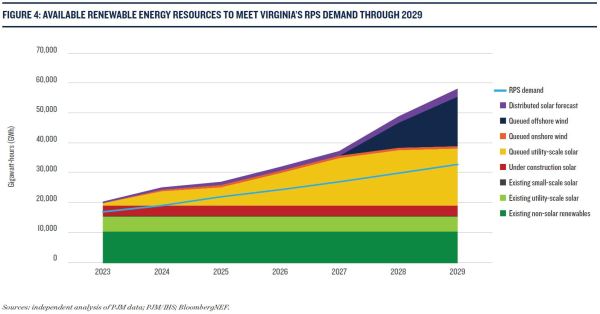

Virginia is on track to meet short-term carbon-free targets laid out in the sweeping Clean Economy Act of 2020.

And advocates agree that’s remarkable considering almost 44,000 megawatts of wind, solar and energy storage projects proposed across the state are stalled in a gummed-up transmission interconnection queue.

Still, they question whether the region’s grid operator is prepared for the massive influx of clean energy mandated over the next three decades. That includes more than 5,000 MW of wind off the coasts of Virginia and North Carolina.

“What I want to highlight is how big of a role offshore wind will play in Virginia,” said Dana Ammann, policy analyst at the Natural Resources Defense Council. “It is the most significant contributor for the state to meet those 2050 renewable portfolio standard goals.”

However, access to the electrical grid — for electrons from wind and other renewables — has to be more robust and less congested for the energy transition to be smooth.

In Virginia, that translates to easing the interconnection queue at PJM, the country’s largest regional transmission organization, which serves 13 states and Washington, D.C. More than 202 gigawatts of renewable energy across the Mid-Atlantic and beyond were stalled on that waitlist last year — 95% of the total energy projects in the queue.

“And even though Virginia is in good shape for the immediate future,” Ammann said, “proactive transmission planning would really help.”

Ammann and other analysts are encouraged — but not pacified — by recent reforms to address that backlog announced by PJM and the agency that oversees it, the Federal Energy Regulatory Commission.

FERC’s Order 2023 rule, issued in late July, requires transmission providers to adopt a first-ready, first-served cluster study model to winnow speculative projects in the queue. It means PJM will evaluate multiple projects together instead of one at a time.

In tandem, late last year, FERC had greenlighted a similar first-ready, first-served plan that PJM released in April 2022 to bump up the number of interconnection projects it processes annually. Renewable energy advocates are cheering PJM’s pivot away from its problematic first-come, first-served methodology because it contributed to soaring costs, long delays and a dramatic drop in projects reaching commercial operation.

In fact, between 2000 and 2020, the average wait time was a U.S. grid-leading seven years between an application submission and a final interconnection agreement.

That changeover means PJM has paused new service requests until 2026 as it focuses on projects submitted between April 2018 and September 2021.

While Ammann praises the effort to clear a backlog, the caveat is that with the onset of 2026, PJM could falter again under a likely onslaught of new projects spurred by Inflation Reduction Act dollars.

“Everyone should care about transmission interconnection,” she said. “It’s not sexy, but it’s essential for the transition to renewable energy.”

Virginia policy a plus for clean energy goals

Ammann emphasized that the interconnection backlog will have unequal impacts across PJM territory, depending on the structure of a state’s renewable portfolio standard and what renewable resources are available.

She laid out state-by-state comparisons in a 38-page May report, Waiting Game: How the Interconnection Queue Threatens Renewable Development in PJM.

In Virginia, the Clean Economy Act calls for 100% carbon-free electricity by 2045 for Dominion Energy and 2050 for Appalachian Power, a subsidiary of American Electric Power.

The law applies only to those two investor-owned utilities, which now represent roughly two-thirds of Virginia’s retail electricity sales. Both utilities are required to meet incremental renewable energy benchmarks over the next several decades.

As well, the policy has broader eligibility standards that allow up to 25% of that power to come from out of state.

Besides solar and wind, eligible fuel sources include geothermal, hydroelectric, municipal solid waste and landfill gas.

“These policy design factors, plus the significant amount of offshore wind energy queued for interconnection through Virginia, allow the state to meet its RPS targets ahead of schedule,” Ammann said.

Schedules indicate that Dominion’s 2,640-megawatt Coastal Virginia Offshore Wind project is set to come online in 2028. South of that project, Avangrid’s 2,400-megawatt Kitty Hawk project, which occupies three slots in the PJM queue, is expected to be operating that same year.

Once offshore wind resources enter production, Ammann said she didn’t expect Virginia would need to import additional out-of-state renewable energy through 2030. By then, at least in theory, PJM queue reform will be well underway.

The Clean Economy Act calls for 5,200 MW of offshore wind. While Ammann is cheered by progress thus far, she also emphasized that developers have faced hurdles as the projects have evolved from the proposal stage.

For example, a balky supply chain means costs for equipment and services have risen. Never mind the complications of finding enough workers, fine-tuning the engineering, and tackling ocean-to-coast transmission issues.

Ammann also noted that because of the outsize renewable energy supply from offshore wind and its unique challenges, there is potential merit in PJM and other regional interconnectors studying the resource separately from the rest of their transmission queues.

Clogged queue stymies big solar

Although offshore wind is poised to have a starring role in helping Virginia meet fast-approaching renewable energy goals, solar isn’t merely a supporting actor. Combined, both solar and onshore wind need to reach upward of 16,000 MW, per requirements of the Clean Economy Act.

The law also cites energy storage as a crucial cog. By 2036, Dominion must have 2,700 MW operational, while Appalachian Power is required to build 400 MW.

