Editor’s note: Seeking Alpha is proud to welcome Eric Wiehe as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

bjdlzx

All $ figures are in USD unless otherwise noted.

Introduction & Overview

Parex Resources (TSX:PXT:CA, OTCPK:PARXF) stands out among Canadian Oil and Gas companies as it boasts a debt-free balance sheet, making it a great choice for investors seeking to avoid the perils of rising interest rates and prioritize safety. However, there are still some key risks to consider.

The company’s operations are entirely centered in Colombia, introducing a host of uncertainties that some investors might prefer to steer clear of in their portfolios. Political, geopolitical, and regulatory risks in South America’s 4th largest economy (trailing behind Brazil, Argentina, and Chile) are factors that can add unwanted volatility into the equation.

In my opinion, these unwanted additional risks are overblown. Parex has proven these risks to be less meaningful than expected by the market. A company that has zero debt, has achieved double-digit growth in production per share, created a low-cost structure, and is buying back shares at an unprecedented rate, is one that deserves more attention.

Background & Corporate Timeline

Parex Resources emerged as an independent entity in 2009 after separating from Petro Andina Resources, a former Canadian Oil and Gas company operating in Argentina. They wasted no time in expanding their business in 2010, securing C$71 million in net funding, and achieving an annual production of 5,345 barrels of oil equivalent per day (boe/d) in 2011. This milestone coincided with their listing on the Toronto Stock Exchange (‘TSX’).

By acquiring companies and land in Colombia, Parex significantly increased its land holdings, reaching an impressive 469,944 net acres by 2013. Throughout the following decade, Parex continued to thrive through a combination of acquisitions and organic growth. Their growth strategy culminated in 2022 when they solidified their position as the largest independent oil and gas company in Colombia, boasting an extensive land portfolio of 5.5 million net acres and proven developed producing (PDP) reserves of 83 million boe at year-end.

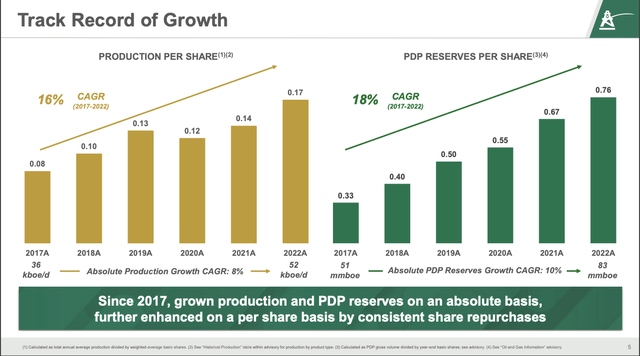

Parex’s ability to increase production and PDP reserves on a per-share basis, as well as in absolute terms, has been a focus for the company in recent years – an objective they have successfully executed with proficiency.

Parex Track Record of Growth (Slide 5)

Why Parex Is A Value Gem

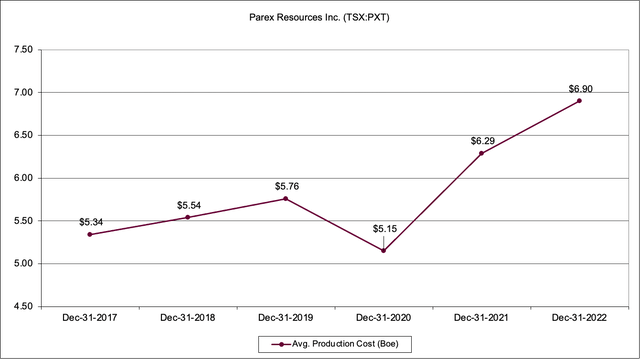

Parex has consistently demonstrated its focus on generating top-quartile Cash Flow per boe compared to other oil and gas companies listed on the TSX. This focus has allowed them to maintain profitability even during periods of declining oil prices, highlighting their resilience. Moreover, Parex has taken measures to mitigate the impact of inflation on its operations. By strategically acquiring long-lead items and essential equipment used in their capital spending programs, the company has effectively controlled costs and prioritized free cash flow generation. Average production costs per BOE have been increasing steadily but still remain one of the lowest among TSX-listed peers:

Average Production Cost – boe (Capital IQ)

