bjdlzx

Baytex Energy (NYSE:BTE) management long had a goal to no longer be dependent upon the original heavy oil business that was the origin of this company. Management was aided in this task with the general attitude that production is cheaper if it is purchased than if it is grown organically. So, management joined the industry-wide shopping spree and caught a prize.

The completion of the acquisition of Ranger Oil (ROCC) gives the company a major presence in the Eagle Ford which the company operates. This complements the acreage that the company has long held that is operated by Marathon (MRO). A major advantage of this acquisition is the ability to share information obtained from one of the best Eagle Ford operators in the industry to use with its own operated acreage. This is likely to lead to some significant operational advances in the acquired acreage.

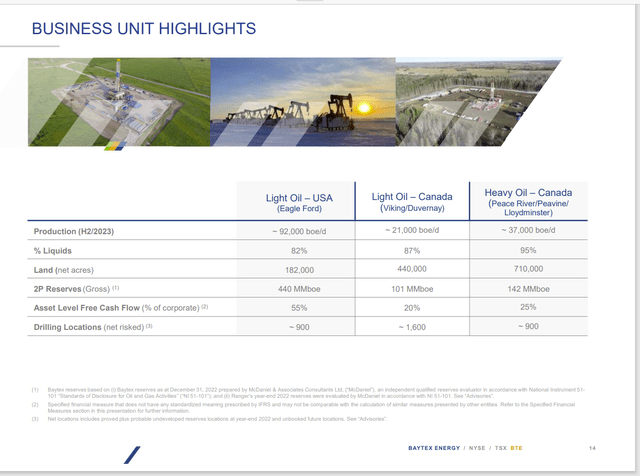

Current Production Profile

More importantly, the company has access to a lot of low-cost production for a premium product. This reduces the risk of the heavy oil discount widening during downturns. Now the heavy oil becomes a “gift” during the boom times without threatening the company existence during the cyclical downturns.

Baytex Energy Production Profile Post Acquisition Of Ranger Oil (Baytex Energy Corporate Presentation August 2023)

This is probably an ideal production profile when heavy oil is involved. Any producer would want the light oil production to “carry” the debt because heavy oil sometimes has to be shut-in to lessen negative cash flow when the discount to light oil expands during periods of weak pricing.

The newest heavy oil play for the company, Clearwater, has unusually low production costs. Therefore, the play could be profitable during a downturn. But a lot depends upon how wide the discount to light oil becomes. Since Clearwater is a relatively new heavy oil play, the market likely wants to see a few industry downturns before giving that production any credit to cash flow during the worst part of the industry cycle.

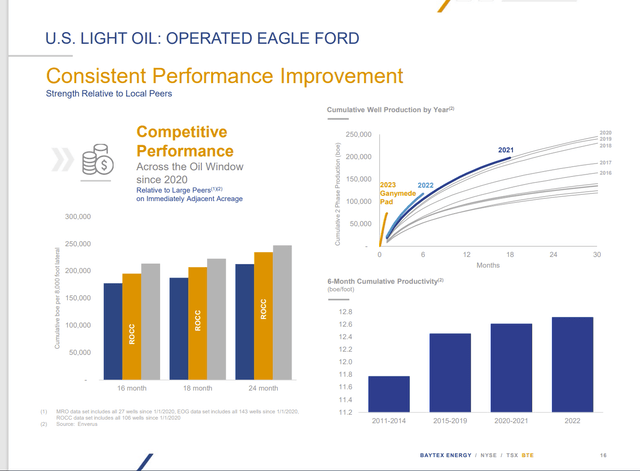

Eagle Ford

The Eagle Ford acreage keeps showing improving results. Much of the acreage has multiple intervals that are likely to become commercial as this cost progress continues.

Baytex Energy Presentation Of Eagle Ford Well Productivity Improvement (Baytex Energy August 2023, Corporate Presentation)

Not only does the Eagle Ford show improvement. But there is some clear slack there for the Ranger Oil wells to possibly improve some more as technology continues to advance.

A few years back, the Austin Chalk formation experienced a revival due to modern completion techniques. For the state of Texas, this is a story that has repeated itself many times. I lost count as to how many times Texas would run out of oil until another technology advance made those fears obsolete.

