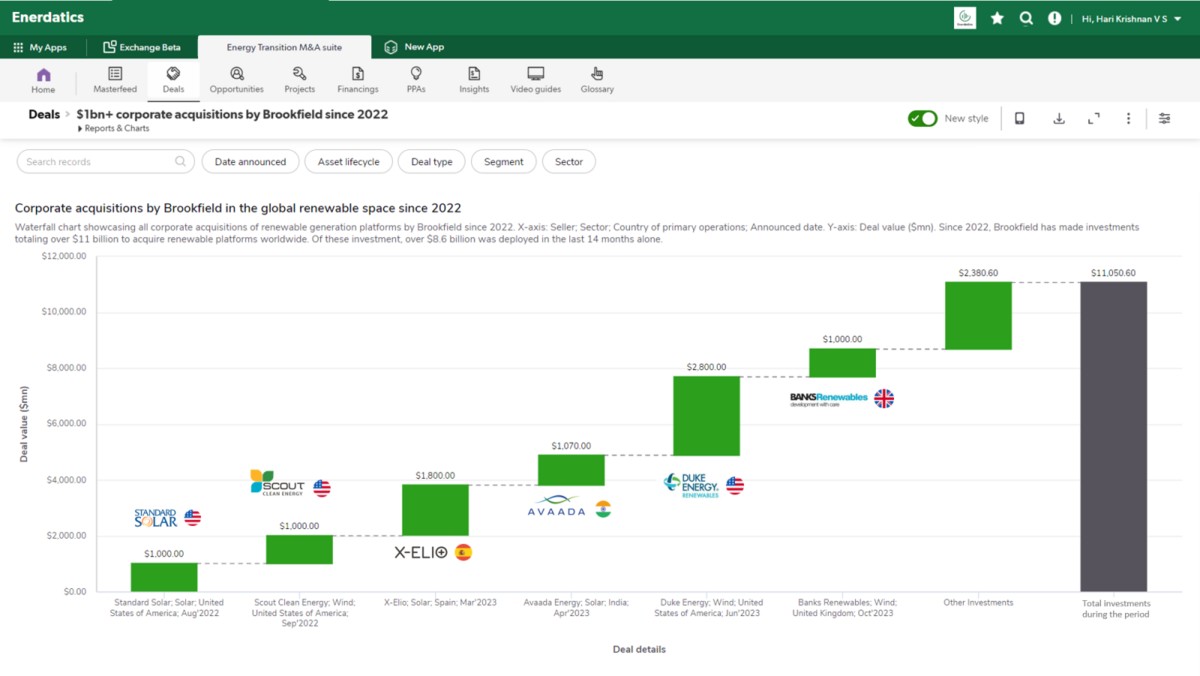

Brookfield has made substantial investments of over $11 billion to acquire several renewable energy platforms since the beginning of 2022. These investments include the acquisition of Duke Energy Renewables, Standard Solar, and Scout Clean Energy in the US for a combined $4.8 billion, the purchase of Avaada Energy in India for $1 billion, and an $1.8 billion investment in the Spanish developer X-Elio. These capital expenditures align with Brookfield’s goal of expanding its global presence by allocating $6-7 billion annually over the next five years. The company aims to achieve an Internal Rate of Return (IRR) of 12-15% from these investments, with the potential to replicate the success of previous platforms like ISAGEN and X-Elio, which generated returns exceeding 20%.

Brookfield’s ongoing investment spree was highlighted once again with its recent acquisition of UK-based onshore wind developer Banks Renewables for approximately $1 billion. The target company’s impressive portfolio currently includes around 39 installed turbines with a total capacity of approximately 300 MW. Additionally, the company boasts a substantial renewable pipeline consisting of wind, solar, and battery assets, which collectively amount to 3.5 GW. Notably, a significant portion of Brookfield’s onshore wind pipeline is located in Scotland, strategically reducing its exposure to more stringent planning regulations that currently exist for the segment in England. This acquisition is being facilitated through Brookfield’s second Global Transition Fund, which has set a target of $20 billion in investments.