baranozdemir

Investment Summary

Investing in coal might seem like a poor investment when there are so many incentives to start with renewables instead. But despite the coal being viewed so poorly, the companies that are operating by making steam coal for example are still seeing strong results. This brings us to Hallador Energy Company (NASDAQ:HNRG) which is still growing it is top and bottom lines very quickly right now.

Higher-priced coal contracts in the last quarter helped underscore the strength of the business model and position that HNRG is in right now. Operating cash flows reached $26.1 million, that’s a margin of around 13%. These sorts of results have me optimistic about the outlook for the business and its capabilities to produce higher and higher earnings. But what keeps me from rating HNRG a buy now comes down to the fact some practices are missing that are quite crucial for me. These are share buybacks and dividends. Currently, HNRG is diluting shares and hasn’t established a dividend yet. As a result, unfortunately, I can make a buy case for HNRG, but I will be viewing them as a hold instead.

Outlook For Coal Is Mixed

As I said in the earlier part of the article, the focus for HNRG is on coal. They have been in operation since 1949. These days it works with producing steam coal in the United States. The operations are in Indiana and products made are used in the electricity power generation industry. The significant assets that are under the company’s ownership are Oaktown Mine 1 and Oaktown Mine 2, two underground mines in the state.

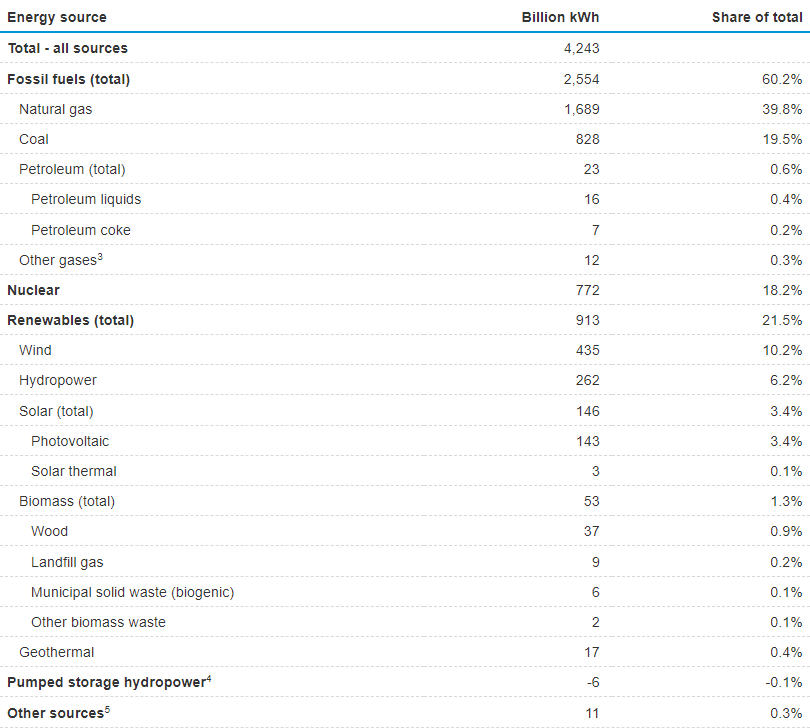

The push for renewables is creating hurdles for the coal industry. But we need to realize that a large portion of all the energy in the US is still being generated by coal. HNRG focuses on steam coal, which is coal that is burned in boilers mostly which then generates steam for the production of electricity or some heating purposes. To get back to the US dependency on coal, as of February 2023, almost 20% of all the energy in the US comes from coal.

Energy Generation (iea)

As we see from the chart above as well as the fact that a large portion of energy comes from renewables, and even though a decrease is happening, it’s not fast enough to suggest companies in the sectors will go out of business. Renewables are being implemented more and more and acts like the Inflation Reduction Act are making investments in that sector much more appealing.

