Sundry Photography

Introduction

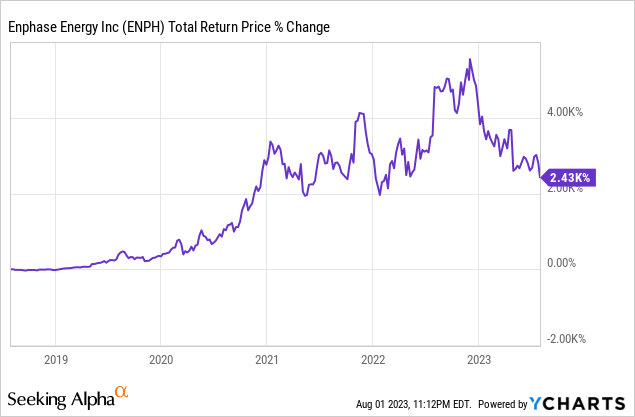

Enphase (NASDAQ:ENPH) is one of the most popular growth stocks today and is also one of the best-performing stocks in the last five years, returning more than 2,500% to shareholders.

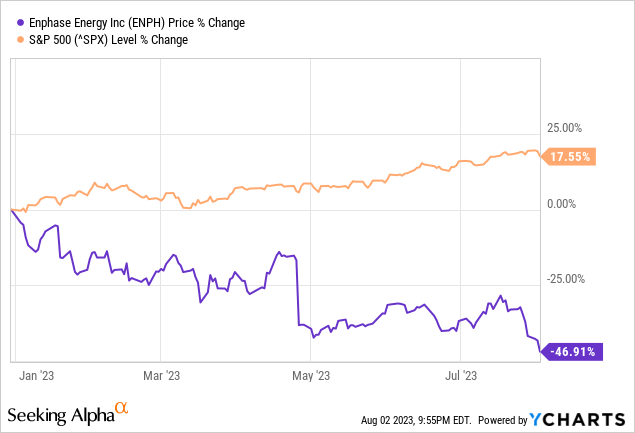

But recently, Enphase released its Q2 earnings results which sent the stock crashing and the stock is now down more than 45% year to date, while the S&P 500 is up 18% — the divergence in share price performance got me interested in Enphase.

That said, here’s a deep dive on Enphase stock. Enjoy!

Company

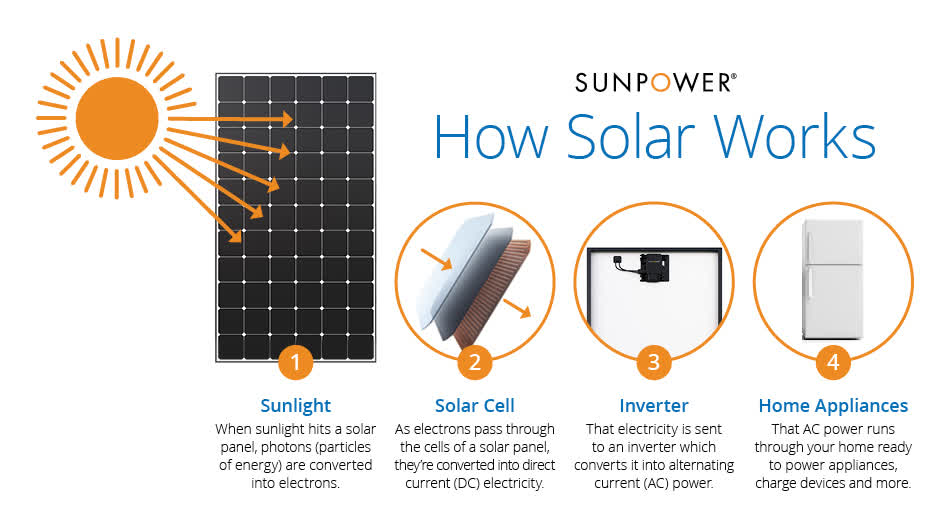

A little bit of background about solar energy production, solar panels generate electricity in the form of Direct Current, or DC, which is sent to an inverter, which consequently, converts the DC into Alternating Current, or AC.

That AC power is then used to power your home appliances, charge devices, and so on.

SunPower

And today, there are three ways in which solar panels convert sun energy to DC, and ultimately, to AC.

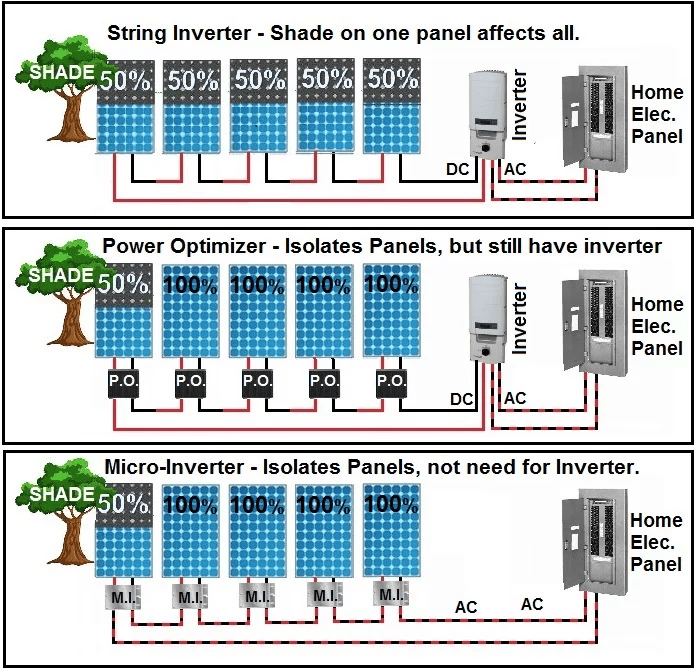

First, we have string inverters, which is probably the oldest and most common way. With string inverters, all of the solar panels are connected to a single inverter, and because only one inverter is required, this method is usually the cheapest out of the three.

However, the downside is that string inverters have a single point of failure, meaning the entire system is only as efficient as the lowest-performing solar panel.

For example, as shown in this diagram, if one of the panels is partially covered by a shade and can only produce 50% of DC output, then the entire system — including the other panels — will also produce only 50% of output.

Put simply, string inverters are cheap but inefficient, and this is why it’s more commonly used in utility projects where shade is not an issue, such as in a desert or a large field.

PlugPV

Two relatively-new methods solve the issues that come with string inverters.

First, we have power optimizers, and a popular company that offers this solution is SolarEdge (SEDG).

Basically, these devices are installed on each solar panel, which essentially isolates each solar panel.

If one of the modules could only produce 50% output, the rest of the modules will not be affected, and therefore, the system could run more efficiently.

However, with power optimizers, a string inverter is still required, which again, if the inverter fails, the entire system fails as well.

That’s where microinverters come in, which is pioneered by Enphase.

Just like power optimizers, microinverters are installed in each PV module, but unlike power optimizers, microinverters do not need a separate inverter but instead convert DC power to AC power immediately at each solar panel.

In other words, microinverters are exactly what they sound like, mini inverters.

Although microinverters are the most expensive option, they are the most efficient form of inverters today, namely due to their ability to produce maximum power per module, with no single point of failure.

And because of that superior efficiency, reliability, and safety, consumers and businesses are not hesitant to pay extra bucks for microinverter systems, and that is why Enphase’s business is growing so rapidly.

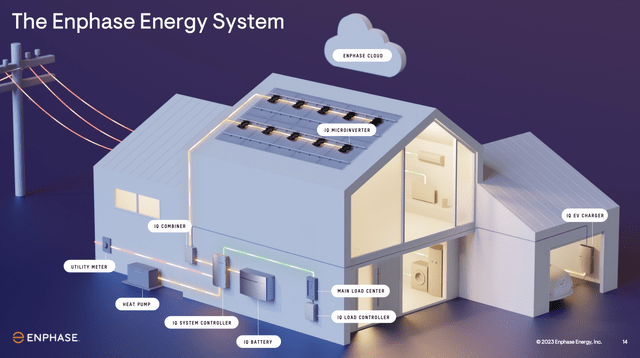

In a nutshell, Enphase is the leading supplier of semiconductor-based microinverter systems, and the Enphase Energy System enables users to capture solar energy, store those energy, and manage them in one software-enabled platform.

