Posted on May 11, 2024 by djysrv

- Terrestrial Energy Inks MOU with Schneider Electric for Data Centers

- OPG Expects Nuclear Construction on 1st SMR to Start in 2025

- Aalo Atomics and DOE sign Siting MOU at INL

- NANO Nuclear Energy Announces Initial Public Offering

- Radiant Inks MOU with Idaho Mining Firm

- UK to Build Urenco HALEU Nuclear Fuel Plant by 2031

Terrestrial Energy Inks MOU with Schneider Electric for Data Centers

- Terrestrial Energy and Schneider Electric to Collaborate on Baseload Zero-Carbon Energy Solutions for Industrial Facilities and Large Data Centers

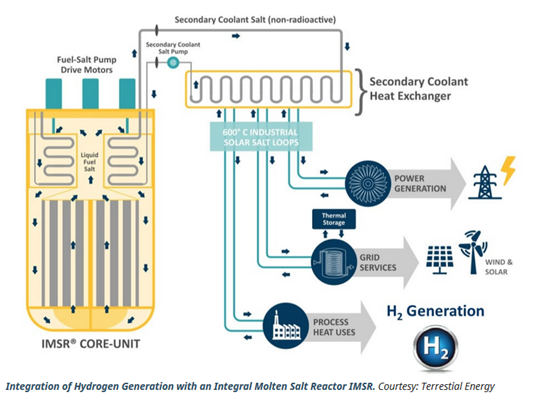

Terrestrial Energy, a developer of Generation IV advanced nuclear power plants that use its proprietary Integral Molten Salt Reactor (IMSR) technology for industrial heat and power supply, and Schneider Electric, a Fortune Global 500 supplier of digital control systems for energy management, have signed a Memorandum of Understanding (MOU) to jointly develop commercial opportunities and advance the deployment of IMSR plants.

The joint press statement did not indicate a timeline for construction of multiple units of the advanced reactor which uses molten salt to produce a 700C outlet temperature for applications of electricity generation and process heat industrial applications.

The announcement, in terms of timing, comes on the heels of an announcement by OKLO of having signed a letter of intent with a major developer of data centers to provide up to 500 MW of electrical power to data centers. Oklo noted its 15 MW basic design is capable of being scaled to 50 MW. The deal includes a $25 million upfront payment to Oklo for future implementation of the power purchase agreement.

In terms of the Terrestrial Energy deal, the scope is more wide ranging with multiple levels of engagement with Schneider Electric. Gary Lawrence, President of Power & Grid Systems at Schneider Electric, said, “Schneider Electric’s value proposition is to leverage Digital Twin technology across the full IMSR project lifecycle and during operations – resulting in a reduction of project time to market and cost as well as more efficient operations.”

Terrestrial Energy’s IMSR plant heat and power supply has many industrial uses that require reliable, baseload zero-carbon energy supply at near-site locations, such as dedicated power for large data centers and cogeneration for heavy industrial facilities. Schneider Electric systems automate and optimize energy management for improved performance, efficiency, and contribute to the commercial and sustainability goals of its customers.

The firm emphasizes the collaboration offers solutions to the major energy challenges faced by data center operators and many heavy industries operating a wide range of industrial processes such as hydrogen, ammonia, aluminum, and steel production.

In April 2023, the Canadian Nuclear Safety Commission (CNSC), following a systematic and multi-year review against nuclear regulatory requirements, concluded that there were no fundamental barriers to licensing the IMSR plant for commercial use. This was the first-ever regulatory review of a commercial nuclear plant using molten salt reactor technology and the first advanced, high-temperature fission technology to complete a review of this type.

& & &

OPG Expects Nuclear Construction on 1st SMR to Start in 2025

Ontario Power Generation (OPG) expects nuclear construction work on its first small modular reactor (SMR) to begin in 2025, according to filings submitted to Canadian Nuclear Safety Commission (CNSC).

The Ontario, Canada, utility is planning to build a total of four SMRs at the Darlington nuclear site and would use GE Hitachi’s BWRX-300 reactor technology. The four units once deployed would produce a total 1,200 MW of electricity.

OPG has said it expects construction on the first reactor to be complete by 2028, with the additional SMRs coming online between 2034 and 2036. The utility aims to take learnings from the construction of the first unit to deliver cost savings on the subsequent units.

In April 2024, the Canadian Nuclear Safety Commission (CNSC) announced that the existing environmental assessment (EA) for the Darlington New Nuclear Project (DNNP) is applicable to the BWRX-300 reactor.

“The CNSC’s decision confirms OPG’s stance related to the EA and is a critical next step in OPG’s application for a [license] to construct the first of the four SMRs at the DNNP site,” said Ken Hartwick, OPG President and CEO.

“Our fleet approach to both early work and the project as a whole means we can leverage common infrastructure, such as shared roads, utilities, and water intake, which will help to drive down regulatory, construction, and operating costs,” added Hartwick.

