Alex Potemkin/iStock via Getty Images

Thesis

With the planet recently setting new highs for mean global temperature, I find myself searching for industries which stand to benefit from climate change. The increasing awareness about climate change is also driving consumers to be more thoughtful about the impact they individually have on the system, so I have been searching for companies that exist in this overlap. So far, I have found one company which benefits from a rise in both mean global temperature, and environmental awareness.

Hudson Technologies, Inc. (NASDAQ:HDSN) is well positioned to thrive as the situation develops. Not only is demand for HVAC and HVACR set to rise with global temperatures, their culture of sustainability and responsible stewardship is likely to be looked at in an ever more favorable light as the situation around us worsens. After looking over their financials and valuation, I presently rate Hudson Technologies as a Buy.

Company Background

Hudson Technologies provides sustainable refrigerant products and services to the HVACR industry. They were incorporated in 1991 and are headquartered in Woodcliff Lake, New Jersey. They are the largest refrigerant reclaimer in the United States and have been in operation for nearly three decades. They are able to recover a wide variety of refrigerants and restore them to AHRI standard for reuse as certified EMERALD Refrigerants™.

HDSN “Our Mission” (Hudsontech.com)

Long-Term Trends

I found two estimates for the global refrigerant market. One is projecting a CAGR of 7.4% through 2030, the other is projecting a CAGR of 7.98%. The global refrigerant recycling market is expected to experience a CAGR of 10.5% until 2028.