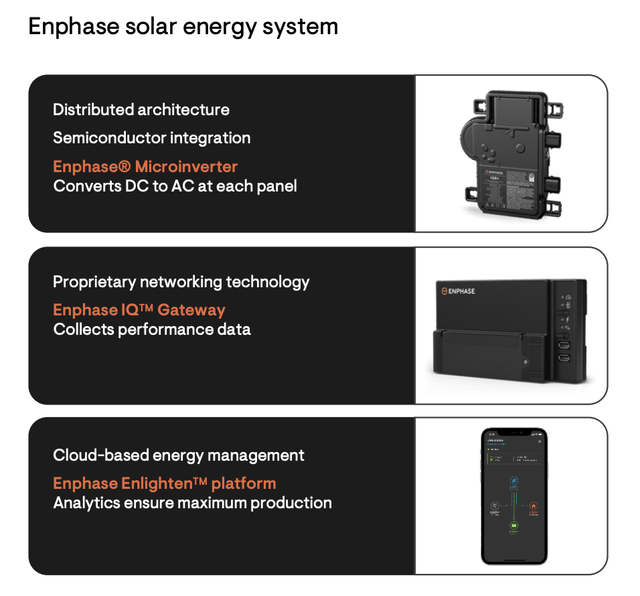

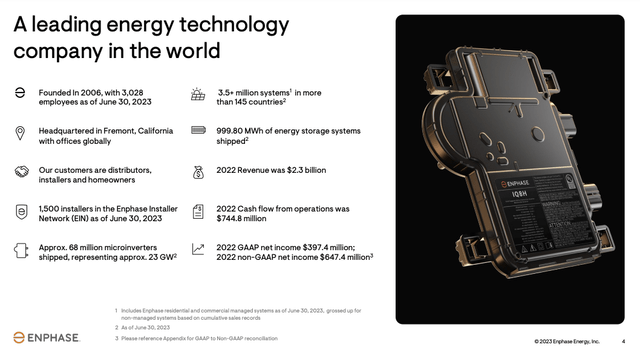

Enphase July 2023 Investor Presentation

At the same time, the Enphase System enables users to lower utility bills, reduce their carbon footprint, as well as power an entire building off the grid or if the grid goes down.

Diving deeper, the Enphase System consists of three major components:

- First, there’s Enphase’s bread and butter, its microinverters, which convert DC to AC at the individual panel level. This includes the IQ7 as well as the recently launched IQ8, which has the new Sunlight Backup feature that allows users access to power even without the grid AND battery.

(It is important to note that Enphase does not sell solar panels, but instead the inverter which is one of, if not, the most important component of a solar panel).

- Next, there’s the Enphase IQ Gateway, which basically connects the microinverters and the Enphase App, by communicating with the microinverters via AC power and the Enphase App via Wi-Fi.

- By doing so, users can monitor solar production and energy consumption remotely, through the Enphase Enlighten App. In addition, Enphase’s cloud-based system allows for remote firmware and software updates and maintenance.

Enphase July 2023 Investor Presentation

Of course, there are other products such as Enphase’s IQ Batteries, which stores solar power to use anytime, even during outages, as well as Enphase’s Bidirectional EV Charger which can charge a car with the sun and power homes during an outage.

So to sum it all up, Enphase offers solar, storage, and energy management solutions, powered by its industry-first microinverters.

Moats

Based on my research and analysis, I identified 3 competitive moats for Enphase: technology, switching costs, and cost advantages.

Technology

Enphase was founded in 2006 by Raghu Belur and Martin Fornage and the two basically invented the first microinverter-based solar energy system, giving Enphase a first-mover advantage.

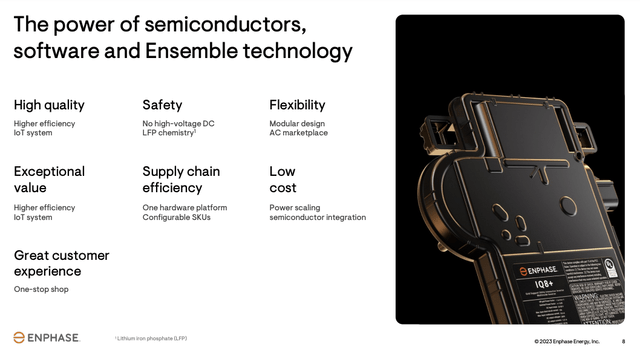

Compared to competitors, Its innovative technology offers higher quality, efficiency, safety, flexibility, reliability, and most of all, value.

Enphase July 2023 Investor Presentation

It is important to note that Enphase’s microinverters are also module-agnostic, meaning they can work with virtually every solar panel made.

Through its unique value promotion, it is no surprise that Enphase is loved by consumers and installers alike, earning the company a net promoter score of 75.

An Energy Sage report released in March 2023 also mentioned that Enphase was the most quoted inverter and battery brand, which is a testament to the company’s incredible technology and brand power.

Switching Cost

Unlike string inverters and power optimizers, microinverters are more expensive and difficult to install given that they are small devices that need to be installed on every individual solar module.

Once consumers and businesses have invested their money on Enphase microinverters, it will be very difficult for them to switch given that they have to uninstall every microinverter as well as replace it with an alternative device, which is often a downgrade to Enphase’s best-in-class technology.

In addition, adding Enphase batteries and EV chargers into the system further solidifies the switching cost moat.

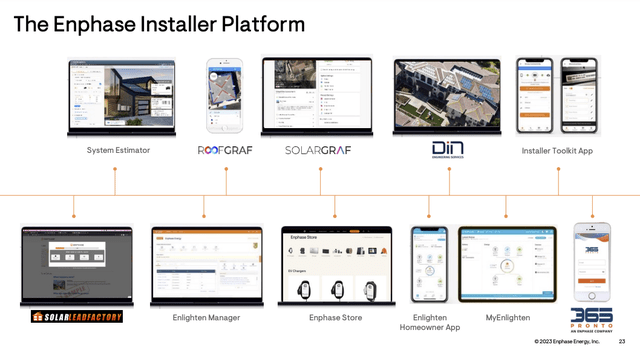

Not only that, but Enphase also offers the Installer Platform, which is an end-to-end digital platform that provides the tools, guidelines, and documentation for installers to seamlessly execute their Enphase installation plans.

Enphase July 2023 Investor Presentation

This includes its recent business acquisitions such as:

- DIN — provides proposal and permitting services

- SolarLeadFactory — provides high-quality leads to solar installers

- 365 Pronto — an on-demand platform for cleantech homeowners to connect with installers and services.

With that being said, Enphase’s vertically integrated platform streamlines the entire installation and maintenance processes, which makes it very convenient for installers to remain on the platform.

Cost Advantages

Finally, I believe Enphase has cost advantages moat.

First, the company has a capital-light business model. Enphase does not have any big factories but instead, works with various suppliers and third-party contract manufacturers to commercialize its products.

This way, Enphase can save on production costs and use that savings to scale further or invest in R&D.

