bymuratdeniz

Thesis

The Invesco S&P 500® Equal Weight Energy ETF (NYSEARCA:RSPG) is an equity exchange traded fund. Formerly known under the ticker ‘RYE’, the fund has recently changed its namesake as part of an Invesco overhaul:

Invesco has changed the tickers for its suite of equal-weight sector ETFs. Invesco united its lineup of 11 equal-weight sector ETFs with new tickers that connect back to the $33.6 billion Invesco S&P 500® Equal Weight ETF (RSP), effective June 6. The suite of equal-weight sector ETFs has a combined $7.5 billion in assets under management.

Source: Nasdaq

The vehicle is an equal weight fund, containing 23 energy stocks with a similar weighting of roughly 4.4%. The fund is a take on the Energy Select Sector SPDR® Fund ETF (XLE), where Exxon (XOM) and Chevron (CVX) make up 40% of the portfolio. The other notable difference between RSPG and XLE is the fact that RSPG is overweight Mid-Cap names, which make up over 56% of the portfolio.

The two vehicles have similar historic performances, but RSPG outperforms both on a 1- and 5-year lookback periods. At the end of the day RSPG represents a more wholistic take on the Energy sector, with a larger granularity in both name weighting as well as services rendered in the sector.

With robust balance sheets, energy names will be very highly correlated going forward with oil prices. In the ‘State of the Oil Market’ section below we discuss the current set-up, and our belief that the factors that have driven down prices in the beginning of the year are now fading. Energy names have very low valuation levels via their P/E ratios and high FCF yields and represent an interesting play at this juncture.

State of the Oil Market

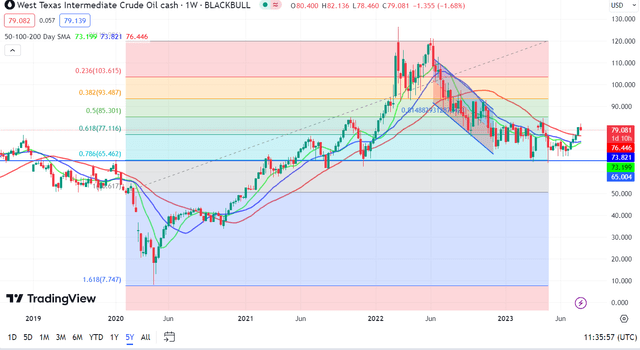

After a very tough start of the year, WTI has rallied hard in the past month:

WTI Price (TradingView)

Recessionary fears coupled with SPR releases pushed oil significantly lower in the beginning of the year. The market was expecting a recession, and thus pushed prices down on demand slowing fears. During recessions the demand side is heavily impacted, with industrial activities and consumer spending down. Those fears have not yet materialized, with a ‘soft landing‘ now the base case for many market participants.

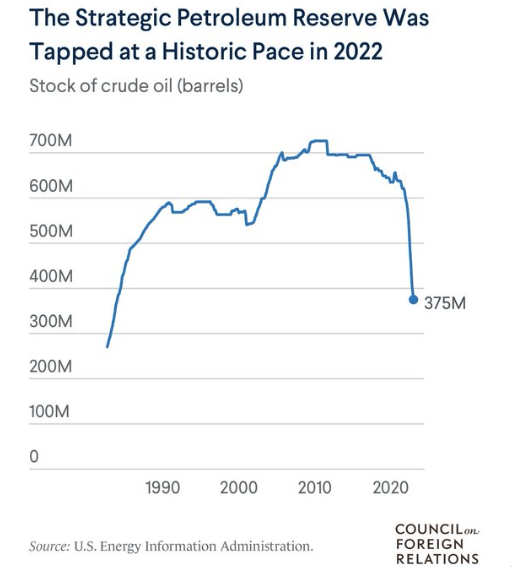

The U.S. has been fighting inflation on many fronts. On one side we had the Fed tighten monetary policy, while the Biden administration was also very active in flooding the market with oil supplies from the U.S. strategic reserve:

SPR Release (CFR)

In fact, the SPR reserve is at its lowest levels since the 1990s, and the Biden administration is showing no willingness to start topping it back up anytime soon.

In addition to the above factors, we also had the OPEC voluntary cuts helping oil prices in the first half of the year. The cartel had both verbal interventions as well as supply cuts. High oil prices mean significant profits, especially for Aramco, the most profitable company in the world history. There are certain break-even prices for national budgets, and that seemed to be the case when WTI was in the mid 60s. Saudi Arabia has been extremely pro-active this year, and just announced another extension of its voluntary cuts.

With discussions around a ‘soft landing’ and absence of price pressures from the SPR releases, we can see how oil can rally here into the year end.

ETF Holdings

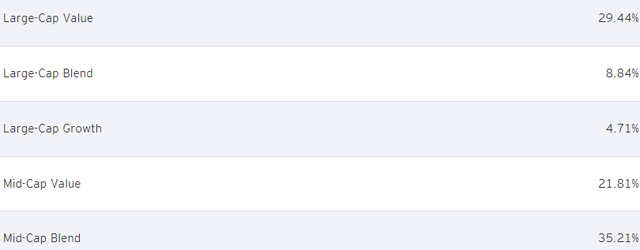

The fund holds 23 names with an equal weight of approximately 4.4% of the portfolio. Most of the energy equities here fall in the Mid-Cap category:

Holdings (Fund Fact Sheet)

We can see that roughly 39% of the fund is allocated to Large-Cap names, while Mid-Caps (across Value and Blend) represent more than 56% of the portfolio. This is one of the main differentiators for the fund versus XLE, which is a predominantly Large-Cap fund.

