Irina Gelwich/iStock Editorial via Getty Images

After analyzing Enagás Q2 results (OTCPK:ENGGF, OTCPK:ENGGY), we are back to providing new insight. At the Lab, we are Enagás’ investors with skin in the game; however, we are no longer bullish on the company’s potential upside. We were first believers in Enagás’s Crucial Role In The EU Energy Crisis and TAP’s latest investment. We now hold reservations over the company’s CAPEX plan to support hydrogen acceleration and the absence of earnings growth. Indeed, in the near term horizon, which was already taken into account due to lower regulatory asset-based remuneration, the company’s earnings will likely continue declining. This leaves Enagás shares incrementally expensive at a P/E multiple levels (18x on 2024 forecasted numbers) compared to other Southern European peers at approximately 14x (in particular, we emphasize the Italian Snam (OTCPK: SNMRF) currently buy-rated). Within the sector, we also covered E-ON with an equal-weight valuation.

Q2 Results

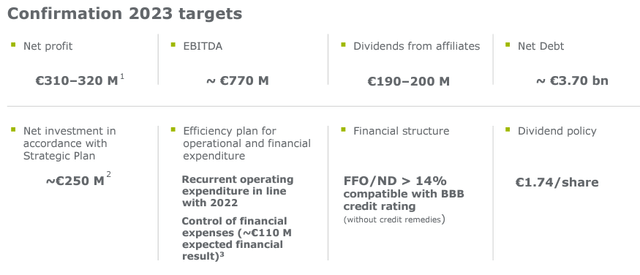

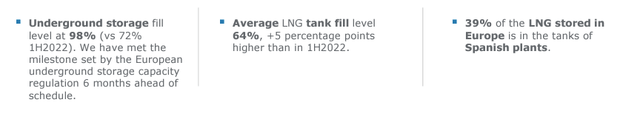

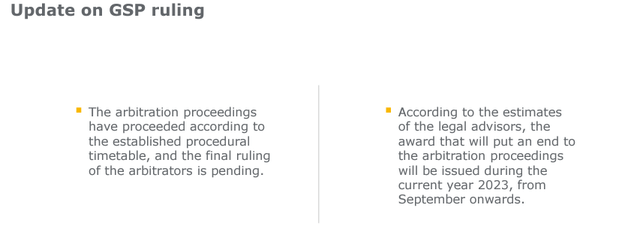

Starting with the positive news, the company is continuing to execute its 2022-2030 business plan and is ahead of schedule. As already mentioned, Enagás increased its equity stake in TAP to 20%, and now it is one of the principal shareholders. TAP value investment will now be accounted at €450 million and represents 10% of Enagás’ current market cap. With the expectation to double the pipeline capacity, TAP will be a crucial dividend contributor for Enagas P&L. In addition, with the El Musel regasification plant now open, this will add a positive earning contribution of €30 million per year. Following the EU indication and six months ahead, Enagás has already reached gas storage of 98% versus the 72% recorded in June 2022 (Fig 2). In light of H1 results, the company also reiterated its 2023 financial outlook with a net profit forecasted of €310 million (Fig 1). In our assumption, we also assume a favorable transaction on the Peruvian GSP arbitration with €200 million expected (Fig 3).

Enagás 2023 target

Source: Enagás Q2 results presentation – Fig 1

Enagás storage capacity

Fig 2

Enagás GSP Ruling

Fig 3

Why are we neutral?

Looking at the aggregate results, the company reached a net income of €176.8 million. Despite that, EBITDA (including equity associates’ dividend) recorded €198 million, confirming a negative trajectory of minus 3.8% on a yearly basis, but Q2 net income was at €122 million, and this included a €42.2 million positive one-off which related to the Mexican pipeline net capital gain. Eliminating this effect, Enagás profit reached €80 million on a quarterly basis and missed our €90 million estimate.

Regarding the natural gas demand, the company reported that “Spain increased its total gas exports by 55% in the first half of the year, and ship reloading has increased by 67%, contributing to Europe’s security of supply.” However, going deeper into the analysis, the H1 demand (including exports) decreased by 5% on a yearly comparison. This was due to lower power generation and gas demand in industrial consumption.

Net CAPEX investments are expected to reach €250 million (including TAP 4% additional equity stake). In addition, hydrogen was also a key topic in the Q&A call, with the Spanish Hydrogen Backbone corridor. Even if we recognize a potential upside, hydrogen is still in its infancy, no rewarded remuneration is in place, and Enagas’ infrastructure is not ready. Here at the Lab, we believe that the company might update Wall Street analysts with a new strategic plan on hydrogen-related outcomes. Ahead of January 2024, the company forecasts an EU plan to unlock vital subsidies.

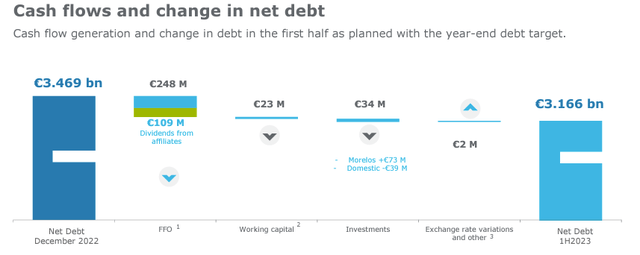

The company FFO reached €166 million in Q2, also considering affiliates’ dividends). Net debt decreased by €300 million, but Enagás paid its tasty dividend in early July. Therefore, in our estimates, the 2023 year-end net debt reached €3.7 billion. With the ongoing dividend policy, the payment exceeds Enagás’ free cash flow. And if we include a new hydrogen network investment, the company’s net debt/EBITDA might reach 5.5x in 2024.

Enagás net debt evolution

Conclusion and Valuation

The dividend has always been a downside protection in our investment thesis, and there are no changes in the company’s dividend policy. But, with a change in CAPEX allocation with higher investments in hydrogen, there is a possibility to change the remuneration payout and the capital structure. Therefore, we decided not to use a dividend discount model as we did before. On reverse engineering, to support Enagas’ previous valuation, we should value the company at a double-digit EV/EBITDA estimate in 2025. In our projection, the Spanish gas business is remunerated slightly below Enagas’ cost of capital (4.5% post-tax). This 1.3% discount is decremental for current investors; therefore, we have decided to remain neutral on the company. Looking within the sector, valuing the company in line with Snam, with a P/E of 12x, we derived a valuation of €16.5 per share.

Upside risks to our target price are new cost-cutting measures, a favorable Spanish regulatory framework, hydrogen funds from the EU, and divestments at attractive prices. Regarding the downside, we should report unfavorable outcomes of ongoing litigation (Peru), higher interest rate, payout remuneration policy changes, and regulatory frameworks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.