bjdlzx

A Hold Rating for Shares of Diversified Energy Company PLC

This article changes the recommendation for shares of Diversified Energy Company PLC (OTCQX:DECPF) to a Hold rating from a previous Buy rating: I think investors should be patient and strategically stick with a Hold rating for now as there is a chance of a more comfortable entry point into this stock with a very high dividend yield.

The new rating for this Birmingham, Alabama-based oil and gas exploration and production operator takes due account of the looming recession and associated headwinds for the stock price.

With the recession signaling a slowdown in growth or even a decline in economic activity, the crude oil and natural gas market will be bearish rather than bullish, as less energy is logically needed to drive consumption, production, and investment activities.

As such, opportunities to add positions in Diversified Energy may arise during the cycle as shares of this company that correlate positively with movements in fossil fuel prices become more attractive than they are now and are likely to do so, as this analysis believes.

The strategy aims for greater participation in corporate dividends, beyond a modest daily average stock trading volume, to take greater advantage of very high dividend yields but a moderate risk of dividend cuts or suspensions.

Their risk is greatly reduced by implementing ad hoc strategies that hedge much of the low-cost fossil fuel production at a price that is likely to be well above the market price during the expected recession.

Diversified Energy Company PLC is strengthening its asset base of high-margin operations by integrating its portfolio of Appalachian gas and oil-rich assets with high-margin upstream assets in the central United States.

For its hedging strategy, Diversified Energy can count on significantly higher fossil fuel production after acquiring assets in the central US region between 2022 and early 2023, such as upstream operations in Oklahoma and Texas, in East Texas and Northwest Louisiana, and most recently again in Texas.

These purchases were partly financed with cash or lines of credit from banks.

A Look at Diversified Energy’s Business Performance

In fact, Diversified Energy ended the first quarter of 2023 reported in May with record production of 139 Mboepd [million barrels of oil equivalent per day], equating to 833 MMcfepd [millions of cubic feet per day], and also appears to be on track for the exit rate (or estimated production rate at the end of 2023) of 145 Mboepd or 872 MMcfepd.

Q1 2023 production represents a 2% increase from 136,022 Mboepd in H1 2022 and an impressive 31.5% increase from 105,707 Mboepd in H1 2021.

The upstream operations in the central US are slightly more costly than Appalachian, which instead benefits greatly from the advantages of a vertically integrated intermediate network. However also thanks to the Smarter Asset Management [SAM] program, the company managed to reduce its total unit cash expenses by 6% sequentially to $10.46 per Boe (or $1.74/Mcfe) in the first quarter of 2023.

Among other evaluation criteria, the SAM program found the integration of assets in East Texas and Northwest Louisiana to be reasonable, with the purchase price relative to net cash flow or Adjusted EBITDA [hedged] at 1.4x, while for the Oklahoma assets and Texas, the purchase price to net cash flow or Adjusted EBITDA [unhedged] ratio was about 2.5x.

The portfolio of hedging strategies has enabled Diversified Energy Company PLC to mitigate the sharp pullback in fossil fuel prices from the 2022 peaks that occurred following the energy crisis that erupted following the strong recovery from Covid-19 and due to the Russian invasion of Ukraine.

So that the company managed to generate an adjusted EBITDA of around $150 million in the first quarter of 2023, which accounted for around 54% of the total revenues of ≈ USD 278 million, after implementing hedging strategies. So, let’s say the total annualized revenue is estimated at ≈ $1.1 billion.

As part of the company’s hedging strategy for 2023 and beyond, 85% of all production of natural gas for 2023 (natural gas represents approximately 90% of Diversified Energy’s total production, including 15% of liquids) has been secured at a price of $3.79. While the remaining 15% of 2023 production is exposed to commodity price market volatility.

To date, Diversified Energy has secured 80% of its 2024 production at a hedge price of $3.30 and 70% of 2025 production at a hedge price of $3.23, but the portion of production to be hedged for 2025 may still increase.

Dividend Sustainability Assessment

This analysis now aims to evaluate the sustainability of the dividend and then determine the risk of a reduction or suspension of the dividend.