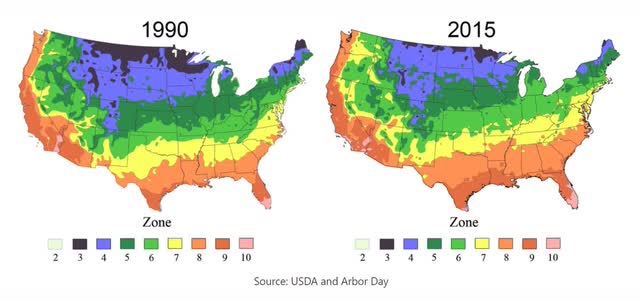

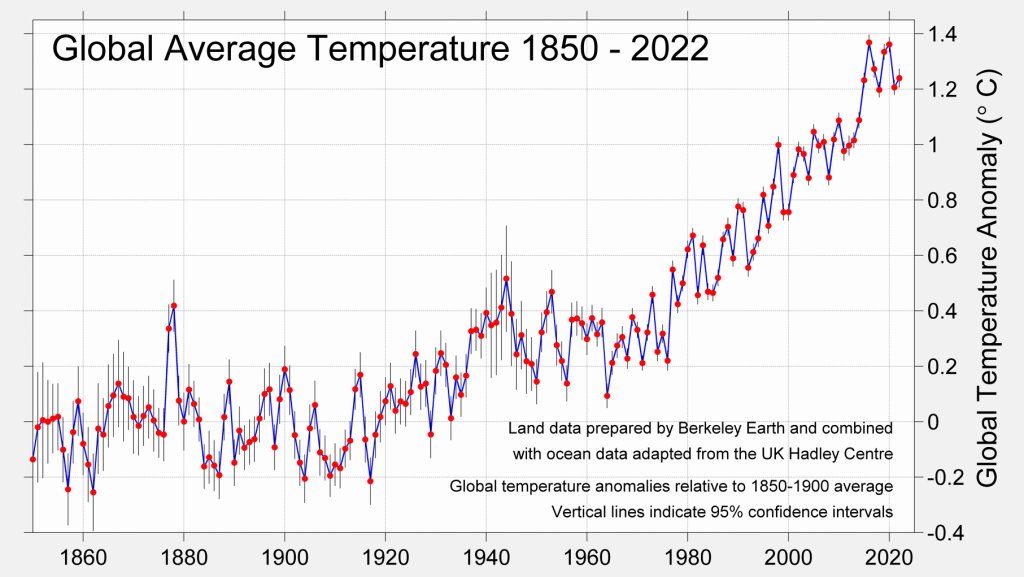

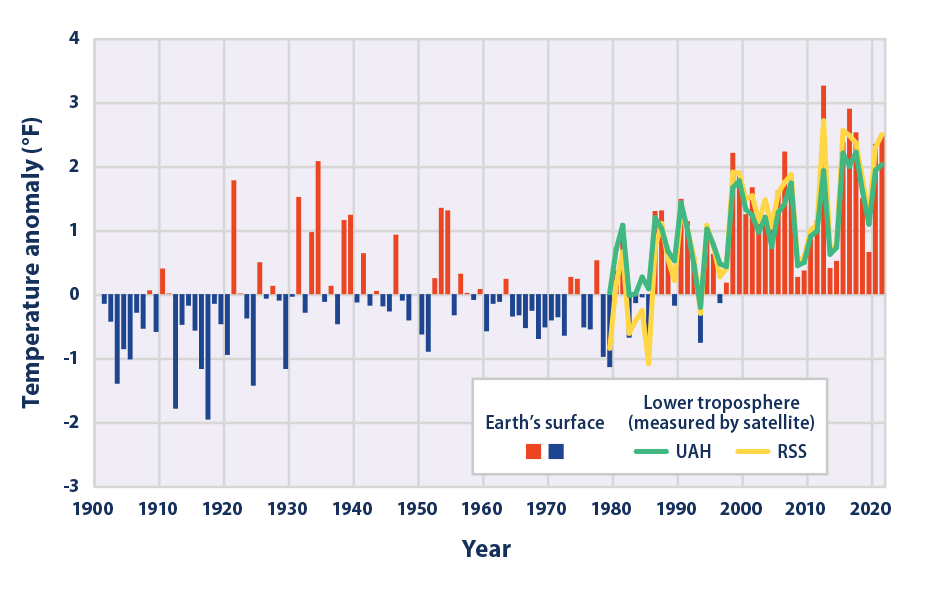

Earth’s mean global temperature has increased by at least 1.1° Celsius (1.9°F) since 1880. This may not sound like much, but large populations live in an ever-warming temperate zone. One of the best ways to show this visually is through planting zone maps. As any gardener or farmer can tell you, the plant hardiness zones have been shifting north as the climate changes. Although plant hardiness maps are based on the average minimum temperature of a location and not the summer highs, their northward shift tells a story. The number of households with air conditioning has already been rising. Not only will those who don’t currently have air conditioning be incentivized to have it installed; consumers who already have it are expected to use it more. I believe this will provide sustained tailwinds for the HVAC industry.

Plant Zone Shift 1990 – 2015 (USDA and The Arbor Day Foundation)

Global Average Temperature 1850 – 2022 (Berkleyearth.org)

Many companies have recognized the public’s growing desire to consume more responsibly and have adopted an ESG (Environmental, Social, and Governance) scoring system. While many consumers and investors do not pay any attention to these scores, awareness for environmental conservation has been growing. I believe that over time, an ever-larger number of investors will begin paying attention to ESG scores. Because their business model revolves around sustainable refrigerant reclamation, Hudson has attractive ESG values.

Environmental: 98, Governance: 80, Sustainability: 95.

Also, because of its environmental responsibility, Hudson directly benefits from the AIM act. It authorized the EPA to force industries to phase out the production and consumption of certain HFCs.

Annual Financials

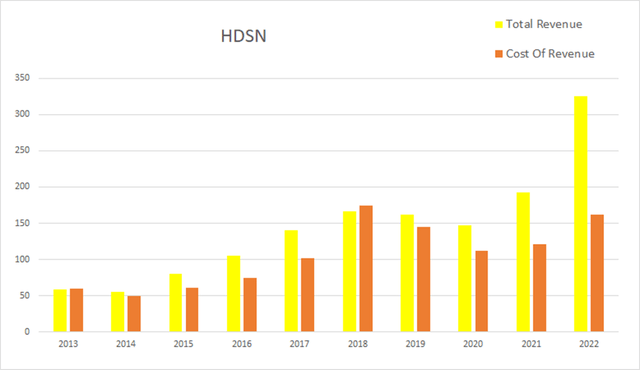

The company has been experiencing significant revenue increases. In 2013 they had an annual revenue of $58.6M, by 2022 that had grown to $325.2M, this represents a total increase of 454.95% at an average annual rate of 50.55%.

HDSN Annual Revenue (By Author)

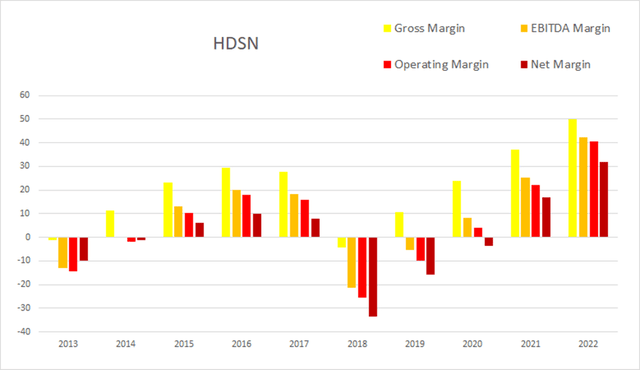

Hudson experienced a sudden and significant margin contraction in 2018. Margins have been recovering since then. I dug into their old earnings call transcripts to try and find out why they had such a rough 2018. In 2017, Chinese refrigerants were dumped onto the market and the price of refrigerants reacted to the supply-demand imbalance by dropping. Also, in early 2019 they spoke of unseasonably cool weather the year prior, leading to a drop in demand.

Much of Hudson’s profits were eaten by the declining value of the refrigerants in their inventory. I will go into this in more detail later, but their margins were attacked by this two-fold effect, and it absolutely can happen again. As of the most recent annual report gross margins were 50.09%, EBITDA margins were 42.28%, operating margins were 40.44%, and net margins were at 31.92%.

HDSN Annual Margins (By Author)

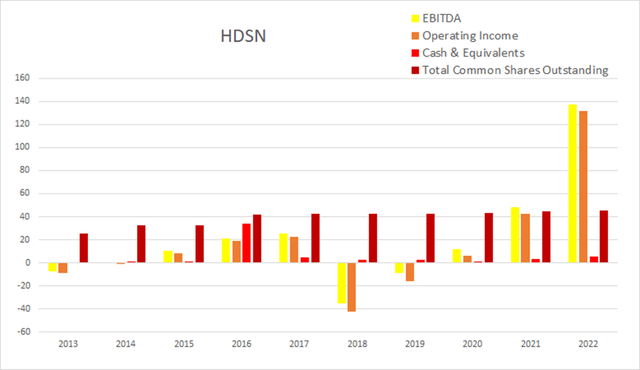

Total common shares outstanding were at 25.1M in 2013; by the end of 2022 that had risen to 45.3M. This represents an 80.48% rise in share count, which comes out to an average annual rate of 8.94%. Over that same period, operating income rose from -$8.5M to $131.5M, and EBITDA rose from -$7.7M to $121.7M. The dilution they were experiencing from 2013 to 2016 appears to have been accretive.

HDSN Annual Share Count vs. Cash vs. Income (By Author)

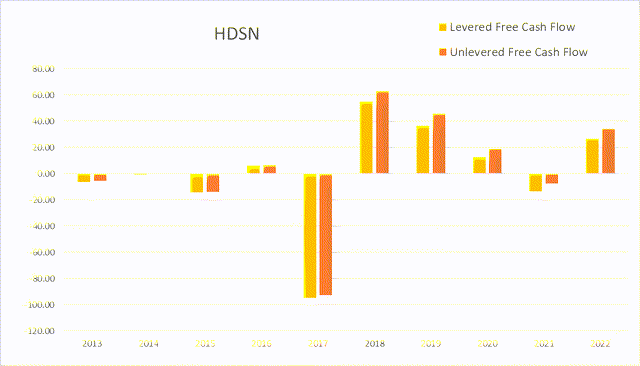

Their free cash flow varies significantly from year to year. As of the most recent annual report, levered free cash flow was $26.4M, while unlevered was $34.2M.

HDSN Annual Cash Flow (By Author)

