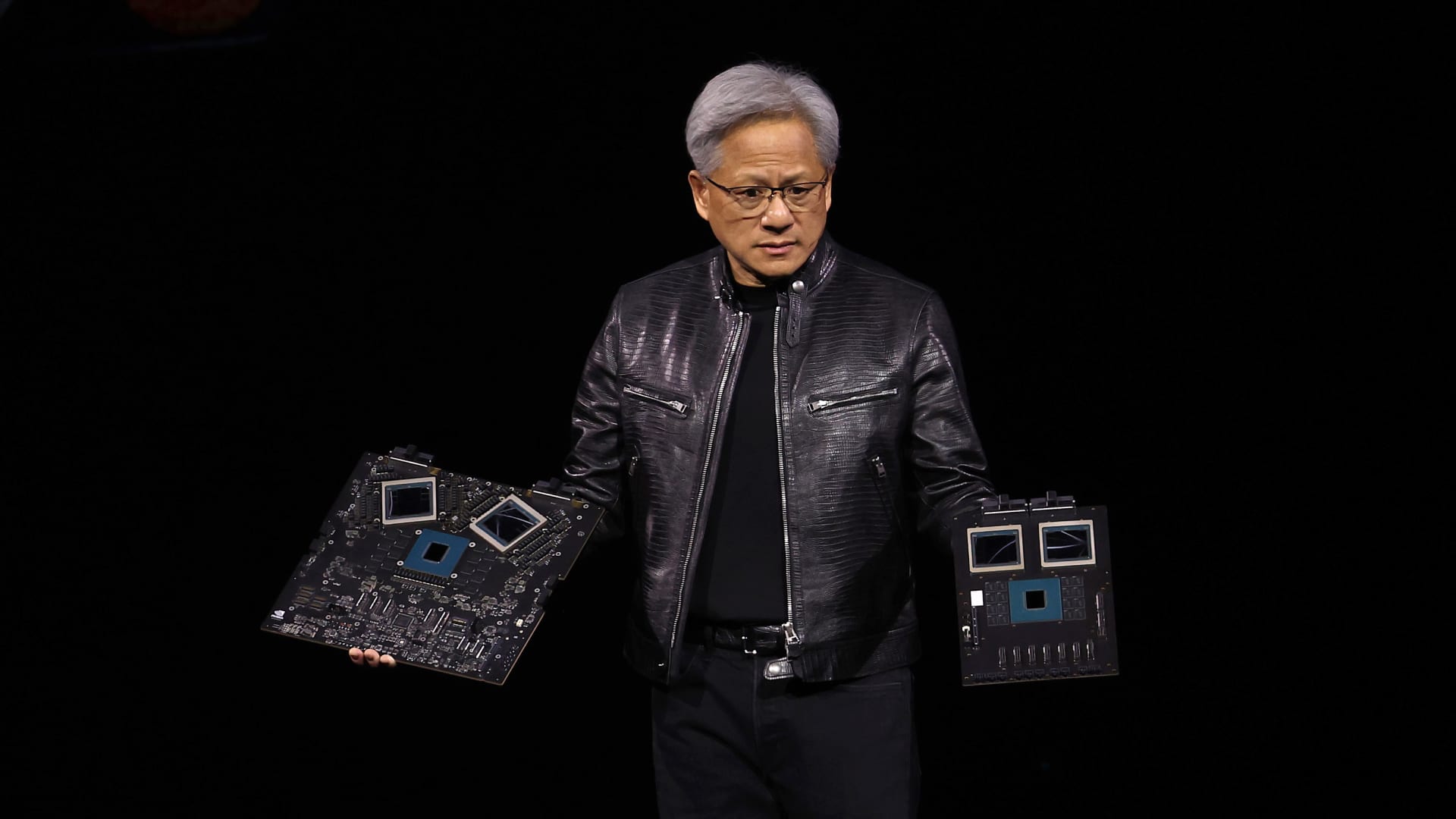

The market may see a new wave of stock splits, creating another growth catalyst for a market that wants to keep rallying, according to Strategas. Strategas thinks it is worth keeping an eye on Chipotle’s recent decision to enact a 50-to-1 stock split in case it ushers in further stock splits, especially considering the higher average price of stocks in the broader market. According to the firm, the average price of a stock in the S & P 500 is off its highs, but is still at about $160, which is more than four times the average price of a share in 2008 before the financial crisis. “We think [the Chipotle stock split] is worth watching for two reasons: 1) in the past, a wave of stock splits was often associated with a significant increase in stock speculation; and 2) it would be a boon for institutional brokers who get paid on a cents-per-share basis,” analyst Jason Trennert wrote in a Monday note. Trennert added that, since 2010, companies that split their shares outperformed the broader market by a “meaningful margin” in the couple months after the changes took effect. The median gain of a stock 65 days post-split is 4.1%, compared to the S & P 500’s median 2.7% gain during the same period. Stock splits do not change anything fundamentally about the company, but they generally make shares more attractive to the retail trader because of lower prices. Here are the highest-priced stocks in the S & P 500 that Strategas thinks investors could benefit from if they split. These stocks were the highest priced per share in the broad market index through Friday’s close: Some major artificial intelligence-related plays, namely Super Micro Computer , Nvidia and Broadcom , are among the high-priced stocks listed by the firm. In response to whether the company could consider issuing a stock split, Nvidia CEO Jensen Huang last week told CNBC’s Jim Cramer , “We’ll think about it … today is not the day to announce it,” and that stock splits are “a good thing,” particularly for the company’s employees. Another name on the list, pharmaceutical giant Eli Lilly , last announced a 2-for-1 stock split in September 1997. The company’s shares have jumped more than 33% this year and 130.5% over the past 12 months, fueled by its robust diabetes and anti-obesity medication pipeline that has positioned the company as a leader in the rapidly growing obesity drug market. Other stocks that made the list include AutoZone , Costco Wholesale and Regeneron .

Watch for potential wave of share splits as the average price of S&P 500 stock hits $160, says Strategas