WHPics/iStock via Getty Images

Introduction

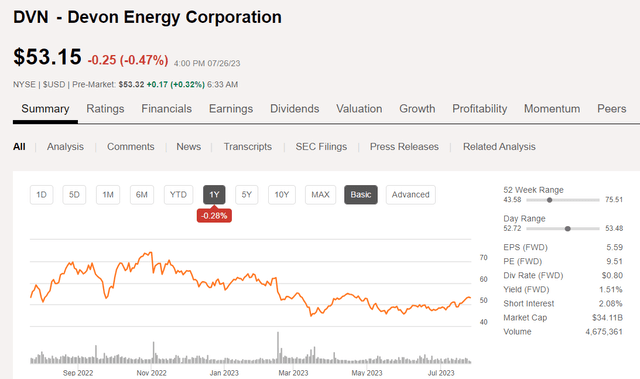

Devon Energy (NYSE:DVN) has underperformed much of its peer group since November of last year in terms of share price. As of today’s market open, DVN looks to open at $53.32, down 27% from November’s high of $73. And, that’s after a nice ~15% rally during July. It’s been worse.

Devon Energy price chart (Seeking Alpha)

By comparison, EOG Resources (EOG) is down 10% from its November high. Pioneer Natural Resources (PXD) is down 11% from its November high of $252. Let’s do one more. How about Occidental Petroleum (OXY). We find OXY at $63.23 today, down 16% from its November high of $75.96 per share. Ok, we will consider this point made. But, it leads to the question, why has the market punished DVN out of proportion to competitors? More importantly is this disdain due to a structural flaw with the company, or just the market misunderstanding its true potential?

I have done a number of articles on Devon, please have a look at the older ones. Many of these feature deep discussion of the company’s acreage quality in the Permian which underpins the investment thesis.

In this article we will discuss our thoughts on the underperformance to this point, and whether we may see a post-earnings opportunity to buy sub-$50.00, and more importantly, why we should own it for long term gains.

The Permian approaches Mid-Life

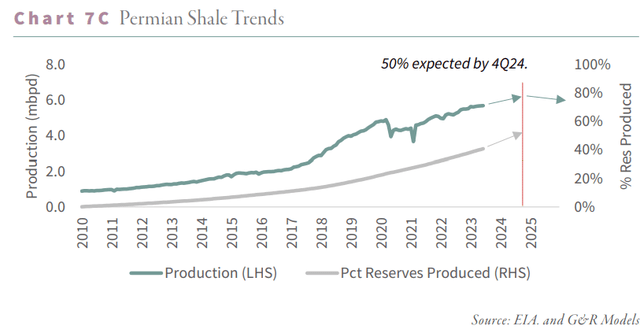

Whatever you think about the longevity of this basin, one thing is absolutely undeniable. We are currently extracting nearly 2 bn BOE annually from it. Over the last 5-years we’ve withdrawn more than 6 bn BOE. Since we began fracking about 15 years ago, we’ve pumped out ~14 bn BOE.

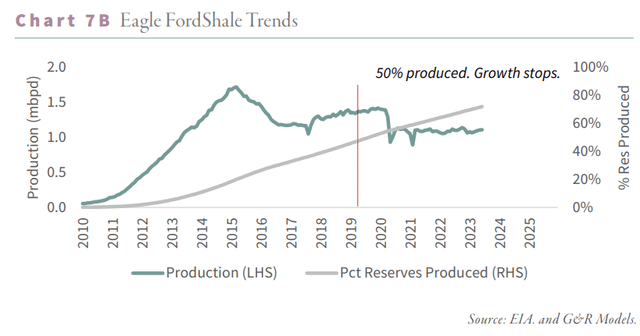

Natural Resources analyst firm, Goerhring & Rosenscwajg (G&R), has modeled productions trends that suggest that “Hubbert’s Peak” for the Permian will hit late next year. Hubbert was a geologist who theorized that once half a basin’s reserves had been recovered, it would have essentially peaked. The graph below taken from a G&R report highlights their expectations. G&R could be off some, but the point remains, there is an inflection point coming that will tilt the slope downward.

G&R Permian shale trend (G&R Advisors)

Another thing that follows this notion is that much of the best acreage has been drilled. This is a point I’ve made many times in past articles. During the low price era from 2017-2020, many companies pulled forward their Tier I – “geological parameters such as thickness, thermal maturity, organic content, oil in place, porosity, and permeability to make accurate well-quality predictions” – acreage for it to meet investment thresholds and payout requirements.

What all of this means, when considering investing in a shale producer, the quality of the rock, and the ‘blockiness’ of their surface acreage are two key features that will drive the long term investing thesis. I have always maintained that Devon would be in the top tier of shale producers for these reasons. And, the company is releasing results that support that contention.