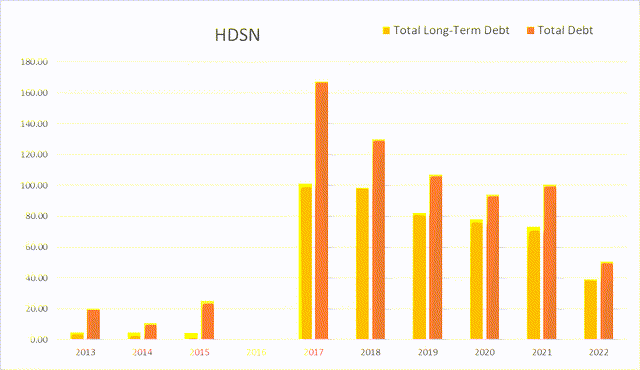

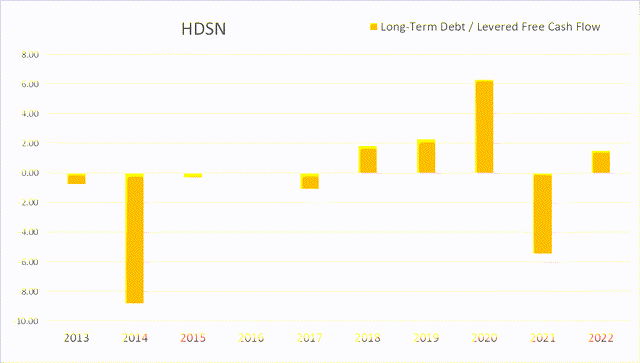

The company took on significant debt in 2017, but their long-term debt has been dropping since then.

HDSN Annual Debt (By Author)

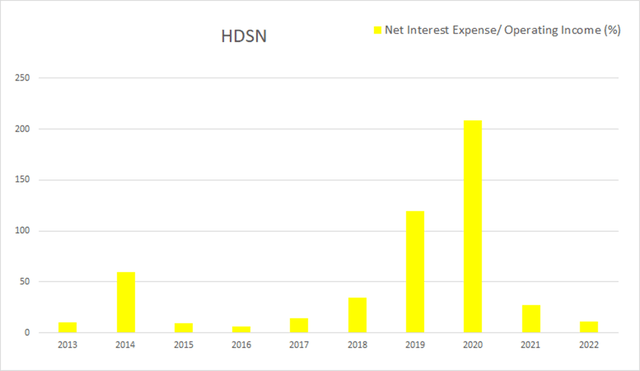

Hudson currently has a very manageable debt load. As of the 2022 annual report, 10.87% of their operating income was consumed by their net interest expense, and long-term debt to annual levered free cash flow was at 1.48x.

HDSN Annual Net Interest Expense vs. Operating Income (By Author)

HDSN Annual Long-Term Debt vs. Levered Free Cash Flow (By Author)

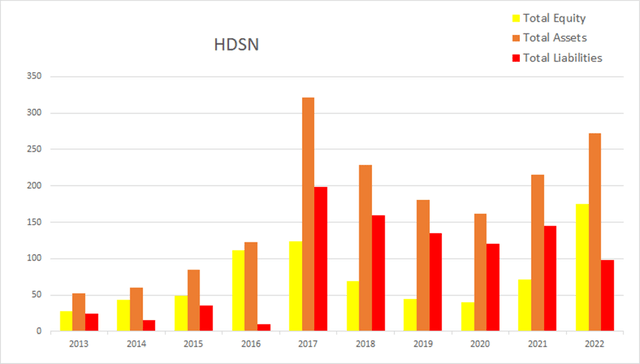

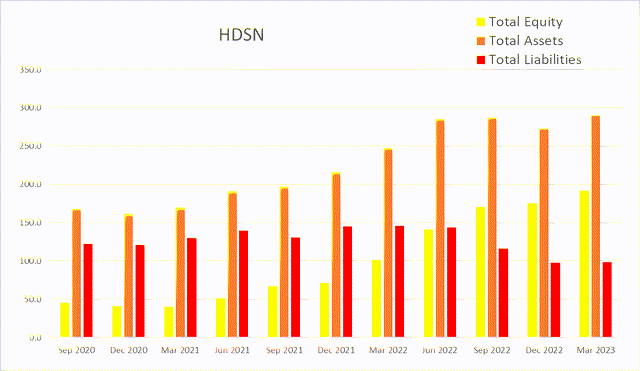

Their total equity experienced a major contraction from 2017 through 2020, but has been climbing steeply since then. As the company continues paying down their long-term debt, liabilities should continue dropping while equity rises.

HDSN Annual Total Equity (By Author)