First, let’s assume that the 833,000 mcf per day of natural gas produced in the first quarter of 2023 was hedged as follows: 85% at an average hedge price of $3.79 per unit, while 15% of production was exposed to volatility in the natural gas market, where the average price of the commodity was probably around $2.65 per unit.

The latter price factor has been determined based on the average of Q1 2023 Natural Gas Futures prices converted from MMBtu [Metric Million British Thermal Unit] to Mcf with a richness factor of 1MCF=1.07MMBtu.

The estimated market price for 15% of total production was approximately 30% below the average hedge price.

So based on the production rate for Q1 2023 if Diversified Energy sold about that volume of production, say ≈ 833 Mmcfe per day, then the sales revenue was about $272 million, which multiplied by a cash margin of 54% gave an EBITDA of ≈146 million (the company last reported adjusted EBITDA of ≈$150 million).

These estimates are based on production in equivalent cubic feet of natural gas while natural gas liquids and crude oil have been hedged against price fluctuations by different inputs. However, it is quite realistic as an estimate since natural gas liquids and crude oil together make up only 10-15% of the company’s total production.

For the future, we assume that the price of natural gas will decline, as indicated by the price performance of the Diversified Energy portfolio of hedging strategies. These prices decline from $3.79 per unit for 2023 to $3.30 per unit for 2024 and $3.23 per unit for 2025.

We then assume that the hedge price will average ≈$3.45 per unit of commodity on 85% of natural gas equivalent production, while the other 15% of production will be exposed to a market price that could be ≈$2.24 per unit of commodity. The latest price is consistent with the company’s ability thus far to maintain a favorable natural gas hedging position (where the average floor price was 35% above the strip for 2023) which will be an advantage amid the expected recession.

At a weighted average price of ≈$3.3 per unit (=$3.45 x 85% and $2.24 x 15%), we estimate sales for Diversified Energy should be approximately $1.05 billion on an annualized basis.

If the company manages to keep costs down during the operation of low decline rate assets and continues to increase the share of LNG in the portfolio, which has become more profitable due to robust demand from Europe, it will be able to keep the liquidity margin of 54%.

With much of the production already secured through 2025 and benefiting, among other things, from the incredible increase in commodity prices in 2022, there’s another reason to be optimistic about the company’s ability to meet its cash margin target.

As such, we believe the company should be able to generate $600 million in EBITDA annually (=54% of annualized revenue of ≈$1.1 billion). This estimate also takes into account higher production in the next few years of at least 875,000 mcfepd, higher than the 872,000 mcf per day it is expected to reach by the end of 2023.

This annual adjusted EBITDA measure would put Diversified Energy on track to achieve its financial leverage target of net debt to adjusted EBITDA of 2.5x or lower.

The ≈$600 million trailing 12-month EBITDA is about 2.5 times the ≈$1.5 billion net debt shown on Diversified Energy’s balance sheet at the end of 2022.

As long as that financial leverage is not violated, the company will generate cash to pay the dividend, as it has done for the past 12 months, including a dividend increase rate of 4.55%.

Quarterly dividends increased from $0.04 per share on December 17, 2021, to $0.043 on March 28, 2022, and $0.044 on March 28, 2023.

The quarterly dividend of $0.044 was also paid on June 30, 2023, and the Board has already approved the next payment for September 29, 2023.

That dividend results in a forward dividend yield of 14.2% at current stock prices, which is 9.5 times higher than the S&P 500’s dividend yield of 1.50%.

The assessment of the financial leverage of the company, which investors use to determine a company’s ability to pay dividends, may have been positively impacted by the higher energy price set in the markets in 2022.

There is arguably a financial solvency ratio for Diversified Energy, which investors typically use to determine a company’s ability to pay dividends, benefiting from a higher energy price determined by the markets in 2022 and another that could be affected by the impending recession.

But it is also true that much of the production including 2025 has already been secured so the formation of a bearish mood in the energy market due to the recession should not have an impact on the ability to continue to pay dividends.

