imaginima

Unitholders likely went into Enterprise Products Partners (NYSE:EPD) recent second-quarter or FQ2 earnings release already anticipating a weaker slate of results compared to the same quarter last year. After all, underlying energy prices (CL1:COM) (NG1:COM) remain well below their 2022 highs as growth normalized.

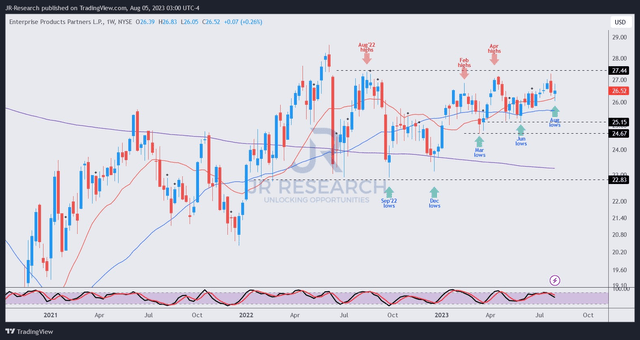

Notwithstanding the underlying weakness, EPD’s July 2023 price action indicated it nearly recovered its August 2022 highs, as EPD holders weren’t unduly concerned about recent energy market volatility. After all, the leading midstream MLP has robust fundamentals undergirding its stable and wide economic moat business model, providing substantial confidence for continued robust performance.

Management’s commentary on its FQ2 report card demonstrated that EPD is well-primed to benefit from the recovery in underlying energy markets, well-supported by its attractive forward distribution yield.

Accordingly, Enterprise updated that processing margins were weaker in the first half, which “negatively impacted profits.” As such, the company posted an adjusted EBITDA of $4.5B in H1’23, 4% below the $4.68B recorded in the first half of FY2022. Despite that, management reiterated it remains committed to meeting its $9.3B adjusted EBITDA target for FY23, suggesting a more constructive second-half growth inflection.

The company predicated its confidence based on the strength of several near-term growth drivers that could spur further recovery. These include higher commodity prices, growth projects starting service in H2, and high capacity utilization.

As such, the near-term weakness in its key profit drivers in NGL and crude oil is expected to normalize subsequently. Enterprise also noted that crude oil exports and market conditions are expected to strengthen moving ahead, coupled with tight supply conditions. With a more constructive global economic outlook, I have confidence in management’s commentary, indicating that the company remains on track to meet or surpass Wall Street’s FY23 estimates.

Furthermore, the company highlighted that its growth CapEx is expected to remain robust beyond 2023, indicating a constructive outlook. The company reiterated its FY23 growth CapEx of $2.6B at the midpoint of its guidance range. Management also indicated that it expects a midpoint growth CapEx of $2.25B moving ahead, which is supported by its reasonable leverage levels (3x currently) within its target range.

As such, I don’t anticipate any imminent challenges to the company’s ability to fund its growth opportunities, even as it allocates its payouts to its unitholders. Management also indicated that it “remains committed to returning capital to its partners through distribution growth and buybacks.” It also articulated that its “strong balance sheet positions Enterprise to be ready to execute on opportunities as they arise.”

With that in mind, I’m confident that EPD’s medium- and long-term uptrend should remain robust, suggesting holders should capitalize on buying significant dips when given the opportunity.

EPD price chart (weekly) (TradingView)

EPD has continued to power higher, forming higher lows and higher highs in the process. As such, its uptrend bias suggests that holders remain confident in buying dips since September 2022’s significant bottom.

EPD’s ability to navigate the underlying market volatility with its stable distributable cash flows or DCFs and robust distribution (forward yields of 7.7%) should continue to attract strong buying sentiments.

Notwithstanding the bullish thesis, EPD still needs to clear a sticky resistance zone at the $27.50 level, which rejected the previous re-test attempt in late July.

However, with increasingly constructive price action, reasonable valuation, and potentially more robust operating performance in the second half, I’m confident EPD should power through that level decisively. Buyers should capitalize on pullbacks to add more units.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!