Marco VDM

Due to a number of large catalysts presenting themselves in two major markets for Enphase (NASDAQ:ENPH), it’s poised to see significant growth in the near future. Policy incentives in the USA alongside a somewhat recently minted solar mandate in the EU prime the company for huge expansion. Add that on top of the extraordinary solar market growth and it’s clear that demand will be there to support this growth.

However, there are a few drawbacks to counter the positives. Firstly, some of its newer products are not backwards compatible, which leaves a chance for customers to switch to a different product when they decide to upgrade their solar tech. Another issue we’re seeing is the increase in interest rates. This is problematic since solar investments are almost always financed by debt. Increasing the costs of solar initiatives increases their economic payback period which subsequently decreases the demand for solar as it becomes less of a financially smart decision to make the change from other means of electricity. Unfortunately for Enphase, it’s expected the FOMC will raise rates again in the near future.

With that said, the company has solid margins, strong financials, and the right strategic partnerships to be able to capitalize on these opportunities presented. Pair that with the substantial decline in stock since Q4 2022 and now may be a great chance for bullish investors to secure their shares and take part in the growth this company could be realizing.

The Company

Founded in 2006, it is a publicly held company that operates out of Fremont, CA 94538. Along with its subsidiaries, the company designs, develops and manufacturers home energy solutions geared towards Solar power. Their main product, their Microinverter, is one of the main reasons they stand out amongst the crowd. To understand it better, you need to understand what a microinverter is.

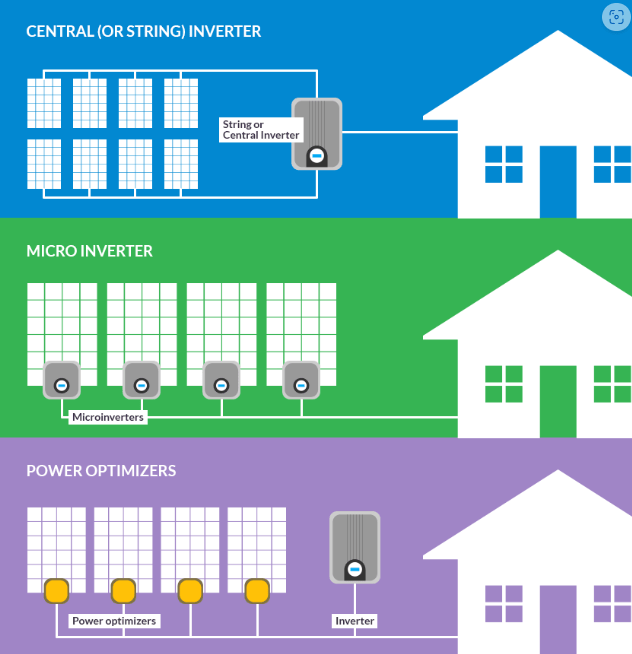

When energy is gathered via solar array, it’s gathered in DC (direct current) energy. Homes, however, operate on AC (alternating current) meaning that somewhere along the way, the energy gathered from the solar panels needs to be converted to AC before it can be of any use to the home or business they serve. There are 3 main ways that the energy is converted from DC.

- String inverters (centralized) – All the DC energy is transferred to one central inverter where it’s changed over to AC and then pushed to the house.

- Microinverters (this is what Enphase creates) – The energy gathered from each solar panel is converted into AC right when it leaves each solar panel and is then pushed to the house. This enables individual panel optimization as well as performance tracking of each specific panel.

- Power Optimizers System (string inverter + Power optimizers) – DC to DC converters that optimize the DC power output of each solar panel before its converted to AC at a central string inverter.

NRG Clean Power

Its newest microinverter, the IQ8+ has technology that sets it apart from the competition. With microgrid forming tech, customers of these microchips can have peace of mind that isn’t found with other inverters. As with most inverters that are grid-following, when the power grid fails, the inverter will shut off the power generating capability of the solar panels on that grid. With the IQ8+ microinverters microgrid forming technology, in the event of a complete power grid failure, users will still receive energy generated from their solar panels that use this product. Something that all grid-following inverters cannot do until the power grid is restored or turned back on.

