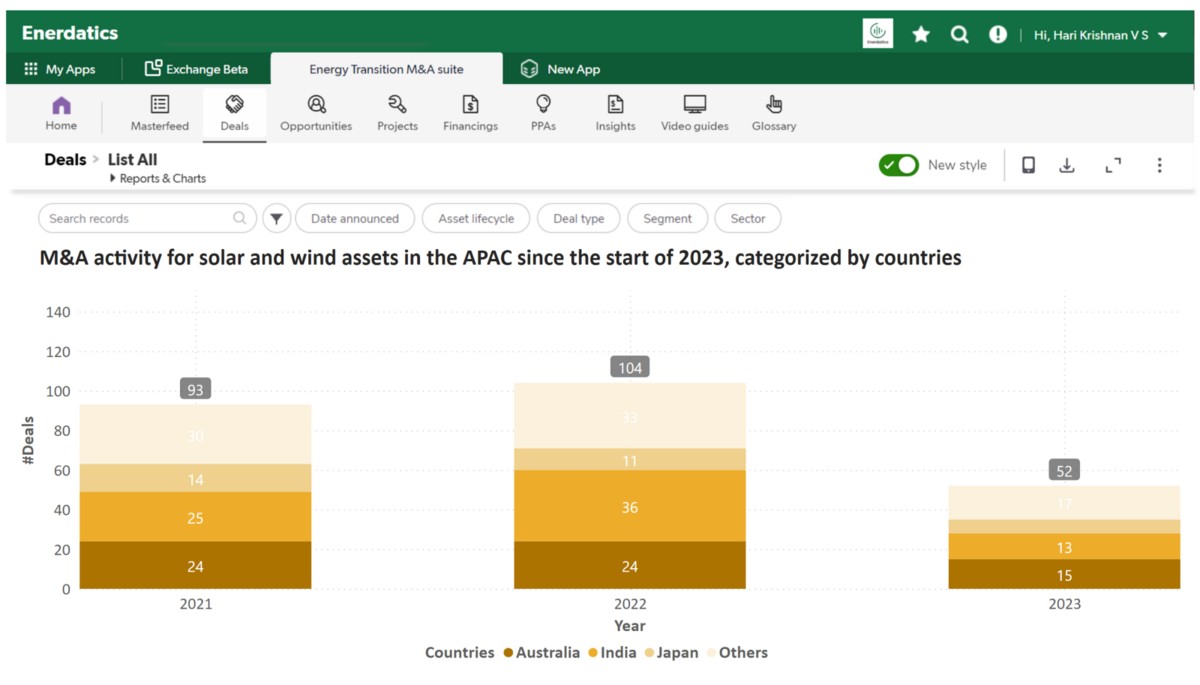

Australia led the M&A activity for solar and wind assets in the APAC since the start of the year, accounting for ~30% of all deals. The activity was propelled by the strong demand for under-development assets, constituting ~75% of the deal activity in the country. Transactions included market entry by firms such as INPEX and Gentari International as well as portfolio expansion by established participants such as Ingka Group and Octopus Energy. Acceleration in activity is primarily due to favorable government policies and ambitious targets, which are supported by funding at both federal and state levels. The availability of abundant land and resources for solar and wind power further enhances Australia’s appeal as an attractive investment destination for these ventures.

The increase in activity was exemplified by APA Group’s recent acquisition of Alinta Energy’s power assets in Western Australia for an enterprise value of $1.1bn. This acquisition encompasses 537 MW of operational portfolio, primarily comprising conventional assets, as well as ~1.1 GW of renewable pipeline. The projects were procured at a deal value equivalent to ~13 times the forecasted FY24 EBITDA of these assets.