ipuwadol/iStock via Getty Images

A Quick Take On Pegasystems

Pegasystems Inc. (NASDAQ:PEGA) provides workflow automation software and related services to enterprises worldwide.

I previously wrote about PEGA with a Hold outlook.

While Pegasystems Inc. may have some potential for an upside surprise, given known macroeconomic softness and a slower forward revenue growth rate, I remain Neutral [Hold] on PEGA in the near term.

Pegasystems Overview

Cambridge, Massachusetts-based Pegasystems was founded in 1983 and sells a variety of workflow automation software to major industry verticals.

The firm is headed by founder and CEO Alan Trefler, who is also founder of the Trefler Foundation.

The company’s primary offerings include the following:

-

Platform.

-

Customer Decision Hub.

-

Customer Service.

-

Sales Automation.

-

Client Lifecycle Management.

-

Know Your Customer.

The firm acquires customers through its direct sales and marketing efforts as well as through partner referrals.

PEGA also operates a Marketplace, Partner Portal and Launchpad.

Pegasystems’s Market & Competition

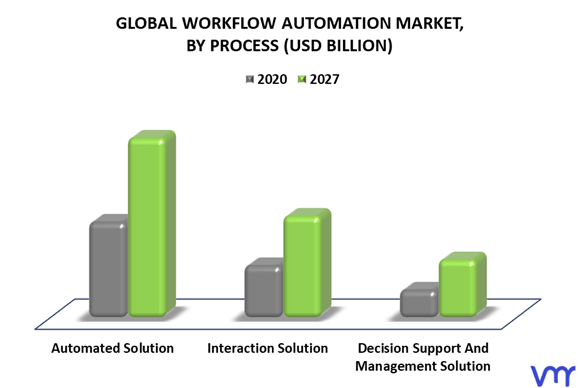

According to a 2022 market research report by Verified Market Research, the global market for workflow automation was estimated at $8 billion in 2019 and is forecast to reach $39.5 billion by 2027.

This represents a forecast very high CAGR of 23.7% from 2020 to 2027.

The main drivers for this expected growth are demand from various major industry verticals for improved digital processes that can drive real-world product efficiencies, lower costs and increase sales volumes.

Also, the chart below shows the global workflow automation market growth outlook by the three main categories of solution:

Global Workflow Automation Market (Verified Market Research)

Major competitive or other industry participants include:

-

IBM.

-

Appian.

-

Oracle.

-

Software AG.

-

Newgen.

-

AURA.

-

AgilePoint.

-

Agiloft.

-

Monday.com.

-

Jira.

-

Others.