Parex’s financial management has led to a debt-free status, enabling them to accumulate a substantial cash position of $372.4 million, which is spread across Canada, Switzerland, and the USA. This cash is invested in money market securities, which are yielding around 5%. This further bolsters their net income. In the most recent quarter, the average cash balance between Q4 2022 and Q1 2023 stood at $395.7 million (($419 million + $372.4 million) / 2). Parex earned $4.644 million in interest income for the quarter, equating to an impressive 4.69% return on the cash balance. Moreover, this cash balance is contributing approximately 3.2% to their operating income each quarter. As Parex doesn’t have any debt, rising interest rates are benefiting them and this is something the market has been ignoring.

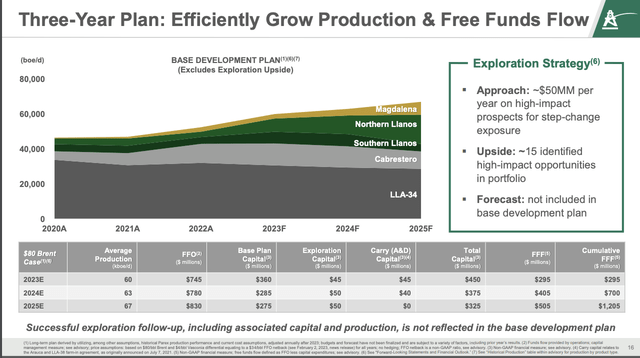

With a cost-effective approach, combined with favorable Brent oil prices and a steady increase in production, Parex foresees a strong Financial Funds from Operations (FFO) performance in the coming years. Guidance indicates FFO of $745 million in 2023, $780 million in 2024, and $830 million in 2025, resulting in substantial Free Funds Flow (FFF) of $295 million, $405 million, and $505 million, respectively, based on their current capital cost plan. These figures are based on the assumption of Brent oil prices being at $80 per barrel, which aligns well with current forecasts from the Energy Information Administration.

This positive outlook indicates that Parex is set to generate over $1.21 billion in Free Funds Flow over the next three years. As part of their capital allocation plan, Parex intends to deploy 100% of this FFF back to shareholders through dividends and buybacks. Given their current market capitalization of approximately $2.25 billion, this implies returning more than 50% of their market cap to shareholders within the specified timeframe, all while continuing their growth initiatives.

They intend to execute their capital plans simultaneously while generating Free Funds Flow. Moreover, any increase in the price of Brent oil above $80 per barrel would lead to further growth in their Free Funds Flow.

At the start of July, Saudi Arabia cut production by 1 million boe/d and Russia began limiting its exports of oil. With a tightening supply situation and the summer being the busiest season with respect to the demand for oil, I believe oil could run much higher than $80.

Additionally, Parex’s ambitious Big ‘E’ exploration plan holds significant potential beyond the provided guidance. By targeting prospects with production levels exceeding 20,000 barrels of oil equivalent per day, the company has identified around 15 high-impact sites. Their goal is to deliver approximately one catalyst per quarter through this exploration initiative. This not only complements their current plans but also adds a layer of exciting opportunities for the future.

I’ve broken down what one catalyst’s impact would be on revenue and operating profit:

Amount of Oil Produced: 20,000 boe/d * 365 days = 7,300,000 boe/year

Revenue Added: 7,300,000 boe * $80/barrel = $584,000,000

EBIT Margin: 50%

EBIT: $292,000,000 (~$2.73 per share)

Even if Parex’s Big ‘E’ strategy only delivers half of what management expects, I’ve calculated this would add around $5.46 per share in EBIT. While expectations of this may be baked into the price of Parex, it’s my opinion that it’s not recognized enough for the potential benefit it could provide.

In conclusion, Parex’s sound financial standing, capital allocation plan, and ambitious exploration initiatives position them favorably for continued success and value creation for their shareholders in the years ahead.

Parex Three-Year Plan (Slide 16)

Parex’s management has proven their capability to meet expectations. A testament to this is their decision to increase the dividend by 50%, now standing at C$1.50 per share. With this adjustment, the dividend offers an attractive yield of 5.47% at the time of writing, providing an enticing proposition for investors seeking consistent returns.