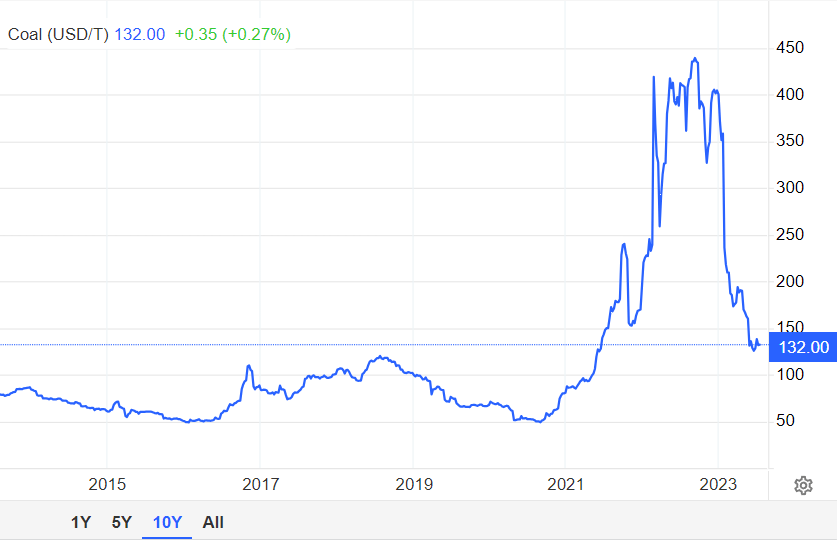

Coal Price (Trading Economics)

A reasonable assumption to make for the coming quarters is that coal prices are to continue being somewhat volatile as we view and asses what source of energy generation we will invest more into. I doubt that we will see coal prices similar to that in 2022. For HNRG that means fantastic revenues and earnings, like an EPS of $0.67, the best yet for the company. But outlooks are very good for HNRG as they have secured high-paying coal contracts. The following quote from the Q1 2023 report highlights the likelihood of strong earnings in coming quarters, “Of the 7.5 million tons contracted for 2024 – 2027, 2.7 million tons are contracted for 2024 at an estimated price of $51 per ton, with up to an additional 3.0 million tons expected to be dispatched to the Merom Power Plant. The remaining 4.8 million tons contracted for 2024 – 2027 are unpriced or partially priced tons”. Being able to secure contracts at these high levels shows dominance and competence from the side of the management. Until 2027 there are 13.3 million tonnes contracted at an estimated average price of $57 during the period. This is creating a strong source of revenues for the coming years and investors should rest assured that HNRG won’t lack growth.

Upcoming Report

For the upcoming report from HNRG, I think the EPS will take a hit QoQ as coal prices are still quite depressed in terms of price. The company will need to prove it can maintain margins though as that will prove the resilience of the business model in less favorable market environments.

In terms of revenues and average price sold, I think these are what will impact the results primarily. I doubt we see a decrease in volumes, but lower average selling prices seem reasonable given where the price of coal has been during the period. Some comments from the management about demand will also be interesting to hear. I don’t think we will receive any news that could make the company a buy though. There seems to be a lack of catalysts for that. A surge in coal prices perhaps could make it a buy, but that is external impact rather than improvements within the business itself.

Risks

Coal companies already face numerous challenges due to increasing environmental concerns and efforts to transition to cleaner and more sustainable energy sources. The shift towards renewable energy and stricter regulations on carbon emissions are gradually reducing the demand for coal.

Additionally, the global push for decarbonization and the rise of alternative energy technologies are posing significant headwinds for the coal industry. Many countries are actively phasing out coal-fired power plants, which further limits the future growth potential for coal companies.

