imaginima

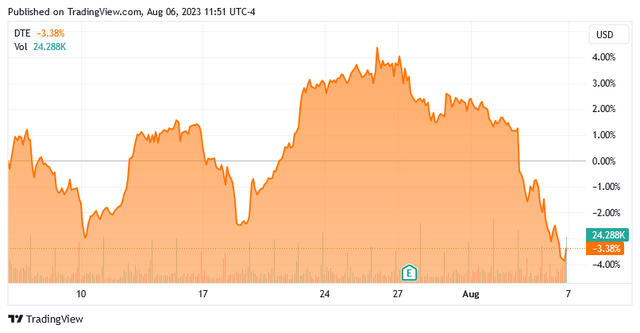

On Thursday, July 27, 2023, Detroit, Michigan-based electric and natural gas utility DTE Energy Company (NYSE:DTE) announced its second quarter 2023 earnings results. At first glance, these results were decent, as the company beat the earnings expectations of its analysts. The market appears to disagree, though, as the company’s stock price has been declining relatively steadily since the date of the earnings release:

DTE Energy

In numerous previous articles on utility companies, including DTE Energy, I pointed out that one of the defining characteristics of these companies is that they tend to enjoy remarkable financial stability over time. DTE Energy did not show this in the reported results, as the company’s revenues dropped substantially on both a quarter-over-quarter and year-over-year basis. Its cash flows showed remarkable resiliency though, so things were certainly not all bad. DTE Energy has long been fairly popular with green energy investors, which unfortunately shows up in its stock price. As such, the stock is a bit expensive relative to its peers. This reduces its investment potential, but the company is still reasonably well-positioned for forward earnings per share growth so there may still be a few reasons for someone seeking a 3.53% yield to purchase shares of the company today.

Earnings Results Analysis

As regular readers are certainly well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis.

Therefore, here are the highlights from DTE Energy Company’s second quarter 2023 earnings results:

- DTE Energy reported total revenue of $2.684 billion in the second quarter of 2023. This represents a 45.49% decline over the $4.924 billion that the company reported in the prior-year quarter.

- The company reported an operating income of $394.0 million during the reporting period. That compares very favorably to the $183.0 million that the company reported in the year-ago quarter.

- DTE Energy placed a new 225-megawatt wind generating power plant into operation. This is the largest wind power plant in the state of Michigan and it is capable of powering approximately 78,000 homes in the state.

- The company reconfirmed its previous operating earnings per share guidance of $6.09 and $6.40 for the full-year 2023 period.

- DTE Energy reported a net income of $201.0 million during the second quarter of 2023. This represents a 443.24% increase over the $37.0 million that the company reported in the second quarter of 2022.

It seems almost certain that the first thing that anyone reviewing these results will notice is that DTE Energy’s revenue declined significantly compared to the prior-year quarter. The company did not provide any reasons for this in either its press release or during the earnings conference call. In fact, the only thing that management mentioned about it was a passing reference to cooler weather than in the prior-year quarter. This certainly goes against the narrative that we have been hearing in the mainstream media about “record-breaking heatwaves” throughout the United States in 2023, but in fact there have only been a few areas in the United States (or abroad) that have been experiencing record high temperatures so far in 2023. In fact, statistically, every day there will be at least one place on the planet that sets a temperature record depending on how you do the measurement and what time period is used for the records.

During the second quarter of 2023, temperatures in DTE Energy’s service territory were on average lower than they were during the second quarter of 2022. This means that less people were using their air conditioners than in the same period of time last year. During the summer months, the use of air conditioners is one of the biggest sources of electricity consumption. The lower use of air conditioners than last year means lesser consumption of electricity and less revenue for DTE Energy. The company also mentioned that residential sales declined a bit due to less electric consumption during the day as people return to their regular places of work and do less remote work. It is hard to believe that this would have a huge impact on DTE Energy’s overall revenue though since commercial consumption of electricity should have gone up by a similar amount.

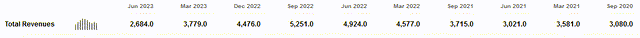

Even so, the company’s revenue decline was very large and as we can see, DTE Energy’s revenues actually came in lower than the company has had during any of the past ten quarters:

Seeking Alpha

We also see that DTE Energy’s revenues also came in lower than in the corresponding quarter of 2021. However, the second quarter of 2021 was the final quarter in which DT Midstream (DTM) was part of the company, so its quarterly results two years ago would have benefited from that. Once we back out the revenues generated by the midstream company (about $208 million), we see that the revenues from the utility operation were pretty similar to what it had two years ago. Thus, the thesis about the stability of this company over time that I presented in various previous articles still appears to hold true.

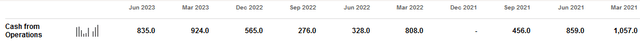

The company’s general financial stability over time is even more evident in its operating cash flow. The operating cash flow is defined as the amount of cash generated by a company’s ordinary business operations, so it is arguably much more important than revenue. As we can see here, the company’s operating cash flow has proven very stable over time, including in the most recent quarter:

Seeking Alpha

The reason for this stability should be fairly obvious. DTE Energy provides a product that is generally considered to be a necessity for our modern way of life. After all, how many people do not have electricity in their homes? Natural gas service is likewise a necessity for people whose residences use a natural gas heating system. As these things are considered to be necessities (and may even be required by habitation laws), people will generally prioritize paying their utility bills ahead of discretionary expenses. This is only natural as it makes no sense to buy a new smartphone or spend your money on a fancy restaurant dinner when you do not even have electric or heat at home.

As such, DTE Energy will usually be near the top of the list when its customers have to decide whom to pay when their money gets tight. This is exactly the kind of business that we want to own today considering the financial stress that many consumers have begun to experience due to the high inflation in the economy. Excluding the most recent quarter, residential and business consumption of electricity does not really change too much from year to year so the company’s revenues will generally remain relatively consistent. This results in remarkably stable cash flows and profits over time.

With that said, we do occasionally see some fluctuations in DTE Energy’s operating cash flow, such as in the middle of last year. One big reason for this is natural gas prices. As is the case with most electric utilities, DTE Energy operates a number of natural gas-fired power plants. In fact, natural gas power plants are a key part of the company’s green energy strategy. Its own website states the following:

Over the next decade, DTE plans to retire older, less efficient coal plants and build new, cleaner natural gas power plants, continuing its focus on energy efficiency. Natural gas from DTE is an economical energy source that keeps bills low, rooms warm, and customers happy.

The use of natural gas power plants is very common because of the very real problems with wind and solar power. In particular, both of these energy sources are unreliable and do not always produce electricity at the times when it is needed. Batteries are not capable of solving this problem with current technology, so utilities have been using natural gas power plants to supplement the renewable energy generation and ensure that the grid remains as reliable as we have come to expect it to be. This does expose the company to natural gas prices though, and high commodity prices can have an adverse impact on its operating cash flow. The same is true of the company’s natural gas utility operations, as DTE Energy will frequently purchase natural gas during the shoulder and summer months and store it until the winter.

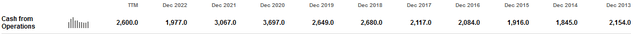

Thus, there can be some quarterly periods in which high natural gas prices reduce cash flow. This tends to balance out over the year though, and as we can see, the company’s operating cash flows are reasonably consistent during most years:

Seeking Alpha

This one of the biggest reasons why utilities like DTE Energy are typically quite popular with retirees and other risk-averse investors.

Growth Prospects

Naturally, as investors we are unlikely to be satisfied with mere stability. We like to see a company that we are invested in grow and prosper with the passage of time. Fortunately, DTE Energy is well-positioned to do exactly that.

