JHVEPhoto

Finding inflation adjusted returns and income has gotten much harder over the last several years. While prices were consistently rising at rates of 2% or lower for much of the last decade, inflation levels have been at 40-year high for much of the last 2 years, and prices still remain high overall.

One sector that has consistently paid out impressive income and in addition to offering investors solid overall returns is the energy sector. Some of the best performing companies in this part of the market have been integrated producers such as Suncor (NYSE:SU). Suncor is an integrated $39.7 billion dollar oil company based in Canada. The leading producer’s two core segments the upstream oil and production business, and the downstream refining operations. The energy producer has some marginal investments in renewables. The current yield of the company is 4.98%

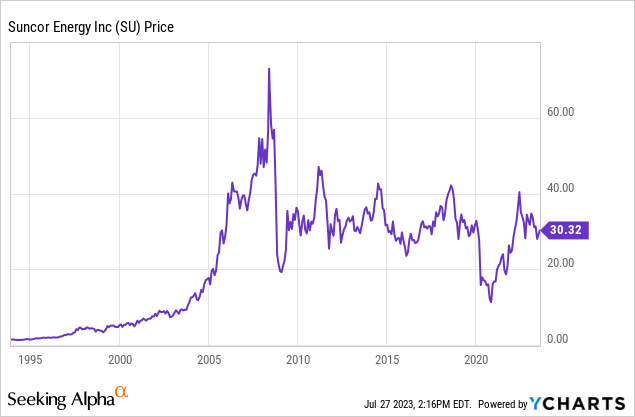

Suncor has been volatile over the last three decades, but the company has performed well since 2020, and management has done a good job of focusing on maximizing shareholder returns since 2022, when the activist firm Elliot Management made a number of demands, almost all of them ones that the current leadership team at this company has agreed to.

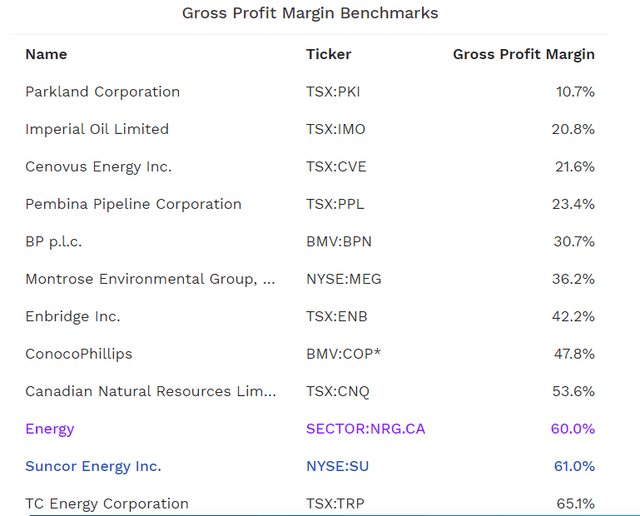

Today I rate Suncor a buy. The fully integrated company has industry leading margins, very strong cash flow, and management is fully committed to maximizing shareholder returns by returning nearly 75% of free cash flow to investors with buybacks and dividends. The company’s operations also remain impressive, and the stock looks undervalued using several metrics as well.

Suncor’s strong recent first quarter earnings report and impressive guidance showed the continued strength of the company’s core upstream and downstream divisions. Management recently reported that the company earned GAAP per share of $1.15, and revenues of $9.16 billion, versus expectations of $.97 a share and revenue of $7.8 billion. The company also stated that management returned $1.6 billion to shareholders in the first quarter alone, with $874 million of that being share buybacks, and $690 million being allocated to dividends.

The company’s production for the full year was 742,000 barrels in upstream production, and 367,700 barrels for refinery output. Management’s guidance was to production in the range of 740,000-770,000 barrels of oil for 2023, and full year capital expenditures to be in the $5.4 billion to $5.8 billion Canadian dollar range, which is comparable to what this level of spending by the company was in 2022.

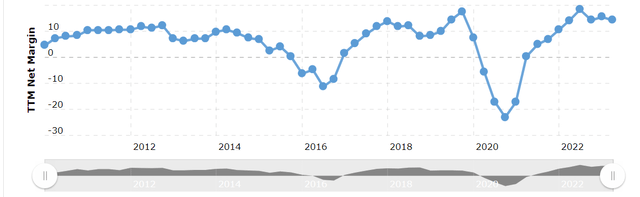

Suncor is committed to returning 50% of free cash flow to shareholders as long as net debt levels remain in the range of $12-$15 billion. The company continues to operate with industry leading margins and cash flow.

A chart of Suncor Energy’s net margins (Macrotrends)

A Chart showing the gross margins of several energy companies (Finbox)

Suncor will allocate 50% of any additional capital towards share buybacks and the remaining 50% towards deleveraging efforts. Management has said they will return 75% of free cash flow to shareholders when net debt levels are lowered to $12.3 billion, and 100% of free cash flow to shareholders when net debt levels are brought down to $9 billion in Canadian dollars. The company expects to be able to reduce net debt levels to $12.3 billion in Canadian dollars this year modeling cash flow based on $90 WTI oil. Most of the free cash flow not returned to shareholders is being used to reduce overall debt levels.

Suncor estimates that based on $90 WTI, it can generate as much as $8 per share in cash flow even after accounting for sustaining capital expenditures while still focusing on maximizing shareholder returns. The company has reduced the share count from 1623 to 1387 over the last 5 years.

Suncor also looks undervalued using several metrics. The company currently trades at 8.39x likely forward GAAP earnings expectations, 4.09x expected forward EBITDA, and 1.28x forecasted book value, and 1.5x projected forward sales. The sector median is 9.71x predicted forward GAAP earnings, 5.63x expected forward EBITDA, 2.13x forecasted forward sales, and 1.57x projected forward book value. Suncor’s 5-year average valuation is also 6.21x predicted forward EBITDA and 1.81x projected forward sales.

Suncor is obviously high leveraged to the price oil, but there are multiple reasons to believe that energy prices will remain high for some time. The average decline rate per year globally of oil fields is also 6%, Russian oil exports remain limited, and the energy industry is also still recovering from an extended period of significant underinvestment from 2016 to 2020 when prices were often at low levels. The recent bombing of key infrastructure in the Crimea, as well as the continued counter offensive by Ukraine, continue to suggest this conflict is unlikely to end anytime soon. Upstream investments in the energy sector have also fallen from $700 billion a year in 2014, to between $370 billion to $400 billion today. The IAEA is forecasting global demand for oil to increase by nearly 2% this year from 2022 levels. Oil demand is supposed to continue to grow by about a half a percent a year from now until 2030. The Energy and Information Administration also recently updated the agency’s forecast for crude oil prices in 2023 to $79 a barrel.

Suncor is fully committed to returning value to shareholders, and the company should be able to reduce debt levels this year to levels where management can begin to allocate 75% of free cash flow to share buybacks and dividends. While this Suncor underperformed the energy sector for some time, management has changed significantly since the intervention by activist investors, and the company’s industry leading margins and impressive cash flow should enable Suncor to continue to outperform moving forward.