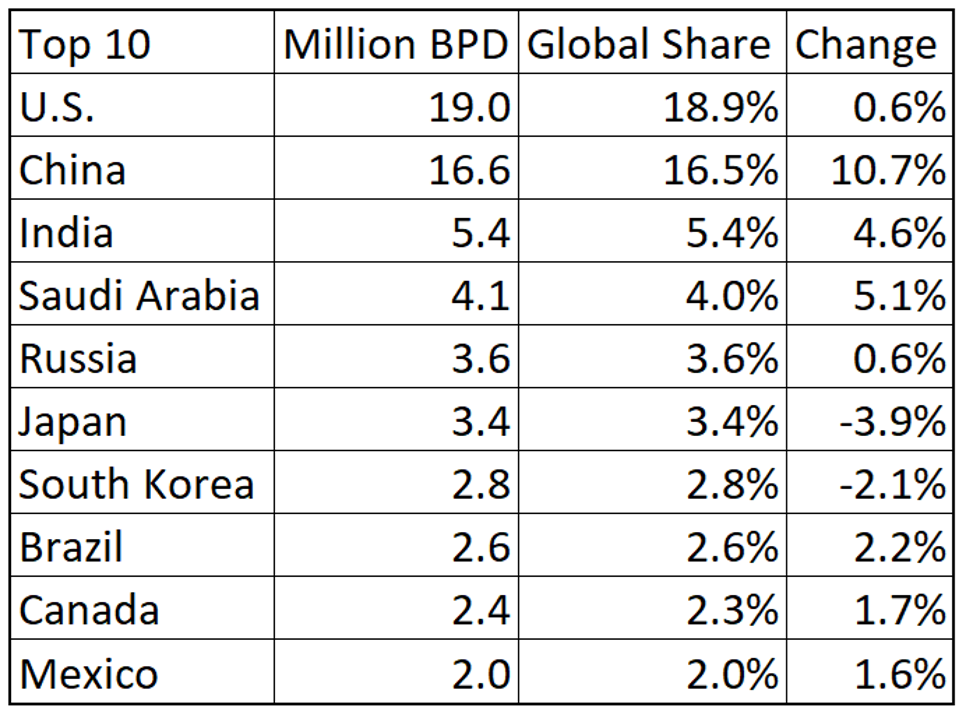

The United States also remained the world’s top oil consumer, averaging 19.0 million BPD in 2023. China was second at 16.6 million BPD, after a double-digit percentage increase from 2022.

The countries listed are the same as in 2022. On average, these countries increased consumption by 2.1% over 2022.

Crude Prices Abate

The Review reported that Brent crude prices averaged $82.64 per barrel in 2023, and West Texas Intermediate (WTI) averaged $78.88. Both prices were nearly 20% below the 2022 average but were still elevated when compared to average annual prices over the past decade.

Conclusions

The 2024 Statistical Review of World Energy highlights an ongoing shift in oil production and consumption patterns worldwide. Notably, global oil consumption hit a new peak of over 100 million barrels per day in 2023, driven by the recovery in demand for gasoline, diesel, and kerosene post-pandemic.

In terms of production, the United States continues to lead, setting a new record and outpacing other major producers like Saudi Arabia and Russia. Russia’s output decreased due to international sanctions, while Saudi Arabia experienced a decline linked to OPEC’s voluntary production cuts.

China’s increasing dominance in the Asia-Pacific region’s oil production and refining capacity further underscores the dynamic changes in the global energy landscape.

Global oil prices pulled back substantially in 2023, after soaring in 2022.

The U.S. remains at the forefront of oil production, bolstered by its substantial natural gas liquids output. However, the shifting dynamics, such as China’s rise in refining capacity and the impact of geopolitical factors on countries like Russia, highlight the ongoing challenges and opportunities within the oil sector.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook