We are pleased to release the 2023 edition of Berkeley Lab’s Utility-Scale Solar report, which presents analysis of empirical plant-level data from the U.S. fleet of ground-mounted photovoltaic (PV), PV+battery, and concentrating solar-thermal power (CSP) plants with capacities exceeding 5 MWAC. While focused on key developments in 2022, this report explores trends in deployment, technology, capital and operating costs, capacity factors, the levelized cost of solar energy (LCOE), power purchase agreement (PPA) prices, and wholesale market value among the fleet of utility-scale solar (and PV+battery) plants in the United States.

The report, published in slide-deck format, is accompanied by a narrative summary briefing, interactive data visualizations, and a public data file, all available through the link above. The authors will host a free webinar summarizing key findings from the report on Wednesday, October 18, 2023, at 10:00 AM PT/1:00 PM ET. Please register for the webinar here: https://lbnl.zoom.us/webinar/register/WN_oBiLi9jbReWc3BQQ8Or31A.

The following are a few key findings from the latest edition of the report.

2022 was another strong year for utility-scale PV deployment. Though below 2021’s record buildout of 12.5 GWAC, 2022’s addition of 10.4 GWACbrought cumulative installed capacity to 61.7 GWAC across 46 states (see map below). Texas (2.5 GWAC) added the most new capacity in 2022, followed by California (2.1 GWAC), Virginia (0.6 GWAC), and Georgia (0.5 GWAC).

Single-axis tracking is the dominant mount type. 94% of all new utility-scale PV capacity added in 2022 uses single-axis tracking, with the remainder mounted at a fixed tilt.

Despite inflationary pressures, installed costs continued to fall in 2022. Median installed costs declined to $1.32/WAC (or $1.07/WDC) based on a 4.6 GWAC sample of 59 plants completed in 2022, and have fallen by 78% (averaging 10% annually) since 2010. The lowest-cost 20th percentile of plants in our 2022 sample cost $1.1/WAC ($0.8/WDC) or less.

Plant-level capacity factors vary widely, from 9% to 35% (on an AC basis), with a sample median of 24%. The high degree of plant-level variation is based on a number of factors, including insolation, tracking vs. fixed-tilt mounts, inverter loading ratios, performance degradation, and curtailment.

Utility-scale PV’s LCOE fell slightly to $39/MWh on average in 2022.The average LCOE has fallen by about 84% (averaging 14% annually) since 2010, driven by lower capital costs and improving capacity factors (as well as other factors).

PPA prices from a small sample of contracts signed in 2022 average $25/MWh (levelized, in 2022 dollars). PPA prices, which to date reflect receipt of the federal investment tax credit (ITC), have largely followed the decline in solar’s LCOE over time, but since 2019 have stagnated and even increased slightly (see graph below). Data from LevelTen Energy on shorter-term PPAs involving primarily non-utility buyers show a similar trend in recent years.

Rising wholesale electricity prices boosted solar’s national average market value by 40% in 2022, to $71/MWh. This increase in solar’s combined energy and capacity value outpaced the more-modest rise in PPA prices, thereby improving solar’s competitiveness (see graph below). Solar’s average market value in 2022 was lowest in CAISO ($51/MWh) and highest in Duke Energy Florida’s service territory ($108/MWh).

Solar’s market value exceeded average electricity prices in 15 of the 25 regions analyzed in 2022. With the exception of ISO-NE and ERCOT, the regions with below-average solar market value are concentrated in the West, where solar’s market share is generally higher. Compared to 2021, solar’s relative value versus a “flat block of power” contracted in 12 of the 25 regions analyzed (again, primarily in western regions).

