By Alexander M. Economides

The US Government made expanding the hydrogen production industry a priority with the passing of the Inflation Reduction Act (IRA) of 2022. Although the act focuses on low- or no-emission technologies, it will spur development across the entire spectrum of hydrogen production options. Since the new regulations cover the entire US, we compared the projected levelized total cost of hydrogen (LTCH) – this includes delivery and refueling station costs – to the average price of gasoline in individual states. What did we find? Hydrogen is already competitive with regular gasoline for use as a transportation fuel, even without the IRA’s production tax credits (PTCs).

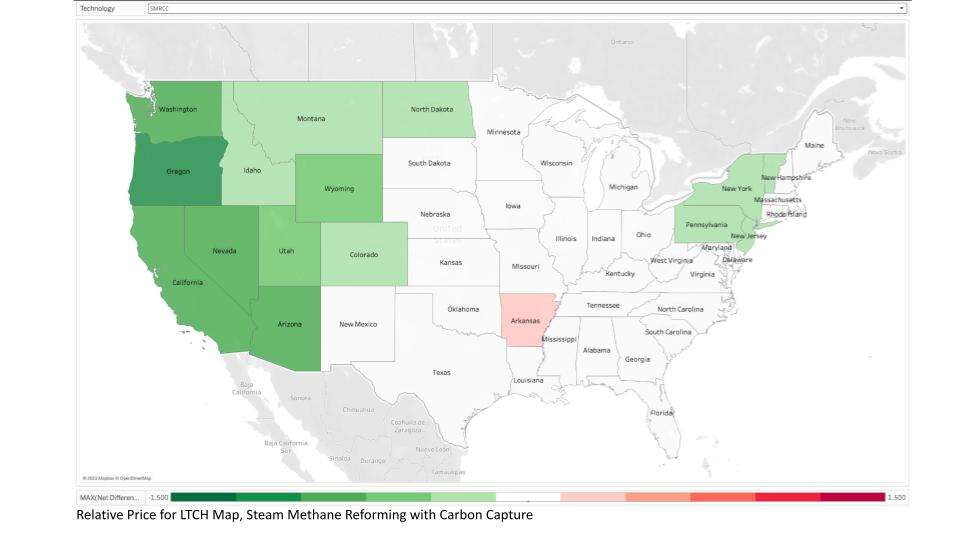

Like the prior article in this series, we again present maps designed to act as a visual guide for relative costs, with states colored from red to green, high to low relative prices of Hydrogen as a fuel, respectively. The scale of the maps ranges from $-1.5 to $1.5 per gallon of gasoline equivalent and the maps include data for all 48 contiguous states. Negative numbers occur in states where predicted delivered prices of hydrogen are below the average price of gasoline.

If produced via Electrolysis, the five most promising states for hydrogen, as a replacement fuel to gasoline, are Washington, Oregon, New York, Arizona, and Louisiana, with relative price differentials ranging from $-0.042 to $0.737 per gallon equivalent. If, instead, produced via steam methane reforming with carbon capture (SMRCC), the five most promising states are Oregon, Arizona, Washington, Nevada, and California, with relative price differentials ranging from $-1.000 to $-0.783 per gallon equivalent cheaper. Electricity, water, natural gas, and average yearly gasoline prices form the primary drivers/differentiators of these costs. The maps clearly show that companies can produce hydrogen via SMRCC and sell it at prices competitive with local gasoline (often much cheaper) in most states.

As in the earlier article, we cannot guarantee the ability to make these projects fully net-zero, and therefore these numbers do not reflect the impact of 45V production tax credits. If we include those tax credits, they will reduce the LTCH numbers by up to $2.25 per kg (assuming the credits last for the first 10 years of the project’s life, and the producers earn the full $3 per kg PTC).

We gathered data from the US Energy Information Administration and the National Renewable Energy Laboratory Hydrogen Delivery Scenario Analysis and Hydrogen Refueling Station Analysis Models and combined them with the report published on Enerdatics on December 15th, 2023 to create this study.

*** These results are part of a larger study involving multiple technologies, and project sizes. For the sake of simplicity, we limited the provided maps to large-scale projects with low- or zero-emission capability.