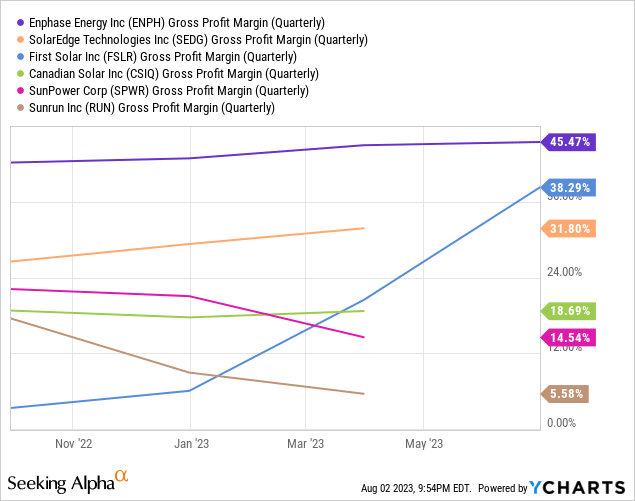

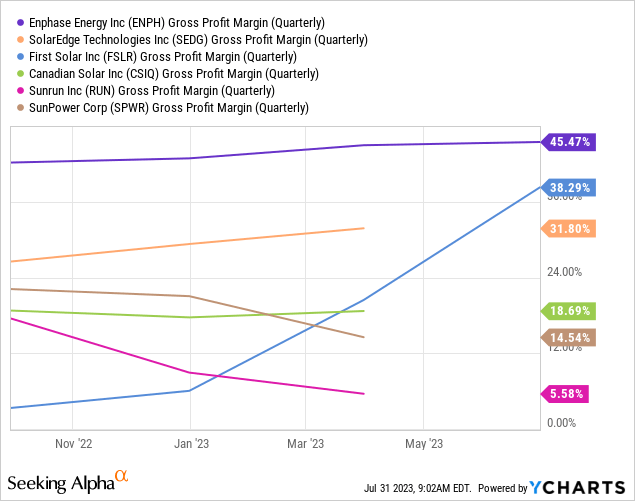

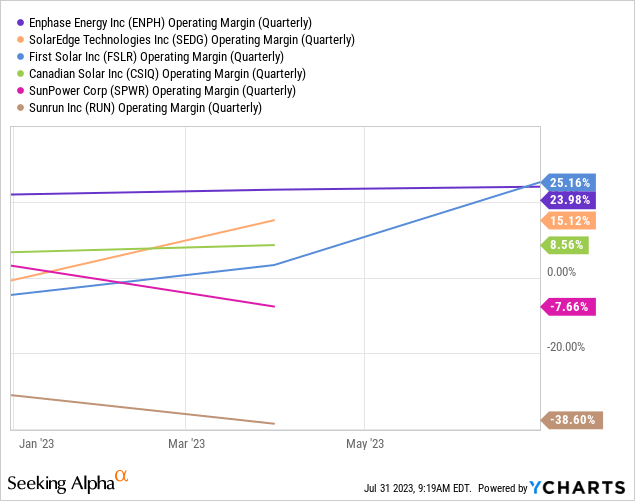

Secondly, Enphase has superior margins compared to competitors. As you can see, Enphase has a high gross margin of about 45%.

And last but not least, the Enphase ecosystem is large and growing. As of Q2, Enphase has over 1,500 installers in its installer network. It has also deployed 68 million microinverters, 1 GWh of energy storage systems, and 3.5 million systems across 145 countries worldwide.

Enphase July 2023 Investor Presentation

As the company scales further, the company should gain economies of scale, which further strengthens its cost advantages moat.

Growth

Let’s now look at Enphase’s financials.

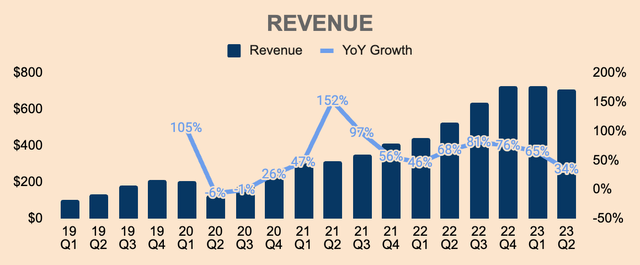

Here’s a chart of Enphase’s Revenue and its YoY Growth rate, and as you can see, Revenue pulled back during the early days of the pandemic as supply chain issues and government lockdowns put pressure on demand.

Author’s Analysis

However, the business quickly recovered in the following quarters, with Revenue growth peaking at 152% in Q2 of 2021.

Since then, growth has slowed down significantly.

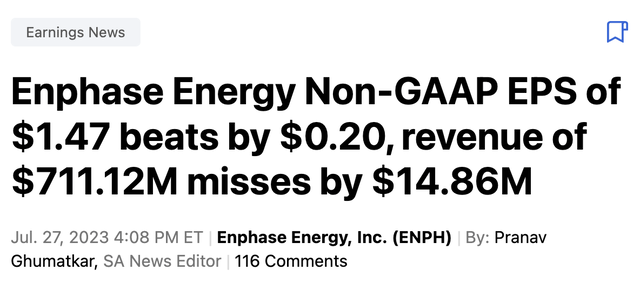

In Q2 this year, Revenue was $711 million, which is up 34% YoY, due to higher consumer demand, increased microinverter shipments, as well as higher average selling price.

However, the 34% reported growth fell short of analyst expectations by 2%, or $15 million, due to high interest rates that affected consumer affordability.

Additionally, this is a 2% decline QoQ as well as a steep deceleration from Q1’s 65% growth, which seems to be threatening the growth story of the company.

