Joe Raedle

The energy sector has been on the move of late due to a number of aligned global factors. However, the BlackRock Energy and Resources Trust (NYSE:BGR) is a poor way for investors to participate in what otherwise is a fairly bullish energy thesis. While some investors get fooled into thinking closed-end funds, like BGR, that trade at a significant discount to NAV offer a chance to pick up a “value”, they fail to realize that these funds typically maintain such a big discount. In addition, this fund has an expensive fee and a terrible long-term performance track record. Today, I’ll list all the reasons why investors should sell the BGR fund and move the proceeds into much better performing assets within the energy sector – or, better yet, outside of it.

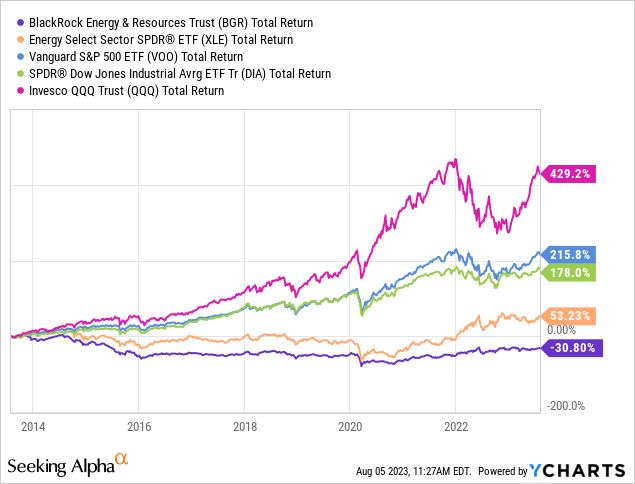

MarketWatch

Investment Thesis

As can be seen in the graphic above, the price of Brent oil has been moving higher of late and appears to be breaking out of the base it made over the past few months. This is likely due to a number of global factors including: continued strength in the U.S. economy, strong jet-fuel demand from significantly increased air-travel, hopes for additional CCP stimulus for a somewhat lethargic Chinese economy, the need to replenish the U.S. Strategic Petroleum Preserve, a 17 million bbl draw in U.S. inventory this past week, and the announcement that Saudi Arabia would extend its 1 million bpd production cut through the month of September. That being the case, investors are once again looking to make money in the energy sector. However, a closed-end fund like BGR is likely not the most profitable way to do so. I’ll explain why below, but first let’s look at the BGR Trust portfolio.

Top 10 Holdings

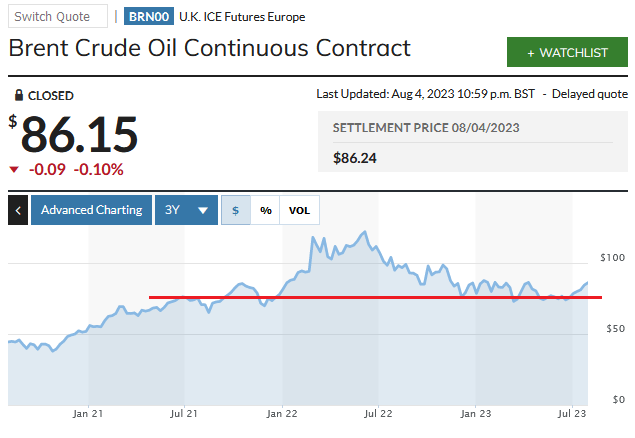

The top-10 holdings in the BGR fund are shown below (as of May 31st) and were taken directly from the BlackRock BGR webpage where investors can find additional information on the fund.

Blackrock

In aggregate, the “big-3” U.S. oil & gas companies – Exxon (XOM), Chevron (CVX), and ConocoPhillips (COP) – equate to almost 30% of the portfolio. It’s interesting to note that Conoco, which has market-cap of $136 billion, has a significantly larger allocation in the BGR portfolio as compared to Chevron, which is a much larger company (market-cap of $297 billion). This may be because of BGR’s apparent emphasis on income: the combination of COP’s base+variable dividend policy has declared $4.54/share in dividends over the past 4-quarters for a TTM yield of 4.00%. That compares to Chevron’s ordinary dividend of $6.04/share dividend which is currently yielding 3.79%. Chevron has decided to over-emphasize share buybacks over dividends directly to investors and famously announced a $75 billion share buyback plan in January.

The GBR Trust maintains a global portfolio and has 23.5% allocated to foreign-based international integrated companies Shell plc (SHEL), TotalEnergies (TTE), and BP (BP), which currently yield 3.52%, 4.89%, and 4.74%, respectively. These international companies have been allocating more capital to the clean-energy transition as compared to its U.S. counterparts.

Canadian Natural Resources (CNQ) – the largest Canadian O&G producer – is the #7 holding with a 4.5% weight. CNQ is +22% over the past year and yields 4.15%.

EOG Resources (EOG), one of the largest U.S. shale producers, is the #8 holding with a 4.2% weight. As the slide below from the Q2 presentation shows, EOG generated $1 billion of free-cash-flow in Q2 and – unlike its bigger peers in the U.S. – is returning much more cash directly to shareholders in the form of dividends as compared to share buybacks (i.e. $480 million vs. $300 million in Q2 alone):

EOG Resources

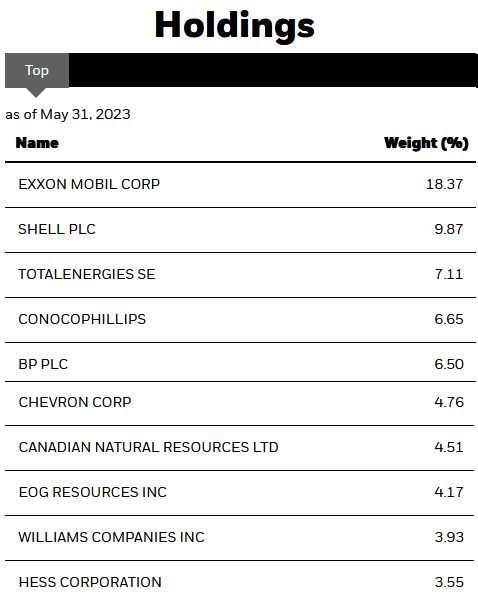

As mentioned earlier, the BGR Trust maintains a global portfolio – with significant allocation of capital to Canada, France, and the UK:

Blackrock

Performance

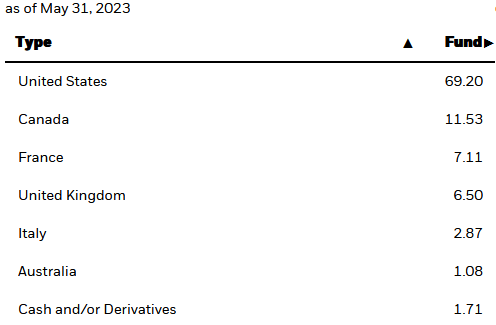

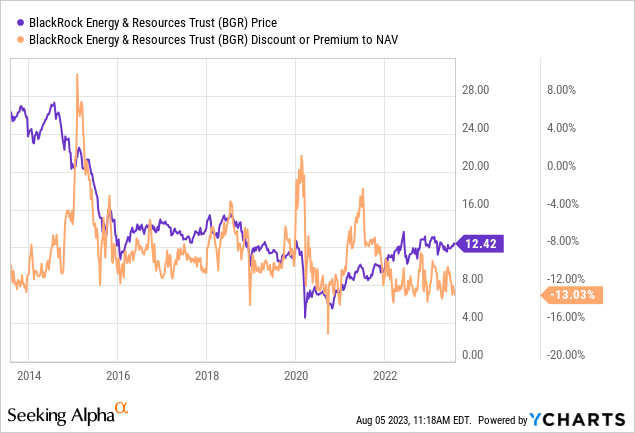

Although the BGR portfolio contains most all of the top energy companies investors are familiar with, the portfolio’s long-term performance track record is, in a word, awful:

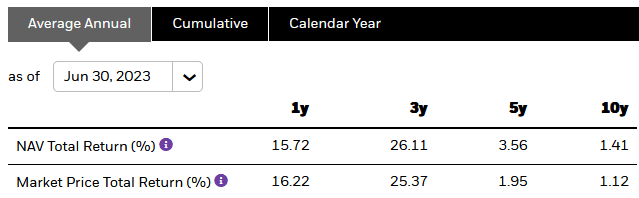

Blackrock

Indeed, the following graphic compares the 10-year total returns of the BGR fund versus that of some of its peers: the fellow closed-end Adams Natural Resources Fund (PEO), the Energy Select Sector SPDR ETF (XLE), the Vanguard Energy ETF (VDE), the Fidelity MSCI Energy ETF (FENY), and the iShares U.S. Energy ETF (IYE):

As can be clearly seen from the chart, the BGR ETF is the notable and very significant laggard of the entire group. That being the case, BlackRock’s investment objective with the fund – “to provide total return through a combination of current income, current gains and long-term capital appreciation” – has arguably been a failure over the past decade.

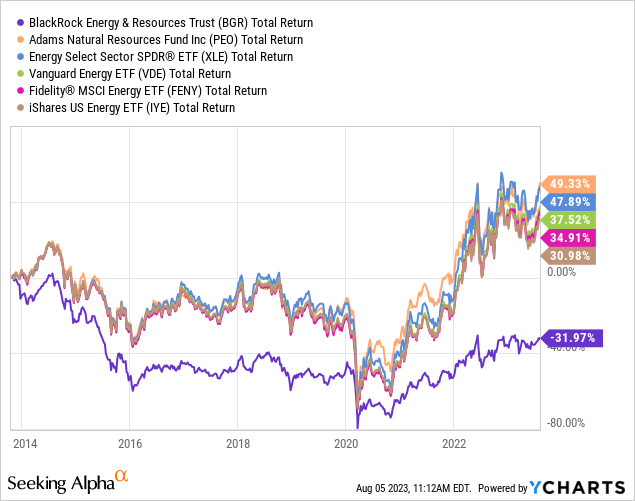

Part of that vast under-performance is due to the very high expense fee (1.26%) and part of that is due to a very high discount to NAV, currently 13.03%, which is toward the high-end of its 10-year range (far right scale):

Distributions & Yield

The BGR fund pays out a monthly distribution that over the past year has averaged ~$0.065 cents per share. The last monthly distribution was $0.0657/share, which was in line with the previous monthly payout.

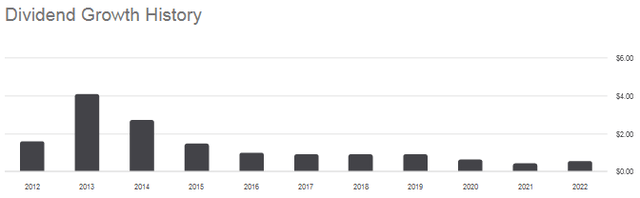

From a dividend growth perspective, Seeking Alpha reports an abysmal track-record:

Seeking Alpha

BGR currently reports its yield as 6.33%, which is significantly higher than the majority of its top-10 holdings are paying out. Once again, that is partly due to compression of the trust’s NAV.

Risks

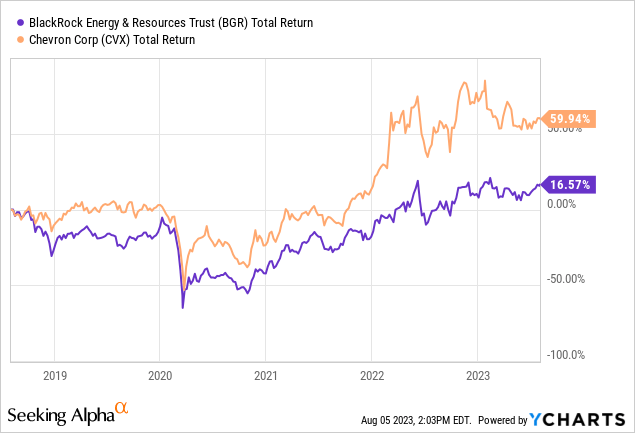

Another reason the BGR has been a total returns laggard is that the Trust also uses derivatives and “utilizes an option writing (selling) strategy to enhance dividend yield.” While the relatively outsized yield may be attractive to some income-oriented investors, the 10-year total returns chart presented earlier shows the kind of returns that investors who over-emphasize dividend income can leave on the table. Indeed, over the past 5-years investors would have been much better off by simply buying and holding Chevron, for instance:

In other words, the extra ~2.5% yield investors stretch for by owning the BGR Trust over that of Chevron stock is certainly not worth the relative disparity in capital appreciation. In addition, investors don’t have to pay a 1.26% expense fee to hold a common stock like Chevron.

Summary & Conclusion

The BGR Trust is a vastly underperforming fund within the energy sector. Investors should not be enticed by the current yield, and I would advise current BGR shareholders to SELL the trust and invest the proceeds in any of the better performing energy sector funds presented earlier.

A better strategy might be to simply buy & hold some of the better U.S. operators (Chevron or Conoco, for instance). Or, skip the energy sector altogether and simply invest in the broad market averages – as represented by the Vanguard S&P 500 ETF (VOO), the DJIA ETF (DIA), and the Invesco Nasdaq-100 Trust (QQQ) – that have delivered superior returns to investors over the past decade as compared to the energy sector, as represented below the BGR and XLE funds: