yangphoto

Investment Summary

Duke Energy Corporation (NYSE:DUK) has become a cornerstone addition to many investors’ portfolios as the company has a dividend yield of 4.5%. DUK focuses on the utilities sector where it has very well diversified its revenue streams, engaging both with electric utilities and gas utilities.

The valuation of DUK is rather appealing seeing as it trades at a discount to the sector based on earnings of around 8%. I think that given the solid report the company had recently and the reaffirmed guidance for growth of 5 – 7% going through 2027 reaching an EPS of $5.65. Given the quality of the business and the assets they hold, I think a decent endearing multiple would be 18, meaning we have a price target of $101. The upside is around 15% but paired with the strong dividend yield they have I think the company does constitute a buy right now as the earnings did include a beat on revenues.

Solid Business Model And Outlook

The business model of DUK I think is quite robust and has proven to weather many downturns and headwinds. As we went over at the beginning of the article, the operations of DUK are well diversified as the company is made up of two primary segments. Within the first one, the Electric Utilities and Infrastructure segment focuses on generating and transmitting electricity in Carolinas, Florida, and the Midwest. The various energy sources that the company has includes coal, hydroelectric, natural gas, oil, and solar but also wind sources too. The list is diverse, to say the least, but that is also what has led DUK to be where they are today.

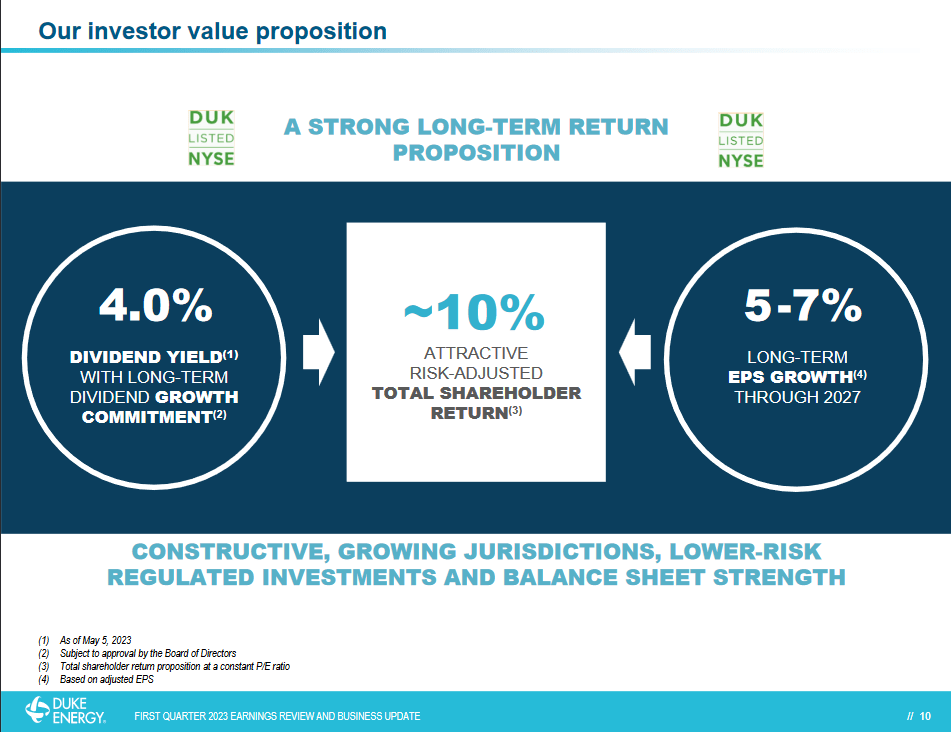

Investor Value (Investor Presentation)

During its years of operations though the focus has shifted towards ensuring that the shareholders in the company get a substantial return on their investments. One of the significant ways they have done this is through dividends, which right now is at 4.5%. The long-term growth of the EPS is set to be between 5-7% which should be translating to a similar long-term growth of the share price. Where the appealing part forms for DUK is the fact they aim to have a dividend yield of at least 4% with a long-term commitment to growing the dividend accordingly. On the lower end that would mean a yearly return of 9%. I think for almost any investor a solid 9% return each year is fantastic and would be beating out most indexes and broader market funds.

The lower we go with the share price the better the margin of safety becomes, but I think with even a 10% discount to the sectors the buy case is evident.