Market Share & Industry outlook

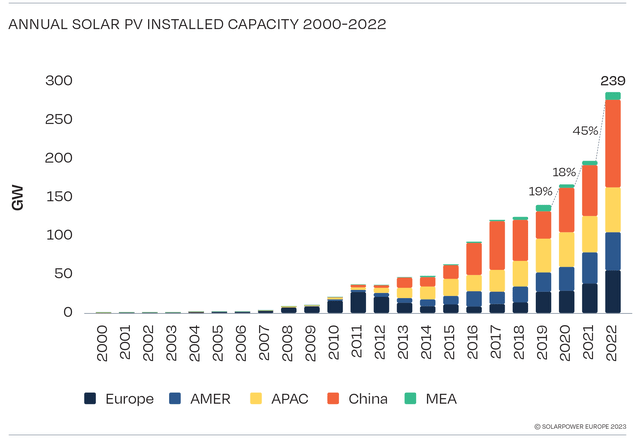

Around 2010, Europe was a world leader in solar PV(photovoltaic) deployment. They produced more than all other countries combined. Soon after, Asia/pacific America (APAC) gained some traction and China followed. Since then, the new trend of solar energy creation has begun, and it’s been China’s game to lose. With APAC following closely in 2nd with Europe and America fighting for that third-place spot. Spoiler: Europe is going to win.

Solar Power Europe

EUROPE – due to the EU Solar Strategy that was announced 18 May 2022, Europe is poised to become one of the fastest growing solar markets in the world. They are aiming to provide the framework to massively deploy solar PV energy in Europe, utilizing some of the following solar mandates as a catalyst:

- On all new public and commercial buildings with useful floor area larger than 250 m² by 2026

- On all existing public and commercial buildings with useful floor area larger than 250 m² by 2027

- On all new residential buildings by 2029

Conveniently, Enphase has strategic partnerships with a few companies in the EU. Firstly, Natec, a European market leader in roof-bound solar systems (how coincidental). Natec utilizes Enphase microinverters when they are selling solar systems to consumers. Enphase will be able to work with Natec as they both capitalize on the solar mandates that were put into effect last year. Especially once more companies & residents start making the transition and start purchasing more solar for their buildings and homes.

Natec

The second partnership they have is with 4Blue which is a full-service solar wholesaler that covers the Netherlands, Germany, Belgium, and Luxembourg. These countries are all very central Europe, which allows for good European coverage as both companies expand.

USA – Due to increasing efforts during the Biden administration, we are seeing growth here in the U.S. for a couple of main reasons:

- Tariff exemption on solar modules manufactured in specific countries. Put into effect June 2022 and will last 2 years.

- Main countries affected: Cambodia, Malaysia, Thailand, and Vietnam which are all major producers of solar modules.

- Inflation Reduction Act

- Raising investment tax credit up to 30% from 26% for commercial and residential initiatives. Will remain in effect until 2032.

The goal for the tariff exemption aims to increase the domestic manufacturing capabilities of solar installers for the United States. On July 06, 2023, President Biden announced the first shipment of microinverters from a new plant in Columbia, SC. Marking the start of a grand partnership between Enphase and Flex Ltd. (FLEX). Together, the two will open 3 new manufacturing facilities across South Carolina and Texas.

Additionally, the partnership between Enphase and Blue Raven Solar (which is the fastest growing solar provider in the US) along with Enphase already having 2 distribution centers strategically located in Texas and in California, it’s clear they are prepping to maintain their almost 50% market share of microinverters here in the US. These partnerships ensure they are in a good position to capitalize on the growth that will soon take place Stateside.

The inflation Reduction Act serves as more of a growth sustainer rather than a catalyst for it. Increasing the Investment tax credit by 4% for commercial and residential initiatives helps offset the challenges that are posed from the net metering modifications. Namely in California which is a state where Enphase makes a lot of its money currently.

Solar Market Future Growth

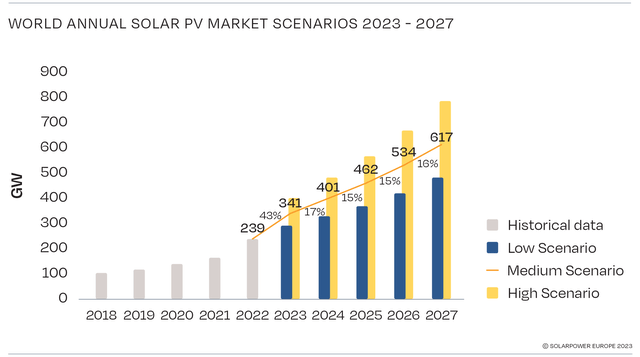

As we see in Figure 4, there is a big expectation of growth in the solar market in future years, with much of the growth coming from Europe and US due to the reasoning previously stated. Enphase stands to capitalize greatly on this over the next few years through increased demand for its products and overall global expansion. Its above average margins aid in its ability to capture new business for lower costs than its competitors, as we’ll touch on later. The partnerships that are currently established will provide enough exposure for it to realize genuine business progression across both of these major markets.

Figure 4 (Solar Power Europe)

(It should be noted that the “GW” unit we’re given stands for gigawatt – think: 1 GW = 1 Billion watts.)