The companies in this fund are involved in all aspects of the energy market – exploration and production, transportation, refining and oil-field services:

- Halliburton Co (HAL)

- Schlumberger NV (SLB)

- APA Corp (APA)

- Marathon Petroleum Corp (MPC)

- Baker Hughes Co (BKR)

- Targa Resources Corp (TRGP)

- Phillips 66 (PSX)

Performance

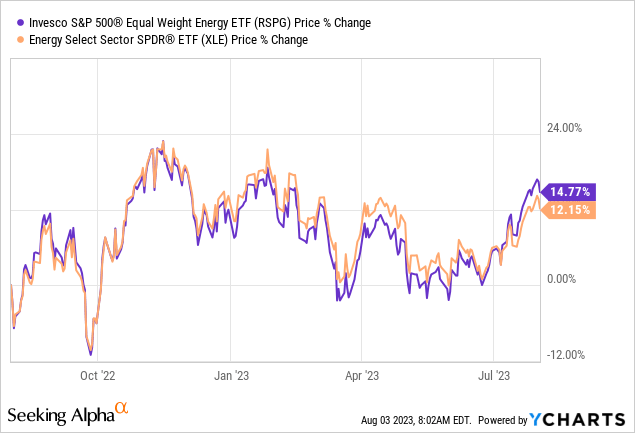

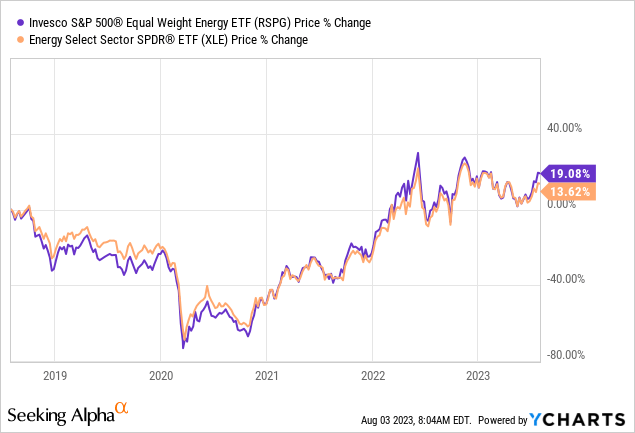

The fund has outperformed XLE in the past year:

While their performances are very similar, RSPG does manage to record a price return 200 bps higher than XLE on a 1-year look-back. The relationship holds, even on a longer look-back period:

XLE, as a market weight fund, is overweight XOM and CVX, which represent roughly 40% of the fund. Their performance drives the overall ETF.

Valuation

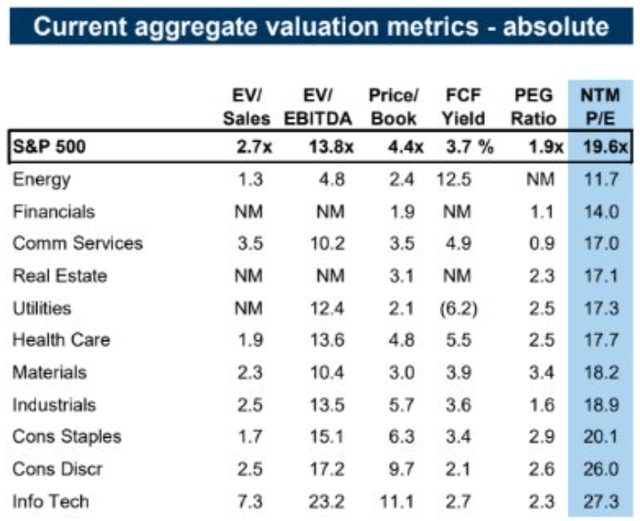

After a two year period of fixing balance sheets and debt maturity schedules, energy companies are in good shape. They are generating high levels of free cash flow and returning capital to shareholders via share buy-backs. Yet the valuation metrics in the Energy sector are extremely low:

Valuation Metrics (BofA)

Energy has an enormous FCF Yield of 12.5%, yet the lowest Enterprise Value / EBITDA metric. Furthermore, the energy sector is trading at one of the lowest Price/Book levels in the cohort. While trends can last for long periods of time, we think that keeping clean balance sheets and being consistent about returning cash to shareholders will eventually pay-off via better valuation metrics.

Conclusion

RSPG is an equity ETF. The fund is an equal weight vehicle for energy equities, and represents an alternative to the much better known Energy Select Sector SPDR Fund. RSPG has outperformed its peer in the past year, and offers exposure to the energy sector with a mid-cap tilt (56% of the portfolio is constituted by mid-caps). With robust balance sheets, energy stocks are now highly correlated with the moves in oil prices. With some of the factors that kept prices down in the beginning of the year out of the way (such as SPR releases) and more talk around a ‘soft landing’, energy prices are set to firm up. Similarly, we see energy equities also gaining in the second half of the year.