Aalo Atomics and DOE Sign Siting MOU at INL

Aaol Atomics, an Austin, TX, based micro reactor startup seeking to commercialize the INL Marvel SMR R&D reactor, announced is has signed a Siting Memorandum of Understanding (MOU) from the Department of Energy (DOE). This marks the first step towards deploying the first Aalo-1 reactor at the Idaho National Laboratory (INL) site in Idaho.

The Aalo-1 reactor, a 10 MWe sodium-cooled, UZrH-fueled reactor, represents a significant leap forward in sodium-cooled advanced nuclear technology in the US. Leveraging low-enriched uranium (LEU) at just under 10% U235 enrichment.

Aalo intends to leverage this Siting MOU towards locating the first Aalo-1 reactor at the Central Facilities Area (CFA) site within INL, a location chosen to collocate with newly constructed megawatt-scale electrolyzers, and INL’s upcoming hydrogen motorcoach fleet. Aalo-1 can provide electricity and heat behind the meter to these electrolyzers and demonstrate seamless hydrogen production. Aalo has recently signed an Umbrella Strategic Partnership Project (SPP) to leverage INL’s expertise to support the exploration of this deployment.

The next step for Aalo is to enter into a real property agreement with DOE, selecting a specific parcel of land to site the Aalo-1 reactor. This step will involve extensive collaboration with INL and local stakeholders to ensure the chosen site meets all technical and environmental requirements.

The firm also announced plans to construct a full-scale, non-nuclear prototype of the Aalo-1 reactor. This endeavor follows the recent successful completion of the Aalo-1 conceptual design. The prototype will serve as an important step in testing and refining our technology, ensuring that Aalo-1 meets its technical, regulatory, and economic targets.

The team is now engaged in the preliminary design. This phase is critical for verifying the reactor design. In parallel, the firm kicked off preparation of regulatory submittals.

& & &

Radiant Sets MOU with Idaho Mining Firm

- Joint Collaboration to Aid Radiant Industries with the Development and Potential Deployment of Kaleidos

- A Meltdown-Proof Microreactor Expected to Service Remote Mine Sites.

Idaho Strategic Resources, Inc. (NYSE:IDR) announced it has entered into a non-binding memorandum of understanding (MOU) with Radiant Industries, Inc. to participate in the Kaleidos Frontier Pilot Program designed to aid Radiant in the development and planned deployment of their meltdown-proof portable microreactor, Kaleidos.

The agreement establishes a pathway for Idaho Strategic and Radiant to operate one or more of the first five Frontier Kaleidos units at a viable Idaho Strategic mining site. The mining company is involved in extraction of gold, rare earths, and thorium at multiple sites along the Idaho /Montana border.

The agreement establishes a pathway for Idaho Strategic and Radiant to operate one or more of the first five Frontier Kaleidos units at a viable Idaho Strategic mining site. The mining company is involved in extraction of gold, rare earths, and thorium at multiple sites along the Idaho /Montana border.

As part of the agreement, the two companies agree to jointly study the licensing process and timeline, and other business and operations factors relevant to the deployment of a Kaleidos unit.

Radiant’s Kaleidos unit is designed to replace diesel generators with base-load power in remote and hard-to-reach locations. Cooled by Helium, which cannot become radioactive, Kaleidos can output 1 MWe electric and 1.9 MWt of heat, and operate with TRISO fuel for an average of five years before refueling . The firm notes it is “mass-producible, transportable by air, sea, road or rail and roughly the size of a shipping container.”

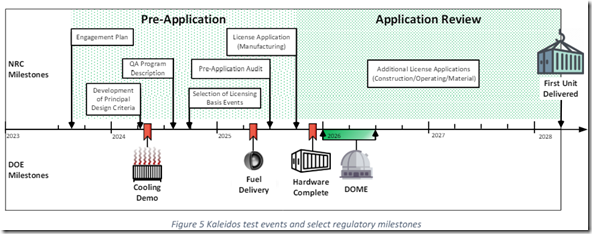

As part of the competitive US Department of Energy (DOE) FEEED program, Radiant is building towards a test at Idaho National Laboratory (INL) in 2026, with their first commercial reactors available as soon as 2028.

Radiant will get the support of the National Reactor Innovation Center (NRIC) at INL to test a fueled prototype of the Kaleidos microreactor.

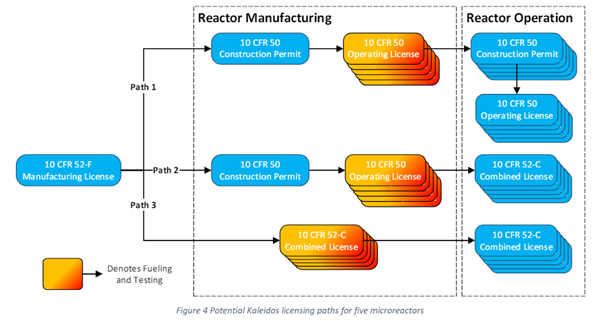

Licensing Radiant Industries engaged the US Nuclear Regulatory Commission (NRC) on the Kaleidos SMR through a public meeting on 02/17/23. Radiant Industries has also engaged the NRC on their business and licensing plans. The firm submitted its Regulatory Engagement Plan to the agency in November 2023. The firm has set a target date of delivery of its first unit to a customer by 2028.

