🤝 KKR has launched a public takeover offer for German solar, wind and storage developer Encavis, which represents a $3bn equity valuation at $19.1/share and an enterprise value of $5bn

🔋 Encavis boasts a total operational capacity of 2.2 GW, 0.8 GW under construction, and ~4 GW in development. The company’s portfolio is located in primarily in Germany, with a strong presence in Italy, France, and the UK. Encavis aims to reach 7 GW of installed capacity by 2027.

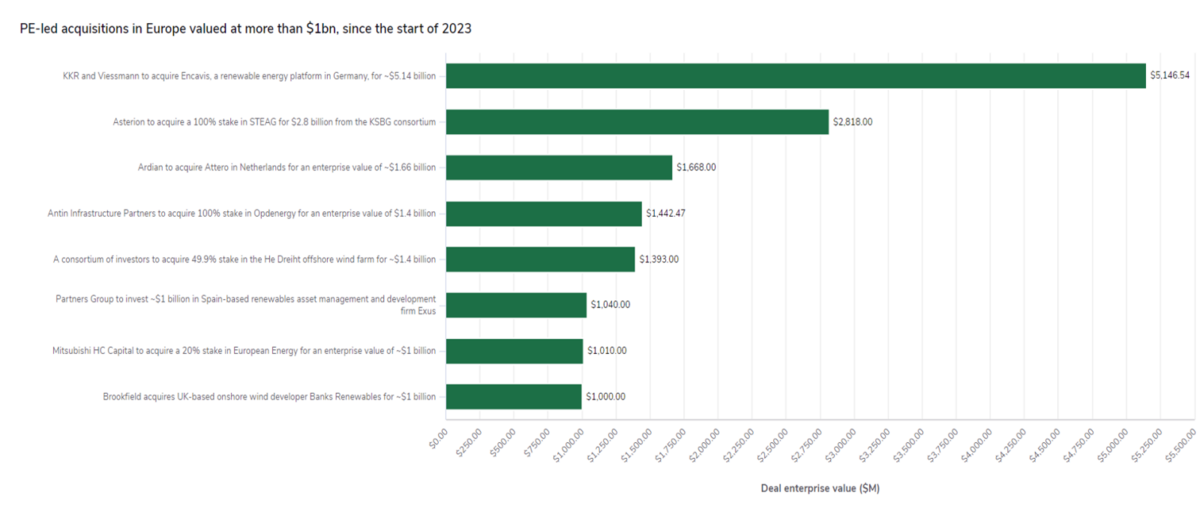

📈 Strong demand for renewables: Germany’s renewable energy sector has witnessed over $8bn in deals since the start of 2023, with PE firms like AIP Management, and Norges Bank carrying out $1bn+ transactions, primarily targeting onshore and offshore wind assets.

↔️ Similarly, Asterion recently completed a $2.8bn deal for onshore wind platform STEAG. Meanwhile, another German platform VSB Group has recently been put up for sale, attracting interest from several institutional investors.

Ram Derkar, an analyst in Enerdatics’ transaction intelligence team commented:

“To meet targets, Encavis has established the Strategic Development Partnership (SDP) program across Europe. The company collaborates with local partners and agrees on pre-defined IRRs for the projects developed under the partnership. In the event of a project failing to meet its threshold, Encavis replaces it with another project sourced from the SDPs. ”