NOTE: This blog post is intended for educational purposes only. Relevant parties should consider consulting a tax professional should any questions arise.

Elective pay, also commonly referred to as “direct pay,” is a new mechanism included in the Inflation Reduction Act (IRA) that enables certain tax-exempt entities to receive direct cash payments from the IRS in the amount of an energy tax credit. This new mechanism has now widened opportunities and accessibility for affordable clean energy deployment, not just for businesses or private individuals but now for communities, schools, rural co-ops, and nonprofits!

Before the IRA became law in August 2022, tax-exempt organizations were not able to leverage the benefits of energy tax credits without collaborating with tax equity partners. For example, to finance a rooftop solar project on a tax-exempt school, it was previously common to find a private-sector entity to pay for this project, leverage the investment tax credit, and sell the power back to the school. Direct pay provides more flexibility for the school to finance the project independently.

The IRA has changed this. Now, with direct pay, nonprofits and other tax-exempt entities can benefit directly from energy tax credits in the form of direct cash payments—without finding a private-sector finance partner or waiting to apply the credit against a tax liability. This dramatically reduces the “soft costs” of installing a new solar or other clean energy project owned and operated by a nonprofit—reducing the overall cost by 30-50%. This provision makes clean energy much more financially feasible and attainable for nonprofits, enabling them to contribute to a healthier, more equitable, and more sustainable future.

Who qualifies for direct pay?

Non-tax paying entities are eligible for direct pay, including the following:

- Nonprofit entities

- State and Local governments

- Tribal governments

- Tax exempt entities under 501(a), including 501(c) organizations

- US territories

- Alaska Native Valley Corporations

- Tennessee Valley Authority

- Rural electric co-operatives

- Agencies and instrumentalities of state, local, tribal, and territorial governments

Direct pay opens the benefits of energy tax credits to entities previously excluded from access, such as rural electric cooperatives, public power utilities, community-based organizations, places of worship, academic institutions, or hospitals. Crucially, Indian Tribal Governments and Alaskan Native Corporations are also eligible.

What are the applicable tax credits for direct pay?

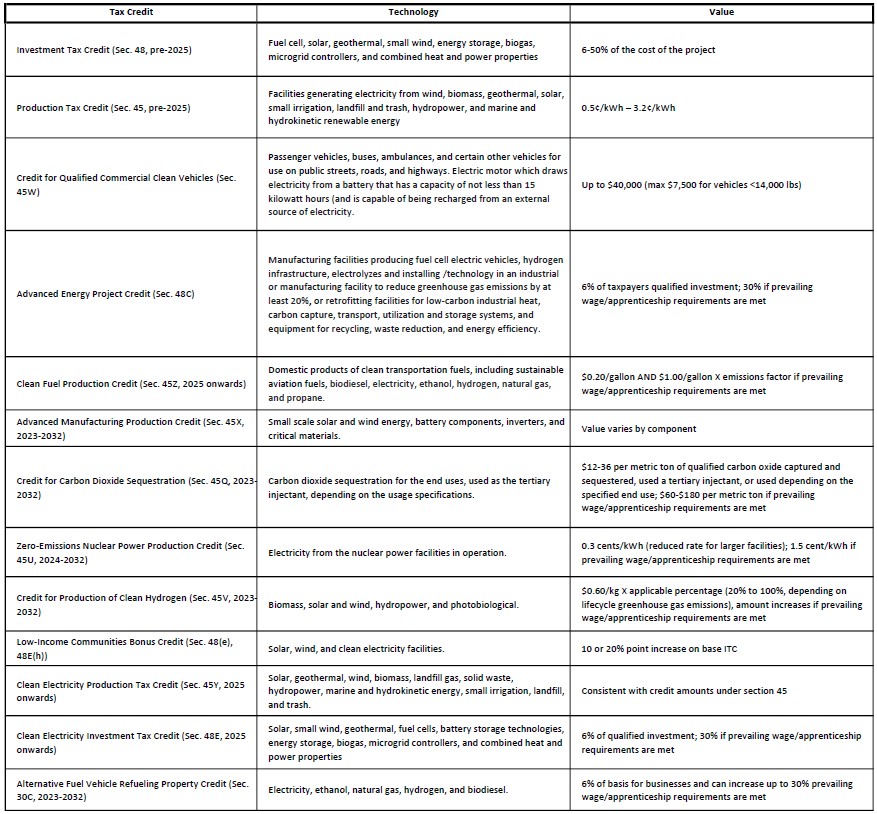

Tax-exempt entities can claim direct pay for the credits listed below (learn more about each tax credit here):

- Investment Tax Credit (ITC) for Energy Property (Sec. 48, pre-2025)

- Production Tax Credit (PTC) for Electricity from Renewables (Sec. 45, pre-2025)

- Clean Electricity Production Tax Credit (Sec. 45Y, 2025 onwards)

- Clean Electricity Investment Tax Credit (Sec. 48E, 2025 onwards)

- Low-Income Communities Bonus Credit (Sec. 48(e), 48E(h))

- Alternative Fuel Vehicle Refueling Property Credit (Sec. 30C)

- Credit for Qualified Commercial Clean Vehicles (Sec. 45W)

- Advanced Energy Project Credit (Sec. 48C)

- Credit for Carbon Dioxide Sequestration (Sec. 45Q)

- Zero-Emission Nuclear Power Production Credit (Sec. 45U)

- Credit for Production of Clean Hydrogen (Sec. 45V)

- Advanced Manufacturing Production Credit (Sec. 45X)

- Clean Fuel Production Credit (Sec. 45Z, 2025 onwards)

A non-exhaustive list of technologies that apply are summarized in the table below:

- Prevailing Wage and Apprenticeship requirements: For several tax credits created or modified by the IRA, the credit amount increases 5x for projects that meet requirements for paying prevailing wages and using registered apprentices. Note that projects under 1 MW are not required to meet these requirements to qualify for the full credit.