Seeking Alpha

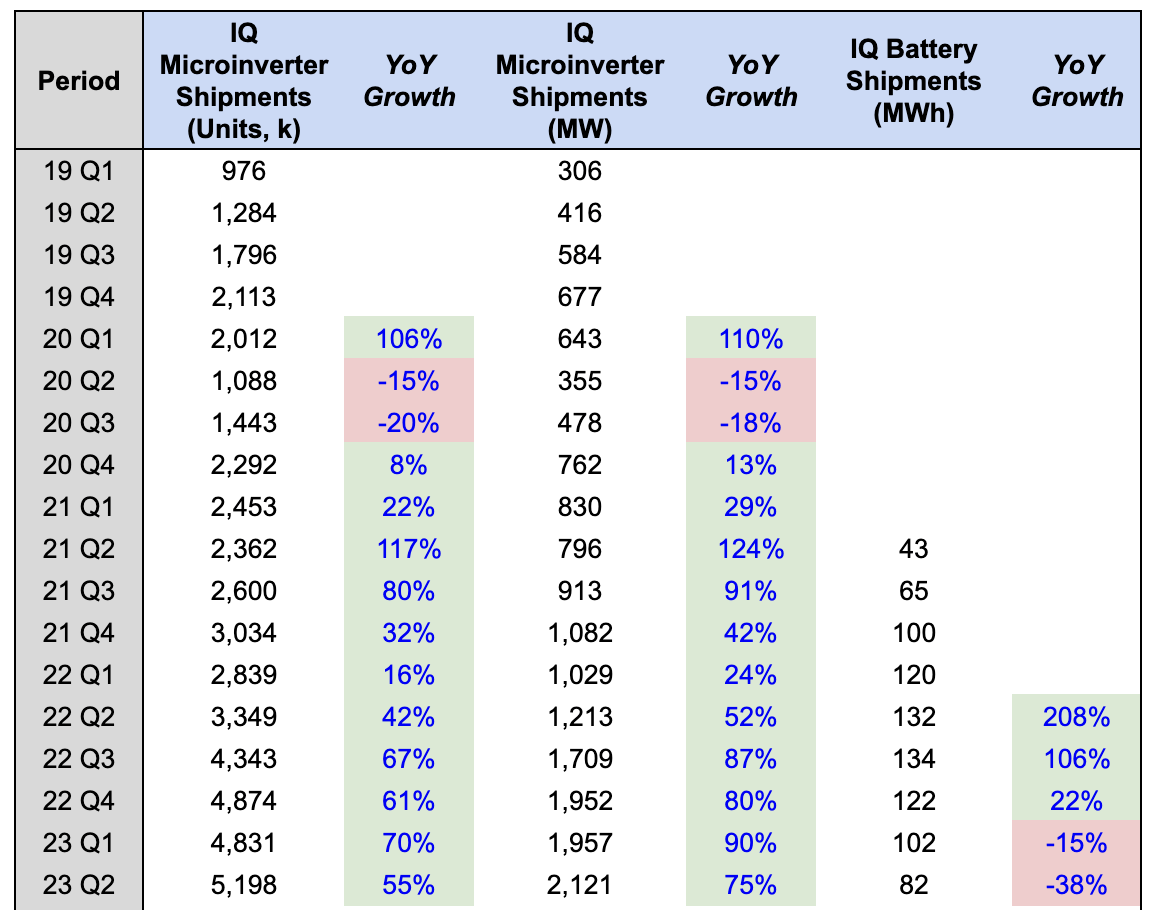

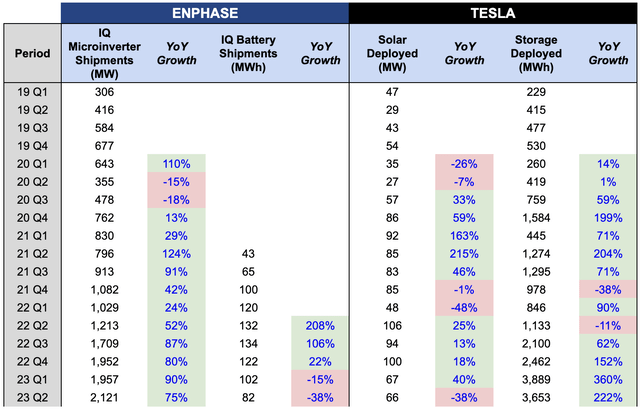

As mentioned earlier, growth was driven by increased microinverter shipments. As you can see, microinverter shipments in terms of units and megawatts have been very strong over the last few quarters, with 5.2 million units and nearly 2,121 megawatts shipped in Q2 alone, which is up 55% and 75% yoy, respectively.

Author’s Analysis

On the other hand, battery shipments grew exponentially last year and then decelerated to negative growth in the first half of 2023. In Q2, battery shipments were just 82 megawatt hours, which is down 38% YoY

As you can see, battery shipments have been falling for three straight quarters, sequentially, which is rather concerning. And this is likely due to high interest rates, which negatively affected affordability. Since batteries are often the most expensive, but not essential, components of a solar energy system, it is not surprising to see a drop in battery demand.

If you’re unaware, California has introduced a new net metering policy called Net Energy Metering 3.0, which went into effect starting April 15.

The main difference between NEM 2.0 and NEM 3.0 is that version 3.0 significantly reduces the average export rate in California, which is the price of excess electricity delivered to the grid. In other words, consumers under NEM 3.0 will receive less compensation for net metering credits, which increases the payback period for their solar installations.

As such, consumers rushed to get their solar systems before the new NEM 3.0 goes into effect, which is why microinverter shipments remain strong while battery shipments falter since batteries are the more expensive component. Coupled with high interest rates, we can see why battery shipments are taking a hit.

But during the earnings call, the CEO mentioned that battery shipments should improve in Q3 and there should be a “bigger inflection for Q4 and beyond” as battery attach rates increase with NEM 3.0.

Early anecdotes on NEM 3.0 activity from our installers are encouraging. Since the crossover date in April, we have seen an increasing rate of NEM 3.0 California proposal activity with healthy storage attach rates.

(CEO Badri Kothandaraman — Enphase FY2023 Q2 Earnings Call)

That said, I think this is just a temporary headwind for the battery segment as consumers will eventually adjust to the high-interest rate environment and NEM 2.0 rush, and over time, demand should pick up again as consumers all over the world transition to off-the-grid power systems.

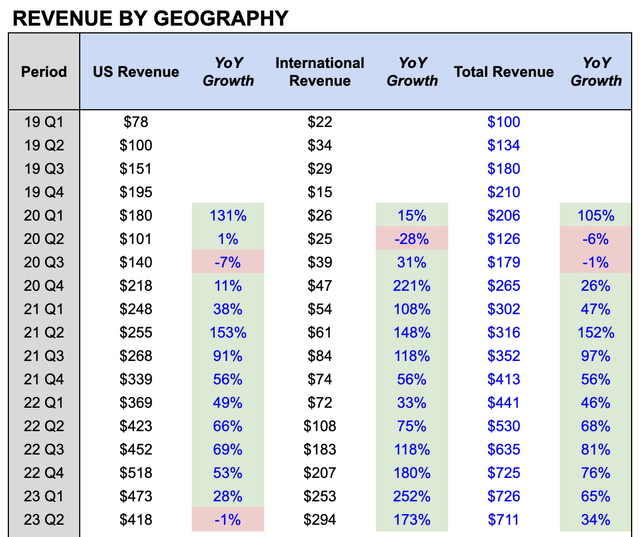

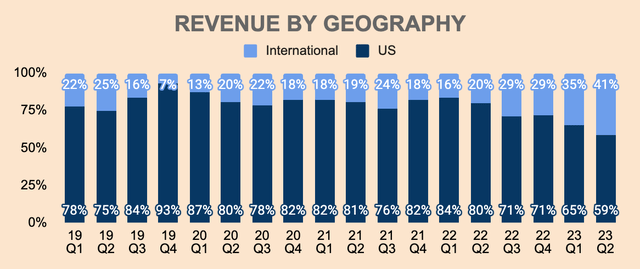

Moving on, you can see Revenue broken down by geography.

As you can see, US Revenue is decelerating meaningfully, declining by 12% QoQ and 1% YoY in Q2, mainly due to tough macroeconomic conditions and lower utility rates in some states.

Author’s Analysis

During the earnings call, management mentioned that in Q2, Enphase did not enjoy the seasonally strong recovery quarter that they expected, and that sell-through of their microinverters in the US decreased 20% compared to Q4.

Clearly, high interest rates are putting pressure on demand for solar powered-equipment in the US.

That aside, the International business drove all the growth in Q2, which is up by 173% YoY, driven mainly by Europe, which grew 25% sequentially, and more than tripled YoY.

Management also mentioned that the sell-through of microinverters in Europe was 13% higher in Q2 compared to Q1.

That said, it’s really great to see the rapid growth in the International segment, which is maintaining the growth of the entire business while the US deal with near-term challenges.

It’s also nice to see that the company is capitalizing on opportunities outside of the US and to see that kind of growth in the international business means there are tons of optionality and Revenue potential for Enphase.

The US has historically been Enphase’s main market, and as of Q2, the US makes up 59%% of total revenue.

However, US Revenue as a % of total Revenue is declining due to a combination of slowing US Revenue growth and aggressive international expansion — it won’t be long before the International segment overtakes the US business.

Author’s Analysis

There’s no doubt that the world is transitioning to renewable sources of energy — including solar energy — and this transition will benefit solar companies like Enphase, which is why we’re seeing such strong growth for the company over the last few years.

Issues such as power outages, rising utility costs, and global warming are all pushing solar adoption faster than ever before, and this is going to be a long-term trend for decades to come.

And given Enphase’s strong competitive position in the microinverter market today, there’s little to no doubt that Enphase will be a dominant force in the solar space in the long run.

However, growth is showing signs of weakness due to macroeconomic conditions and high interest rates, and this is particularly serious in the US market where US Revenue declined YoY.

However, these are temporary problems and consumers will eventually adjust to the higher interest rate environment. Besides, the Fed will eventually cut rates, which will drive demand once again.

And while we wait for the US market to stabilize, the International segment is still growing rapidly, which is a reflection of its industry-leading technology and competitive positioning.