Pegasystems’ Recent Financial Trends

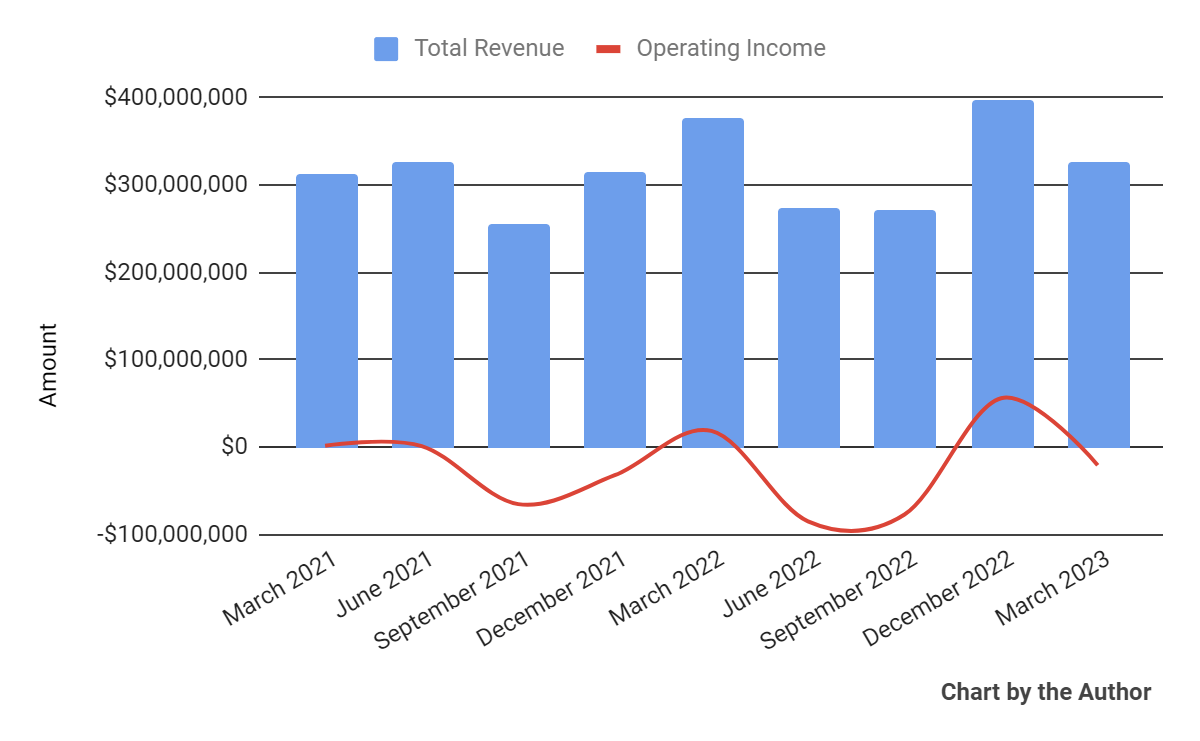

-

Total revenue by quarter has fallen YoY for the most recent quarter; Operating income by quarter has fluctuated markedly.

Total Revenue and Operating Income (Seeking Alpha)

