spooh

On August 2nd, the management team at midstream/pipeline operator Energy Transfer (NYSE:ET) announced financial results covering the second quarter of the company’s 2023 fiscal year. On both its top and bottom lines, the business missed expectations. But when you dig deep down into the fundamental data that was provided, the overall picture, while not as attractive as last year, still remains appealing. Even though guidance was narrowed for the current fiscal year, the midpoint of it remains unchanged. And that means that shares of the company are still significantly undervalued, both on an absolute basis and relative to similar firms. Given these factors, I feel very comfortable keeping the company rated a ‘strong buy’ and, as of this writing, it remains the second largest holding in my portfolio, only behind telecommunications conglomerate AT&T (T).

A glance at recent results

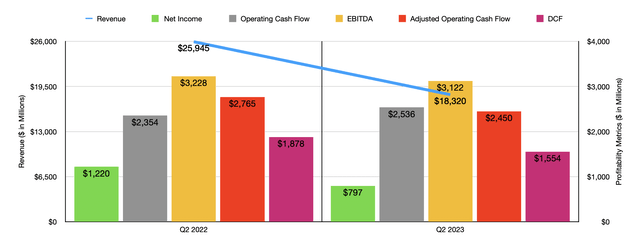

At first glance, the financial results reported by management may look very bad. Revenue, for instance, came in at $18.32 billion for the quarter. That represents A decline of 29.4% over the $25.95 billion management reported the same quarter last year. It was also $2.08 billion lower than what analysts anticipated. As I recently discussed in another article regarding rival Enterprise Products Partners (EPD), revenue really is not that significant for companies in this space. Rather, margin and volumes transported tend to be the most significant drivers of value.

Author – SEC EDGAR Data

When you look at the volume data, the picture for the company was quite attractive. Natural gas volumes transported under the Intrastate Transportation and Storage segment of the company, for instance, grew by 2.5% year over year thanks to increased utilization involving its Enable Oklahoma Intrastate Transmission system, as well as higher natural gas production from the Haynesville Shale. Even though revenue for the company plummeted from $2.20 billion to only $807 million, segment EBITDA dipped only slightly from $218 million to $216 million. Even though margins were negatively affected to the tune of $44 million because of lower natural gas prices and by $5 million due to realized natural gas sales, as well as pipeline optimization, these were offset in part by higher transportation fees thanks to new contracts and an increase in storage margin caused by favorable storage optimization.

Another big driver behind the revenue decline was the Midstream segment. Gathered volumes for the company shot up 8.3% year over year while the volume of NGLs produced grew 6.2%. Even so, revenue was cut by more than half from $5.05 billion to $2.47 billion. Volume increases, naturally, came about because of higher demand for its products under this segment and because of its acquisition of Woodford Express. This was one area where margin did contract rather significantly, dropping from $903 million to $579 million. But outside of this, the picture for the company was very positive.

For instance, an increase of 22.6% when it comes to crude transportation volumes under the Crude Oil Transportation Services segment, accompanied by a 15.2% rise in volumes involving the company’s crude terminal activities, as well as higher margins associated with this segment, sent segment EBITDA up from $562 million to $674 million. Similar improvements can be seen by looking at both the NGL and Refined Products Transportation and Services segment, and the Interstate Transportation and Storage segment.

It is worth noting that this did not stop the company from seeing a decline in profits year over year. Earnings per share dropped from $0.39 in the second quarter of last year to only $0.25 per share the same time this year. That actually missed analysts’ forecasts by $0.07 per share. Put another way, profits went from $1.22 billion down to $797 million. But again, this is not a metric that is all that valuable for a business like Energy Transfer. What’s really valuable would be the cash flow data. And although the company did demonstrate some weakness from that perspective, that weakness was mild compared to the revenue and profit declines. Operating cash flow, for instance, did manage to rise from $2.35 billion to $2.54 billion. But after adjusting for changes in working capital, the increase turned to a decrease from $2.77 billion to $2.45 billion. DCF, or distributable cash flow, went from $1.88 billion to $1.55 billion. And finally, EBITDA for the company slipped only modestly from $3.23 billion to $3.12 billion.

To some investors, any decrease at all may be perceived as a negative. But when you really dig into the picture in its entirety, things are going quite well. For the 2023 fiscal year as a whole, management is forecasting EBITDA of between $13.1 billion and $13.4 billion. This actually represents a narrowing of the forecast. In the first quarter of this year, management was forecasting EBITDA of between $13.05 billion and $13.45 billion. If you do the math, this change still results in a midpoint for guidance of $13.25 billion. No estimates have been provided when it comes to other profitability metrics. But according to my own estimates, DCF for the year should be around $7.59 billion, while adjusted operating cash flow should be around $10.93 billion. It is important for me to note that, for the purpose of adequately valuing the company, I do subtract the preferred distributions that the business pays from the adjusted operating cash flow number. This allows me to see the cash flow that common shareholders only are entitled to.

Author – SEC EDGAR Data

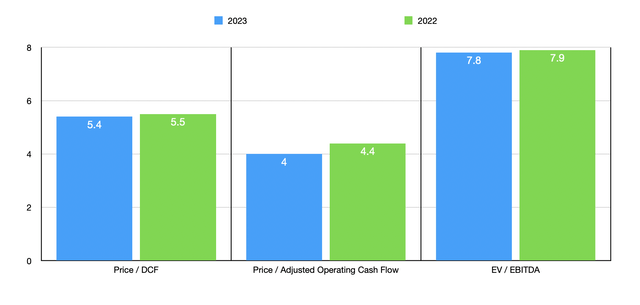

Using these numbers, I was able to create the chart above. In it, you can see how shares are priced using forward estimates for 2023, as well as using historical results for 2022. Pricing is actually quite similar, especially when it comes to the price to DCF and the EV to EBITDA multiples. Meanwhile, in the table below, I took two of these three metrics and valued the company against five similar firms. In both instances, Energy Transfer ended up being the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 4.4 | 7.9 |

| Kinder Morgan (KMI) | 7.5 | 11.0 |

| The Williams Companies (WMB) | 7.9 | 10.5 |

| Enbridge (ENB) | 8.0 | 15.3 |

| Enterprise Products Partners (EPD) | 7.8 | 9.7 |

| MPLX LP (MPLX) | 6.8 | 9.0 |

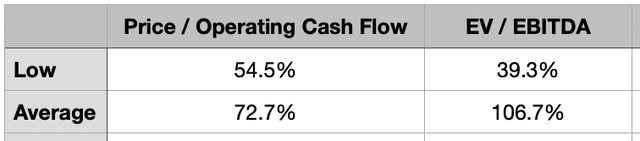

The next thing I did was to see what kind of upside potential the enterprise might offer investors. In the first scenario, I looked at what kind of upside the company might have if it were to trade at a level that would match the lowest valuation of the five companies that I listed. Using the price to operating cash flow approach, upside would be 54.5%. Using, instead, the EV to EBITDA multiple would imply upside of 39.3%. Next, I looked at a scenario where I averaged out the valuations of each of these firms. In this instance, we would be looking at upside of between 72.7% and 106.7%.

Author – SEC EDGAR Data

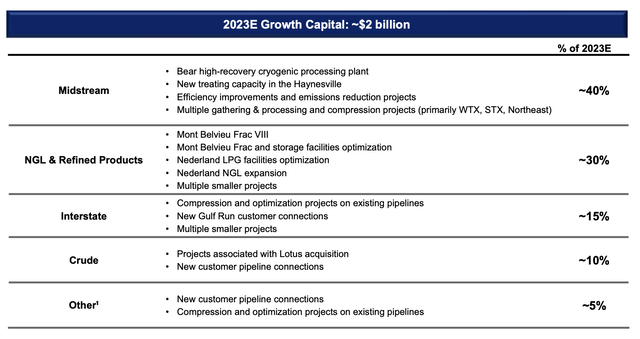

In addition to shares of the business trading at incredibly low prices, it’s also important to note that management continues to grow the firm. This year alone, for instance, management is allocating around $2 billion toward growth initiatives. And this is outside of acquisition activities like its recent purchase of Lotus Midstream that cost it $930 million in cash and 44.5 million shares. About 40% of this growth capital would be dedicated to the Midstream operations of the company. The next largest exposure will involve its NGL and Refined Products operations. That should come in at around 30%. Of course, growth does not come without consequences. In my last article on the company, I made clear that I would like to see some debt reduction. However, I also acknowledged that the past couple of years have seen the business report levels of debt they have remained in a narrow range. Well, sure enough, debt did increase on a net basis from the first quarter to the second quarter, rising by $900 million. But when you factor in a big acquisition like the aforementioned one, this should not be a surprise. The good news is that, even with the $47.80 billion in net debt on the company’s books, it is still sporting a net leverage ratio of 3.61. That is perfectly acceptable.

Energy Transfer

Takeaway

Based on all the data provided, I must say that I am shocked that shares of Energy Transfer did not shoot up in response to the financial results posted for the second quarter. While it is true that revenue and profits failed to match analysts’ forecasts, the overall cash flow picture for the company remains robust and management is comfortable with the midpoint of guidance that was issued previously. The stock is very cheap, both on an absolute basis and relative to similar firms. And management continues to grow the business through acquisitions and organic capital expenditures. To me, this all sounds like a perfect combination for strong upside. And until the market realizes this, I am perfectly comfortable with the 9.7% yield that the company currently pays, a yield that, for me, translates to about 11% based on my weighted average purchase price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.