Jeremy Poland

Japan Petroleum Exploration (OTCPK:JPTXF), better known as JAPEX, was one of the greatest investments we’ve made so far. It continues to be extremely undervalued, and like many other Japanese stocks is going to be a target of initiatives by the TSE to unlock shareholder value. JAPEX has massive non-operating balances that the company wants to use to transition away from its E&P focused business to other more long-term sustainable businesses. They may also review shareholder payout policies at some point. In the near term, the business benefits from being well positioned for the incoming winter. With exposure to gas prices and being a key gas infrastructure with regasification and gas highways across Japan, a cold winter and trouble with allied reserves could create another gas scramble. Finally, Sakhalin seems to be politically tenable, and shouldn’t be written off.

Financial Updates and Valuation

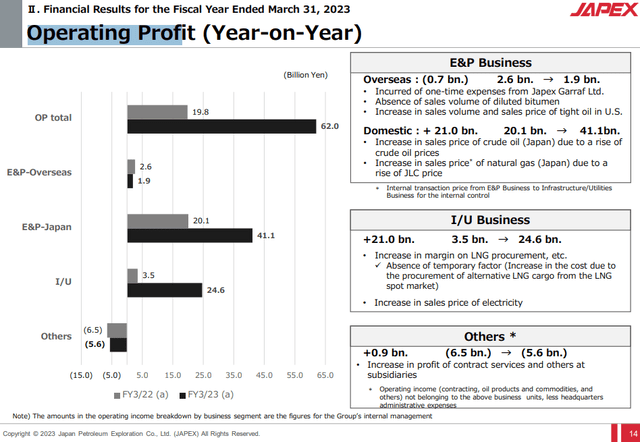

A good place to start is at the operating profit comparisons. For detailed descriptions of each segment, refer to our previous articles on JAPEX. The main things are the domestic E&P business, where JAPEX owns interests in oil and gas fields and receives income from the operators who wan to bring these fields to fruition. They have some foreign fields, but they are either under development or are a small part of income like those in Iraq. Otherwise, they have their business in infrastructure, as they call it, which is a business where they distribute and sell gas throughout Japan using their own infrastructure and where they also produce electricity.

Operating Profit (FY Pres)

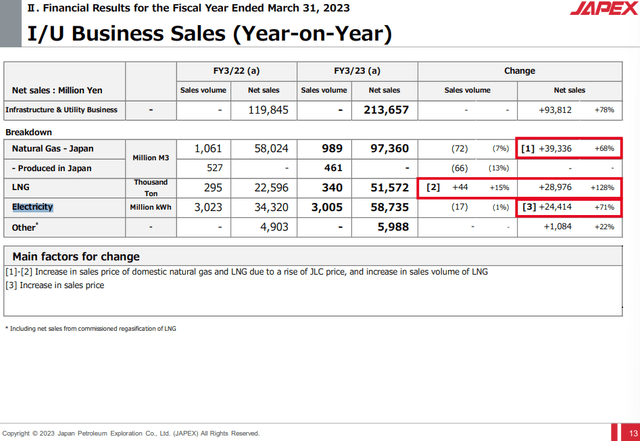

The electricity business in the infrastructure segment is actually becoming a pretty major sales contributor, and in general the fact that they also control regasification facilities and are a key gateway for increasingly scarce gas to enter this gas dependent country has meant phenomenal profits in this business. Since gas and electricity prices are quite correlated, due in part to the fact that a lot of global electricity is produced using gas in CCGT facilities, our thoughts on the incoming, potentially cold winter apply for the whole IU business where we expect more great performance.

IU Business (FY Pres)

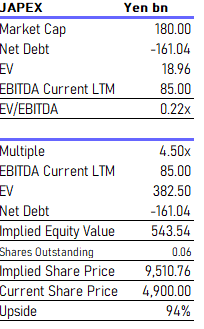

The company is extremely undervalued due to large non-operating balances including a shareholding in another oil and gas player in Japan called Inpex (OTCPK:IPXHY). But they also keep a pretty low payout ratio for their dividend at 30%, and this means that for their very profitable quarters they’ve been having these last couple of years they’ve been accumulating large cash balances. This accumulation means that the upside opportunity remains from the non-operating balances in the equity bridge that continue to be ignored.

Valuation (VTS)

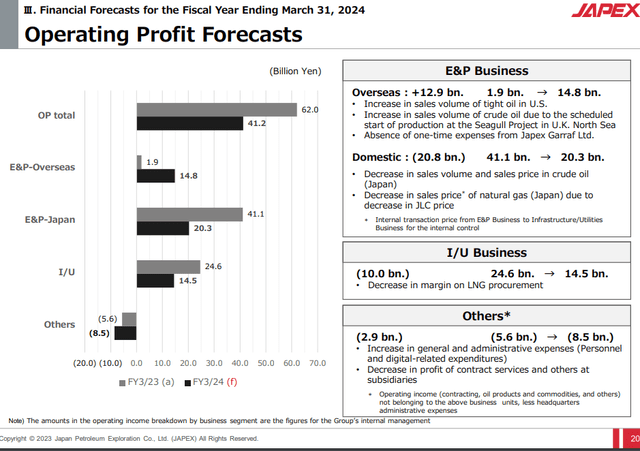

Forward forecasts for EBITDA are quite in line with current forecasts thanks in part to quite resilient expected performance in IU and also new capacity coming online in the currently marginal overseas E&P business. We expect all businesses to perform above forecasts due to a couple of key macro considerations.

Forecasts (FY Pres)

Bottom Line

The first consideration concerns the E&P business, which is that in addition to new sales volumes from the first production from the UK North Sea development, crude oil prices are likely to remain structurally high. This is in part to a better demand environment that previously expected at the time of the forecasts due to the more resilient than expected US economic performance, but it is also due to how undeniable the importance of oil has become, where we think lessened risks of peak oil has allowed major OPEC producers to stay calm and not void their reserves as quickly as they were inclined to do before.

In the IU business, we have optimism in a decent performance again in gas and electricity prices as there is risk of a cold winter. While procurement margins are going to decline YoY, because JAPEX got really lucky with how their gas inventory could be sold at extremely high prices after the Ukraine invasion, scarcity is still good in gas prices because JAPEX acts as the gateway of LNG into the country.

Another thing that contributes to a favorable picture for JAPEX is the fact that the Sakhalin-1 project, which was an uncertain asset after the Ukraine invasion, is more likely to be accepted as a necessary production font for Japan by the international community, which would otherwise prefer that Russian decoupling went further. This could be a major overseas asset so we’re happy about that.

Finally, the catalyst for the equity bridge to be realized properly by markets is the ongoing efforts by the TSE to force up P/B values for Prime Market companies including JAPEX. This is the focus of a lot of shareholder queries, and could be a major catalyst for a low of low P/B Japanese equities which has been the focus of our high conviction coverage this year.

Overall, JAPEX remains a geopolitically well positioned company. It is also well positioned in domestic politics of Japan which wants its markets to become better realized and received by foreign investors. The risks are of course the substantial commodity exposure in every single part of the business. The end of the Ukraine war would be a bad thing for JAPEX as an example, and this could come about in a variety of ways, including a stalemate in the war bringing the sides to the table, or by a victory of Trump in the next election who seems to want to end the war as part of his initial campaigning. Still, risk-reward is phenomenal here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.