pidjoe

To the untrained eye, bargains may seem hard to come by when the S&P 500 (SPY) is trading not far from its all-time high achieved in early 2022. However, savvy investors know that markets are inefficient by nature, and that sectors will fall in and out of favor, creating opportunities for those who know how to spot value.

Such I find the case with Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI), which has traded in the opposite direction from the market in recent weeks, and currently sits 29% below its 52-week high. In this article, I discuss why HASI’s +6% dividend yield and capital appreciation potential make it a potentially terrific choice for value investors today.

HASI Stock (Seeking Alpha)

Why HASI?

HASI is a self-managed, leading climate positive investment company that partners with clients to deploy real estate that’s related to renewable energy. Its investment portfolio is valued at $4.7 billion and is spread across a diverse set of assets. Residential Solar, Grid-Connected Solar, and Wind represent HASI’s top 3 segments, comprising three-quarters of total.

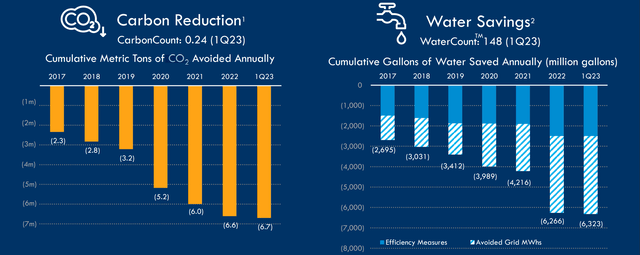

HASI’s green footprint has resulted in meaningful savings in carbon dioxide and water. As shown below, management estimates that 6.7 million metric tons of carbon dioxide and 6.3 billion gallons of water are being saved annually as a result of its funded projects.

Investor Presentation

Investors may like HASI for its non-cyclical business model, since its run-rate business is not directly affected by commodity prices. In reality, higher oil and gas prices should actually help HASI, since that would make renewable energy more attractive. But no matter where commodity prices go, HASI is expected to benefit from the $1 trillion infrastructure bill, of which $23 billion is earmarked for enhancing the resiliency of the power infrastructure and investment in renewable energy.

Meanwhile, HASI hasn’t shown signs of slowing down in a higher interest rate environment, as the first quarter was the highest ever in terms of investment volume, with the portfolio growing by $389 million, or 9% quarter-on-quarter. Moreover, HASI has plenty of visibility as its investment pipeline is now over $5 billion.

Importantly, HASI is growing in an accretive manner, as average yield on new investments is over 8%, and distributable EPS grew by $0.01 YoY to $0.52. It’s worth noting that the bottom line growth was impacted by interest expense growing by $11 million annually due to higher outstanding debt balance and higher interest rates. Nonetheless, management is still guiding for robust distributable EPS growth of 10% to 13% annually through 2024.

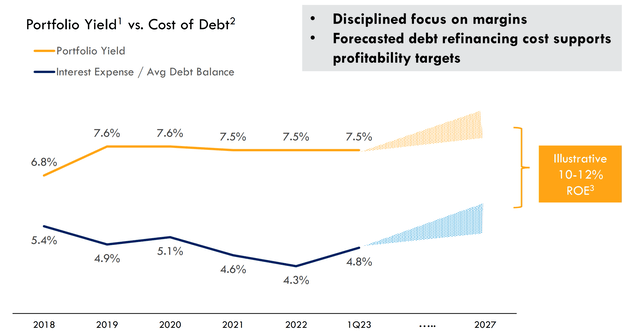

Looking ahead, this appears to be feasible considering the aforementioned tailwinds supporting renewable energy and the large pipeline of projects. In addition, interest rate growth has already shown signs of slowing down. According to S&P Global, the Fed’s quarter point rate hike in July is widely expected to be the last one in 2023. As shown below, management expects to continue to generate a healthy spread between portfolio yield and interest expense, with an 11% projected return on equity going forward.

Investor Presentation

Moreover, continued growth in HASI’s managed assets business adds a layer of stability to the enterprise. In the first 10 years as a public company, this segment has grown at a CAGR of 11% (including 15% YoY growth in Q1) to a balance of $10 billion in assets under management, resulting in an even higher shareholder return of over 15% per year.

This side of the business is not too different from the one adopted by Extra Space Storage (EXR), through its 3rd party management platform, in which it manages self-storage properties for other owners. In HASI’s case, asset owners benefit from HASI’s expertise and platform, while HASI benefits from the capital-light nature of (higher margin) nature of this business.

Importantly, HASI carries a strong balance sheet for a commercial mortgage REIT, with a Baa3 investment grade credit rating from Moody’s and BB+ by S&P and Fitch. This is supported by a reasonably safe 2.0x debt to equity ratio, sitting lower than that of names like Blackstone Mortgage Trust (BXMT), which carries a 3.5x leverage ratio. Plus, 87% of HASI’s debt is fixed rate, and it carries $490 million in total liquidity.

This lends support to its 6.1% dividend yield, which is protected by a 76% payout ratio based on the last reported quarter’s Distributable EPS of $0.52. Management has also guided for a 5% to 8% annual dividend growth rate over the next couple of years, on back of the aforementioned 10% to 13% distributable EPS growth rate.

Risks to HASI include potential for materially higher interest rates, which could pressure its investment spread. Also, a slowdown in the renewable energy market could dampen demand for its capital. Plus, while HASI is generally immune to commodity prices, a sustained drop in fossil fuel prices could make economic decisions around renewable energy harder to justify for its customers.

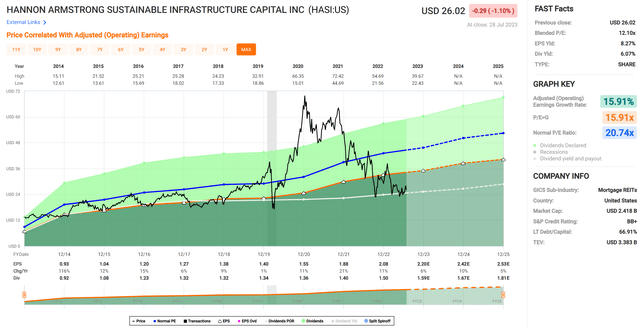

Considering all the above, HASI appears to be reasonably attractive at the current price of $26.02 with a forward PE of 12.0. This is considering HASI being the leading player in its field of competence, its strong track record, and pipeline of opportunities. As shown below, HASI’s normal PE is 20.7. While I believe that would be too rich, I don’t think a PE of 15.0 is out of the question, which could lead to double-digit total returns.

FAST Graphs

Investor Takeaway

Overall, HASI looks like an attractive option for income investors looking to benefit from the long-term growth of renewable energy. It has a number of tailwinds, including government spending in the renewable segment and a promising managed asset business. Its strong dividend yield, coupled with its forward potential and sound balance sheet make it an interesting play for value investors, especially after the recent pullback in share price.