The U.S. shale revolution is changing the energy picture in our country, but also impacting crude oil, natural gas liquids (NGL), and natural gas supply and prices worldwide. The combination of horizontal drilling with hydraulic fracturing to unlock hydrocarbons from tight rock has made a huge impact.

Perhaps an overlooked collateral benefit to the U.S. of this development is the impact on the domestic petrochemical industry, capital investment, and economic growth.

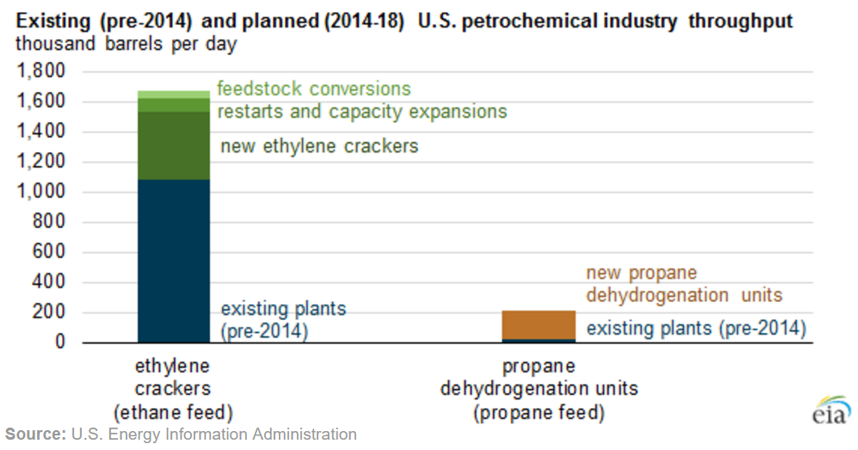

Per the U.S. Energy Information Administration, U.S. petrochemical capacity expansion projects are projected to increase domestic demand for ethane by nearly 600,000 barrels per day (BPD) and propane by nearly 200,000 BPD. This increased economic activity is due to the increasing supply of U.S. NGL and its price competitiveness in the world market.

The increased NGL supply, lower-priced petrochemical feedstock, and low energy (natural gas) prices are a direct result of horizontal fracking to increase the natural gas supply in the U.S.

Why is this important to the U.S. economy? Similar to my article, “Why U.S. Crude Exports Make Cents”, the U.S. is once again using its technical and logistical expertise in petrochemical feedstock production, and price advantage to generate higher-value products for export. My crude export article link is https://www.linkedin.com/pulse/why-us-crude-exports-make-cents-ron-miller-pe-mba?published=t

The ability of the U.S. to produce a reliable supply of reasonably-priced petrochemical feedstock positions it to export higher-value finished products into the international market at a competitive advantage.

The low-priced ethane available in the U.S. is a key strategic advantage over international competitors who use the higher-priced, crude-based naphtha as a feedstock. This advantage increases the crack spread (the margin received from processing ethane into ethylene), thus incenting increased plant investment in the U.S. Consequently, U. S. ethylene plant economically compare favorably to the lowest cost Middle East plants.

Despite efforts to use energy more efficiently and to generate more renewable energy, the products such as plastics, fibers, resins, and a wide range of other consumer and industrial materials come only from petrochemical production plants.

With more “wet” natural gas being produced in the U.S. due to the shale gas revolution, the “wet” liquids entrained in the natural gas is separated to produce relatively-inexpensive petrochemical feedstocks such as ethane and propane.

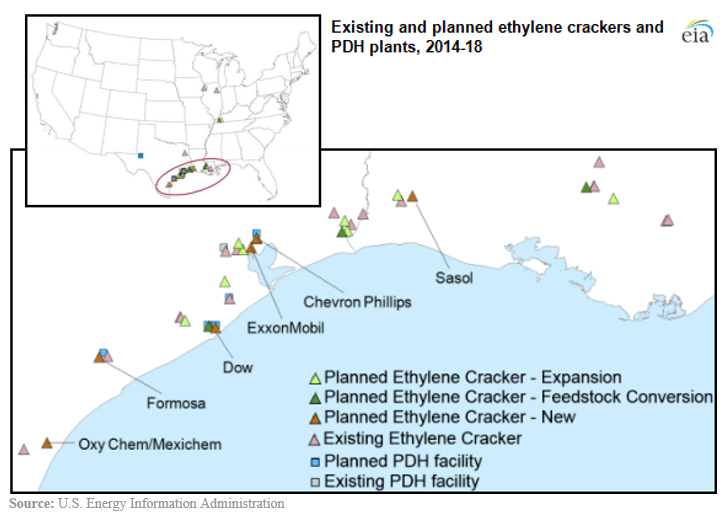

Several new ethylene projects are already underway, (Dow, ExxonMobil, Chevron Philips, and OxyChem / Mexichem) while another two (Formosa and Sasol) are going through the approval process.

These plants will increase U.S. ethylene production by 40% to a total of 37 million metric tons per year, or more than 20% of worldwide ethylene.

Similarly for propylene, the increased supply of U.S. propane and its low prices act to increase the propylene-propane price spreads and leads to new propane dehydrogenation (PDH) plants which produce propylene. Six new U.S. PDH projects are in the development stage with an increased propane demand of 200,000 BPD.

The planned ethylene and PDH plants for the U.S. Gulf Coast are shown below.

Additionally, increased ethylene capacity could be added in the U.S. by foreign firms as they realize the American value in: 1) low-priced ethylene feedstocks, 2) feedstock and ethylene storage capacity, and 3) favorable logistics to the export market. This new investment in U.S. plant facilities could total between 10 and 20 million metric tons per year.

The new investment already underway or planned represents an investment in the U.S. is over $18 billion. After this initial group of new plants comes online around 2018, the foreign-owned petrochemical company investment would represent an incremental capital infusion in U.S. assets.

Due to ethane availability from the Marcellus shale in the Pennsylvania, Ohio, and West Virginia, Shell has announced a new ethylene plant in Pennsylvania.

I welcome your comments and questions, and the opportunity to assist you with your energy questions and concerns. I am the principal at Reliant Energy Solutions LLC, a Certified Energy Manager, and can be reached at ron@reliantenergysolutions.com, or at www.linkedin.com/in/ronmiller10.

Copyright © December 2016 Ronald L. Miller All Rights Reserved