Indigo Division

Introduction

Coal is in a tricky spot. In 2020, everyone was convinced that coal was dead.

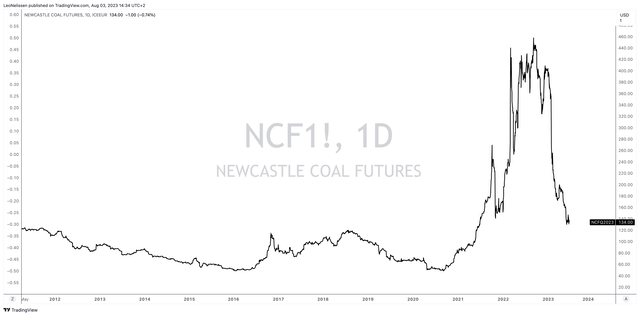

Newcastle Coal futures were trading at $50 per ton, one of the lowest numbers in modern history. Economic growth was in a very bad spot, and everyone was talking about renewable energy.

TradingView (ICE Newcastle Coal Futures)

While renewable energy is still a hot topic, coal isn’t going anywhere.

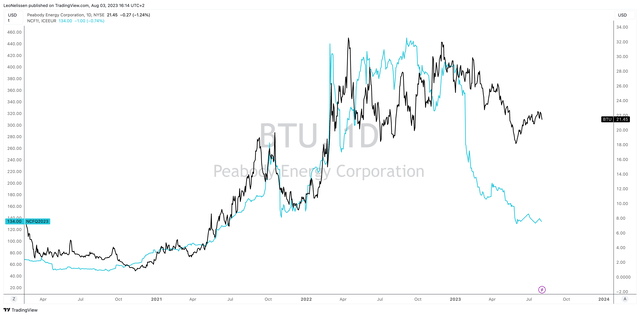

Currently, coal futures are significantly lower than their 2022 highs, which occurred when the world had to quickly transition to coal due to the high cost of natural gas. However, we are still far from the lows that were observed before the surge in coal demand in 2021.

Coal seems to have plateaued, at least for the time being.

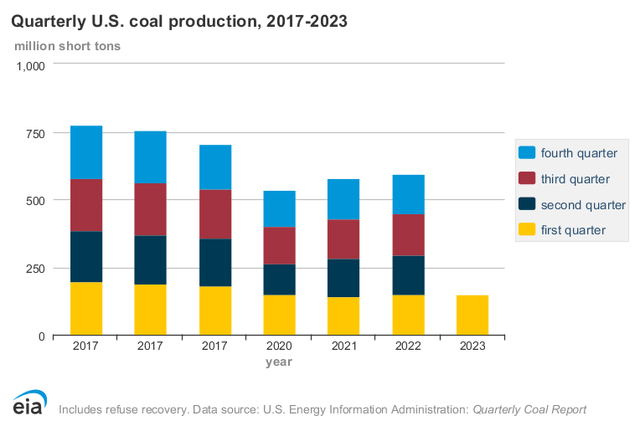

For example, looking at the EIA’s Quarterly Coal Report, which was published on July 3, we see a few interesting developments.

- In the first quarter of 2023, coal production in the United States came in at 148.7 million short tons (MMst). This was an increase of 2.1% compared to the previous quarter, but a decrease of 0.2% when compared to the same period in 2022. Since 2020, production has been fairly steady.

Energy Information Administration

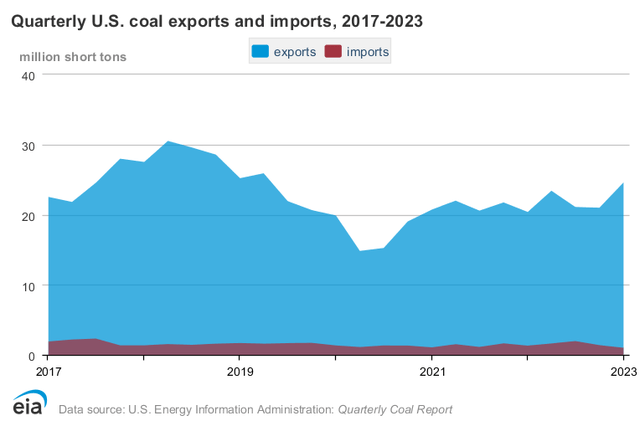

- During the first quarter of 2023, the United States witnessed an increase of 17.2% in its coal exports, which amounted to 24.6 million metric tons. The average price of these exports was $177.89 per short ton.

