naphtalina/iStock via Getty Images

Thesis

The recent run-up in crude prices has allowed Devon Energy’s (NYSE:DVN) stock price to rally in the last month. However, I believe investors will be disappointed by the Q2 results that are expected to be released on August 1st.

This has been a repeatable pattern for the last year and I do not expect the discounted price to last long. Investors should be prepared with any unallocated cash on the sidelines to potentially scoop up shares of DVN at a discounted price.

Method To The Madness

With crude rallying, and notching consistent gains since the basement lows in June and early July, you might think I’m crazy. After all, crude is finally challenging $80/barrel and natural gas appears to be dragging itself out of the $2/MCF abyss. So why should we expect to get a discount when the future prospects are starting to look rosy?

The simple, yet nontechnical reason is that I believe the average investor makes their decisions based partially on emotion and poor information. Q2 results most certainly will be a down quarter compared to Q1. Crude prices averaged roughly $73/barrel in Q2 vs $76 in Q1. Natural gas prices also are compounding the issue. They have spent almost the entire quarter near $2/MCF compared to an average price of $2.65/MCF during Q1. Therefore, it is pretty easy to conclude that profits in Q2 will be lower quarter to quarter.

I know what you are thinking. “There’s no way people are missing this. This information is public knowledge and is pretty simple to compare quarter to quarter data.”

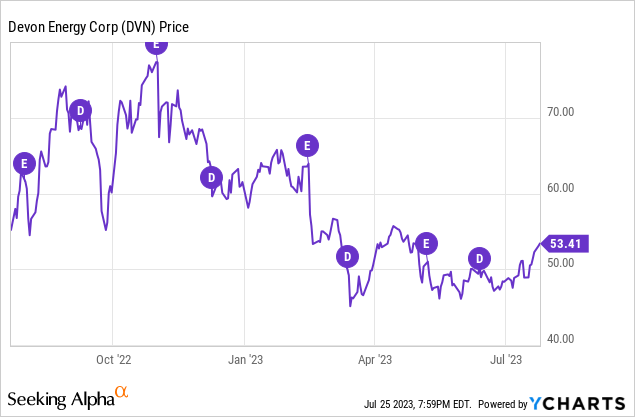

The only response I can muster is that you are right. Yet, the market has consistently behaved this way, to the point I think it is safe to claim this is a tradable pattern. The last four earnings dates have been greeted with losses immediately following, 3 of the 4 have been significant, exceeding 10%. This is very evident in the chart shown below.

This type of price movement is usually associated with the dividend date, however the two large drops surrounding the dividend payment are associated with large collapses in crude price at that time. Therefore, we can conclude that an opportunity will arise given the recent run in DVN’s price, expected disappointing results for Q2, and historical evidence.

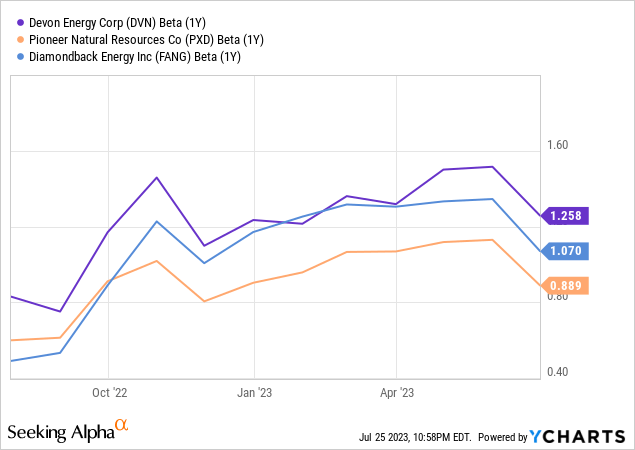

Further evidenced of the non-rational behavior of DVN’s stock price is the company’s beta. DVN has consistently demonstrated higher levels of volatility compared to its peers PXD and FANG. The difference in beta between DVN and PXD is quite significant considering they sell the same product. I personally cannot explain what causes this additional volatility but it is something that can allow investors to capitalize on potentially irrational market behavior.

Q2 Expectations

Now that we have already laid the foundation for a lower quarter, we need to have our own expectations set appropriately. First, the first quarter dividend was padded by $0.11. This bonus distribution was associated with annual divestiture contingency payments. Working backwards, that takes our $0.72/share dividend down to $0.61/share.

Second, Q2 will have a flat production profile. The company has guided for a slight production boost by year-end as projects complete, and a compressor station has been repaired following a fire. The company expects to reach an end of year production level of 663 MBOE/d versus 641 MBOE/d in Q1. This unfortunately, is expected to manifest in Q3 and won’t be able to take root in time for this quarter’s earnings.

After accounting for these variables and reduced selling prices, I believe the Q2 variable dividend will come out in the $0.45 to $0.55 range barring changes to capital spending. On an annual basis, this equates to a yield in the ballpark of 4% at current prices. This may be a gut punch to some investors and may further amplify the post earnings depression in my view.