- Domestic Content Bonus: Projects or facilities that meet domestic content requirements are eligible for a 10% increase to the PTC or up to a 10% increase to the ITC. For projects starting construction in 2024 and entities using direct pay, the domestic content requirements can lead to a reduction of the Production Tax Credit (PTC) or Investment Tax Credit (ITC) if not met.

- Energy Communities Bonus: Projects situated in historical energy communities, including those with closed coal mines or coal fired power plants, are eligible for a 10% increase in the PTC and up to a 10% increase in the ITC. The bonus can also be used for brownfield sites and locations that derive significant employment or local tax revenue from fossil fuels and higher than average unemployment.

- Low Income Communities Bonus Credit Program: Increased credit of 10% or 20% to certain applicable ITC credits for select facilities situated in low-income communities, tribal lands, and federal housing projects, or catering to low-income households.

The IRS and the Treasury department released proposed guidance in December 2023, which provides procedures for eligible entities to gain the exception for the reduced ITC or PTC credits for direct payment for projects starting construction in 2024 but that don’t meet the domestic content conditions.

The phaseout credit reductions for direct pay and the statutory exception applies to the credits below:

- Renewable Electricity Production Credit (Sec. 45)

- Clean Electricity Production Credit (Sec. 45Y)

- Energy Credit (Sec. 48)

- Clean Electricity Investment Credit (Sec. 48E)

How can direct pay be claimed?

To claim direct pay, eligible tax-exempt and governmental entities must follow a specific process. First, the entity must identify and pursue a qualifying clean energy project or activity and determine which tax credit applies to use elective pay for. Once the project is completed and in service, the entity must determine its tax year and file a tax return by the due date. Pre-filing registration with the IRS is required (see below), providing basic information and ensuring eligibility. The entity claims direct pay on the tax return, and after the return is processed, the IRS will make a payment to the entity equal to the full value of the tax credit claimed, providing direct cash benefits for clean energy projects.

How does an entity register for pre-filing?

Qualifying entities must complete the pre-file registration process to obtain a registration number, which will be included on a taxpayer’s annual return. To facilitate this, the IRS has launched the IRS Energy Credits Online pre-filing registration tool. The IRS Energy Credits user guide and video tutorial helps entities navigate the process.

Eligible entities should complete the pre-filing registration request no earlier than the start of the relevant tax year. However, the IRS suggests submitting the pre-filing registration at least four months before an entity plans to file its tax return on which it will make its election.

How do grants and loans impact the value of a tax credit?

A special rule enables entities to combine grants and forgivable loans with tax credits.

If an investment-related credit property is funded by a tax-free grant or forgivable loan, entities would receive the same value of eligible tax credit as if the investment were financed with taxable funds, provided the credit plus restricted tax-exempt amounts do not exceed the cost of the investment.

For instance, a nonprofit entity may fund a significant portion of a solar project utilizing a grant. If the grant plus the value of the tax credit (30%) exceeds the total cost of the project, then the nonprofit would only receive the value of the tax credit up to the total cost of the project. A project that is funded 90% by a grant would reduce the value of the direct cash payment to only 10% of the total cost of the project.

What is the timeline for direct pay eligibility?

Projects that are placed in service after 2022 are eligible for direct pay. This means that eligible entities can now benefit from direct cash payments for qualifying clean energy projects. Furthermore, direct pay will continue to be available as the tax code transitions to a technology-neutral framework from 2025 to 2032.

What is transferability?

Transferability refers to the ability to sell tax credits to unrelated third parties. Under this mechanism, all tax credits are now eligible for transferability, eliminating the previous requirement for tax-equity partners to have ownership stakes in projects. This change simplifies the process and provides more flexibility, allowing entities to transfer their tax credits to buyers in exchange for immediate cash. This can be particularly beneficial for entities that may not have sufficient tax liability to fully utilize the credits themselves, providing an alternative means to monetize the value of the credits.

A small project developer for instance may not have enough “tax appetite” to benefit fully from a tax credit. Previously the developer would turn to large financial institutions that have a much larger tax appetite to help finance a project and turn the tax credit over to the financial institution. With transferability, the developer can simply sell the tax credit to an unrelated third party that does not have a financial stake in the project.

Conclusion

Direct Pay is an exciting new mechanism that is improving accessibility and affordability of clean energy deployment by allowing tax-exempt entities like nonprofits and local governments to take advantage of new and expanded energy tax credits. Keep your eye out for new guidance and resources coming out of the IRS, and be sure to take advantage of the existing pre-filing registration tool, user guide, and video tutorials!

For more information on what’s in the IRA, check out CEBN’s Insight into the Inflation Reduction Act blog series. We will continue to update and produce new content as more guidance becomes available!

Additional Resources

Direct Pay | Clean Energy | The White House

Direct Pay and Transferability factsheets

Federal Solar Tax Credits for Businesses | Department of Energy

White House and Treasury Stakeholder Briefing on Direct Pay – YouTube

The post Insight into Direct Pay for Clean Energy Tax Credits appeared first on Clean Energy Business Network.