DKosig

American Electric Power (NASDAQ:AEP) is a pure-play regulated utilities company with service territories in the South (Texas, Oklahoma, Eastern Louisiana, and Eastern Arkansas) and Midwest (Ohio, Indiana, Michigan, West Virginia, Virginia, and Eastern Kentucky).

The utility holding company is a giant in the industry, boasting the nation’s largest transmission network (40K miles) and one of the largest distribution networks (225K miles) in the US. It also owns a diversified power generation fleet with about 25 gigawatts of capacity.

AEP enjoys a few key advantages that make it an attractive investment opportunity, especially for dividend growth investors.

First, it operates in mostly favorable regulatory environments and areas of above-average growth. Even if its allowed ROEs aren’t the highest in the industry, its regulatory environments tend to be quite stable over time, promoting predictability. And many of its service territories enjoy strong population and economic growth.

Second, AEP’s vast transmission network and investment opportunities to expand that network are a valuable asset, especially as more wind and solar power facilities come online. The power they generate outside of population centers will need to be transmitted to those population centers.

Third, though the utility has ambitious capital investment plans ahead, its investment grade credit ratings of BBB+ (S&P), BBB (Fitch), and Baa2 (Moody’s) should ensure relatively low-cost debt financing over time.

Finally, management aims for 6-7% EPS and dividend growth over time, which, combined with AEP’s current dividend yield of 3.9%, renders an interesting dividend growth investment opportunity with potential total returns of about 10%.

AEP recently reported somewhat disappointing Q2 2023 earnings, but this relative weakness came largely from milder than expected weather in certain areas. Weather is obviously variable and can be beneficial or detrimental. It doesn’t change the long-term investment thesis as outlined in the points above.

Midyear Update On A Utility Stalwart

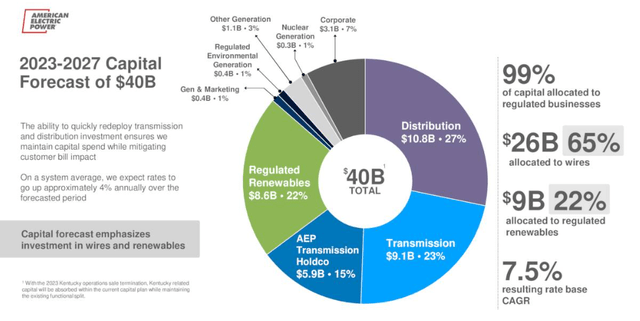

Bolstering management’s 6-7% annual EPS growth target is AEP’s $40 billion 5-year capital deployment plan. About 2/3rds of that is expected to go toward transmission and distribution wires, which will significantly strengthen the resiliency and efficiency of the power grid.

AEP Q2 Earnings Presentation

Notice that 22% of the expected capital deployment is in renewable power generation assets, namely wind and solar. These facilities tend to be located outside of population centers, which increases the need for transmission and distribution wires.

As such, investments in renewables and wires tend to be mutually beneficial.

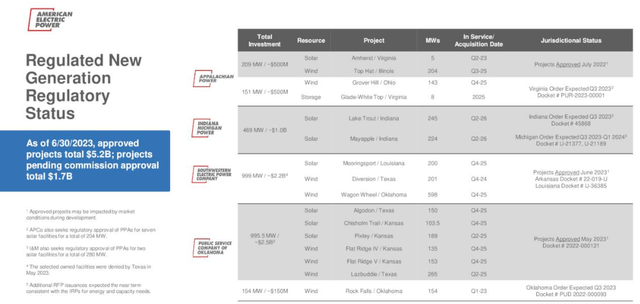

Somewhat worrisome about this plan is the fact that Texas grid regulators have demonstrated a resistance to adding further renewable power to the grid. This may be political, or it could be related to grid reliability concerns. In any case, AEP has also gotten renewables projects approved in other states in its territories, such as Kansas, Ohio, Virginia, Illinois, and Oklahoma.

AEP Q2 Earnings Presentation

Moreover, of the $8.6 billion in expected investment in renewables over the next five years, AEP has already secured approvals for over $5 billion of that.