Those goals aren’t lost on utility-scale solar developers doing business in Virginia, who are confounded by the trickle-down effects of a clogged PJM queue. Take Urban Grid, for example, a Maryland-based company that does business across 12 states between Pennsylvania and Texas.

Just one annoyance with delays in Virginia arises with the uncertainty caused by Dominion occupying three PJM queue positions with its behemoth offshore wind project.

Shaun Murphy, Urban Grid’s director of transmission and interconnection, said not having access to a specific construction schedule makes it difficult to not only site new solar projects but to find financing for projects that have emerged from PJM’s queue.

“When we seek financing for our Virginia projects, it requires a long-term [grid] congestion forecast of the Dominion system,” Murphy said. “These offshore wind projects and their transmission upgrades have a huge impact on that forecast.”

That’s a huge detriment because it affects the power-hungry south-north corridor between Richmond and “data center alley” in Northern Virginia.

Stewart West, Urban Grid’s director of site acquisition, said the PJM backlog has lengthened the lead time for new project development to about a decade. Siting is difficult because landowners aren’t keen on tying up their land for such long-term option agreements, thus missing out on lucrative business deals.

Both West and Murphy point out how PJM could up its interconnection game to help solar developers thrive in Virginia. A start would be pairing up projects so as to match the right land and permits with a decent queue position. That could be done without compromising privacy.

“It might surprise folks outside the renewable industry that we collaborate with developers of other queue projects,” Murphy said. “Often the hardest part is figuring out who’s developing a nearby project.”

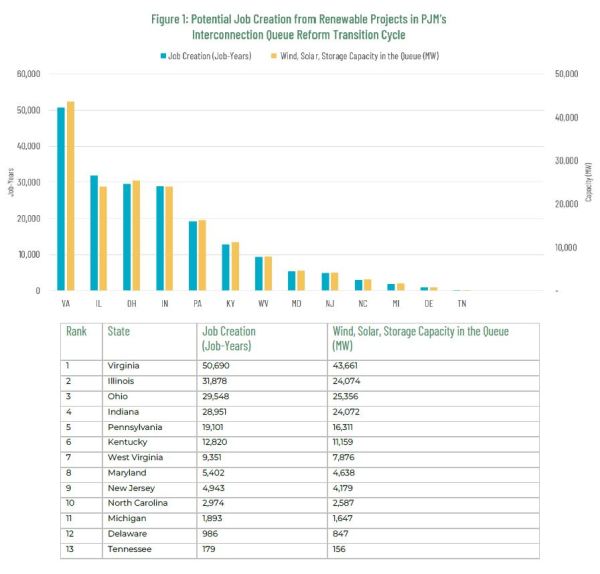

With 43,661 MW of renewable energy lingering in the queue, Virginia blows away its nearest competitors — Ohio, Illinois and Indiana — in the 13-state market, according to the American Council on Renewable Energy.

Relatedly, the national nonprofit also reported that those stalled projects are costing 50,690 “job-years” — equivalent to a full-time job for one year — far outpacing potential job creation in the 12 other PJM states.

“Virginia is projected to benefit from more jobs in the solar and battery storage sectors than any other state in the region,” said Noah Strand, lead author of ACORE’s “Power Up PJM” report released in June.

Strand, a policy associate, noted that the jobs data was reported in job-years. That’s the full-time equivalent of one job for one year, based on an annual, industry-specific average.

‘Challenging to see the future’

As today’s electrical grid is so “fragmented and balkanized,” PJM’s queue reform is just one piece of the renewable-onboarding puzzle, said Elise Caplan, vice president of regulatory affairs at ACORE.

Strand stressed that PJM has not stepped up on constructing high-voltage transmission lines to dispatch clean, affordable power.

“It’s not a finger-snapping process where if we wish really hard, the grid will work,” he said. “We can’t deliver [enough] power to load centers if grid capacity doesn’t improve.”

Ammann agreed. A University of Virginia study she reviewed for her NRDC report highlighted how imperative it is for PJM and state regulators “to get transmission right” this decade so the renewables boom can meet the burgeoning clean electricity needs of homes, vehicles and commercial buildings. That includes building new lines and addressing congestion on existing ones.

“Scrambling in the 2030s will lead to much bigger and more costly problems,” she said. “With the current piecemeal plan, costs are dumped on [solar and wind] developers and they can’t afford them.”

Energy-affiliated technology is rarely the stumbling block to reaching renewable power goals.

“What matters more is how much it will cost and who pays,” Ammann said. “The longer we wait and allow the status quo with interconnection queue issues to continue, the more the cost of the transition to clean energy will go up.”

Over at Advanced Energy United, director Jon Gordon tracks PJM issues for the national industry association focused on clean power.

It’s not acceptable, he said, that Virginia developers shelved at least 225 projects since 2016 because of interconnection headaches that made their proposals economically unviable.

“The cluster approach is a step in the right direction,” Gordon said, “but a lot more needs to be done to get out of this mess.”

That long list includes reforms that address concerns such as the price tag of grid upgrades — who covers them and why developers aren’t notified earlier.

“There’s no silver bullet answer to navigate all of this,” Gordon said. “Per usual, it requires silver buckshot.”

For starters, PJM needs to explore automating certain tasks and hiring more staff. Employees need advanced degrees and a specialized skill set.

Historically, he said, the PJM interconnection model was based on hooking in large, fossil fuel-powered plants, and that happened infrequently. PJM never imagined the massive volume of projects engendered by a solar and wind revolution.

“They moved too slowly, things kept piling up and PJM became overwhelmed,” Gordon reflected. “You could argue that PJM should have seen this coming and prepared. But it’s challenging to see the future.”