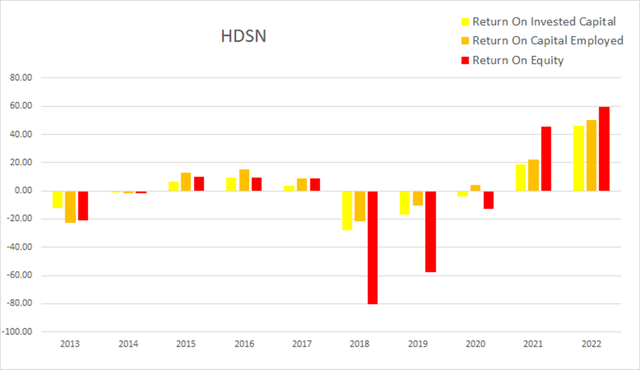

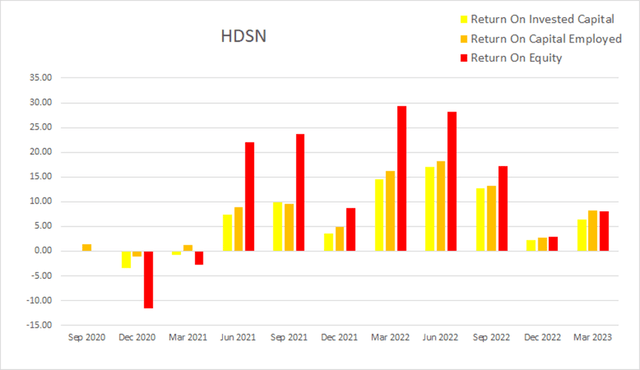

The same factors that affect their margins also affect their returns. Hudson currently enjoys fantastic, yet cyclical returns. As of the most recent annual report ROIC was 46.01%, ROCE was 50.42%, and ROE was at 59.35%.

HDSN Annual Returns (By Author)

Quarterly Financials

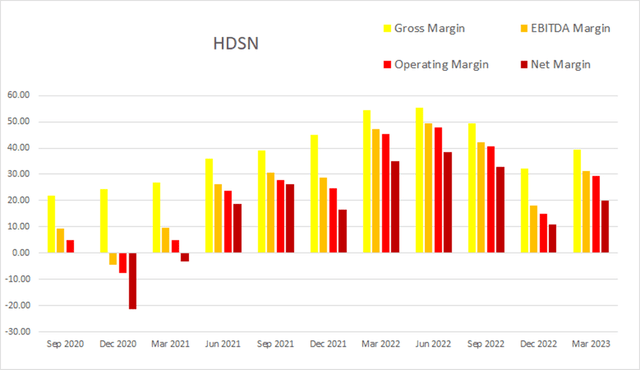

Their most recent earnings call transcript revealed that they consider 2022 an above average year because the prices of some refrigerants were elevated and demand was above average. Their first quarter of 2023 had a gross margin of 39%, which came in ahead of their long-range target of 35%. As their gross margins continue to normalize, they expect the gap between inventory costs and sale prices to narrow.

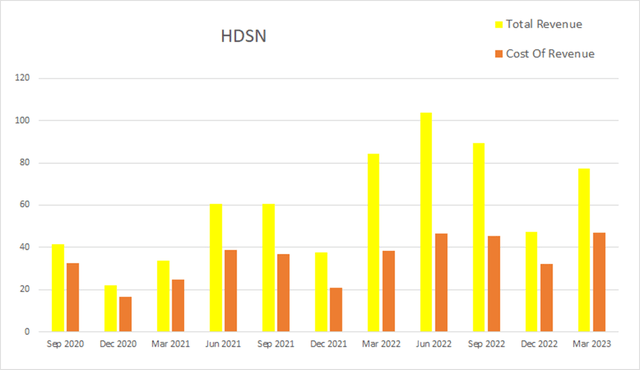

In addition to longer term swings in price and demand, Hudson is heavily affected by seasonality. They typically experience diminished revenue every Q4 as the winter months set in. Eight quarters ago Hudson had a quarterly revenue of $33.8M. Four quarters ago that had grown to $84.3M; by this most recent quarter that had declined to $77.2M. This represents a total two-year increase of 27.60% at an average quarterly rate of 3.45%.

HDSN Quarterly Revenue (By Author)

Both the long-term trend related to fluctuations in weather and refrigerant prices, and the short-term dips from seasonality show up fairly clearly in their quarterly margins. As of the most recent quarter gross margins were 39.25%, EBITDA margins were 31.22%, operating margins were 29.40%, and net margins were at 20.08%.