Financials

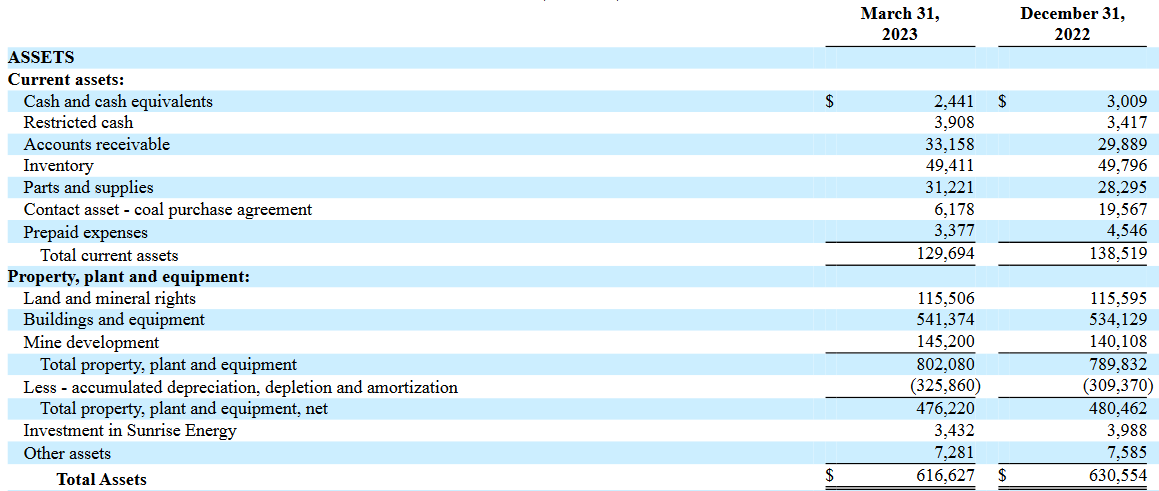

Viewing the balance sheet of HNRG there are some improvements that I’d like to see going forward. Firstly the cash position has been decreasing on a QoQ basis. This has happened despite generating very good operating FCF for the quarter. As the management made clear in the Q1 report, paying down debt and getting into a stronger financial position is a high priority.

Assets (Earnings Report)

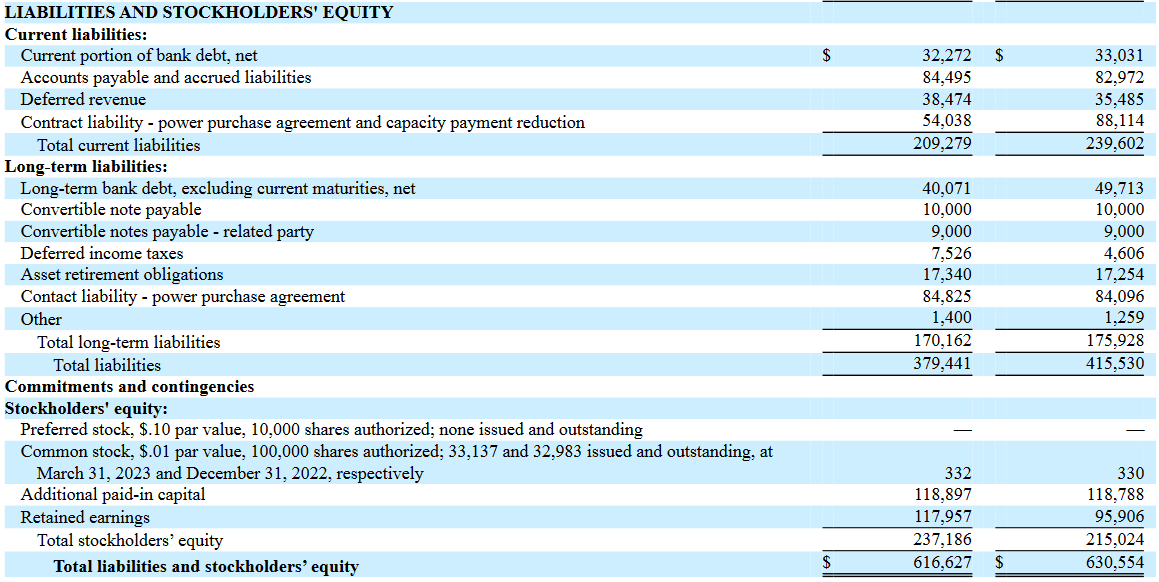

Liabilities (Earnings Report)

The actual progress on paying down debt was very satisfactory, I think. They reduced it by $9 million and it now sits at $40 million. This is a healthy position to be in. But I am skeptical about expansion prospects. I think acquisitions or purchasing existing land or factories is the best route to go down, rather than investing in new land and building from the ground up. There is a lack of initiatives I think for companies in the coal industry to invest heavily as legislation is trying to push out the reliance on it in favor of more cleaner energy sources. We don’t know what the policies for coal might be in 10 years, most likely more strict. In conclusion, though the state of the balance sheet I think is healthy and positions HNRG well to invest if they so wish.

Valuation & Wrap Up

Investing in coal might not be on everyone’s list of possible prospects, but HNRG seems to prove that the industry has a lot of potential. They have managed to secure a lot of contracts until 2027 that will help them generate strong revenues for years to come. The operating FCF from this will be used to bolster the financial position of the business.

Stock Price (Seeking Alpha)

However, what leads me to rate them as a hold is the fact share dilution is happening and that they lack a dividend too. Diluting shares hurts a buy case and with no dividend, the appreciation that investors can get comes from the share price growing as HNRG grows its EPS. But as there are challenges and volatility in prices relying solely on that to get value here seems lackluster. Investors seeking something more instant in terms of shareholder value might want to consider Alpha Metallurgical Resources, Inc. (AMR) instead. A company with fantastic buyback potential and very reasonable value. But to reiterate the stance on HNRG, I think a hold is the best until these shareholder-friendly practices are set in place.