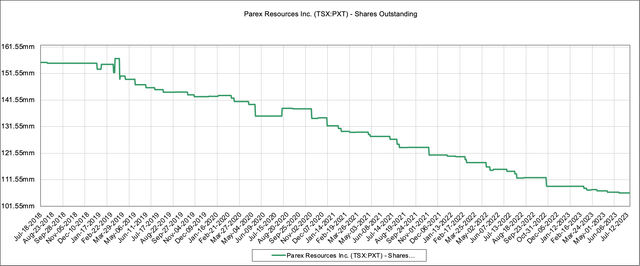

Furthermore, over the past five years, starting from 2018, the company has reduced its share count by more than 30%. In the last four years, they have utilized the Company’s NCIB (Normal Course Issuer Bid) to repurchase the full 10% amount allowed. I believe the significant reduction in share count and consistent buybacks through the NCIB hint at the possibility that Parex might consider taking themselves private in the future. Companies that take themselves private generally offer a premium to shareholders in order to entice them to accept the offer. With a very high level of cash on their balance sheet, it would be surprising to hear it hasn’t been thought before.

Shares Outstanding (Capital IQ)

Overall, I feel that the company’s strength on the balance sheet, proven ability to grow and remain cost-effective in a sporadic operating environment, strong capital allocation plan, the potential for huge growth, and consistency in returning capital to shareholders make Parex very undervalued.

Risks

The risk factors that could potentially dissuade investors are multi-faceted. Recent changes in the Colombian Government and its tax policies, the threat of instability in the region, FOREX risk, the success of their Big ‘E’ exploration plan, and commodity price volatility all contribute to the company’s risks.

The 2022 presidential election in Colombia marked an unprecedented shift as Gustavo Petro, the first left-leaning president in Colombian history, assumed office after Ivan Duque. This political transition introduced heightened volatility for Parex in 2022, largely due to Gustavo’s policies prioritizing Social Programs, Environmental Protection, and Land reform. These policies signaled a potential increase in taxes in the region, which ultimately materialized later on.

Given the current political regime, there remains a looming possibility of further tax hikes, leaving Parex exposed to additional risk. Navigating this uncertain landscape will be critical to safeguarding the company’s value and ensuring its long-term sustainability.

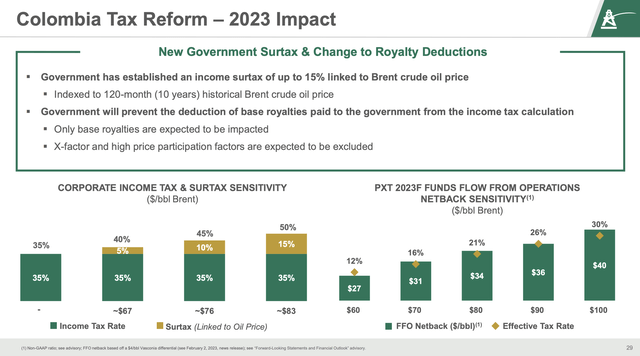

Colombian Tax Reform (Slide 29)

Another significant risk for Parex is the threat of shut-ins, where production comes to a halt due to regional instability. On January 21st, 2023, the company experienced a shut-in that resulted in approximately 6,500 barrels of oil equivalent per day (boe/d) being taken offline, impacting operations. This shut-in persisted until April 17th, 2023, spanning 86 days and leading to a loss of more than 550,000 boe. Such regional instability necessitates a risk premium to compensate for potential disruptions and is often omitted from discounted cash flow analyses Parex Resumes Operations.

To assess this risk premium, I utilized country risk premiums provided by NYU Stern and applied the Capital Asset Pricing Model (CAPM). Based on these calculations, I estimated a Weighted Average Cost of Capital (WACC) of approximately 17.4%, taking into account a risk-free rate of 3.65%, a beta of 1.77, a country risk premium of 3.3%, and an equity risk premium of 5.94%.