HDSN Quarterly Margins (By Author)

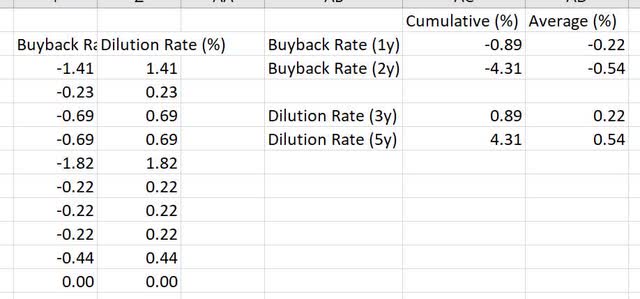

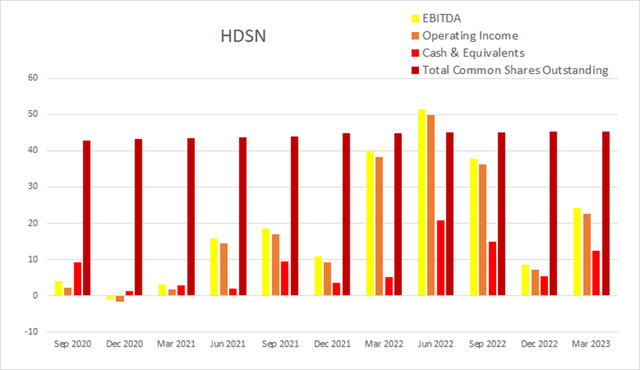

Hudson has been diluting at a rate that is far from alarming. The last year of dilution has maintained an average rate of 0.33% per quarter, which is down considerably as the two year average is 0.54%.

HDSN Buyback/Dilution Rate (By Author)

As of the most recent quarter, cash and equivalents was $12M, while quarterly operating income was $23M.

HDSN Quarterly Share Count vs. Cash vs. Income (By Author)

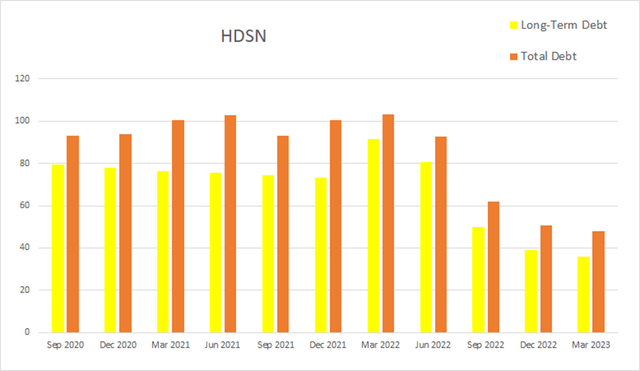

Quite wisely, the company used their better than average financial conditions in 2022 to pay down debt. As of the most recent quarterly report, total debt was at $48M, and long-term debt was at $35.9M.

HDSN Quarterly Debt (By Author)

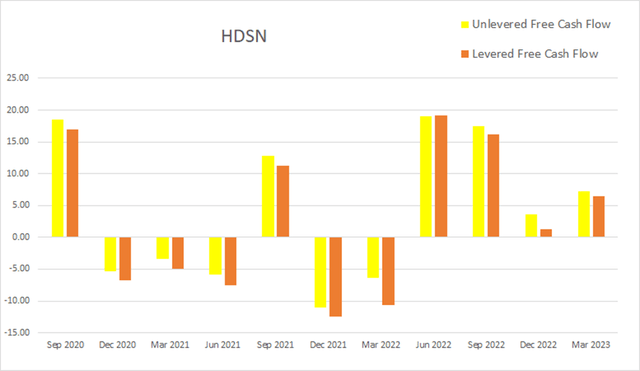

This most recent quarter, Hudson had -$1.8M in net interest expense, $23M in operating income, $15.5M in net income, unlevered free cash flow was at $7.30M, while levered free cash flow was at $6.4M.

HDSN Quarterly Cash Flow (By Author)

Total equity has been climbing fairly steadily after it began inflecting upward in the first half of 2021.

HDSN Quarterly Total Equity (By Author)

Their quarterly returns are also showing strong seasonality. Hudson is capable of extremely attractive returns when conditions are correct. In 2022, their quarterly return on invested capital values peaked at 17%. As of the most recent earnings report, quarterly ROIC was 6.47%, ROCE was 8.17%, and ROE was at 8.09%.

HDSN Quarterly Returns (By Author)

Valuation

As of July 26th, 2023, Hudson had a market capitalization of $405.24M and traded for $8.91 per share. They do not pay a dividend, so using their forward P/E of 7.15x, and their EPS Long-Term CAGR of 27.50%, I calculated a PEGY of 0.26x and an Inverted PEGY of 3.85x. With them both being far from 1, these PEGY values imply the company is presently dramatically undervalued.