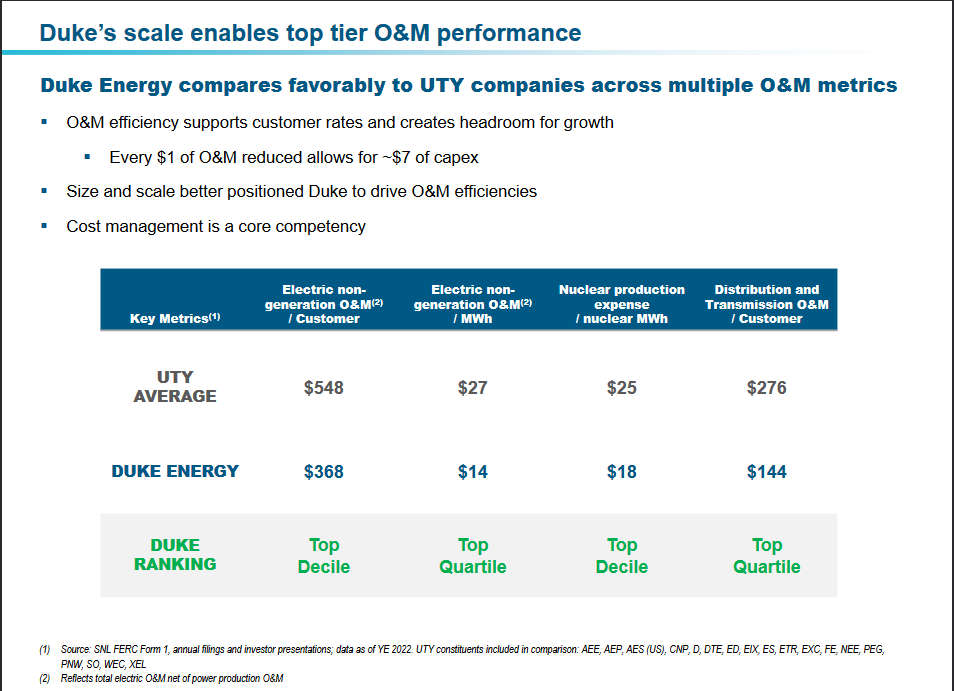

Company Scale (Investor Presentation)

One of the key advantages of DUK is the scalability of the business and the ability they have to acquire new companies and market share rather efficiently. Worth noting with DUK is the fact that every $1 of O&M reduced allows for an additional $7 of capex. That is a solid ratio to have for any business.

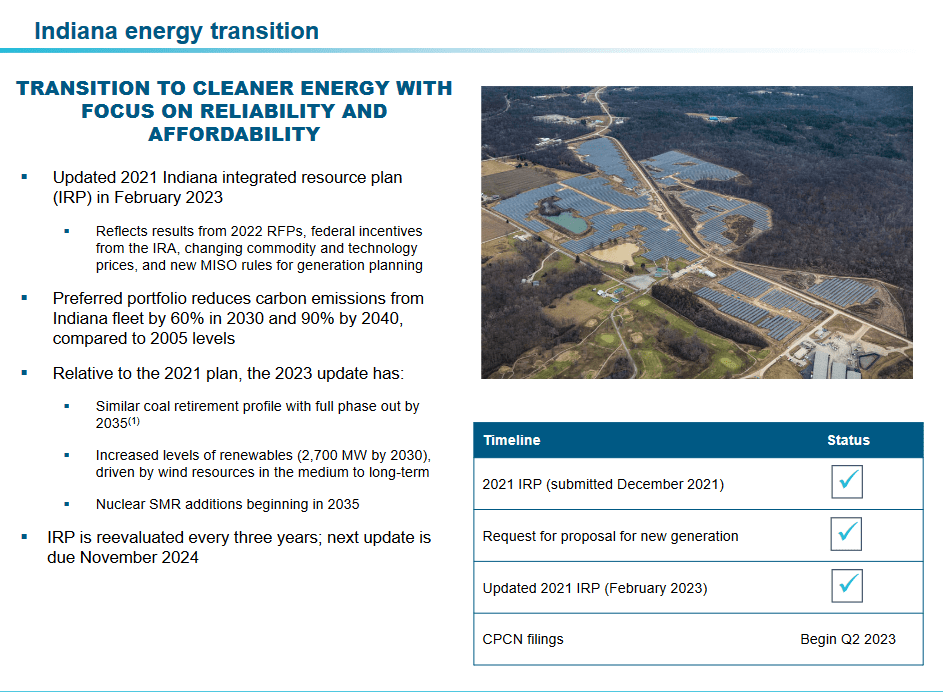

Indiana Energy (Investor Presentation)

Seeing as the company also has exposure and operations involving renewable energy I think that it’s important to have some of these highlights in the business. DUK is aiming to retire some of its coal operations and be completely phased out by 2035. As for nuclear, however, it is expected to begin increasing in 2035 instead. Strong renewable investments I think will be present in the coming reports. Speaking of upcoming reports, the EPS estimate for Q2 was $0.98 which is a slight decrease from a year prior, but seeing as electricity prices were far higher last year around as a result of worrisome times after the war in Ukraine commenced. The slight miss on the EPS doesn’t worry me that much, seeing revenue growth was good news enough. Margin expansion will come when interest rates go down. I think going into 2024 instead for DUK we will see strong EPS growth as the company continues to invest and broader its operations. Another factor I will be looking at in the coming report is margin growth. Net margins stand at 8.7% which is below where it has historically been. A strong improvement to the upside here I think would help the share price come out of the slump it has been in recently.

Risks

As DUK undertakes strategic initiatives to shape its future, several factors warrant attention due to their potential impact on the company’s trajectory. While these moves are poised to bring positive outcomes, it’s important to acknowledge and assess the associated risks that could influence DUK’s performance in the coming months and beyond.

