Eloi_Omella/iStock via Getty Images

This article was coproduced with Dividend Sensei.

It’s always and forever a market of stocks, not a stock market. Some blue chips can get crushed even with stocks a stone’s throw from record highs, like NextEra Energy Partners (NYSE:NEP).

It’s important to always follow the facts wherever they lead. That’s because 44% of US stocks suffer permanent 70+% declines.

NEP’s collapse, if its not due to a collapse in fundamentals, could be a life-changing opportunity to lock in a safe 6.3% yield with 13% to 14% long-term growth.

That’s Buffett-like return potential, not even counting an almost 40% discount to historical fair value.

Could Almost Double In 18 Months

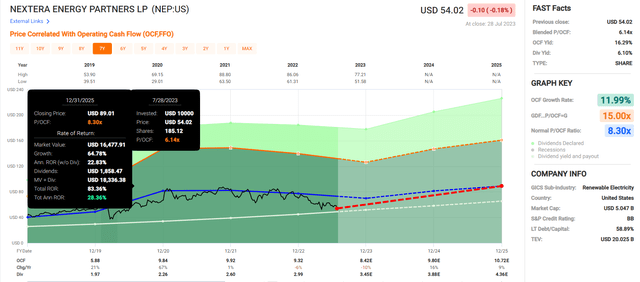

FAST Graphs, FactSet

But that’s assuming the investment thesis holds, and those growth estimates don’t fall off a cliff. So let’s look at why Wall Street is so down on NEP and whether or not this anti-bubble speculative blue-chip is worth considering for your portfolio.

NextEra Struggling With Financing

NextEra Energy Partners is a YieldCo, which is like a midstream MLP except for green energy, and it doesn’t issue a K1 tax form.

NEP is old school in that NEE, its sponsor, still owns incentive distribution rights and funds growth through stock and debt issuance.

That’s fine as long as the access to low-cost debt and high-priced stock is abundant.

REITs like O and FRT and utilities have a similar business model. However, there is one key difference.

While yieldCos are green energy utilities, they are almost all (except for BEP and BEPC) junk bond rated.

That’s because they use project-level non-recourse self-amortizing debt, a commercial mortgage, on each project they buy.

BEP has been doing this for almost 20 years and is now diversified enough and backed by mighty Brookfield, and that’s why it is the only yieldCo with an investment-grade credit rating.

When money was free, Wall Street wasn’t very worried about this high level of debt leverage. But then money stopped being free in a hurry.

For most big companies, this wasn’t that much of an issue.

Large companies have barely seen borrowing costs increase, but smaller companies, especially junk bond-rated ones? Well, that’s another story.

As my fellow Dividend King Justin Law explained in this excellent analysis of NEE’s bailout of NEP a few months back,

“NEP pioneered what it calls Convertible Equity Portfolio Financings (CEPFs). The company made a presentation about them in 2020 if you want to see all the details. But it boils down to a corporate version of Buy Now Pay Later.” – Justin Law

For 4 to 7 years, NEP had access to almost all of an asset’s cash flow and only later had to buy out its private equity partner at a 7% to 11% rate of return.

The trouble is that NEP’s ability to buy out its private equity partners is impaired in a much higher rate world.

Thus the reason for the Convertible Equity Financing Buyout Plan that management announced back in early May.

It solved 80% of NEP’s convertible equity overhang problem, but there was one problem.

It was partially funded by selling its pipeline business which would have raised the payout ratio to 105%, and that’s not counting the 3% quarterly hikes that management has been delivering since the IPO eight years ago.

So management announced it would suspend incentive distribution rights or IDR fees through 2026 to ensure income investors could get their safe 12% to 15% income growth.

Management at the time was guiding for that level of growth through at least 2026. And since its IPO, NEP has constantly pushed back its 12% to 15% growth guidance like clockwork.

So, things looked great for NEP, which has been through sharp bear markets.

Its sponsor, an A-rated king of global green energy, rescued it again.

In 2015 uncertainty surrounding the extension of the production tax credit helped cause SunEdison, then the king of green energy, to collapse. TerraForm and TerraForm Global would fail, too, but Brookfield stepped in to save the day.

This is why the 54% bear market in NEP at the time didn’t kill its ability to grow steadily, shielded by the might of NextEra Energy.