This acreage is likely to produce oil and gas long after you and I are gone, as long as technology continues to advance. In the meantime, it is very clear that operators continue to lower the breakeven point for wells drilled. Not only has production continued to improve as shown above, but many operators report lower drill times as well.

The continually lowering of costs makes deals that were done in the past look better all the time. No one prices in continuing improvements when making a bid for acreage. But shareholders benefit from lower costs of operating acquired properties all the time. These advances continue to favor purchasing production over organically growing it because established production becomes less valuable as newer production becomes cheaper to establish organically.

It also implies that in the long run, corporate breakeven points will continue to decline. That would mean that margins will widen at various WTI prices. While unconventional will likely remain the swing production during good and bad times, that unconventional production keeps lowering costs to compete with other types of production that are not usually sensitive to the business cycle. If the trend continues long enough, it could change industry thinking about swing production.

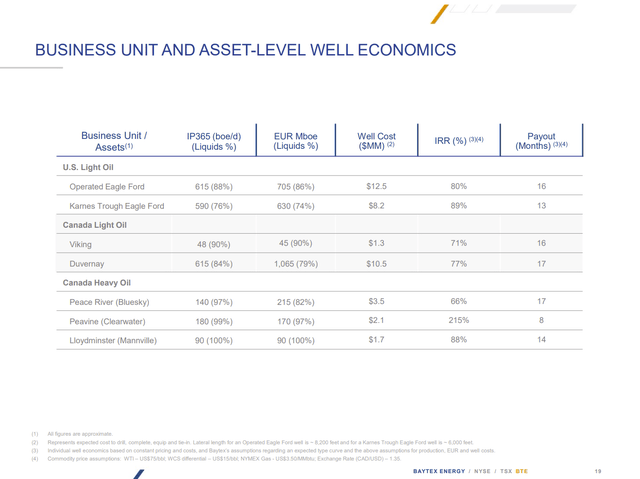

Heavy Oil

Clearwater is the most profitable asset in the current environment. But that profitability and cash flow can completely disappear in a downturn as the discount widens.

Baytex Energy Relative Profitability Of Portfolio Leases In The Current Pricing Environment (Baytex Energy Corporate Presentation August 2023)

The acquisition of the light oil (which has less profit volatility) gives the company some financial room to take advantage of the very profitable Clearwater Play. This will likely happen at the expense of the other heavy oil plays because it is more profitable.

However, technology advances can easily alter that strategy in the future. For that reason alone, basin diversification is essential because profitability leadership often switches basins and intervals as technology advances. It really has not settled down at all since I began following this a few decades back. So, there is no reason to not expect the basin switching (for cost leadership purposes) to continue.

Nonetheless, in the current environment, the ability to exploit a low-cost play (and high profitable one too) like Clearwater is an advantage that few competitors have. For the time being, that profitability constitutes a competitive moat that is not easily replicated in the industry. It gives the company a huge profitability advantage over the competition.

The acquisition of the Eagle Ford properties probably lowered the corporate breakeven quite a bit. Exploring and developing the Clearwater play will likely continue to lower the corporate breakeven more.

Summary

Baytex Energy is basically a materially different company with the acquisition of Ranger Oil. The introduction of a lot of Eagle Ford production that the company controls is a value changer for the newly combined company. Before, Marathon operated all the Eagle Ford acreage, so that holding was a passive investor type situation which therefore had a discounted value. Therefore. the newly combined company very likely could end up with a higher valuation in the eyes of the market once a track record is established.

In addition to this, the Clearwater play is likely to grow at the expense of the established legacy heavy oil production to add to a lower breakeven for the corporation and enhanced profitability even if production does not grow.

The acquisition has led to the establishment of a dividend and a greater return to shareholders of free cash flow. That should indicate that the company is in a better financial position than it has been since the original acquisition of the non-operated Eagle Ford properties a few years ago.

There is a lot of ways for this stock to increase in value. As such it is a strong buy consideration even if production does not grow. Those considerations do not include that the industry overall is very cheap and should over time return to historical valuation averages as well. This company therefore has some valuation advantages over much of the industry. This stock which is up about 1000% from the low point in 2020 has a lot more running room left.