Is Devon Still A Buy?

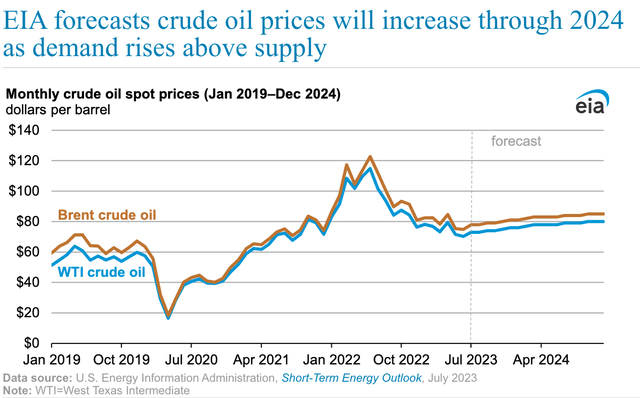

In my previous take on DVN, I speculated that a consistent 5% yield could be achieved in a $70 crude environment if purchased at $48/share. I’ll admit my long term average price range of $70-$75/barrel is a somewhat bearish view on the oil market, but I also believe in being defensive in my oil investments. The good news is that there is momentum building for near term prices to exceed my target crude price range.

With the SPR still not being filled, and Saudi Arabia continuing production cuts, some analysts are calling for an average price of over $80/barrel in Q3. This view is backed by the EIA, which forecasts a slow trend upward for the next 12-18 months to above $80/barrel. Sustained prices at this level could help drive the dividend back to Q4 2022 levels ($0.89/share) where the average WTI price was $82.53/barrel.

EIA

This level of cash flow cannot be achieved by crude prices alone. Natural gas needs to start recovering and carrying its own weight. I believe natural gas will recover but it may take some time to develop. It is important not to forget that natural gas accounts for roughly 25% of the company’s total volumes, and therefore the price impact is not trivial.

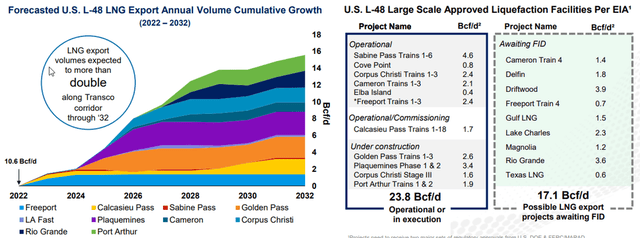

Starting in 2024, the US will see a massive ramp up in liquified natural gas exports. This is due to four LNG export terminals that are currently under construction. Adding more fuel to the fire, the Rio Grande export terminal reached FID earlier this year. Combined, these projects could add more than 13 BCF/d of export capacity, which will drive up the price of natural gas.

Internally, DVN is also making efforts to get in on the action. DVN has partnered with Delfin Midstream to support natural gas exports using a floating LNG export terminal. This project, if completed, will allow DVN to sell its natural gas into foreign markets where the margins are considerably higher.

LNG Export Projects (Williams Companies)

With all of these factors considered, I view DVN as fairly priced at current levels. I believe investors should be looking to add to their position on weakness. I prefer to add when prices are under $50/share to maximize yield and minimize downside risk for a long term holding position.

Risks

Risks to overall performance are elevated when crude prices rise. It is worth a cautionary tale of chasing yield in this particular business. Share price and yields could potentially skyrocket as energy prices rise. In 2022, yields were seen to surpass 10% at the peak of the crude price curve. Investors who purchased at this time are probably regretting their investment choice now, only 12 months later.

Both share price and dividends have fallen during this period of time. This is natural for this business model and should be anticipated. That’s why I try to be as defensive as possible in this space, realizing that the bad times are as common as the good times in a cyclical business. Buying on dips from here not only allows buying quality companies at a lower price but also improves the odds of a successful investment from a statistical standpoint.

Summary

I believe a brief buying opportunity will present itself post Q2 earnings. This has occurred for the last four quarters. The current price momentum and Q2 results will be in opposition to each other and thus could lead to a large, but temporary, sell off.

My personal target is to acquire additional shares around $48-$50/share under the assumption of a long term average of $70-$75/barrel WTI prices. Current market fundamentals may push long term prices above this target if current projections materialize. Capitalizing on any brief price weakness will provide higher yields and lower risk for capital losses.

Additional margin can be achieved by the continued recovery in natural gas prices. I believe this will be achieved on a longer term horizon once several LNG export terminals come online. These projects will more than double the current US LNG export volumes allowing prices to recover. This, and being able to capitalize on foreign natural gas market pricing could provide DVN a small, but meaningful, uplift in the long term.

I therefore, remain bullish on DVN as a I believe in its long term prospects and look to add to my position on price weakness.