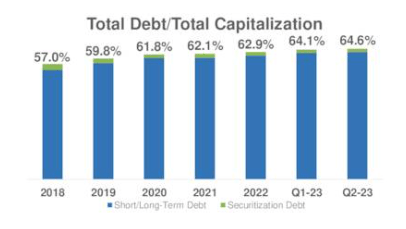

Also somewhat worrisome is the fact that AEP is about to enter the most capital intensive period of this investment cycle. The years 2024 and 2025 are projected to see the heaviest capital investment, requiring AEP to secure ~$12.4 billion in new debt during those two years alone.

This at a time when AEP’s debt to capitalization has been creeping up and is already a little above its 60% long-term target.

AEP Q2 Earnings Presentation

The good news here is that the sale of the unregulated renewables assets (set to close in August) should bring this metric down closer to management’s target of 60%.

My expectation (and my hope) is that cooling inflation and economic growth causes the Federal Reserve to enter into a rate cutting cycle, thereby pressuring all interest rates lower. This should hopefully make for a more attractive debt financing/refinancing environment for the likes of AEP.

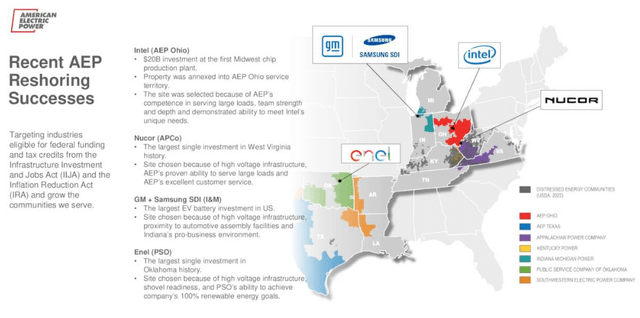

More on the good news front, the company and the governments in its service territories have done a good job of luring industrial businesses, including from reshoring manufacturing.

AEP Q2 Earnings Presentation

The $20 billion investment into two chipmaking plants in Ohio by Intel (INTC) is an example of the future growth in electricity demand AEP expects to see.

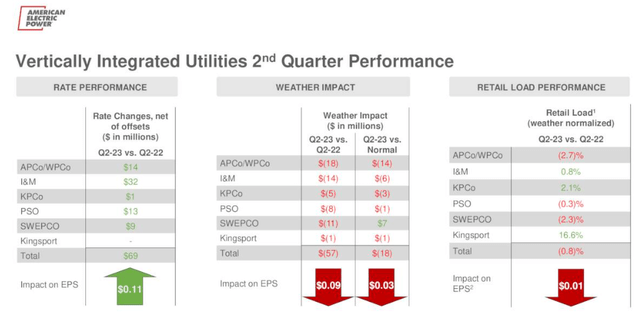

Why was the Q2 2023 earnings report disappointing to the market? And why did non-GAAP EPS fall YoY?

The answer is that in Q2, the weather was milder across many of AEP’s service territories than the year prior (during which it was hotter than normal).

AEP Q2 Earnings Presentation

April and May saw milder weather than usual.

On the Q2 2023 earnings conference call, CFO Ann Kelly said:

I will note, from a year-to-date perspective, 2023 weather has been the most mild on record for the AEP system in the past 30 years, resulting in 29 cents EPS impact year-over-year and about 20 cents versus normal weather.

The good news (for AEP, not for the rest of us) is that temperatures have been breaking records in June and July, implying AEP could see a beneficial impact from weather conditions in Q3. The “heat dome” that has punished the Southern region around Texas in June and July now appears to be moving toward AEP’s Midwest service territories to break some temperature records there as well.

As Indianans and Ohioans fire up their A/C amid rising heat, it wouldn’t surprise me to see AEP turn in stronger-than-expected Q3 results following Q2’s weaker-than-expected results.

Bottom Line

At a current price of $85, AEP trades at a P/E ratio of 16.1x, compared to its 5-year average of 18.5x. Just to get back to its average valuation implies 15% upside on top of the estimated 10% total returns outlined in the introductory section.

AEP’s extensive portfolio of (after the sale of the unregulated renewables in August) pure-play regulated utilities is attractive in this environment, especially as management begins to raise allowed ROEs. Moreover, AEP’s massive fleet of transmission and distribution lines, and its big development pipeline of more wires, should prove to be an invaluable asset in a future more reliant on renewables where transferring power across the country is more necessary.

If, as I expect, interest rates markedly fall by sometime in 2024, then AEP will be in a great position to obtain debt financing for its heavy investment load in 2024-2026.