However, if Diversified Energy Company PLC is unable to achieve further improvement in total cash expenses per unit (in Q1 2023 they were $1.74/Mcfe) while integrating its core US asset portfolio with central region activities under its SAM program, Adjusted EBITDA may not move beyond $500 million. This could translate into a deterioration of the net debt to adjusted EBITDA ratio to 3x and the board could decide to change the dividend. But the sharp 6.5% drop in total cash expenses to $1.74 per mcfe in just one quarter signals to me that a very positive trend has taken hold, significantly mitigating the risk of this scenario materializing.

The Stock Valuation

The onset of recession due to the US Federal Reserve’s tightening policy to combat high inflation should not impact dividends but could potentially drop the share price well below current levels.

Shares are currently trading at $1.23 apiece after falling 15.17% over the past year, giving a market cap of $1.18 billion and a 52-week range of 1.02 to $1.74 equivalent.

Source: Seeking Alpha

According to the US30 index, the US stock market is expected to decline 3.7% to $34,287.11 by the end of the third quarter of 2023 and 7.8% to $31,613.33 by this time in 2024.

Since the stock has a 24M Beta of 0.48 (scroll this webpage down until the “Risk” section), likely less than proportional to US publicly traded stocks in general, but it should still follow the downtrend.

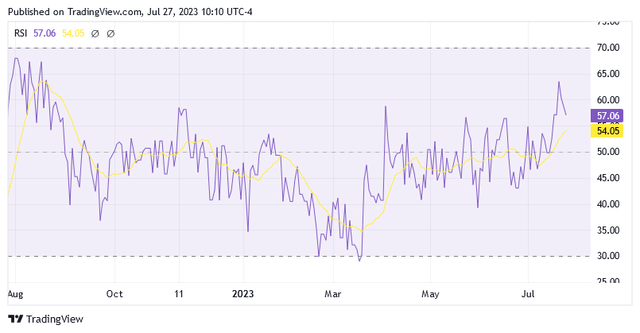

The 14-day relative strength indicator at 57.06 suggests that the shares still have plenty of room for downside.

Source: Seeking Alpha

Additionally, bearish sentiment can make the strategy to increase the position even easier by overcoming some obstacles caused by trading volume.

Diversified Energy Company PLC stock consists of 971.11 million shares outstanding and 74.86% of 810.8 million shares outstanding [the float] are held by institutions.

And then the daily trading volumes are very modest as signaled by a 3-month average volume of just 33.42K and a 10-day average volume of just 61.67K.

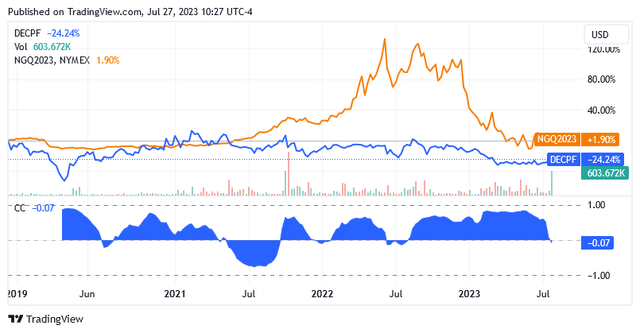

A very strong positive correlation with its main commodity – the price of Natural Gas futures – as the indicator [CC] curve is almost always in the blue area above zero, assigns a high likelihood of a lower share price during the recession with the recession boding ill for the energy consumption.

Source: Seeking Alpha

Conclusion

Diversified Energy Company PLC is strengthening its asset base of high-margin operations by integrating its portfolio of gas and oil-rich assets in Appalachia with high-margin upstream assets in the central region of the United States. Through ad hoc hedging strategies, the company has already secured the majority of production through 2025 and will still benefit from record-high energy prices in 2022. From a cost perspective, the Diversified Energy SAM program appears to be doing very well to keep costs under control. The company seems to have everything it needs to provide good financial leverage which is a preparatory exam for paying dividends.

Shares could get cheaper and trade below $1 in the future as the Federal Reserve is likely to push the economy into a recession and investors may then want to consider buying more shares.

For the time being, I think investors should just Hold shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.