Understanding Devon’s Core Assets

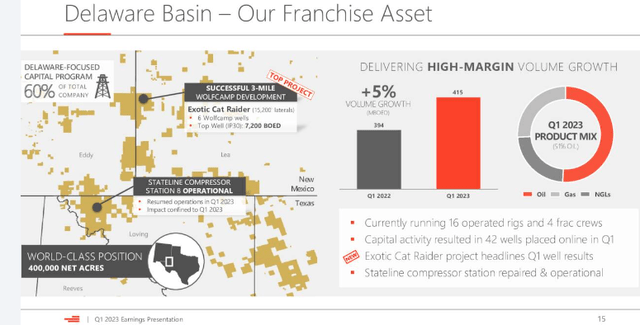

Devon’s current pad development, “Exotic Cat Raider, “is the latest example of science meeting great rock, backed by a 12,000 foot horizontal leg with nearly 3,000 ppf of sand tucked away in fissures.

DVN Franchise asset (DVN)

With an IP30 of ~7,200 BOEPD, the EUR’s on these wells are prodigious. Clay Gaspar, President of Devon comments:

Individual wells at Exotic Cat flowed at rates over 7,200 BOE per day and well — per well recoveries from this pad are on track to exceed two million barrels of oil equivalent. The flow rate from this activity rank among the very best projects Devon has ever brought online in the basin.

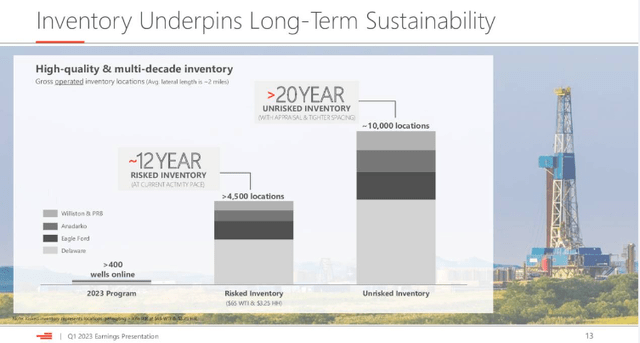

It is worth noting that in the latest EIA-DPR, new well production averaged by the rig count, is only 963 BOPD. Great rock matters! With a Risked inventory of 3,000 Tier I drilling locations, Devon has years of development runway ahead of it in the Delaware. It’s no wonder they refer to it as their Franchise Asset. Devon has been turning ~250 wells in the Delaware to sales annually, putting their risked inventory at 12 years.

Derisking involves drilling in an area and confirming what modeled subsurface data and AI analysis have suggested. Then there are the cores and logs that give further clues about the subsurface conditions. As the company continues to develop assets like Exotic Cat, it derisks further drilling locations, which then be moved up the valuation chain. Looking at the slide below it’s clear Devon believes there are at least another couple of thousand drill sites to be derisked in its Delaware acreage.

DVN inventory in key basins (DVN)

Note-Risked inventory can be considered Tier I rock that will meet capital return goals. Some portion of Unrisked inventory will become Tier I when more thorough assessments are done.

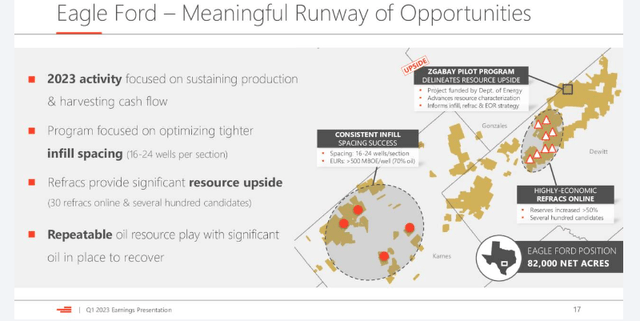

The Eagle Ford-EF, has met its Hubbert’s Peak according to G&R, noting the basin has produced “65% of its recoverable oil.” That doesn’t mean there isn’t still money to be made in the EF, as DVN demonstrated last year when it bought Validus Energy.

G7R Eagle Ford chart (G&R)

Something I learned about working through this article was the DOE project to increase production from mature basins, where the bulk of the wells were completed before shale fracking was well understood. In Devon’s case this project is taking place on the Zgabay property with the objective of going back into these older wells and selecting candidates for refracs.