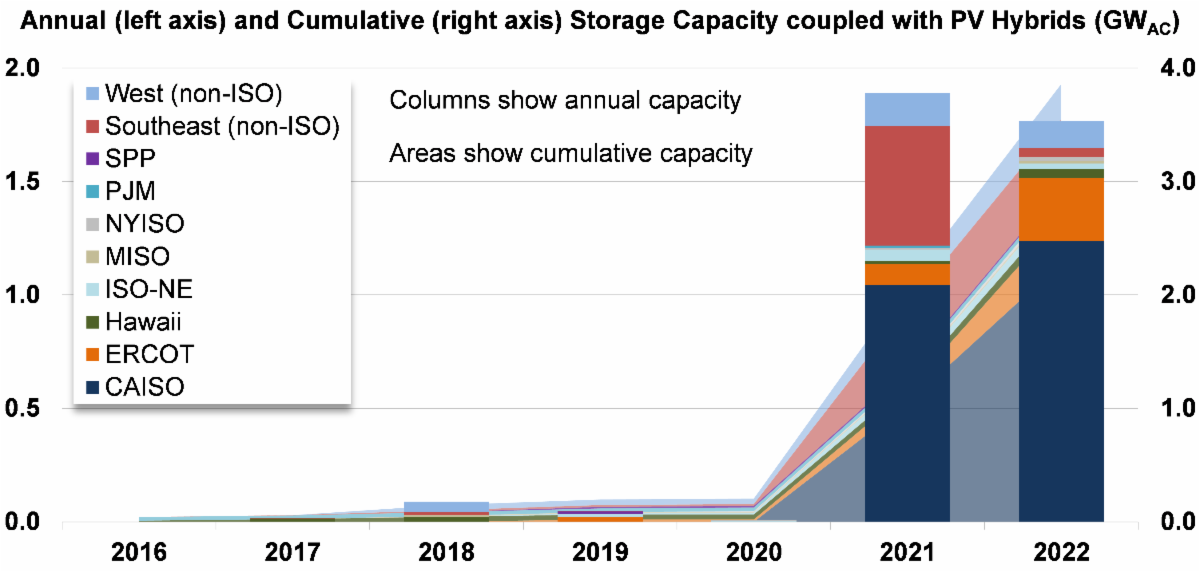

2022 was another strong year for PV+battery hybrid plants. Adding battery storage to shift a portion of excess mid-day solar generation into evening hours is one way to increase the value of solar. These PV+battery hybrid projects are becoming increasingly common, particularly in markets with a higher share of solar generation. In 2022, 35 PV+battery hybrid plants totaling 3.6 GWAC of PV and 1.8 GW / 5.4 GWh of battery storage achieved commercial operations, while many additional hybrids entered the development pipeline. The report presents plant metadata, including installed costs and PPA prices, from a subset of these online and in-development PV+battery hybrids.

A massive pipeline of utility-scale solar plants dominate the interconnection queues across the country. Looking ahead, at least 947 GW of solar capacity was in the nation’s interconnection queues at the end of 2022. Nearly 457 GW, or 48%, of that total was paired with a battery.

The Inflation Reduction Act (IRA), which became law in August 2022, introduced numerous provisions to stimulate additional clean energy deployment in the United States. The provisions most likely to impact the utility-scale solar market include a production tax credit for solar, along with various tax credit adders (e.g., for prevailing wages, apprenticeships, location of projects in energy communities, using domestically produced equipment). While these policy developments have generated much excitement within the industry, we do not yet see the impact of these incentives in this year’s Utility-Scale Solar report, for several possible reasons. First, the IRA was passed relatively late in the year, with Treasury guidance on implementation coming even later, and the market naturally takes time to react. In addition, several incentives only came into effect starting in 2023, while this report focuses primarily on projects built in 2022. Meanwhile, interconnection queues from some of the bigger regions had either already closed their open application season by the time the IRA passed, or else did not accept or discouraged new interconnection requests in 2022.

Nonetheless, 2023 is shaping up to be the strongest year on record for utility-scale solar, as the first eight months have already yielded 8.6 GW of capacity additions, which is 30% more than the prior record pace through August set in 2021. Based on EIA projections of capacity additions for September through December, total new utility-scale solar capacity added in 2023 could surpass 24 GW by the end of the year.

Funding support was provided by the U.S. Department of Energy Solar Energy Technologies Office.

The authors will host a free webinar summarizing key findings from the report on Wednesday, October 18, 2023, at 10:00 AM PT/1:00 PM ET. Please register for the webinar here: https://lbnl.zoom.us/webinar/register/WN_oBiLi9jbReWc3BQQ8Or31A.