Their forward EV/EBITDA of 4.85x, and trailing Price/Cash flow of 5.92x. both show the company as overvalued, but not as dramatically as their PEGY. I believe this discrepancy may be due to the extremely cyclical nature of the company. The PEGY is showing the company as currently trading at roughly 1/4 of its fair value, while the EV/EBITDA and Price/Cash Flow are both showing something closer to 1/2. Since I am not sure which of the metrics to trust more, I believe the best stance is to use the most conservative estimate and treat the company as trading at roughly half of its fair value.

HDSN Valuation (By Author)

Cyclicality

Many investors shy away from companies in extremely cyclical industries, but I do not. With cyclical investments, it is critical to understand the conditions which lead to the company over or under performing. Hudson purchases old refrigerant from customers and carries it in their inventory, this leaves them heavily exposed to price swings of refrigerants.

When prices are falling, their financial statements show falling and often negative returns. Fortunately, demand for refrigerants is heavily affected by weather and investors can watch for unseasonably cool summers. The goal would be to sell before the margin contraction shows up in their financial statements. While this isn’t exactly foolproof, it does provide a framework to form a plan around.

In addition to Hudson being negatively affected any time refrigerant prices are falling, they also receive positive benefits anytime prices are rising. This means that unusually warm summers have the potential to produce outsized profits for Hudson. Again, investors can watch weather forecasts and refrigerant prices to help them look for buying opportunities.

Temperatures in the Contiguous 48 States, 1901-2021 (EPA.gov)

Risks

It is always possible that Hudson places itself into an unfavorable debt situation right before a period of falling refrigerant prices and is unable to climb back to financial stability before reaching failure.

Outside of changes in supply and demand based on weather, Hudson also faces risk from the potential of a repeat of the events of 2017 and 2018. Any time an oversupply of refrigerants enters the market, Hudson is going to take a financial hit as the value of the refrigerants in their inventory drop.

Hudson faces competition from American Refrigerants, Inc., C&L Refrigeration, CoolSys, Inc., and others. Although they are currently an industry leader, this can always change.

Catalysts

Hudson has a solid reputation and secured a long-term contract with the Department of Defense in 2016. The DoD appears to be pleased with the service they are providing; in 2021 they extended the contract out to 2026. Once a customer is happy with a recurring service, they are less likely to risk switching to another provider. The more pleased the DoD is with their quality of service, the more likely they will continue their relationship with Hudson after 2026.

As stated previously in the long-term trends section, Hudson faces sustained tailwinds from the AIM act, global climate change, and ongoing shifts in public perception about responsible environmental management. The combined net effect of all three of these should provide fairly strong tailwinds.

Our global equilibrium temperature is changing and this tailwind will last longer than most. When dealing with positive feedback loops such as this one, changes in temperature always lag their underlying causes. This means the current mean temperature is lagging equilibrium temperature. Even if we halt greenhouse gas output, mean temperature is projected to continue rising until it reaches the new equilibrium point. Current median projections are estimating a 1.5-2.0°C (2.7-3.6°F) increase by 2050.

Conclusions

I am perpetually on the hunt for undervalued companies with the potential to become long-term compounders. Hudson has already proven it is capable of producing extremely attractive returns when conditions are correct, and appears to be well situated to benefit from multiple long-term trends. However, because of the cyclical nature of its business model, this investment is not for everyone.

I believe HDSN is an attractive investment for anyone who regularly pays attention to the price of refrigerants. If you already work in the refrigerants industry or are willing to go out of your way to stay up to date on their prices, then the cyclical risk the company is exposed to can be mitigated. While I doubt having a slightly cooler than average summer would be a good enough reason to sell, a repeat of the supply glut that occurred in 2017 would. In fact, being in tune enough with the refrigerant market that one could correctly time entries and exits has the potential to lead to considerable alpha.

HDSN can also find a home in a deep conviction portfolio. In this type of portfolio, the investor selects companies from several highly cyclical industries based on their ability to survive severe stress events. Along with any others that appear extremely robust, you want to choose the most likely “last man standing” from each industry. Buy a single share of each company to act as placeholders, place most of your capital into high-yield monthly dividends, and then every month buy the one with the most attractive valuation metrics. Ideally, you will always have something extremely cheap available to buy. You may end up buying the same company multiple months in a row before moving on to the next one. After their industry eventually recovers, sell the position back down to one share and buy more dividends. Assuming you also choose wisely with where the yield comes from, the security that comes with knowing you always have next month’s payment coming should help your conviction when buying the dip on these distressed companies.