Financials

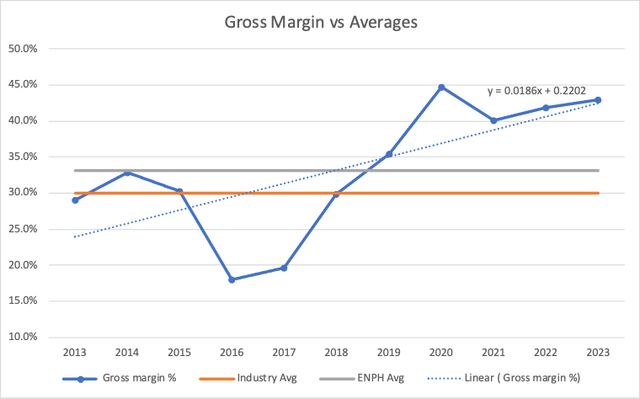

Averaged over the past 10 years, it operates with a gross margin of 33.2% which compares well to the industry average of about 30% over the same time frame. Since 2020, it’s been able to maintain a gross margin above 40%. Compared to its major competitor here in the US, SolarEdge (SEDG) which has a 10 year average closer to 35% for its solar segment. Though their average is higher than Enphase’s, they have had a steadier track record, leading to a higher average. In Q1′ 23, Enphase reported a gross margin of 45.7% up from 43.8% in Q4 22′, proving that its upward trend in margins is not something that’s unstainable. It’s expected that Enphase will maintain a gross margin well above the industry average.

Figure 5 (B Jerde)

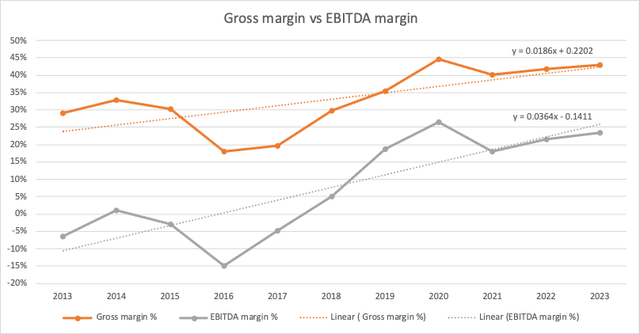

Utilizing figure 6 – The linear regression over the past 10 years looking at gross margin and EBITDA margin, we can actually see that its EBITDA margin is growing at a rate of around 3.8% compared to gross margins growth of roughly 1.8%. We expect these margins to maintain their positive trajectory into future years, but we also expect to see both margins level off slightly above their current levels. One big item to note here is that with each year that passes, the distance between GM and EBITDA margin actually decreases which is a very strong indicator.

Figure 6 (B Jerde)

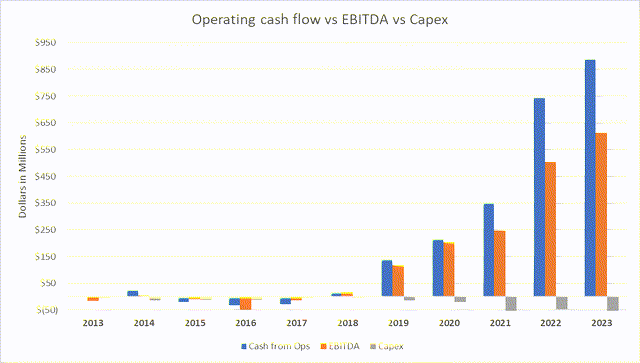

Along with solid margins, we can also see a good correlation between cash from operations, capex, and EBITDA. (see graph below)

Cash from ops – since gaining traction in 2018, when it first seems to have broken through its business barriers, its cash from operations has been growing at a pace of roughly 27.5% YOY. The reorganization and improved bottom line seems to have been a key contributor to these increases and they seem to be holding.

Capex – YOY growth in capex has been much smaller, closer to a 1.2% YOY change in spending. Largely attributed to a growing business requiring more assets and equipment to support growth. It actually seems to be quite efficient with its spending from a cost of revenue standpoint as its average annual Capex as a percentage of revenue is consistent around 2.7%.

EBITDA – Showing YoY Growth rates of just under 18% since 2013 are in line with its expected growth when compared to other factors such as revenue or those listed previously. Proving its overall business efficiency in the sense that as revenues continue to increase, so do its earnings.

Figure 7 (B Jerde)

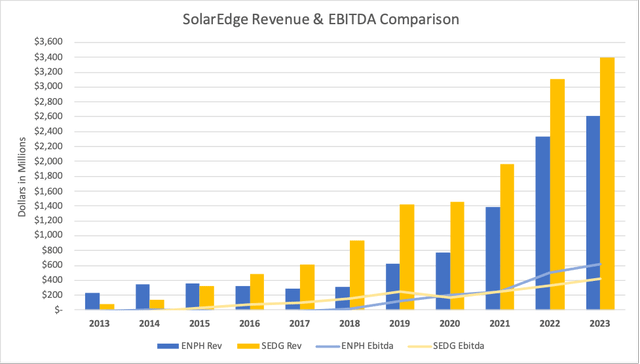

There is an interesting trend to note with figure 8 – Annually from 2020 and on, Enphase has been able to produce around ~66% the revenue that SolarEdge produces. Over the same period, Enphase has been able to generate an EBITDA that is ~28% greater than its competitor. This proves that Enphase is managed excellently and It helps showcase how management is very focused on keeping costs low and the business operating efficiently.