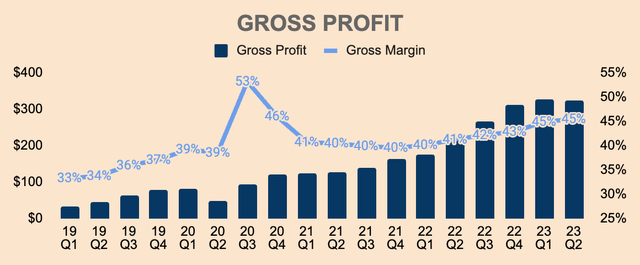

Profitability

Turning to profitability, Gross Profit has been growing steadily as you can see right here.

Author’s Analysis

In 2022, Gross Profit was $975 million, which represents a 42% GAAP Gross Margin and a 43% Non-GAAP Gross Margin.

Moving on, Q2 Gross Profit was $323 million, which is a 45% GAAP Gross Margin and a 46% Non-GAAP Gross Margin.

Notice how Gross Margins have been improving over the last few quarters. This is due to 1) higher average selling prices, 2) favorable product mix as the company sells more of its newer, more advanced IQ8 microinverters, and 3) improved logistics. In Q2, IQ8 makes up 78% of all microinverters shipped, which increased average selling prices by 3%.

The expanding Gross Margin is a great indicator of strong pricing power, economies of scale, and higher earnings potential.

At the same time, Enphase has the highest Gross Margin profile in the solar industry, which gives the company extra freedom to allocate that excess capital.

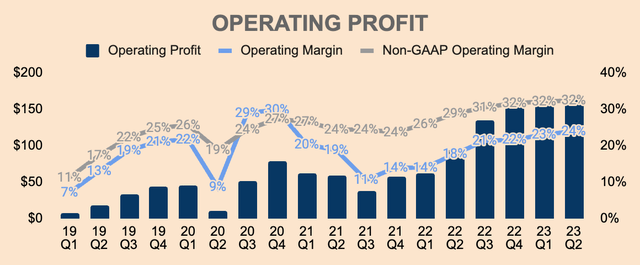

Moving down the income statement, Operating Profit in 2022 was $448 million which represents a 19% GAAP Operating Margin and a 30% Non-GAAP Operating Margin.

In Q2, Operating Profit was $170 million, which is a 24% GAAP Operating Margin or a 32% Non-GAAP Operating Margin.

Author’s Analysis

As you can see, both metrics have been improving over the last few quarters which reflects management’s disciplined cost control as well as operating leverage within the entire business.

Enphase also has one of the best Operating Margins in the solar industry, although the company has recently been overtaken by First Solar (FSLR), which is currently seeing unprecedented demand for its solar PV modules.

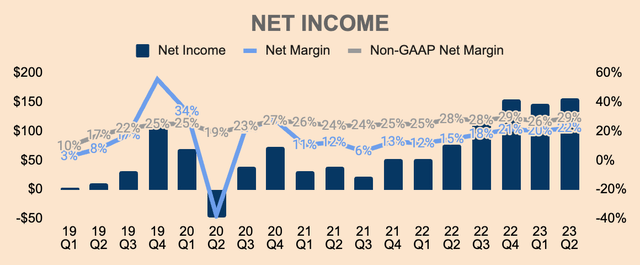

And finally, the bottom line looks great as well.

In 2022, Net Income was $397 million, which is a 17% GAAP Net Margin or a 28% Non-GAAP Net Margin, while Q2 Net Income was $157 million, which is a 22% GAAP Net Margin or a 29% Non-GAAP Net Margin.

Author’s Analysis

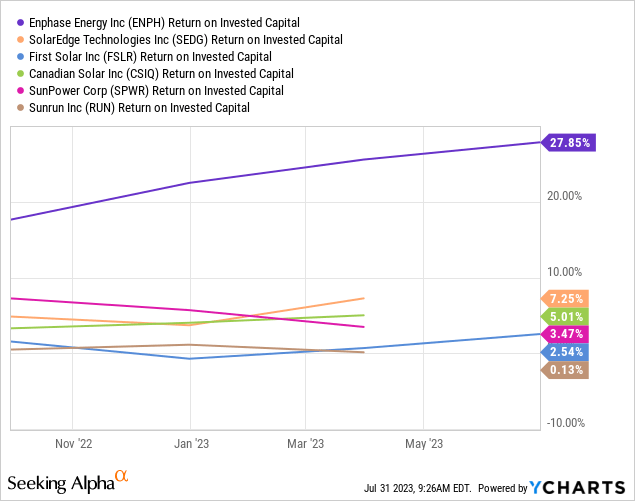

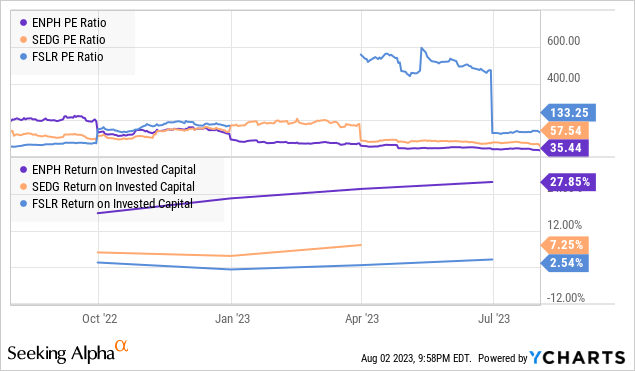

But here’s the chart that separates Enphase from the rest. As you can see, Enphase has a much higher ROIC than any of its peers. Higher ROIC means higher cash returned to shareholders and an ROIC of above 20% is usually considered excellent. In other words, Enphase has superior profitability.

So fundamentally speaking, Enphase is a highly profitable business despite growing rapidly in the emerging solar industry. It’s also great to see that margins are improving, which shows economies of scale and operating leverage within the business.

It’s quite rare to find companies that are growing at such a fast pace without actually sacrificing profitability, but we won’t know for sure how margins will look in the long term as competition in the microinverter category increases and solar components become commoditized.

That said, I’m impressed with the margin profile of Enphase and to see that margins are improving also means that the company has strong pricing power as well as a strengthening of its cost advantages moat.

Financial Health

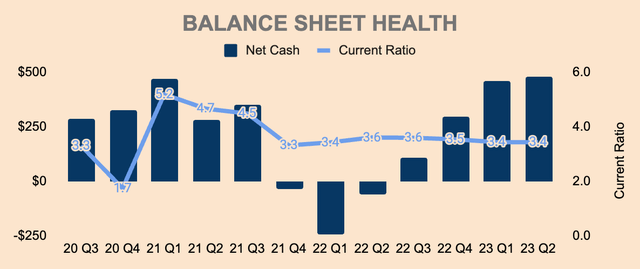

Enphase has a strong balance sheet. As of Q2, Enphase had $1.8 billion of Cash and Short-term Investments and a Total Debt of about $1.3 billion, which puts its Net Cash position at half a billion dollars.

At the same time, the company has a Current Ratio of about 3.4x which is healthy and liquid.

Author’s Analysis

As you can see, its Net cash position is starting to pick up over the last few quarters, and the reason why Net Cash hasn’t grown much in 2021 and 2022 is due to the fact that the company made 7 business acquisitions in those two years alone, so if there aren’t any more acquisitions in the pipeline, we may see net cash position increasing from here.

Enphase July 2023 Investor Presentation

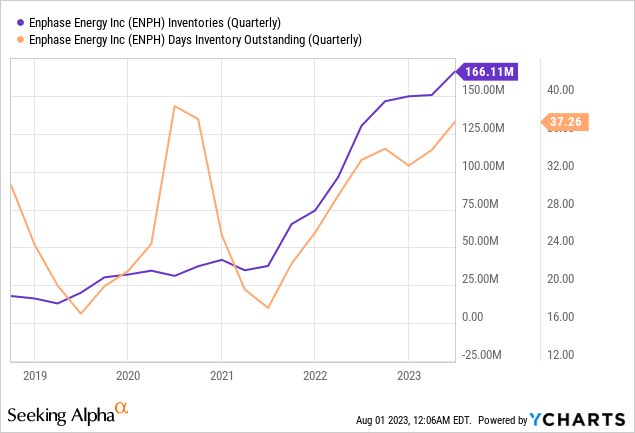

On a side note, Enphase is also dealing with inventory challenges. As mentioned earlier, their microinverter sell-through rates in the US decreased by 20% compared to Q4, thus building excess inventory in the channel.