- In the first quarter of 2023, coal consumption in the United States was 100.3 MMst. This is a decrease of 13.4% compared to the previous quarter’s consumption of 115.8 MMst, and a 25% decrease compared to the same period last year’s consumption of 133.7 MMst.

Energy Information Administration

In other words, we’re witnessing that the US is playing an increasingly important role in facilitating international coal demand. Its production and exports remain strong, while domestic consumption is steadily declining, fueled by the ongoing energy transition.

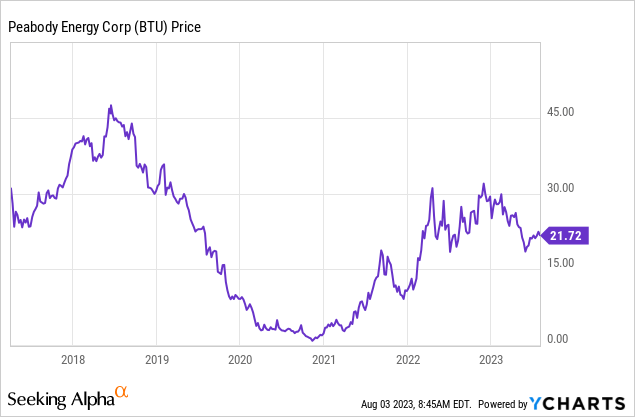

This is good news for Peabody Energy (NYSE:BTU), which recently released its earnings and continues to do quite well despite secular challenges in the domestic coal industry.

While its stock price is trading roughly 34% below its 52-week high, the company is upbeat about its future and eager to let shareholders participate in its success.

In this article, I’ll walk you through the company’s numbers and discuss the risk/reward for investors.

So, let’s get to it!

BTU Sees Coal Tailwinds

As one could have expected, given the development of global energy commodities (like coal), the company mentioned during its earnings call that it had encountered volatility as prices dipped because of high coal and natural gas inventories in the northern hemisphere following an unusually warm winter. This led to a weaker pricing environment for high-energy thermal coal.

Because most investors (including me) went into the past winter with expectations of severe energy shortages, the surprisingly warm winter weather caused investors to unwind very bullish bets on coal, natural gas, and related.

It also left some nations with large coal stockpiles. Even my home country, the Netherlands, briefly turned into a net export nation of coal because it had too much coal.

The result was the decline in coal prices I discussed in the introduction.

Having said that, there’s good news – despite the ongoing decline in economic growth expectations.

To quote Peabody Energy (emphasis added):

China’s year-to-date thermal coal imports point to significant increases in consumption of seaborne thermal coal, with an annual thermal coal import run rate of approximately 400 million tons per year, representing approximately a 90% increase over 2022 levels. India too has shown signs of improved economic activity during the first half of 2023 and with it increased power demand and elevated coal imports.

Overall, demand for seaborne thermal coal is robust and supply remains constrained across major supply regions. We anticipate that the onset of peak summer energy demand in the northern hemisphere followed by a restocking in preparation for winter will contribute to a normalization of inventory levels, providing support to seaborne thermal coal markets.

Here’s a recent screenshot from Google showing coal-supporting China headlines:

Google News

Not only is this great news for American coal exports and prices, but it should also be reflected in the 3Q23 earnings of major American railroads, which ship coal from mines to export facilities.

In the case of Peabody Energy, these railroads are Buffett-owned BNSF and Union Pacific (UNP), which services mines like its North Antelope Mine, the world’s largest coal mine.

Moving over to steelmaking coal, the seaborne metallurgical market experienced variable global crude steel output, with China and India showing notable growth.

Metallurgical coal supply remained constrained due to weather events, keeping premium hard-coking coal pricing elevated.

Despite challenges, demand for seaborne thermal coal remained robust, and supply constraints across key regions are expected to balance out due to peak summer energy demand and winter restocking.

What This Means For BTU

BTU’s seaborne thermal coal exports in the second quarter surpassed expectations at 2.6 million tons, thanks to the completion of a Longwall move at its Wambo mine and improved weather conditions.

Peabody Energy

Seaborne met coal shipments also exceeded projections, driven by strong sales from the CMJV (Coppabella-Moorvale Joint Venture) complex in Australia.