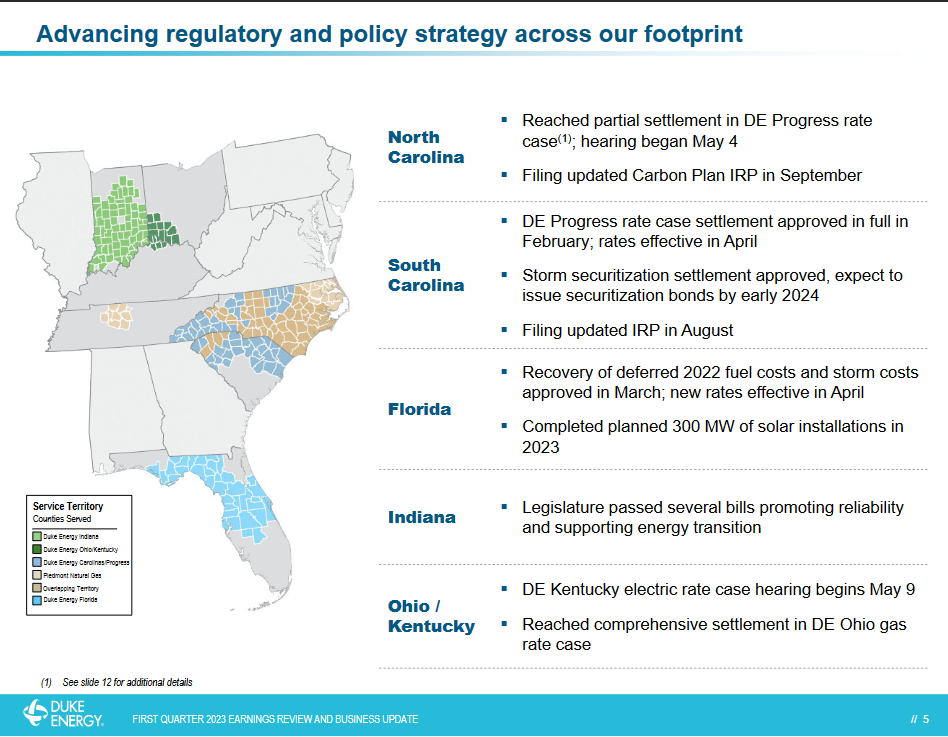

One area of concern lies in unresolved regulatory issues. The energy sector is subject to a lot of regulations, and any lingering regulatory uncertainties could introduce unpredictability to DUK’s operations. Changes in regulatory frameworks or delays in obtaining approvals might impact the company’s strategic plans and financial projections.

Company Project (Investor Presentation)

Another factor to consider is the potential EPS dilution stemming from the issuance of convertible notes. While these notes can provide an avenue for raising capital, the conversion of these securities into common shares could lead to a dilution of existing shareholders’ ownership. Investors will need to closely monitor the impact of such dilution on DUK’s earnings per share and its implications for shareholder value.

Financials

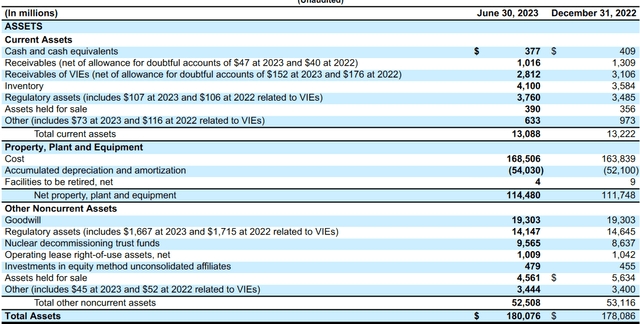

Looking at the balance sheet for DUK I think there is some work to be done here. The company has $377 million in cash but has long-term debts of $69 billion. This is a difficult position to operate from but it seems that DUK has set up its debt profile rather well. Interest expenses were at $2.5 billion but EBITDA sitting still at $12 billion.

Assets (Earnings Report)

Looking at the coming reports I think a further increase in the cash position will do the company very well and a higher share price might happen as a result of the increased quality and safety of the balance sheet. All in all, though DUK is seemingly very much able to handle its debt position without harming shareholders too much. The payout ratio is at 76% but remains stable here as the company has reached its target of a 4% dividend yield.

Valuation & Wrap Up

DUK has managed to very well diversify its business and has operations spanning many markets in the energy and utilities sector. Why I think that DUK is such a solid addition comes from the fact the management is devoted to ensuring investors are getting a solid return. The dividend is aimed at staying around 4% and with a target EPS growth of 5- 7% until 2027 the ROI looks appealing.

Stock Price (Seeking Alpha)

Besides, DUK is trading at a discount to the sector by 8% based on earnings. For investors that seek a long-term dividend income stock then DUK is perfect. The company manages a vast majority of the electricity in the US and some markets and regions too. Investing is a bet on continued electricity demand in the US which seems likely as both manufacturing trends are positive and more homes are being built. Rating DUK a buy ahead of earnings