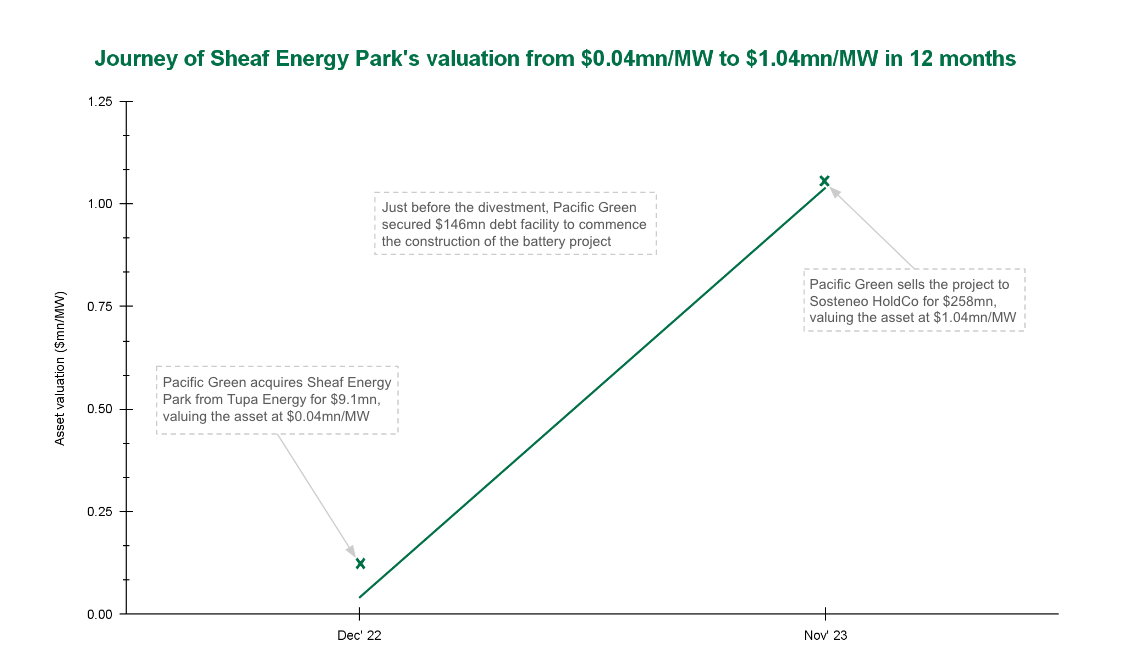

🤝 Pacific Green’s recent divestiture of its 100% stake in the 249 MW Sheaf Energy Park BESS to Sosteneo HoldCo for a $258mn showcases the significant value creation realized during the last 12 months.

⚖️ This acquisition places the valuation of the asset at $1.04mn/MW. Just 12 months prior, Pacific Green’s acquisition of the asset from Tupa Energy stood at $0.04mn/MW. What caused this valuation spike at such a short period?

💡 According to Enerdatics, a couple of key factors are at play:

– securing FID for the project, including necessary approvals and $146mn debt financing to proceed with construction

– High investor interest in England’s BESS space, eager to capitalize on lucrative revenue potential

🔗 This valuation isn’t an isolated case. Earlier this year, Richborough Energy Park followed a similar trajectory, sold by Pacific Green to Sosteneo HoldCo upon FID at $0.94mn/MW.

💼 For dealmakers in the renewable energy space, these figures aren’t just numbers—they’re a testament to the sector’s dynamism and the lucrative opportunities it presents.