The company also successfully resumed operations at Shoal Creek after a first-quarter fire, focusing on the new L panel area for better mining conditions.

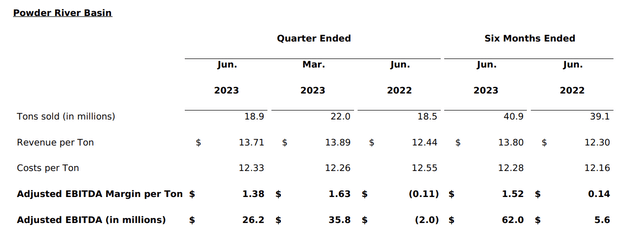

The PRB (Powder River Basin) experienced lower-than-anticipated shipments due to low customer demand, high coal inventory levels, natural gas pricing, and a tornado event. These are essentially the fundamental headwinds discussed in the first part of this article.

Having said that, the company is preparing to boost coal output in 2024, which should (hopefully) come with a bottom in global economic growth, but it’s too early to make that call.

Since commencing redevelopment in North Goonyella in late 2022, the company has invested $53 million of the initial approved redevelopment capital expenditures, which includes further ventilation, equipment, conveyors and infrastructure updates in anticipation of reaching development coal production subject to regulatory approvals in the first quarter of 2024.

With this in mind, let’s take a look at the performance per segment, including some comments, before we move to the company’s revised outlook.

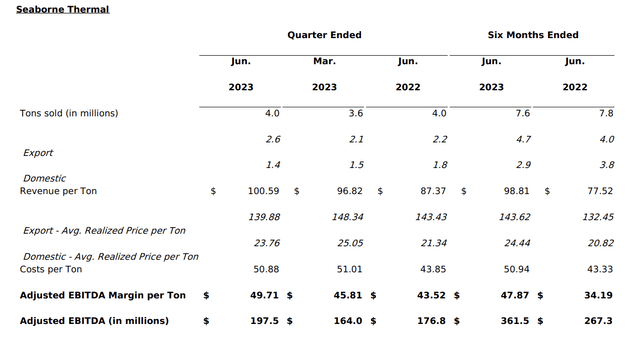

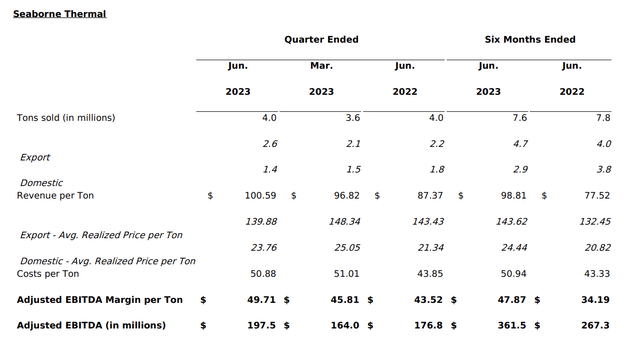

- In the second quarter, the Seaborne Thermal segment recorded $198 million of adjusted EBITDA, 20% higher than the previous quarter, despite the aforementioned decline in the average Newcastle benchmark price. Higher production rates led to costs at the low end of the guidance range, and higher export shipments resulted in adjusted EBITDA margins of approximately $50 per ton.

Peabody Energy

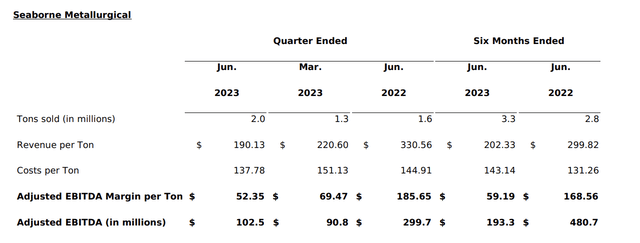

- The Seaborne Metallurgical segment generated $103 million of adjusted EBITDA, with shipments exceeding expectations by over 50% compared to the previous quarter. The US Thermal Mines produced $78 million of adjusted EBITDA, impacted by fewer shipments due to low natural gas prices and higher utility customer inventories.

Peabody Energy

- The PRB Mines generated $26 million of adjusted EBITDA but lost approximately one million tons due to a tornado at the NARM mine and lower-than-expected volume on two requirements contracts.

