JazzIRT/iStock via Getty Images

Federal Reserve’s low-interest regime had a lot of unintended consequences. Creating massive inequality aside, I believe this has created a lot of businesses with unsustainable business models. Recently, I was reviewing the annual report for Sunnova and their latest earnings and I realized this business model may not continue to be sustainable in a high-interest rate regime. I will present my thesis below by reviewing the way they make money and how their financials are reflective of their business model and the new high-interest rate regime.

Business Model

Sunnova Energy International (NYSE:NOVA) is a leading residential solar and energy storage service provider. The company operates as a solar energy system and equipment leasing company, offering solar power and energy storage solutions to homeowners across the United States and select international markets.

How the business operates and makes money:

-

Solar Leasing and Loans: Sunnova’s primary revenue source comes from leasing and loaning of solar energy systems to residential customers. For leasing, Homeowners pay a fixed monthly fee for the use of solar panels, inverters, and related equipment, while Sunnova retains ownership and maintenance responsibilities. For loans, the company operates an “Easy Own Plan equipment purchase” agreement. According to this, the customers buy solar energy systems through financing provided by the company and repay it along with a finance charge over 10, 15, or 25 years. The company purchases these agreements from dealers and handles the operation and maintenance of the solar energy systems.

-

Power Purchase Agreements (PPAs): Sunnova also offers Power Purchase Agreements, where homeowners purchase the energy produced by the solar system at a predetermined rate, typically lower than utility rates. This allows homeowners to access clean energy without upfront costs.

-

Energy Storage Solutions: In addition to solar, Sunnova offers energy storage solutions, such as batteries, to homeowners. These storage systems allow customers to store excess energy generated during sunny periods and use it during peak demand or when the sun is not shining.

-

System Monitoring and Maintenance: Sunnova provides ongoing monitoring and maintenance services for the solar systems it leases to ensure optimal performance and customer satisfaction.

As of December 2022, approximately 24% of customers had lease agreements, 28% had PPAs, 28% had loan agreements and 17% had service plan agreements.

The elusive profitability

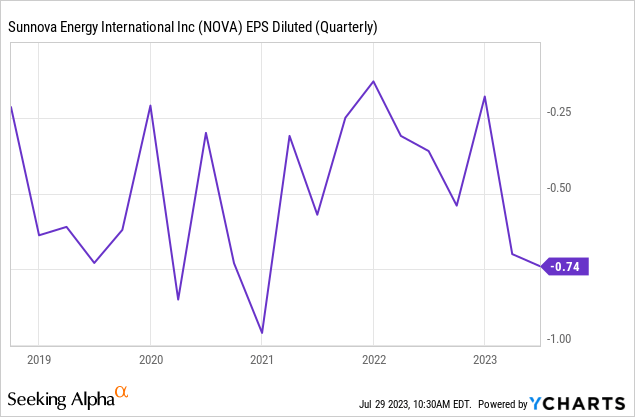

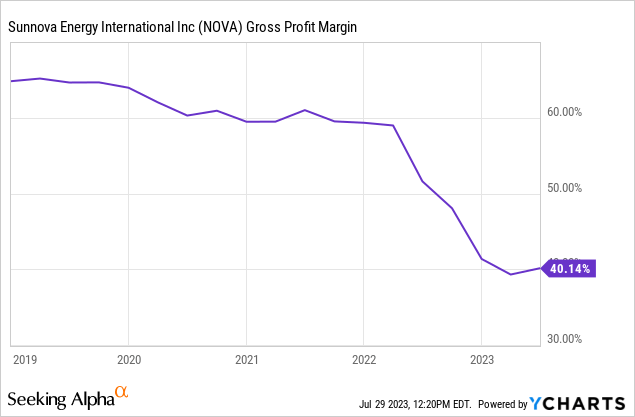

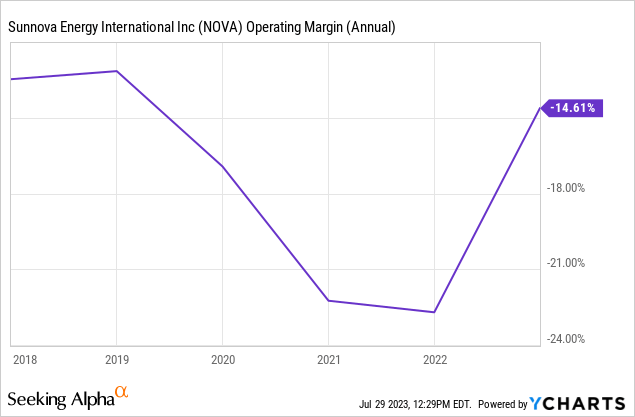

Despite all the growth in revenues, the company has not shown any profitability. And this is not just due to growth in costs in one area either. Across the board, the inherent nature of the business means that profitability is hard to come by.

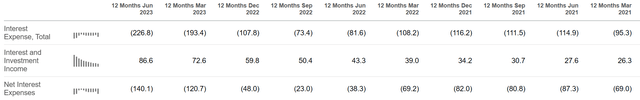

Declining and negative margins have been a constant occurrence. For the latest quarter, the company again reported a negative operating margin of -35.3%. A closer look suggests that while revenue increased by 13%, operating expenses increased by more than 100%. While previous quarters have also seen more than 100% increases in revenues, the company’s inability to keep a lid on costs is a growing concern. And we have not yet covered financial expenses. While reviewing the company’s business model we observed that a notable portion of their business is dependent on leasing and loans. Essentially, the company raises capital from external sources and provides financing options for customers to implement their solar upgrades. This makes their business model quite susceptible to interest rates and this is evidenced in the increase of their net interest expenses.

