zhengzaishuru

Devon Energy Corporation (NYSE:DVN) investors were hammered yesterday (August 2) as DVN declined more than 7% as investors parsed the company’s earnings conference. On a risk-off day for the S&P 500 (SPX) (SPY), only the consumer staples (XLP) and healthcare (XLV) sectors finished slightly positive, as the market fretted over the US long-term credit rating downgrade by Fitch.

However, DVN also underperformed its sector peers (XLE), which fell by 1.3% yesterday. As such, DVN’s underperformance to its sector peers has continued since DVN/XLE topped out in August 2022.

I assessed that the risk-off positioning on DVN is justified, given the relatively weak price realizations in the company’s second quarter of FQ2 earnings release. However, I believe income investors also likely added to the selling pressure, as DVN reduced its variable dividend payout, culminating in a total quarterly payout of $0.49 (down from $0.52 in FQ1).

As such, investors likely reassessing that the risk/reward appeal (relative to the 2Y Treasury yield: 4.89%) has worsened further. Some investors could also attribute yesterday’s broad risk-off sentiments to the Fitch rating downgrade. However, it’s also important to note that DVN has attempted to recover since my previous update (upgraded to Strong Buy) in mid-July. Accordingly, DVN outperformed the S&P 500 significantly before yesterday’s sharp selloff, suggesting that dip-buyers weren’t particularly concerned with the relative spread between the 2Y and DVN’s forward dividend yields.

As such, I assessed that yesterday’s selloff could likely reflect income investors capitulating as they worry about potentially lower variable dividend payouts moving forward. With that in mind, it has opened up highly attractive opportunities for dip buyers who missed DVN’s mid-July lows to pick up more shares.

Does it make sense? Devon Energy’s price realizations were surprisingly weak in Q2. The company reported an average realized oil price of $71.74, about 2.7% below the WTI crude (CL1:COM) benchmark of $73.76. It was slightly worse than Q1, which could have spurred negative sentiments over Devon’s execution.

Moreover, its natural gas price realizations were also weak. Devon Energy reported average price realizations of $1.66 compared to the Henry Hub benchmark (NG1:COM) of $2.09. It was much lower than Q1’s average realizations of $2.47 (relative to the benchmark of $3.44). However, I believe the market has likely reflected it. However, while natural gas futures bottomed out in April 2023, they have yet to gain significant recovery momentum. Still, it’s critical to note that the worst selloffs in NG1 are likely over, corroborating potentially higher sequential realizations moving ahead.

Moreover, management telegraphed its confidence that it’s on track to achieve its targeted production growth. Devon’s free cash flow, or FCF, fell to $326M, affected by a lower operating cash flow of $1.4B. However, analysts’ estimates indicate that Devon’s operating cash flow has likely bottomed out in Q2, with sequential growth expected through the first quarter of 2024.

In other words, with weak income investors likely flushed out by the adjustment in variable dividend payouts, I believe it represents a glorious opportunity for value investors and dip buyers anticipating a more robust second half moving ahead.

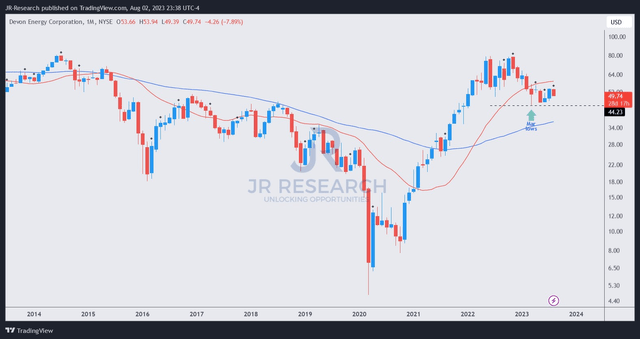

DVN price chart (monthly) (TradingView)

Despite the selloff, DVN buyers continued to defend its March 2023 lows ($44 level), a valid bear trap (false downside breakdown), which attracted dip buyers then.

Over the past five months, the consolidation has also been constructive, as buyers attempted to stage a decisive recovery in July 2023. While this month’s early selloff could have spooked some holders, DVN’s long-term uptrend bias remains intact as long as it holds its March lows robustly.

With DVN’s forward EBITDA multiple of 4.9x below its 10Y average of 6.5x and below its peers’ median of 5.2x (according to S&P Cap IQ data), DVN isn’t expensively configured.

As such, I maintain my conviction in DVN’s Strong Buy thesis.

Rating: Maintain Strong Buy

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!