Financing Radiant has secured public and private sector financing in support of the Kaleidos microreactor. This includes more than $50 million in private financing and two awards through the US Small Business Innovation Research program totaling approximately $250,000 to support modelling and simulation capabilities.

Through the NRIC FEEED process, Radiant was awarded up to $1.5 million to progress towards deployment of the Kaleidos at the DOME facility located at the INL’s Materials Fuels Complex (old Argonne West) site about 25 miles west of Idaho Falls, ID.

Fuel In 2022, Radiant Industries launched a Request for Proposals for fuel fabricators to produce TRISO fuel, and in 2023 the company entered an agreement with Centrus Energy to work towards identifying a path to provide a future supply of HALEU for up to 20 Kaleidos microreactors.

& & &

NANO Nuclear Energy Announces Initial Public Offering

NANO Nuclear Energy Inc. (NASDAQ: NNE) announced the pricing of its initial public offering of 2,562,500 shares of its common stock at a price to the public of $4.00 per share, less underwriting discounts and commissions. NANO Nuclear’s common stock has been approved for listing and is expected to begin trading on the Nasdaq Capital Market under the symbol “NNE” on Wednesday, May 8, 2024. The offering is expected to close on May 10, 2024.

The gross proceeds to NANO Nuclear from the offering, before deducting underwriting discounts and commissions and estimated offering expenses, are expected to be approximately $10,250,000 million. NANO Nuclear intends to use the net proceeds from this offering to;

- continue the research and development of its proprietary micro nuclear reactor designs, ‘ZEUS’ and ‘ODIN’,

- advancing its exclusive licensed technology to transport commercial quantities of High-Assay, Low-Enriched Uranium (HALEU) fuel needed for the future of the advanced nuclear industry,

- development of a U.S. domestic source of HALEU fuel fabrication for NANO Nuclear’s own microreactors and the broader advanced nuclear reactor industry

- and for general corporate purposes and working capital.

Licensing The firm has not announced timelines for licensing the reactors or nuclear fuels programs nor target dates for delivery of products / services to customers.

A search of the NRC ADAMS library did not turn up any citations indicating formal regulatory engagement with the NRC, by the firm, using the term “NANO Nuclear Energy” in the search box. Typically, at a minimum, a firm seeking a license will file a regulatory engagement plan with the NRC spelling out how it plans to proceed.

A Regulatory Engagement Plan (REP) establishes “Rules of Engagement” between the applicant and NRC. The primary goal of the REP is to reduce regulatory uncertainty by establishing such agreements as early in the regulatory process as possible.

Prior coverage on this blog: Fact Checking a Nuclear Startup’s Claims

& & &

UK to Build Urenco HALEU Nuclear Fuel Plant by 2031

(WNN) The UK government is awarding GBP196 million (USD245 million) to Urenco to build a uranium enrichment facility with the capacity to produce up to 10 tonnes of high-assay low-enriched uranium (HALEU) per year by 2031. The funding decision is part of the UK government’s efforts to cut out dependance on Russia for nuclear fuel for its reactors.

UK Prime Minister Rishi Sunak said that building the uranium enrichment plant was essential for guaranteeing the country’s nuclear and energy security. The Department for Energy Security and Net Zero says the new facility “will put an end to Russia’s reign as the only commercial producer” of HALEU fuel in Europe.

The GBP195 million funding is part of the GBP300 million HALEU program announced in January 2024, with the energy department saying that the remaining funding would be allocated later this year to other parts of the program including to support deconversion capability (converting the enriched uranium into a form to be made into fuel).

Urenco is one third owned by the UK government, one third by the Dutch government and one third by two German utilities, E.ON S.E. and RWE AG.

Other HALEU Production Efforts

In September, Orano revealed plans to extend enrichment capacity at its Georges Besse II (GB-II) uranium enrichment plant in France, and said it had begun the regulatory process to produce HALEU there.

The US is also developing a domestic supply of HALEU. In November 2023, Centrus Energy delivered the first HALEU produced at its American Centrifuge Plant in Piketon, Ohio, to the US Department of Energy (DOE).

Construction of the 16-centrifuge demonstration cascade plant began in 2019, under contract with the DOE. The delivery by Centrus of more than 20 kilograms of HALEU to the DOE means that phase one of the contract has now been completed and Centrus can move ahead with the second phase: a full year of HALEU production at the 900 kilograms per year plant.

# # #