Figure 8 (B Jerde)

EPS Growth

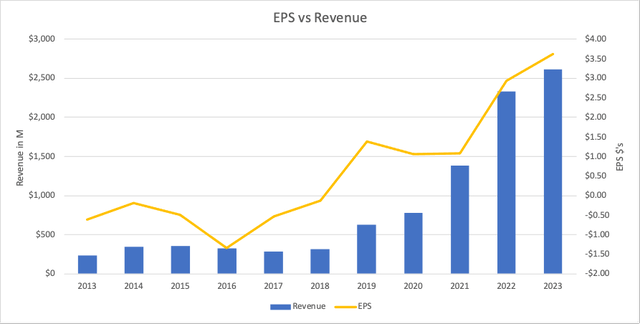

Though negative for much of its time since its IPO, it has been able to maintain positive EPS and mostly positive EPS Growth with a bit of a lull in 2020 – 2021, thank you Covid19. What we note here is that it is challenging for companies to continue to increase earnings if revenue is not increasing. Thankfully, that is not the case here as we are expecting revenue to eclipse >2.8B in 2024 as well as for EPS to surpass $5 in the same time frame.

Figure 9 (B Jerde)

Another quick item to note here regarding EPS and comparing against SolarEdge; since Q3 2022, Enphase has been beating SolarEdge in quarterly EPS, even if just slightly. It will be interesting to see how the two stack up for Q2 2023.

Drawbacks

Firstly, its newest model of microinverter, the IQ Series which launched in 2021, is not backwards compatible with older models. Meaning a current customer who is using a previous model, like the MP50, would need to purchase all new microinverters in order to make the switch to the newer technology. Since the product is already more expensive upfront compared to other products offered by competitors, like the string inverter, there’s a lingering potential to lose customers over the long term with this issue.

Secondly, it relies greatly on other companies to produce and sell its products. Take the distributors listed previously for example. There are a few big partnerships that enable It to sell its products across larger geographic regions. Granted, it’s beneficial for both parties for the distribution and sale of Enphase products but that doesn’t always mean the partnership will be around forever. There is always the chance that these partnerships fall through, and Enphase is left unable to meet the demand for its products through greatly increased shipping costs and time.

Its dependence on a small number of outside contract manufacturers means that its business could be disrupted if problems arise with those manufacturers. Among all its current manufacturing facilities, it has 2 partnerships, one with Flex LTD and one with Salcomp (not covered in this report). If something goes wrong with either of those partnerships, It won’t be able to match the forecasted demand for its products.

Lastly, the high interest rate environment we find ourselves in today will also negatively affect its sales moving forward. Solar panels are already a long-term investment, one that is usually financed with debt. Higher interest rates make this option even less viable in the shorter term. Especially since in the last FOMC meeting, they mentioned future rate hikes would probably be taking place, which means even more expensive loans. The next FOMC meeting will take place July 26, 2023. It’s possible we could see a prolonged period of slower growth while interest rates cool off over the next few years.

Looking Forward

Europe – The solar mandate that was implemented by the EU Solar Strategy will have huge impacts on companies associated with providing solar solutions that offer products in the EU. Being that Enphase has multiple strategic partners that allow it to sell and distribute its products all across Europe, we see this as a fantastic opportunity that will enable solid growth propelling Enphase to become an even more well-known brand in Europe.

USA – The partnerships that Enphase has in place in the United States are setting it up to maintain its ~50% market share of the microinverter market. With the creation of 3 manufacturing plants to support domestic demand, as well as increased global demand, it’s clear that it wants to be a household name in solar. We believe they are on track to do just that.

All analysts’ forecasts that we’ve seen undoubtedly signal that the solar development market will maintain its strong growth. With more than a few catalysts to help ensure this happens, we fully expect to see more countries creating and implementing strategies to switch to more green energy in the future.

The shift to renewable energy is not a fad or some short-term trend that is going to be out of style in a few years. It’s an economic movement that is rallying more political support as each day passes. As more individuals and companies make the push towards renewable energy, it will only strengthen the movement even more. With the strong footholds that Enphase has in Europe as well as in the US and other countries – It is positioned to heavily capitalize on the solar movement going forward. This could mark a good time to enter a long position if you can tolerate the potential risks.

We would like to thank Brandon Jerde for this piece.