So why is the stock tanking once more?

Management continues to guide for the same 12% to 15% dividend growth it has had since the IPO. Well, there’s just one problem. NEP has almost always hiked 3% per quarter, which works out to 15% yearly.

The good news is that on a YOY basis, this is still 12% growth, and management says that it expects normal seasonality to help boost cash flow growth to double-digits in the 2nd half of the year.

“From a base of its fourth-quarter 2022 distribution per common unit at an annualized rate of $3.25, NextEra Energy Partners continues to see 12% to 15% growth per year in limited partner distributions per unit as being a reasonable range of expectations through at least 2026.”

– NEP earnings

Guidance is unchanged, though the new actual hikes might be on the low end of NEPs’ guidance.

“Since our last earnings call, NextEra Energy Partners completed its previously announced acquisition of approximately 690 megawatts of wind and solar assets. With this acquisition, NextEra Energy Partners’ renewable portfolio is over 10,000 megawatts. It is further strengthening its position as the world’s seventh-largest electricity producer from the wind and sun. The partnership is well-positioned to execute its simplification plan to become a 100% renewables focus company.”

– NEP

NEP remains on track for the plan to maintain a safe yield growing at double digits through at least 2026.

And note that NEP’s plan is designed to eliminate the need for new stock sales through the end of 2024.

No Cracks Forming Yet In NEP’s Plan But Threats Remain

The biggest risk to NEP’s thesis is if interest rates remain higher for longer.

Since NEP’s business relied on private equity, which was getting a 7% to 11% guaranteed return, it needed to borrow at under 7% to make its business make sense.

BB-rated bonds now yield 7%, so their profitability on new projects is significantly reduced.

The good news is the bond market doesn’t think rates will stay this high for long.

The bond market is confident the Fed will start cutting in May, corresponding to the recession of 2024.

If there is no recession? Then rates would have to go a lot higher.

How high?

The most dovish member of the Fed pre-pandemic is now a hawk calling for 6% rates by the end of the year.

The Fed’s various moods tell it that the Fed funds rate should be between 5.7% and 8.4%. This implies that if inflation does get stuck, rates could go to 6% or even higher and stay there through 2024.

That would be a major problem for NEP if it happened.

Its trading at 14X distributable cash flow, with a 7.1% DCF yield.

The cost of debt is also around 7%.

The cost of capital is thus 7%, and if rates go higher, NEP could likely be looking at 8% or even 9% cost of capital, above the cash flow yields of its projects.

It also still has one $300 million convertible equity deal to buy out later and won’t be able to resume those deals unless rates go down significantly.

Does that mean NEP is unsafe at the moment? No. NextEra’s plan to safeguard its yieldCo just as it did in the 2015 yieldCogeddon, is going fine…for now.

But NEP has always been speculative because its BB credit rating and reliance on stock and bond issuances to grow means its destiny is in the hands of financial markets.

NEP will likely be just fine, but for now, there is an elevated risk that the cost of capital remaining 7% could threaten the growth rates investors are accustomed to.

Growth Prospects Still Bright: Cost Of Capital Is The Big Question

|

Metric |

2022 Growth |

2023 Growth Consensus |

2024 Growth Consensus |

2025 Growth Consensus |

|

Sales |

12% |

14% |

13% |

12% |

|

Dividend |

15% |

15% |

11% |

12% |

|

Distributable Cash Flow |

4% |

19% |

9% |

14% |

|

EBITDA |

5% |

142% |

15% |

9% |

|

EBIT (operating income) |

-37% |

93% |

53% |

9% |

(Source: FAST Graphs, FactSet)

NEP’s growth outlook remains double-digit in the short to medium term.

Long-term, the median consensus from all analysts is that NEP will grow at 13% to 14%, with a tight range of 10% to 14%.

How safe is the yield? Let’s consider the DCF payout ratio consensus:

-

2023: 94% (90% or less safe)

-

2024: 93%

-

2025: 88%

-

2026: 93%

-

2027: 95% ($5.77 distribution = 10.2% yield on cost)

NEP appears ready to run the payout ratio hot, which would lower its safety score to 61%, the lowest safe level.