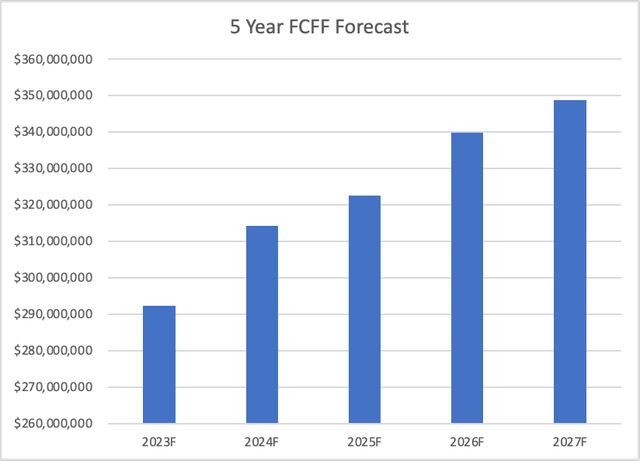

Using historical data, oil price projections from the Energy Information Administration (EIA), analysts’ forecasts of barrels produced, and the average realized discount on the price of oil (information sourced from Parex’s financial statements), we constructed a sales forecast. Leveraging this information, we projected unlevered Free Cash Flow (FCF) to develop a discounted cash flow model. Analyst’s forecasts came from Capital IQ and are a consensus amount.

This approach aims to incorporate the potential impact of regional instability into the valuation model, providing a more comprehensive assessment of Parex’s intrinsic value. By accounting for the risk of shut-ins through an appropriate risk premium, the discounted cash flow analysis can offer a more accurate evaluation of the company’s potential future performance and overall worth.

5 Year FCFF Forecast (Author’s representation using data from Seeking Alpha)

The Results:

| Enterprise Value | $ 2,048,690,783 |

| Plus: Cash and Short Term Investments | $ 372,419,000 |

| Minus: Debt | $ 6,700,000 |

| Equity Value | $ 2,414,409,783 |

| Shares Outstanding | 106,891,565 |

| Fair Value (CAD) | $ 30.49 |

Indeed, using a higher Weighted Average Cost of Capital (WACC) can provide a more realistic valuation of Parex, reflecting the additional risks and uncertainties the company faces.

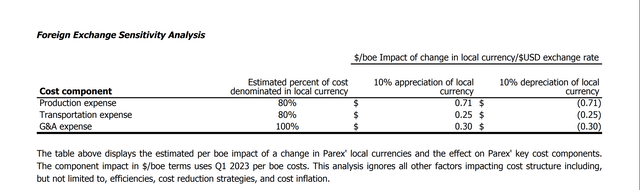

Foreign exchange risk and commodity price risk are two critical factors that significantly influence Parex’s financial performance. Commodity price risk is a general concern for all oil and gas companies, as global instability or an economic recession can lead to a decrease in oil prices, impacting Parex’s revenue and profitability. Moreover, fluctuations in the Colombian peso against the USD present foreign exchange risk, as Parex’s reporting currency is in USD. An appreciation of the local currency can lead to decreasing margins and increased costs for the company.

Foreign Exchange Sensitivity (Page 32)

The risk of the Big ‘E’ exploration program failing is a significant consideration for investors. Although Parex has not explicitly included potential catalysts in their guidance or forecasts, the success of this exploration initiative holds substantial value for the company and its shareholders. A failure in the program could result in a decrease in share price, as investor confidence may be impacted.

The tangible consequences of such a risk were evident when Parex released the results of the first site in the Big ‘E’ program on July 17th, 2023, which indicated no presence of oil or gas. The market reacted swiftly, and the share price experienced a significant drop. I felt the reaction appeared overblown because this program hasn’t been forecasted in Parex’s overall operating business. The next day, the share price rebounded indicating that it was overblown.

As the Big ‘E’ exploration plan progresses and more results are disclosed, the impact on share price and investor sentiment will likely continue to be significant. I believe the significance will be short term in nature for negative news but will be permanent for positive news. This provides investors with a win-win situation.

Conclusion

Considering the various risks associated with Parex, investors are undoubtedly faced with important considerations. The company exhibits a high level of unique risk. In my view, Parex is undervalued at current market prices and despite the persistent risks the company has encountered in the past, management has proven its ability to successfully achieve their objectives.

While the risks should not be ignored, I find the information insufficient to persuade me otherwise. Moreover, Parex’s potential for outsized returns, both in terms of capital appreciation and dividends, adds to its allure as an investment prospect. In my opinion, this promising outlook, combined with management’s track record, suggests that Parex is positioned for a solid future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.