DVN Eagle Ford Positions (DVN)

Clay Gaspar President of DVN comments on the potential of this project:

The refracking activity is very encouraging. Some of that is pretty unique to the Eagle Ford. Talked about some of the reservoir characteristics there. It has an ability to stay really — the original completion tends to stay very near wellbore, and so it gives you that opportunity to feather in a few more wells or other basins. That just really doesn’t work very well. And then the re-stim, figuring out the techniques how to go about this, how to prosecute this and we’ve seen tremendous upside. So all of that is great inventory. And most of it, to be honest, is upside from what we underwrote with the Validus acquisition.

Refracs and EOR are a bit like rock recycling, or taking a second squeeze at your sponge to wring out the last few drops of water. You don’t get it all and if you really tried, you could get more, but as the popular expression goes, at this point, “the juice isn’t worth the squeeze.” So too with shale recovery.

Devon’s underperformance

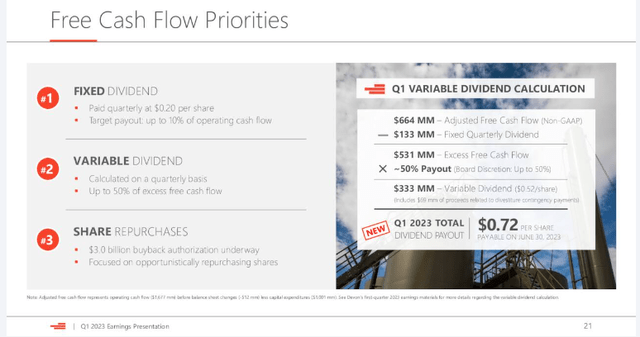

In addition to the low oil and gas prices (relatively speaking to the first 3 quarters of 2022), the market has reacted adversely to the last couple of DVN dividend announcements. In each case it was a significant step down from falling cash flows. The important thing to me is management stuck to their previously announced distribution formula, so there should have been little surprise. With the $0.72 cash payout (fixed and variable), and share repurchases totaling a 12% cash yield for Q-1, investors were well rewarded for hanging on to the company’s stock. It didn’t matter and DVN was punished anyway. Investors are a fickle lot.

DVN Free Cash Flow priorities (DVN)

What to expect for Q-2

It’s a forgone conclusion that excess free cash will come lower than Q-1. I peg it at about $0.80 per share for Q-2. In that event non-GAAP free cash should be on the order of $516 mm. Back out the fixed dividend of $.20 per share, and you have $383 mm excess free cash. If we assume the same 50% split, it comes $191 mm, or $0.29 per share for a total fixed and variable dividend of $0.49-.50 per diluted share. At today’s selling price of $52 that works out to a cash yield of 3.8%, or less than a T-bill. I anticipate the market will punish DVN once more.

Your takeaway

The good news is things should improve from here. The forecast is for the EPS to rise in Q-3 and that should have a positive effect on the dividend.

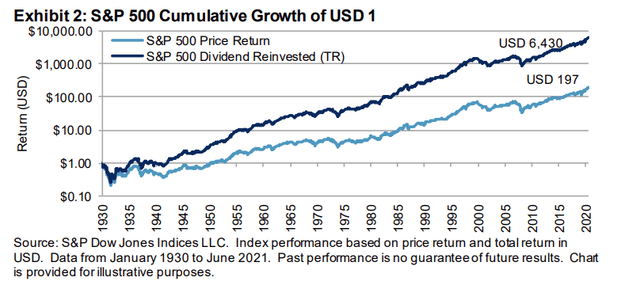

There is certainly a case to be made for having sold in November of last year and buying back in now. I get it, I just don’t like to work that hard. Virtually everything that could have gone wrong for oil prices did go wrong over the last 8 months. Who knew how bad the macro-environment would get? I didn’t. If you are a market timer, you are almost certain to miss the highs, and lows, and be stuck on the outside as dividends roll in. Been there, done that. The graph below from S&P Global makes the point fairly well.

S&P Price returns since 1930 (S&P)

DVN has been a long term core position in my portfolio, since it announced its new capital return program in 2021. My bet is that I will come out better owning this stock through down cycles, such as the one we have just come through, as opposed to trying to time the market. I will admit my thinking is influenced by my extremely low cost basis in the stock-~$22 per share. Even with the savage downswing we’ve had, my position has been solidly in the black, and as I DRIP my dividends, my share count as risen.

Right now DVN is trading at <5X EV/EBITDA and about $59K per flowing barrel. My strategy will be to accumulate incrementally if the stock dips back into the $40's on the earnings release. I already have a large position in the company so it's not going to be a big buy, just a bet on higher prices to come and juicier dividends to follow.

Investors looking for growth and income should definitely monitor DVN post-earnings for a buying opportunity that may not come around again for a while. I think DVN is a long term player in American shale and am sticking around for the reasons I’ve discussed here.