Income Statement Snapshot (LTM) (Seeking Alpha)

It provides some comfort to know that the company claims to have hedges in place to protect them from interest rate changes. They also mention that they have a significant spread between the return from the total expected cash flows from all the systems (loans, leases, etc.) and the blended yield from all the debt they have raised. However, I cannot entirely say how or why this is not yet reflected in their financials.

Simply said

If I try to think of this as a customer, I would be going for a solar solution only if it reduces my net energy bills. A financing solution would work only when the resulting costs can still come lower than the energy bill. This means that the company may not have as much freedom to pass on any increased rates from its borrowing to its customers. Temporarily, they may be able to absorb this on their books if they can control other costs on their revenues. But as we saw earlier this is not the case either. The net result is that the company’s profitability is susceptible to a variety of factors.

What about scale?

Achieving scale in a business can have a positive impact on operational cash flow. When a business achieves scale, it generally means that it is increasing its production or sales volume while keeping its fixed costs relatively stable. Decreasing Operational cash flow indicates that the benefits of scale may not be realized by Sunnova’s business model.

Snapshot of Cashflows (TTM) (Seeking Alpha)

From their recent earnings, they also mentioned outsized growth means to improve liquidity they will have to raise additional capital.

Due to our growth exceeding expectations, we are updating our liquidity forecast, which can be found on slide 13, to include a $500 million corporate capital raise by the end of this year, primarily to fuel the outsized origination we are currently experiencing and which is driving our customer count expectations for 2024. Our current expectation is 85% of the potential $500 million of corporate capital expected to be raised by year-end will be debt in the form of a high-yield bond, and 15% of the $500 million of corporate capital will be common equity.

This is a risk the company recognizes. It will always have to count on favorable external financing terms to grow the business and as such till the current high interest rates environment turns this is a big factor that will continue to weigh on their business.

How long can they survive?

This is what separates a business just going through unfavorable market conditions and a business that can actually survive unfavorable market conditions and in my opinion, Sunnova could be coming dangerously close to capitulation should their performance and these market conditions continue.

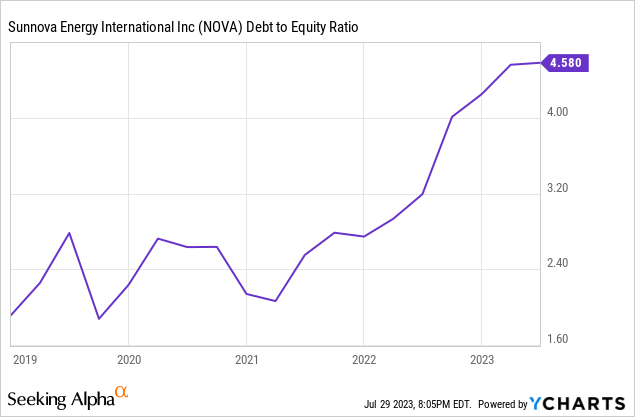

1. Sunnova’s debt to equity has significantly increased in the last five years

2. They have sufficient liquidity for the near term as evidenced by their current and quick ratios (1.2 and 0.8 respectively)

3. Their current free cash flow suggests that they do not have sufficient cash runway and would have less than a year if cash flows continue to decrease at the same rate and they do not raise capital

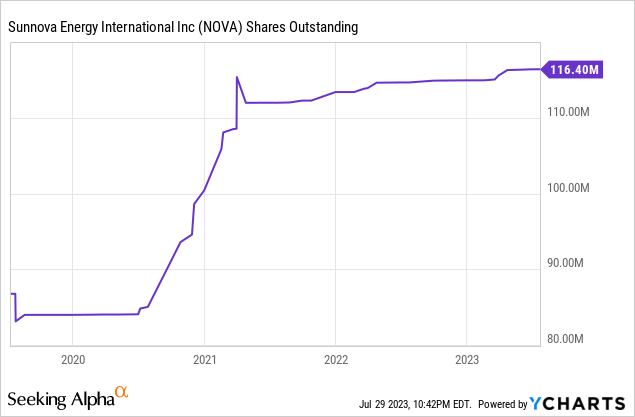

4. I believe the company may have to increasingly turn to raise capital through share issuance should these conditions persist. There is already evidence of dilution in the past few years and the share count has increased by more than 35% in the last few years

Risks to this thesis

I believe the company has been able to make the business model work so far due to looser monetary conditions and a return of those conditions could definitely see the company taking advantage of that environment. Also, the ongoing switch to renewables makes it an attractive investment for multiple green energy-focused funds or investors which could continue to help the company succeed in a difficult environment. As such most of the company’s financing is provided by tax equity investors who provide financing for the company’s solar projects in exchange for tax credits or tax benefits from the project. The company also makes use of tax benefits and other incentives from the government and the continued decarbonization plans mean that these become more and more available in the future. In fact, in its annual report, the company makes this comment:

For our leases and PPAs, we also currently receive tax benefits and other incentives from federal, state, and local governments, a portion of which we finance through tax equity, non-recourse debt structures, and hedging arrangements in order to fund our upfront costs, overhead, and growth investments. We have an established track record of attracting capital from diverse sources.

Final Call

I rate this company as a Strong Sell. Aside from the company being in a favorable industry that subsidizes a majority of its costs, I believe the business model is inherently unsustainable and even more so in the current environment. There is clear evidence of this in their financials itself. But I would not bet against this stock in any way. The prevailing environment has seen the likes of many stocks with unsustainable business models move irrationally and short-term movements could induce a significant blow to one’s portfolio. The risks of taking the wrong position in this stock far outweigh the benefits of taking “no action” and I will be on the sidelines as of now.