Statkraft has completed the acquisition of renewable energy developer Enerfin from Elecnor Group for $1.95bn. The transaction will provide Statkraft access to ~1.2 GW of operational wind energy assets across Europe, South America and North America.

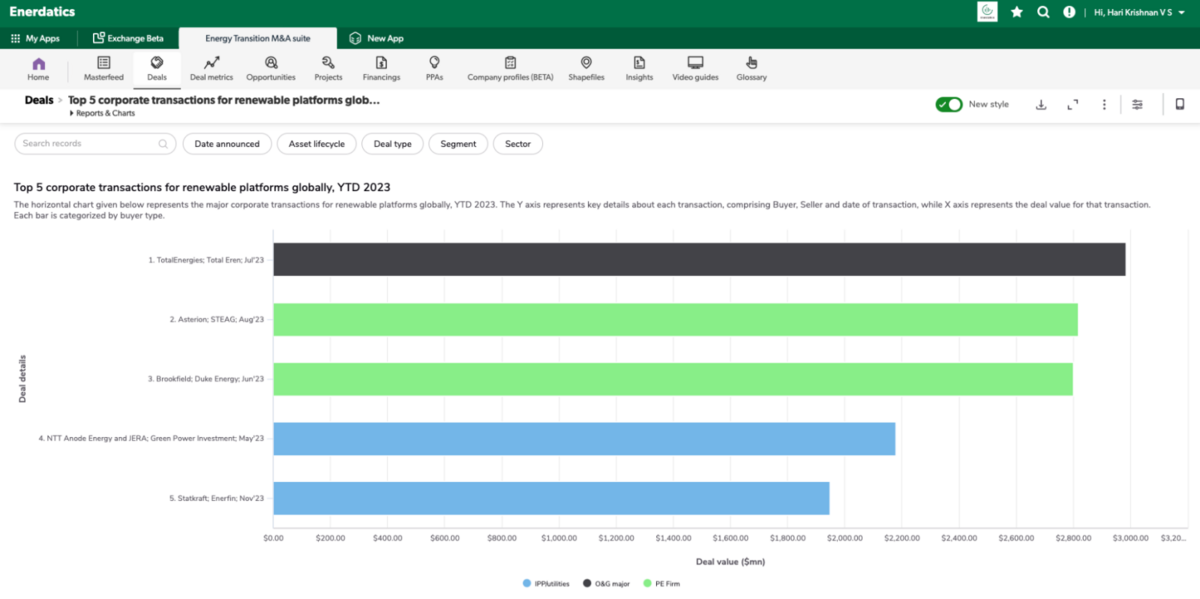

This move reflects a broader trend: Cash-rich investors drive corporate-level transactions this year, taking over revenue-accretive platforms with huge development pipelines that are currently under-valued. Meanwhile, highly-leveraged utilities and power producers are currently focussed on paying down debt and funding development through equity by divesting non-core assets.

Market Insight: The above motion was earlier iterated by Brookfield Renewable CEO Connor Teskey, who cited the presence of ‘more opportunities to buy high-quality renewable energy developers in core markets at cheaper prices than in 2021’ as the reason for Brookfield’s $11bn investment spree since 2022.

Future Outlook: Looking ahead, Enerdatics expects to see major players like Brookfield and Blackstone, as well as O&G majors like TotalEnergies, leading the way in renewable energy investments. Profitable power companies such as RWE and Statkraft are also set to play a significant role in this trend.