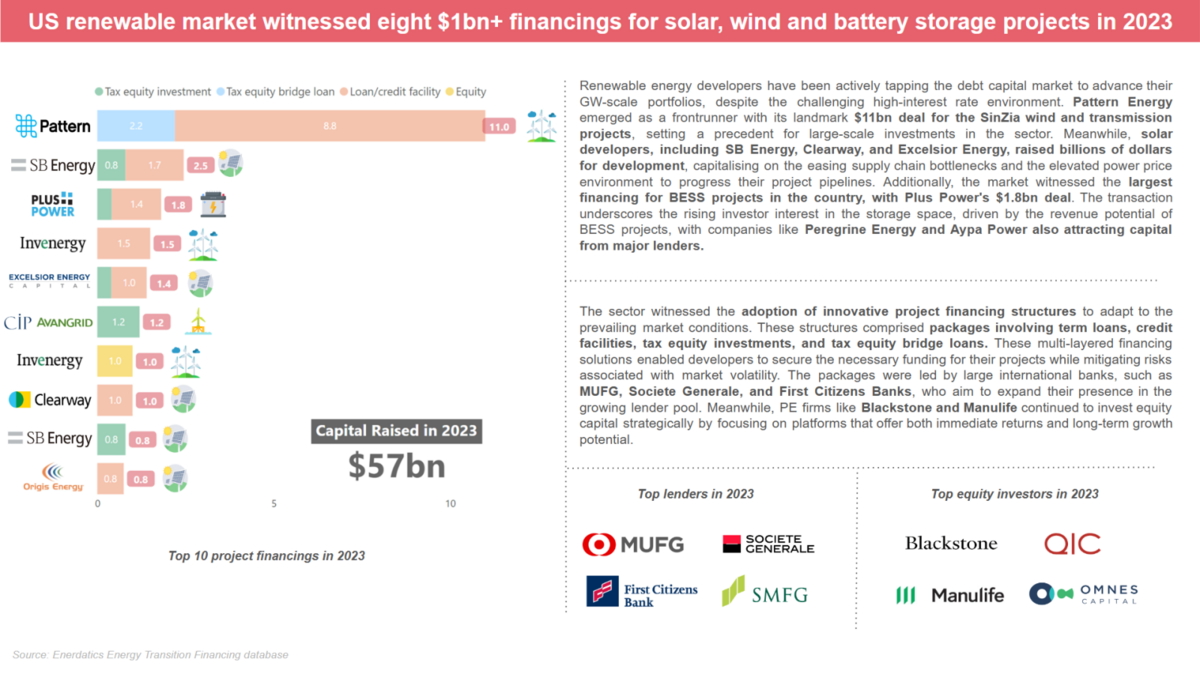

Renewable energy developers have been actively tapping the debt capital market to advance their GW-scale portfolios, despite the challenging high-interest rate environment. Pattern Energy emerged as a frontrunner with its landmark $11bn deal for the SinZia wind and transmission projects, setting a precedent for large-scale investments in the sector. Meanwhile, solar developers, including SB Energy, Clearway, and Excelsior Energy, raised billions of dollars for development, capitalising on the easing supply chain bottlenecks and the elevated power price environment to progress their project pipelines. Additionally, the market witnessed the largest financing for BESS projects in the country, with Plus Power’s $1.8bn deal. The transaction underscores the rising investor interest in the storage space, driven by the revenue potential of BESS projects, with companies like Peregrine Energy and Aypa Power also attracting capital from major lenders.

The sector witnessed the adoption of innovative project financing structures to adapt to the prevailing market conditions. These structures comprised packages involving term loans, credit facilities, tax equity investments, and tax equity bridge loans. These multi-layered financing solutions enabled developers to secure the necessary funding for their projects while mitigating risks associated with market volatility. The packages were led by large international banks, such as MUFG, Societe Generale, and First Citizens Banks, who aim to expand their presence in the growing lender pool. Meanwhile, PE firms like Blackstone and Manulife continued to invest equity capital strategically by focusing on platforms that offer both immediate returns and long-term growth potential.

US renewable market witnessed eight $1bn+ financings for solar, wind and battery storage projects in 2023