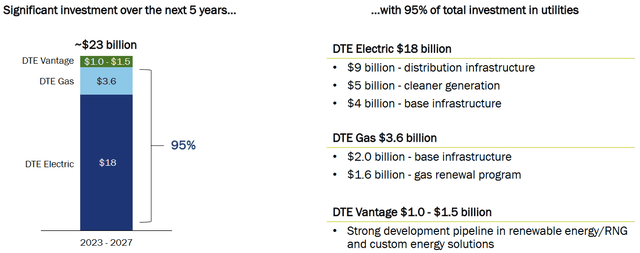

The primary way through which the company will achieve its forward earnings growth is by increasing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the prices that it charges its customers in order to earn that specified rate of the return. The usual way through which a company grows its rate base is by investing money into upgrading, modernizing, and possibly even expanding its utility-grade infrastructure. DTE Energy is planning to do exactly this as the company outlined a plan to invest approximately $23 billion into its operations over the next five years, most of which will be directed into its electrical infrastructure:

DTE Energy

This is hardly surprising. After all, most of the company’s peers are investing far more into their electric infrastructure than their natural gas infrastructure. This is at least partly due to the push for electrification push, as the electric grid is currently nowhere close to sufficient to support widespread adoption of electric cars, let alone the other things that some activists are pushing for. The investment program as designed should allow DTE Energy to grow its operating earnings per share at a 6% to 8% compound annual growth rate over the 2023 to 2027 period. When we combine this with the company’s current 3.53% dividend yield, we get a projected average total return of 10.5% annually at the midpoint, which is a very reasonable return for a conservative utility stock.

Financial Considerations

It is always important to investigate the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. That is usually accomplished by issuing new debt and using the proceeds to repay the existing debt, as very few companies have the ability to completely pay off their debt with cash as it matures. As new debt will be issued with an interest rate that corresponds to the market interest rate at the time of issuance, this process could cause a company’s interest expenses to go up following the rollover in certain market conditions. In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. While utilities such as DTE Energy tend to have remarkably stable cash flows over time, this is still a risk that we should not ignore as bankruptcies have occurred in the sector before.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. The ratio also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation, which is arguably more important.

As of June 30, 2023, DTE Energy had a net debt of $19.839 billion compared to $10.485 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.89 today. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity |

| DTE Energy | 1.89 |

| CMS Energy (CMS) | 1.91 |

| Exelon Corporation (EXC) | 1.68 |

| Eversource Energy (ES) | 1.58 |

| Public Service Enterprise Group (PEG) | 1.28 |

As we can see here, with the notable exception of fellow Michigan utility CMS Energy, DTE Energy is more levered than its peers. This is not a good sign as it could be an indication that the company is too reliant on debt to finance its operations. As such, it presents a somewhat greater risk to investors than its peers due to this leverage. Anyone considering purchasing the stock should take this into consideration as part of their decision-making process.

Dividend Analysis

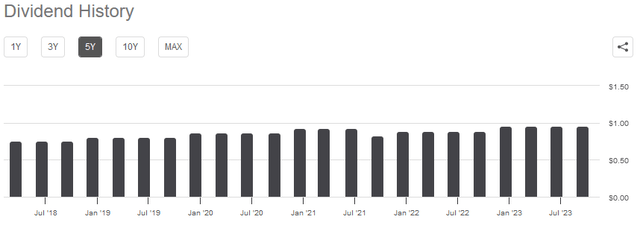

One of the biggest reasons why investors purchase shares in a utility company like DTE Energy is because of the very high yield that these stocks typically possess. DTE Energy is certainly not an exception to this, as the stock yields 3.53% at the current price. DTE Energy also has a long history of raising its dividend on an annual basis:

Seeking Alpha

We do see a slight decline in the dividend beginning in the third quarter of 2021. This does not change the accuracy of the previous statement regarding the company’s dividend growth, however. Prior to the third quarter of 2021, DT Energy and DT Midstream were the same company but afterwards they were two separate firms. The shareholders in DT Energy at the time received shares of DT Midstream and the combined dividend of the two companies more than made up for the cut from DT Energy alone. Thus, the shareholders of DT Energy have seen a consistently growing dividend income over the period. There was not actually a decline in an investor’s dividend income unless the shares of DT Midstream were sold.