-

NEP remains a speculative blue-chip, but the quality falls to 61%

How worried would I be about NEP cutting its dividend? In a regular recession, the risk of a cut is approximately 1%. In a severe recession, or if rates keep rising, the risk rises to 6%.

Management is likely to slow the growth of the distribution below the guidance range before it cuts the distribution.

Valuation: Anti-Bubble Blue-Chip Bargain

NEP is trading at just 6X cash flow, an anti-bubble valuation that’s cheaper than the average Shark Tank deal (7X cash flow).

|

Metric |

Historical Fair Value Multiples (all Years) |

2022 |

2023 |

2024 |

2025 |

12-Month Forward Fair Value |

|

5-Year Average Yield |

3.85% |

$88.83 |

$88.83 |

$88.83 |

$118.70 |

|

|

7-year median yield |

3.59% |

$95.26 |

$95.26 |

$95.26 |

$127.30 |

|

|

7-year average yield |

3.42% |

$100.00 |

$100.00 |

$100.00 |

$133.63 |

|

|

P/OCF |

8.30 |

$69.89 |

$69.89 |

$81.34 |

$14.69 |

|

|

Average |

$69.89 |

$86.84 |

$90.81 |

$43.56 |

$89.20 |

|

|

Current Price |

$54.23 |

|||||

|

Discount To Fair Value |

22.40% |

37.55% |

40.28% |

-24.50% |

39.21% |

|

|

Upside To Fair Value (including dividend) |

28.87% |

60.13% |

67.45% |

-19.68% |

70.80% |

Is the risk real? This BB-rated speculative growth stock relies on access to capital markets to continue growing. NEP has never had to operate in a world of 5.25% interest rates.

NEE is capable of much help, but if the Fed has to go to 6%? Or 7%? Or 8%? There won’t be much NEE can do to make NEP’s current business model make sense for new projects.

|

Rating |

Margin Of Safety For Medium-Risk 10/13 Speculative Blue-Chip |

2023 Fair Value Price |

2024 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$86.84 |

$90.81 |

$89.20 |

|

Potentially Good Buy |

25% |

$65.13 |

$68.11 |

$66.90 |

|

Potentially Speculative Strong Buy |

35% |

$56.44 |

$59.03 |

$57.98 |

|

Potentially Very Strong Buy |

45% |

$35.82 |

$49.94 |

$49.06 |

|

Potentially Ultra-Value Buy |

55% |

$39.08 |

$40.86 |

$40.14 |

|

Currently |

$54.23 |

37.55% |

40.28% |

39.21% |

|

Upside To Fair Value (Including Dividends) |

66.43% |

73.76% |

70.80% |

NEP is a speculative strong buy for anyone comfortable owning a yieldCo whose cost of capital has currently risen to the point at which sustaining its 12% to 15% target growth rate is being called into question.

Bottom Line: 6.3% Yielding NEP Remains A Wonderful Green Energy Play For Those Comfortable With Interest Rate Uncertainty

I own a lot of NEP; for now, I am comfortable holding and trusting NEE to execute its simplification plan.

I am concerned that analysts expect the payout ratio to rise by 10% to 95% and stay there.

There would be virtually no margin of safety for cash flow, which is somewhat variable due to the nature of its solar and wind assets.

NEP should be just fine as long as rates come down to the 2% to 3% the bond market expects.

If rates keep marching higher, though very slowly, NEP’s growth rate will likely collapse.

I doubt that NEP will ever “Kinder us,” but if the risk increases of that, I will let you know.

For now, you can get a 6.3% safe yield growing at 13% to 14% over time, on top of significant valuation return potential.

-

6.3% yield

-

13.4% growth consensus

-

40% undervalued (5.1% valuation boost over ten years)

-

24.8% 10-year consensus total return potential

-

817% potential consensus return potential for the next eight years

-

about 20X the return potential of the S&P

If NEP can deliver on the expected growth (NEE’s backlog of projects to buy is far larger than NEP can buy), then it could be a potential 9-bagger within a decade.

Is it speculative? Yes.

Is the dividend safe but just barely, thanks to the new 95% payout ratio? Yes.

But is NEP potentially worth a 2.5% position given its incredible upside potential and management from the global king in renewable energy? I also believe the answer is yes.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.