Peabody Energy

- The other US Thermal Mines delivered $52 million of adjusted EBITDA, with a focus on cost control, maintaining adjusted EBITDA margins of 26%.

So far, so good.

But what about the outlook?

Peabody’s Outlook & Shareholder Returns

We have already briefly discussed the company’s positive comments regarding coal demand. This was reflected in its full-year guidance.

BTU has updated its outlook for the remainder of the year. Seaborne Thermal volume is expected to be 15 million to 16 million tons, reflecting a 500,000-ton increase due to higher expected production at Wilpinjong, which is an Australian mine close (Australians would call it close) to Newcastle (the coal futures are named after this export town).

Metallurgical volume is projected to be 6.5 million to 7.5 million tons, 500,000 tons lower than previously expected, mainly due to reduced production at the CMJV and Shoal Creek.

PRB shipments have been revised downward to 80 million to 85 million tons, reflecting the impact of low natural gas prices, utility inventories, and mild weather.

With that in mind, the outlook was a bit of a mix of one-off production changes and the impact of unfavorable macro conditions.

Nonetheless, the company remains upbeat about its future, backed by the aforementioned longer-term outlook. This is also why the company sticks to its goal to return at least 65% of annual available free cash flow to shareholders.

This shareholder distribution plan was initiated in the first quarter. Thanks to a healthy balance sheet, the company does not need to prioritize debtholders over shareholders. Bear in mind that the company is expected to end this year with $920 million in net cash.

In 2Q alone, the company bought back 8.3% of its shares, which is truly spectacular.

With our balance sheet built to withstand the volatility and lower prices we saw in the second quarter, we were pleased to return $262 million to shareholders, including a cash dividend of $11 million and share repurchases of $251 million. This reduced our share count by 8.3% in just one quarter. We currently have $749 million of remaining authorization under the $1 billion share repurchase program.

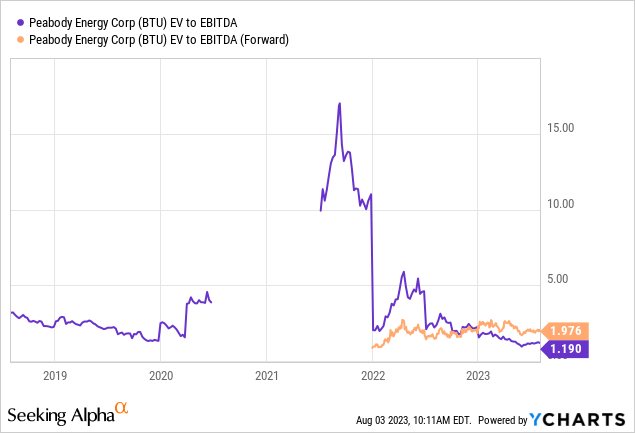

Valuation

Putting a valuation on BTU is difficult. The same goes for other commodity-driven stocks, by the way.

BTU is trading at 2.0x NTM EBITDA, which is fair. However, it doesn’t mean a lot. If coal prices rise or fall 10%, EBITDA expectations will change dramatically.

The chart below shows that despite its solid financials, BTU hasn’t been able to gain momentum. The problem is obviously the decline in coal prices.

TradingView (ICE Newcastle Coal, BTU)

Having said that, if the company is right and volumes get stronger, we could see a bottom in BTU’s stock. Especially if natural gas gains upside momentum, I expect BTU to do well.

For example, I recently wrote an article that explains my bullish view of natural gas and two of my favorite plays.

In general, I prefer oil and gas over coal, as secular headwinds are less severe. I also do not like how volatile BTU is.

So, if investors are interested in buying BTU because they like the longer-term outlook of coal and related energy commodities, please be aware of the volatility.

For now, I will stick to a neutral rating. I will upgrade this rating once I can make the case that coal will get more cyclical support.

Takeaway

In conclusion, the coal industry is experiencing a mix of challenges and opportunities.

While global coal prices dipped due to high inventories and warm winter weather, demand for seaborne thermal coal remains robust, especially in China and India.

American coal exports and prices are benefitting from this demand, boosting companies like Peabody Energy.

Despite ongoing economic growth concerns, BTU is optimistic about its future and plans to increase coal output in 2024.

However, investors should be cautious about the volatility in the coal market.

As a result, I currently maintain a neutral rating on BTU, but with the potential for an upgrade if cyclical support for coal strengthens.