Our microinverter sell-through in the U.S. peaked in the fourth quarter of 2022. The sell-through in the first half of 2023 in both Q1 and Q2 was approximately 20% below the fourth quarter due to the high interest rate environment in the U.S. Our sell-in to the channel was only 10% down in the first half of 2023 relative to the fourth quarter. We were expecting a seasonally up Q2 ’23 but that didn’t materialize. This has increased the inventory in the channel.

(CEO Badri Kothandaraman — Enphase FY2023 Q2 Earnings Call)

As you can see, Days in Inventory, have been picking up over the last few quarters as demand slowed down, with that figure approaching levels seen during the early days of the pandemic. As a result, management plans to decrease shipments in Q3 to reduce inventory in the channel.

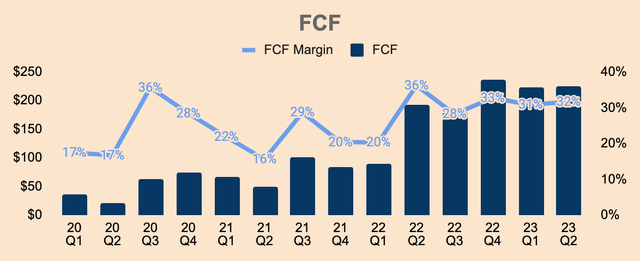

Nevertheless, Enphase is well-positioned to deal with near-term challenges, particularly because of its strong Free Cash Flow profile.

As shown below, Enphase has been consistently generating FCF Margins of over 30%.

In 2022, Free Cash Flow was $698 million, which represents a 30% Free Cash Flow Margin, and in Q2, the company generated $225 million of FCF, which represents an impressive FCF Margin of 32%.

Author’s Analysis

And of course, because of this solid cash generation, Enphase is able to acquire other businesses, which it has done so aggressively over the past two years as the company enhances its consumer and installer platform.

As a result of high FCF generation and plummeting share prices, management also took the opportunity to scoop up its own shares, buying back $200 million worth of its stock in Q2.

Consequently, the Board of Directors authorized a new share repurchase program which extended the company’s buyback capacity to $1 billion.

Prior to Q2, the last time Enphase bought back shares was in Q4 of 2021, specifically in the month of December when the stock was trading between $180 to $250 a share.

Given that 1) shares have fallen by 50% from all-time highs, 2) management bought $200 million of stock at an average price of $159 in Q2, and 3) share prices remain below the levels in December 2021, I expect Enphase to continue to buy back shares aggressively in the next few quarters, especially if the stock goes below $150 a share.

That said, Enphase is a highly capital-efficient business with a strong balance sheet which should allow the company to scale quickly through a consistent cycle of reinvesting capital for growth, thus generating shareholder value.

Outlook

While the fundamentals of the business look solid, the near-term outlook of the business looks discouraging.

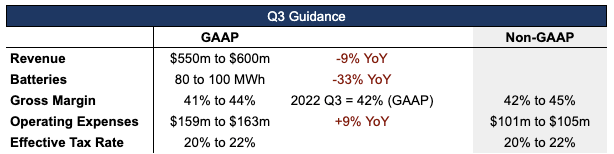

Here, I’ve compiled management’s guidance in an easy-to-read table. I’ve included both GAAP and Non-GAAP measures, but I’ll just be analyzing the GAAP numbers as I don’t really look at Non-GAAP measures, but it’s there just for reference.

Author’s Analysis

Management expects Q3 Revenue to be in the range of $550 million to $600 million, which is a 9% YoY decline if we take the midpoint guidance. This is well below analyst estimates of $749 million and this is a steep deceleration from Q2’s 34% YoY growth.

Weak guidance is due to the lower sell-through rates as I explained earlier, which were down 20% in both Q1 and Q2, compared to Q4, due to high interest rates.

Management was expecting a seasonally up Q2, 23 but that didn’t materialize, which caused excess inventory in the channel, which consequently forced the company to reduce shipments in Q3 to prevent excess inventory in their balance sheet, and therefore, Revenue is expected to be down in Q3.

In my opinion, this is the right move by management as it prevents the company from over-manufacturing and overbuilding its inventory, which could lead to inventory writedowns in the future if demand in the near term continues to be soft.

But it’s important to note that the weak guidance is almost exclusively due to the issues faced in the US market.

During the earnings call, management mentioned that 85% of the QoQ Revenue decline is due to a one-time rebalancing of its US operations while the remaining 15% is due to Europe being seasonally down in Q3. That said, it’s great to hear that the outlook in Europe remains robust.

Moving on, the Revenue guidance, management also expects shipments of 80 to 100 megawatt hours of Enphase IQ Batteries, which if you take the midpoint guidance, is actually a 33% YoY decline. So again, we’re going to see the batteries business continue to struggle in this high-interest rate environment.

GAAP Gross Margin is expected to be between 41 to 44% before Net IRA Benefit, which is expected to be about $15.5 million in Q3 based on shipments of 600,000 units of US-manufactured microinverters.

Moving forward, Enphase plans to reap more benefits from the IRA’s Advanced Manufacturing Production Credit, which incentivizes clean energy component sourcing and production in the US, and for Enphase, the IRA provides a tax credit on microinverters of 11 cents per alternating current watt basis.

At scale, the net benefit can be significant:

We will do 4.5 million units per quarter. We will reach up to that number in Q4 of ’24. So that number, if you do the math, it is 4.5 million units times, let us say, an average benefit of $25. That’s like $112.5 million of net benefit in Q4 ’24.

(CEO Badri Kothandaraman — Enphase FY2023 Q2 Earnings Call)

That said, the midpoint guidance of about 42.5% is slightly higher than last year’s figure of about 42%, so the increase in Gross Margin is a good indicator that the company is gaining economies of scale.

GAAP Operating Expense is expected to be $159 million to $163 million, which is roughly a 9% YoY increase. This figure is higher than Revenue growth, which means Q3 Operating Margins will drop YoY.

So overall, Revenue guidance is pretty underwhelming probably due to high interest rates, weak sell-through, as well as tough yoy comps, which is why the stock sold off after earnings.

In addition, the CEO mentioned that demand will unleash only when interest rates return to normal, but recently, the Fed hiked rates by another 25 basis points, so that could mean additional short-term headwinds for Enphase.

But that aside, the fundamentals of the business remain strong and the issues it is facing currently are externally driven, rather than a company-specific problem.

With that being said, the long-term outlook of the business remains positive as the world continues its transition toward renewable energy.

Here’s what the CEO has to say about the company’s outlook:

We are managing through a correction in the U.S. solar market after three years of phenomenal growth, a period in which the residential solar market doubled and Enphase sales tripled. Even so, residential solar has only achieved 4% to 5% penetration in the U.S. We believe there are several positive long-term drivers which will accelerate adoption, such as the 30% ITC tax credit, the rising utility rates, increased grid instability, climate change and increasing EV adoption. There is no doubt that these will drive meaningful solar plus battery growth over the long term.

