The company, backed by Antin Infrastructure, overtakes Clearway Energy for the most debt capital raised for solar projects in the US this year, thanks to the $750mn construction warehouse facility secured from Santander Bank, Natixis, and Rabobank.

In spite of heightened interest rates, US developers continue to aggressively tap into the debt market, as companies are in a race against time to secure capital before the moratorium period for import ban of solar modules from Southeast Asia ends. Developers are additionally mitigating the impact of elevated interest rates through incentives secured under the IRA.

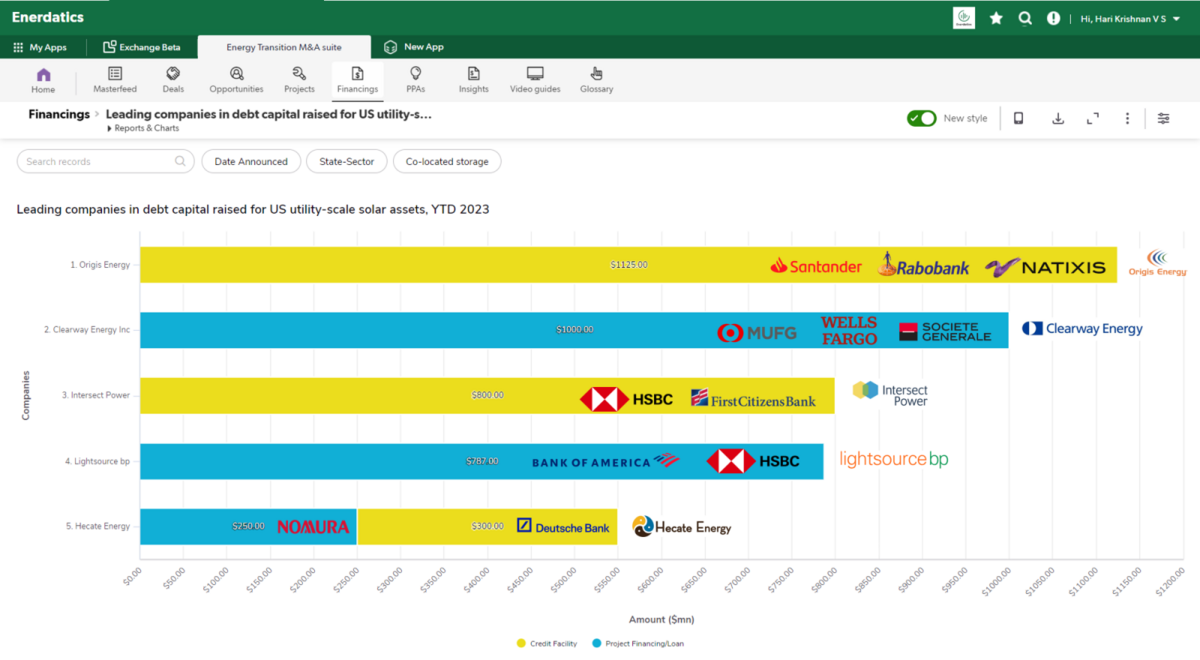

Enerdatics has plotted the top 5 list of companies with most debt capital raised for utility-scale solar assets this year.