The fact that the company has consistently grown its dividend over time is something that we very much like to see, especially during inflationary periods such as the one that we are experiencing right now. This is because inflation is constantly reducing the number of goods and services that we can buy with the dividends that the company pays out. That can make it feel as though an investor is steadily getting poorer and poorer, which is especially noticeable for retirees or others that are dependent for their portfolios for the income that they need to cover their expenses. The fact that the company increases its dividend every year helps to offset this effect and maintains the purchasing power of the dividend over time.

As is always the case though, it is critical that we ensure that the company can actually afford the dividends that it pays out. After all, we do not want to be the victims of a dividend cut since such an event would reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividends is by looking at its free cash flow. The free cash flow of a company is the amount of cash that was generated by a company’s ordinary operations and is left over after it pays all of its bills and makes all necessary capital expenditures. This is, ultimately, the money that is available to perform tasks that benefit the shareholders such as reducing debt, buying back stock, or paying a dividend. During the twelve-month period that ended on June 30, 2023, DTE Energy reported a negative levered free cash flow of $1.4501 billion. That was obviously not nearly enough to pay any dividends, but the company still paid out $719.0 million in dividends during the period. This is likely to be concerning at first glance as the company does not have nearly enough free cash flow to cover its dividends.

However, it is fairly common for a utility to finance its capital expenditures through the issuance of debt and equity. It will then pay its dividends out of operating cash flow. The reason that this is done is that the incredibly high cost of constructing and maintaining utility-grade infrastructure would otherwise preclude ever paying a dividend to the investors if the utility had to finance its expansion internally. In the trailing twelve-month period, DTE Energy reported an operating cash flow of $2.6000 billion. That was more than enough to cover the $719.0 million that the company paid out in dividends with a substantial amount of money left over for other purposes. Overall, DTE Energy should not have any particular difficulty maintaining its dividend at the current level going forward.

Valuation

It is critical that we do not overpay for any assets in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a utility like DTE Energy, one way to value it is by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few stocks that are undervalued relative to their growth prospects right now as the market remains richly valued. This is particularly true in the low growth utility sector. Thus, the best way to use this ratio today is by comparing DTE Energy’s price-to-earnings growth ratio to its peers in order to determine which company has the most attractive relative valuation.

According to Zacks Investment Research, DTE Energy will grow its earnings per share at a 6.00% rate over the next three to five years. This is in line with the figure that we used earlier to calculate a projected total return based on the company’s rate base growth. As such, it seems like a fairly reasonable estimate. This earnings per share growth gives DTE Energy a price-to-earnings growth ratio of 2.91 at the current stock price. Here is how that compares to the company’s peer group:

| Company | PEG Ratio |

| DTE Energy | 2.91 |

| CMS Energy | 2.38 |

| Exelon Corporation | 2.69 |

| Eversource Energy | 2.71 |

| Public Service Enterprise Group | 3.63 |

As stated in the introduction, DTE Energy is a rather popular stock among the green energy crowd so it tends to trade at a richer valuation than many of its peers. We can see that clearly in the table above. It is not as richly valued as it has been in the past, though, so that is a good thing for anyone that is considering purchasing the stock. It does still look a bit expensive, though, so it might be best to wait for a dip in the price before buying in.

Conclusion

In conclusion, DTE Energy mostly delivered the reliable and consistent financial performance that we normally expect from this company, although it was adversely impacted by cooler than normal temperatures during the second quarter. The company continues to execute on the growth program that we have outlined in previous articles on the company, which positions it to deliver around a 10.50% total return annually over the next five years. The biggest problems here are that DTE Energy Company is more reliant on debt to finance its operations than some of its peers and it trades at a fairly expensive earnings multiple relative to the growth that it can actually deliver.