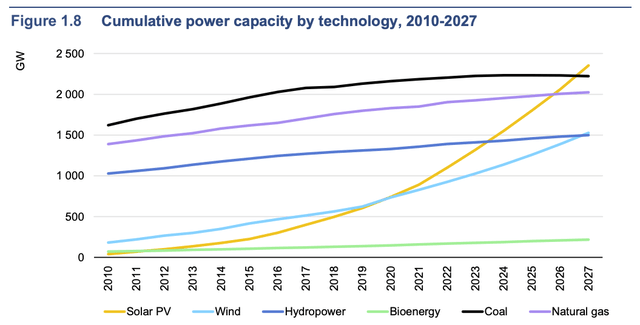

For one, according to the International Energy Agency, Solar PV installed power capacity is expected to become the largest source of electricity by 2027 while other sources of energy such as coal and natural gas are expected to flatten and decline over time.

IEA

In addition, according to Bloomberg New Energy Finance, energy storage installations are expected to grow at a 23% compounded annual growth rate, reaching annual additions of 88 gigawatts by 2030.

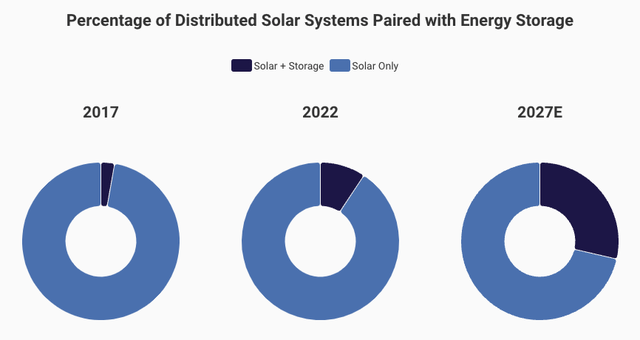

Furthermore, according to the Solar Energy Industries Association, storage is increasingly being paired with all forms of solar modules. As you can see, solar plus storage systems only accounted for 10% of all distributed solar systems in 2022, and that figure is expected to reach nearly 30% by 2027.

Solar Energy Industries Association

In other words, more consumers will likely opt for solar plus storage solutions in the future.

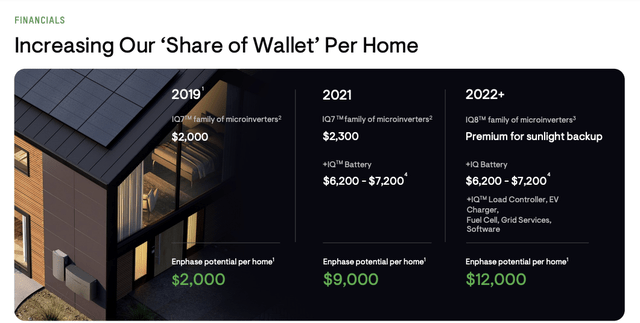

And Enphase is already capitalizing on this opportunity by expanding its ecosystem of products and cross-selling them. As you can see, Enphase is increasing its “share of wallet” per home.

Enphase 2023 July Investor Presentation

Back in 2019, its potential per home was only $2000, which consists of only microinverters. But as the years go by, Enphase introduced more products to enhance the Enphase Energy System.

For instance, with IQ Batteries, the potential per home increased to $9000, and today, with other products such as IQ Load Controller and EV chargers, Enphase’s potential per home is now close to $12,000.

Put simply, the trends are clear. Solar PV and energy storage adoption will only continue to grow from here and this will be a massive tailwind for Enphase in the long run, and Enphase’s ability to innovate new products, expand the ecosystem, and increase monetization for each home is proof that the company has a massive market opportunity ahead.

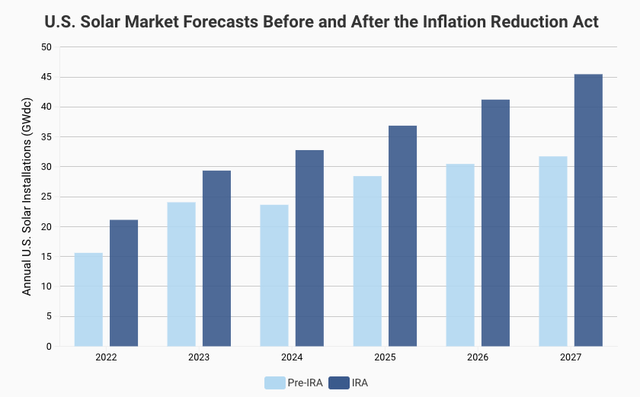

Not forgetting to mention, there are numerous government policies that support solar system adoptions, including the Inflation Reduction Act, which was enacted in August 2022.

Through the IRA, the federal solar investment tax credit of 30% has been extended until 2032, allowing homeowners to save 30% of the cost of installing a residential solar system in the US. At the same time, the IRA also includes the new advanced manufacturing production tax credit

That said, the investment tax credit for consumers and production tax credit for suppliers will push demand for solar-plus-storage systems to new heights as you can see right here by the dark blue bars.

As such, favorable policies like this will boost Enphase’s outlook.

Solar Energy Industries Association

On the other side, there’s the California Net Energy Metering 3.0 which reduces the average export rate by nearly 80%, so that means less incentive for homeowners, which is likely to decrease demand for solar PV systems in California.

And given that California is Enphase’s largest market, it is no surprise that investors are concerned with this new policy.

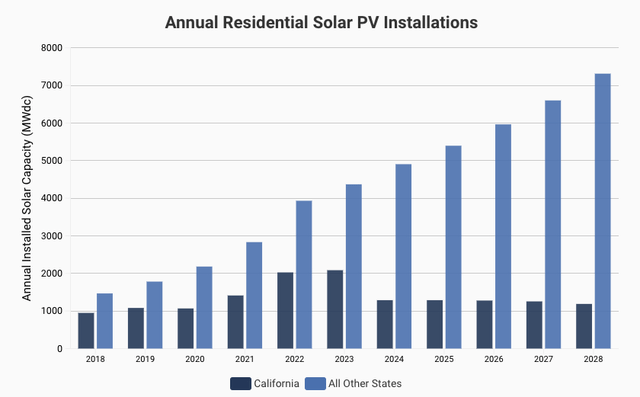

As you can see, NEM 3.0 is expected to decrease installations in California by nearly 40% in 2024 and beyond. But on the bright side, installations in other states are expected to continue to grow over the next few years, which is still going to support Enphase’s growth.

Solar Energy Industries Association

Valuation

Following Q2 results, Enphase stock crashed 7% the following day, and the stock is now down more than 47% year to date, while the S&P 500 is up 18%. This kind of divergence got me interested in the stock.

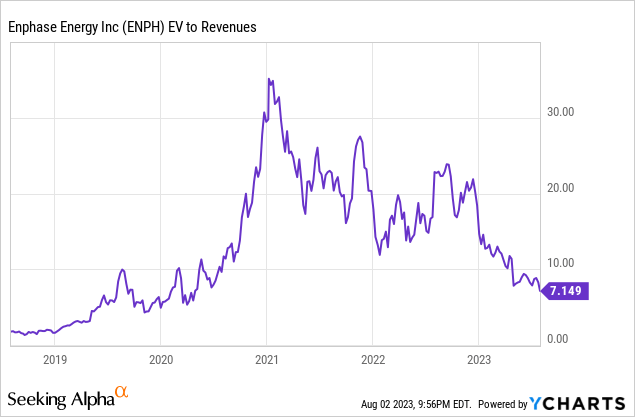

If we look at valuation multiples, we can see that Enphase is trading at an EV/Revenue multiple of just 7.1x, which is back to prepandemic levels and it is also a significant discount to when the stock traded at more than 30x its sales.

Of course, it’s not as low as it was back in 2019, but the company is much bigger and much more profitable than ever before so the higher valuation multiple is justified.

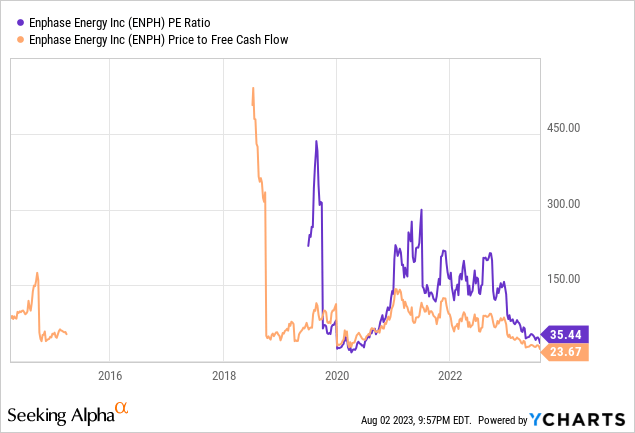

At the same time, its PE and Price to FCF ratios are trading near their all-time lows, at just 35x and 24x, respectively. As you can see, valuation multiples are trading at a massive discount, which looks attractive from an investment standpoint.

If we compare Enphase to its peers, it gets even more interesting.

As you can see, I’ve included the PE ratios of its competitors SolarEdge and First Solar, which have PE ratios of 58x and 133x, respectively, compared to just 35x for Enphase.

But the interesting part is that Enphase has a much higher ROIC than its peers.

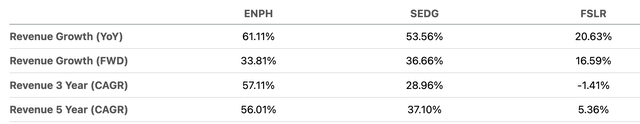

Furthermore, Enphase has higher growth rates than its peers as you can see here.

Seeking Alpha

So clearly, there’s a huge disconnect in fundamentals and valuations among these three companies, and just a quick peer comparison tells me that Enphase is significantly undervalued given its superior growth and ROIC.

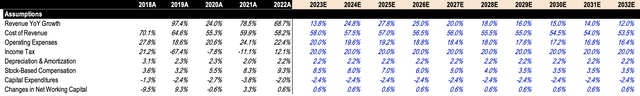

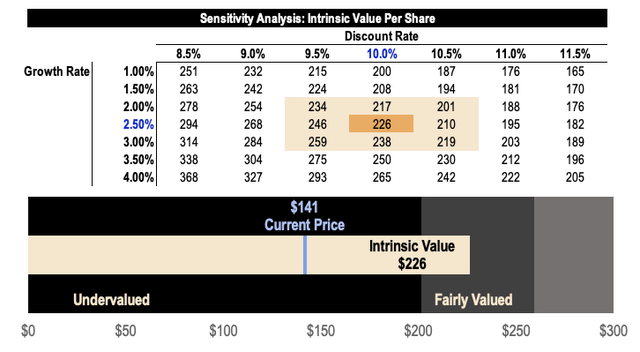

I also did a DCF analysis on Enphase. Here are my key assumptions:

- Revenue Growth: I’ve used analyst estimates for the first three years and then I’m going to gradually drop growth rates down to just 12% by the end of 2032.

- Cost of Revenue: I expect the company to gain economies of scale, so I expect Cost of Revenue as a % of Revenue, to drop over time to 53.5% by the end of 2032, which translates to a gross margin of 46.5%.

- Operating Expenses: I expect the same thing for Operating Expenses, which is going to improve as a % of Revenue over time, to just 16.4% by the end of 2032, which leads to an operating margin of about 30%.

Author’s Analysis

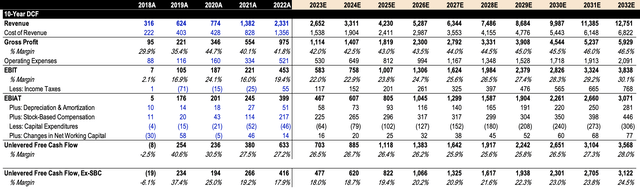

So based on all these assumptions, I expect Enphase to reach a Revenue run rate of about $12.8 billion by 2032, with an FCF margin of about 28%.

Keep in mind that Enphase has an FCF margin of over 30% currently, but I expect competition to put pressure on margins over time, thus, the lower projected FCF Margin profile.

Author’s Analysis

So based on my projections, and based on a discount rate of 10% and a perpetual growth rate of 2.5%, I arrive at an intrinsic value per share of about $226, which is higher than the average analyst price target of $200 a share.

Author’s Analysis

That said, my price target represents an upside of about 60% based on the current price of $141 a share.

Personally, for mid-cap growth stocks, I would like a wide margin of safety of at least 40%, which brings my wide margin of safety price to about $136.

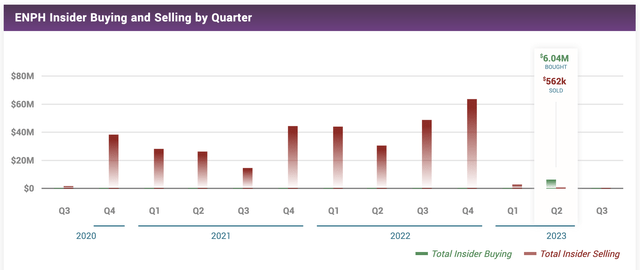

On the other side, management seems to be quite bullish after the recent drop as they bought $6 million worth of Enphase stock in Q2 alone, which is probably the first time insiders are net buyers of the stock.

MarketBeat

That said, I do think there are some catalysts for Enphase stock, namely expanding margins, the reacceleration of its battery business, better-than-expected growth, strong international growth, as well as interest rate cuts.

It’s also worth mentioning again that the company initiated a new stock repurchase program of $1 billion — management may find the stock undervalued which is why they accelerated the buyback program.

Even though shares look undervalued today, I won’t be buying the stock as it has not fallen below my margin of safety price. However, it’s getting close, so I’ll be watching the stock closely.

Risks

Concentration

According to the company’s annual report, one customer accounted for 37% of total revenue in 2022, which was up from 34% and 29% in 2021 and 2020, respectively.

The rising concentration could be a problem if we see this customer facing its own company-specific challenges.

Competition

As you may know, the solar industry is very competitive with players like Solar Edge, Huawei, Tesla, and so on.

For comparison, I’ve included Tesla’s solar and storage operating metrics. As you can see, Tesla’s solar business is way smaller than Enphase’s solar microinverter business.

However, Tesla’s energy storage business is much larger than Enphase’s battery business, and I think this is due to the fact that Tesla serves more of the large-scale projects while Enphase leans more on the residential side.

Author’s Analysis

That said, growth for the Enphase battery business on the commercial side may be limited given Tesla’s dominant position. But the point is, Competition is fierce, and that may slow down Enphase’s growth.

At the same time, as the solar and energy storage industry matures, components such as microinverters may become commoditized, which means price competition for Enphase as cheaper alternatives flood the market.

That means Enphase would need to cut prices, which of course, is going to hurt the company’s Gross Margins, and ultimately overall profitability.

But for now, it seems that Enphase has strong pricing power and customers are willing to pay for the premium, which can be seen from its improving Gross Margins

Nevertheless, we need to carefully track Gross Margins, because if gross margins are going down, it’s a strong indication that demand has shifted to competitors.

Regulation, Policies, and Incentives

We saw how rising interest rates put a strain on consumer demand for IQ Batteries, which are already very expensive.

We saw how NEM 3.0 is likely going to reduce future solar installations in California.

And what happens if the government suddenly withdraws the 30% solar investment tax credit? I think that would be a huge blow to the solar industry.

Investment Thesis

I think Enphase could be a really attractive investment if investors want exposure to cleantech, given its technology, high switching cost, and cost advantages moats.

The company is growing rapidly, has superior margins, and has a long growth runway ahead as consumers and businesses all over the world transition to renewable energy.

The fundamentals of the business remain strong and although it is facing some near-term challenges such as high interest rates and NEM 3.0, it is clear that solar adoption will continue to increase day by day, which is going to be a long-term tailwind for Enphase.

And by the way, this is a US-specific issue. Last time I check, the International business is still growing by triple digits.

In addition, the 50% selloff provides a wide margin of safety for investors to accumulate shares today.