VanderWolf-Images

Earnings season can be a great time to pick up bargains, as the market will more often than not react meaningfully one way or another. While overall market sentiment has been bullish over recent weeks, there are many stocks that are in their own bear markets, creating bargain opportunities for value investors. In other words, it’s a market for stocks rather than the stock market.

This brings me to RTX Corporation (NYSE:RTX), which recently changed its name from Raytheon Technologies. As shown below, RTX has fallen materially by more than 15% since June, when it hit the $100 mark. I last covered RTX here back in May, highlighting its high project backlog. In this article, I provide an update and discuss why RTX is a buy on the dip, so let’s dive in.

RTX Stock (Seeking Alpha)

Why RTX?

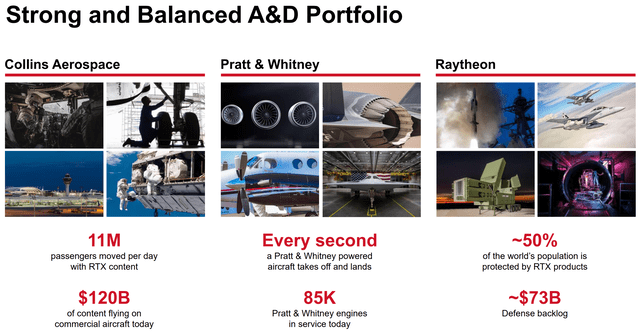

RTX Corporation is a leading global aerospace and defense company with more than 180K employees worldwide. Its business segments include Collins Aerospace, Pratt & Whitney, and Raytheon, and last year, generated $67 billion in total revenue.

One of the reasons for why RTX could be core holding is because of the economically essential nature of its products. This includes key facts such as 11 million passengers moved per day with RTX content and 50% of the world’s population being protected by RTX products.

Investor Presentation

RTX recently posted very strong results, with sales growing by 12% YoY (13% on an organic basis) and adjusted EPS growth of 11% YoY. This was driven by accelerating demand from commercial airlines and strong defense spending from governments worldwide.

Also encouraging, RTX currently has a record backlog of $185 billion, thereby providing plenty of revenue visibility for the foreseeable future. This includes $25 billion of new awards in the past quarter, and RTX is making good progress in working through its backlog, with a 1.34 book-to-bill ratio.

RTX benefits from global uncertainty and unrest, as its key Missiles & Defense segment saw sales grow by 12% YoY, and favorable net program efficiencies and operating leverage (through higher volumes) enabled this segment to achieve faster operating profit growth of 23% YoY.

In addition, its Collins aerospace market grew sales by 17% YoY and operating profit by 36% YoY, driven by favorable product mix and strong aftermarket sales growth of 27%. This includes new solutions such as the Common Tactical Edge Network program for the U.S. Air Force, enabling time-sensitive tactical data to be shared across disparate networks for faster decision-making in the modern battlefield.

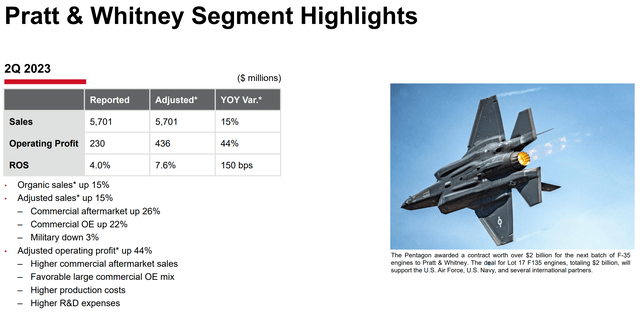

Importantly, the Pratt & Whitney segment saw impressive 15% sales growth and 44% operating profit growth, driven by a Pentagon contract worth over $2 billion for the next batch of F-35 engines from P&W.

Investor Presentation

Looking ahead, RTX’s has plenty of growth runway as the U.S. House of Representatives passed an appropriation bill this year to fully fund many of its programs. This includes the important F135 engine core upgrade, which is the only engine funded for the cutting edge F-35 joint strike fighter.

Also funded are other RTX missile programs such as LTAMDS, hypersonics, and Standard Missile-3. This could go a long way as the U.S. is seeing heightened demand from defense partners like Poland as it seeks to bolster its security in prep for potential spillover from the war in Ukraine.

In fact, Poland is the first international customer for RTX’s LTAMDS system and could be indicative of future deals in the region. Moreover, the Raytheon segment was recently awarded its largest AMRAAM contract for $1.2 billion from the U.S. Air Force and international partners including Ukraine.

Risks to RTX include the recent determination that a rare condition in powder metal used to manufacture certain engine parts could reduce the life of those parts. Management noted that current production is not impacted, thereby not impacting delivery of new engines and spare parts. While there will be a financial impact to inspecting current parts in the market, it doesn’t appear to be too significant, as management reduced its 2023 cash flow expectations by $500 million to $4.3 billion.

This appears to be more than manageable as RTX carries an A- rated balance sheet with $5.4 billion in cash on hand, and reasonable net debt to EBITDA of 2.6x for a capital intensive company.

RTX also pays a 2.8% dividend yield at present, which is covered by a 45% payout ratio. It’s also a dividend aristocrat with 29 consecutive years of raises, including the 7.2% raise a few months ago. Admittedly, RTX isn’t a stock that’s going to make you rich overnight, but it can help investors sleep well at night due to its moat-worthy attributes that have outlasted many lesser technology companies throughout its history.

Plus, the stock looks very appealing after the recent drop to $84.67 with forward PE of 16.9. This is considering RTX’s record backlog, with analysts expecting 11.6-17.4% annual EPS growth over the next 2 years. As such, I believe RTX is deserving of a forward PE in the 18-20x range, which could mean potential double-digit total returns for investors in the near term. I’m also upgrading it to a Strong Buy (from ‘Buy’ last time) on better valuation.

Investor Takeaway

RTX has seen a strong pullback in price, which could be a great opportunity for value investors to step in and take advantage of the current bargain valuation. With its large backlog of orders and impressive financial performance during Q2, RTX is well-positioned for future growth as global tensions loom large. Plus, it offers a defensive moat with economically essential products, as well as an impressive dividend yield and history of consistency. Therefore, I believe RTX is a great value play on the dip that can provide investors with long-term returns.