kokouu/E+ via Getty Images

Investment Thesis

Southwestern Energy Company (NYSE:SWN) is about to report its Q2 2023 results Thursday, August 3, post-market.

I argue that investors shouldn’t expect to be blown away by its Q2 results. But Southwestern Energy’s prospects don’t stop there. Looking further ahead to the end of 2024, there’s a lot to be excited about regarding natural gas prospects.

In sum, Southwestern Energy is a cheaply valued natural gas firm. With natural gas demand expected to improve over the next twelve months, this stock provides a compelling risk-reward upside.

Why Invest in Natural Gas?

Natural gas is more than a bridge fuel. It’s a destination fuel that will play a critical role in the energy transition.

What the energy transition is, at its core, is a reduction in carbon-intensive energy sources. This means that natural gas will be given preference to thermal coal, particularly right now, with natural gas being cheaper than coal on a relative basis.

Looking ahead to the next couple of years, as temperatures around the world continue their incessant climb, there will be more demand for air conditioners, which are extremely energy hungry.

And this will come concurrently as electric vehicles (“EVs”) continue to take market share away from internal combustion engines (“ICE”), further driving an uptake in the need for natural gas, both in the U.S. and globally.

While EVs themselves run on electricity, the increased demand for electric vehicles will drive a parallel rise in electricity consumption. As the need for electricity surges to power EVs, air conditioners, heat pumps, and energy-intensive AI data centers, natural gas is poised to play a pivotal role in meeting this growing demand.

Altogether, this will call for significantly more reliable peak and base load electricity running through our electrical grid.

Meanwhile, beyond an aspiration to build wind and photovoltaic cells (solar panels), there’s the reality that building renewable energy sources and adding this energy to our infrastructure requires a tremendous amount of coordination, regulation, physical resources (think steel, aluminum), and time.

There are no shortcuts to getting renewables to go from around 20% of the electricity supply in the US to around 40% and beyond.

Demand for natural gas will only move higher in the next couple of years.

Why Invest in Southwestern Energy?

In the first instance, I’ll highlight the negative consideration that weighs on Southwestern’s near-term prospects. Then, I’ll discuss what investors should view as the bull case for Southwestern.

The overarching negative consideration weighing on Southwestern is that it holds a significant amount of debt.

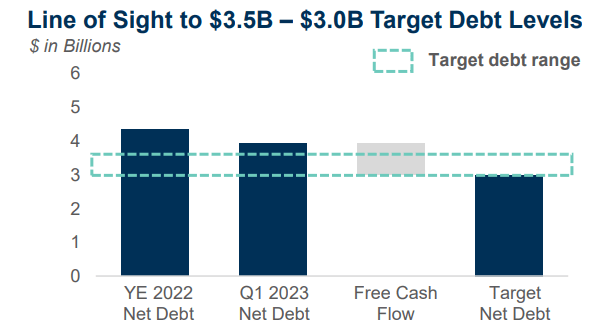

More specifically, Southwestern held about $4 billion of net debt as of Q1 2023 and this figure reaches just over half of its market cap. Consequently, investors will have to be very patient while Southwestern meaningfully improves its balance sheet, before it can significantly ramp up its capital returns program.

SWN Investor Day

As we see in the graphic above, Southwestern intends on using all its excess free cash flow to bring down its net debt profile to around $3 billion, before it can resume a meaningful capital return program.

Furthermore, I suspect that, when Southwestern reports its Q2 results on Thursday, we’ll see that its average unit costs per thousand cubic feet will probably come in at around $2.10 or thereabout.

Meaning that there’s a significant likelihood that Southwestern deemed it necessary during Q2 to take on more debt onto its balance sheet as a precaution. After all, recall that during Q2 there were prolonged periods of time when the spot market fell below $2.00 MMBtu.

Furthermore, on top of all that, Southwestern’s Q2 will also have had a discount relative to the spot market for the transportation of natural gas. Meaning that, when Southwestern reports its results, we are going to see a more leveraged company than it was in Q1, with close to breakeven free cash flows.

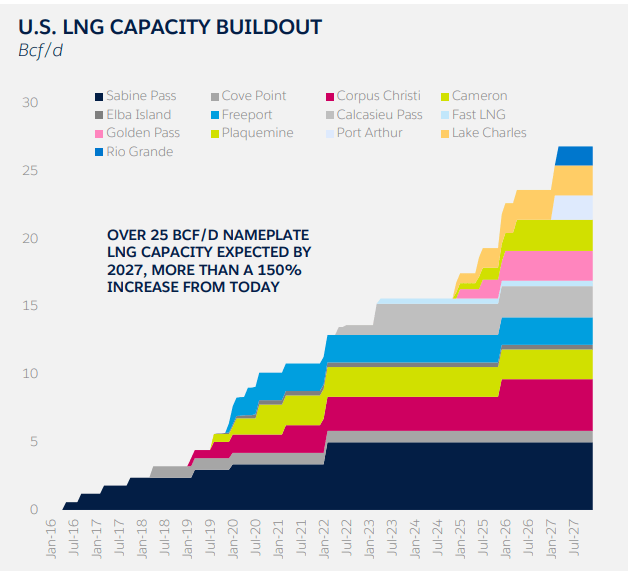

Next, we’ll discuss the good news. The good news can be seen in the graphic that follows:

EQT Investor Presentation

The illustration above serves as a reminder of the LNG capacity that is anticipated to start operating in late 2024. As a result, significant LNG volumes will be exported from the United States. And suddenly, within 12 months, we’ll have gone from having an oversupply of natural gas to a very tight natural gas market.

SWN Stock Valuation — Not the Cheapest Natural Gas Player

Compared with some of its peers, particularly Antero Resources Corporation (AR) (note, I’m long AR), Southwestern carries substantially more leverage. This means that it will take a very strong natural gas market in 2024 for this stock to re-rate higher.

So, even though Southwestern may appear to be optically cheap, at approximately 8x normalized free cash flow, the fact of the matter is that Southwestern’s balance sheet hinders its full potential to return capital to shareholders.

The Bottom Line

In light of Southwestern Energy’s upcoming Q2 2023 results, I don’t anticipate any groundbreaking performance, but the long-term prospects for natural gas present an exciting opportunity.

Natural gas is more than a transitional fuel; it plays a critical role in the energy transition, particularly as it gains preference over thermal coal due to its lower carbon emissions.

The increasing demand for electricity to power electric vehicles, air conditioners, and energy-intensive data centers positions natural gas as a pivotal player in meeting these energy needs.

While Southwestern Energy carries a substantial amount of debt, its strategic plans to reduce net debt and tap into the growing LNG export market show promise.

Although Southwestern Energy Company may not be the cheapest player in the natural gas market, the anticipated surge in LNG volumes in late 2024 creates an optimistic outlook for the company’s future. Investors must consider the long-term potential of Southwestern Energy and the significant role it can play in supplying natural gas amid the increasing demand for clean energy solutions.