-

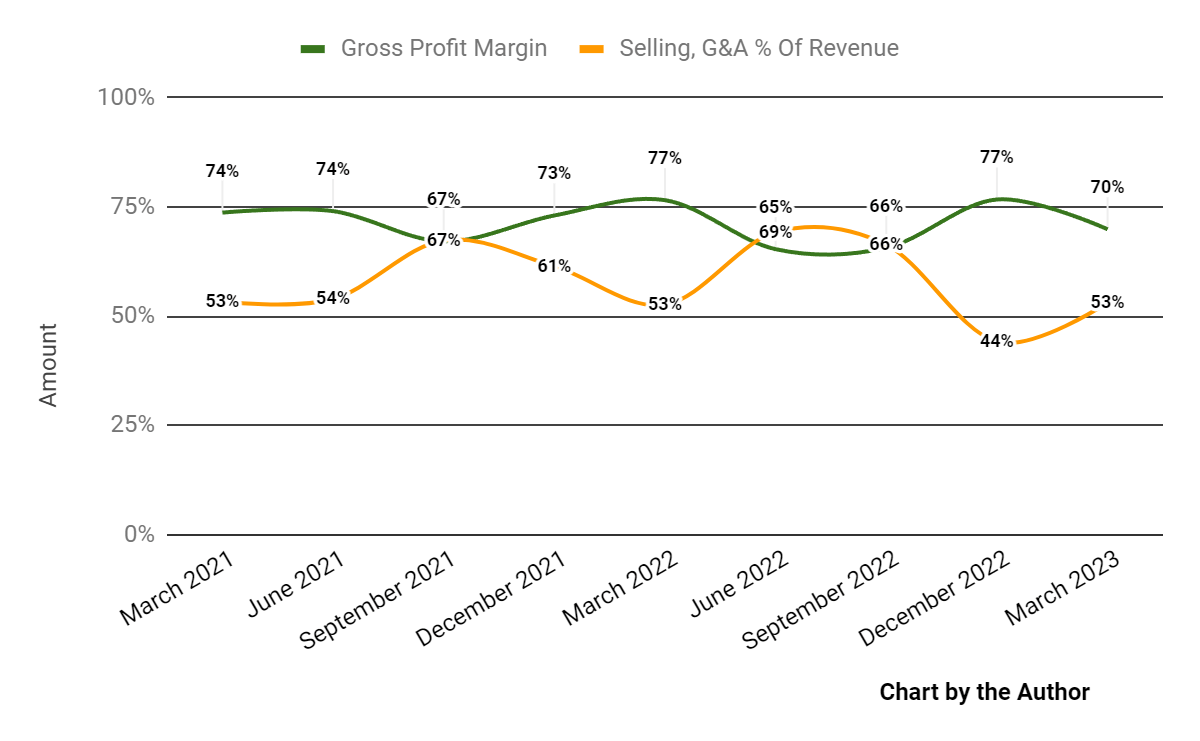

Gross profit margin by quarter has trended lower in recent quarters; Selling, G&A expenses as a percentage of total revenue by quarter have dropped sharply recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

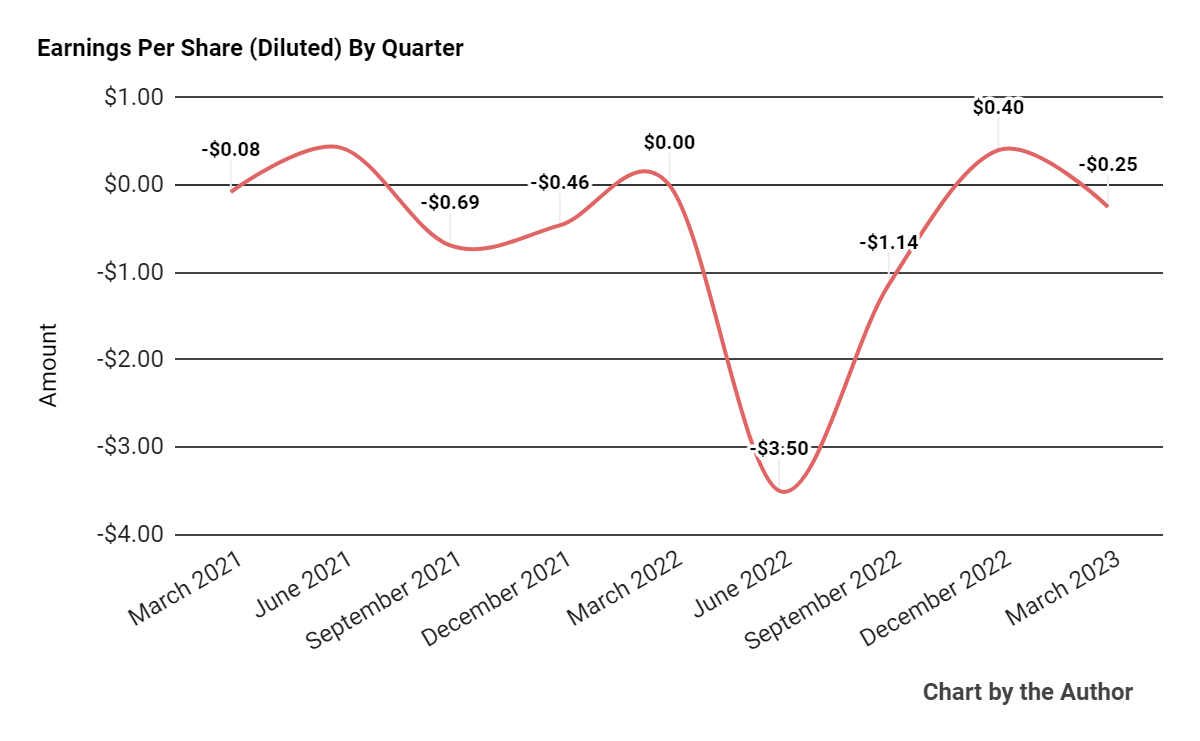

Earnings per share (Diluted) have produced wide fluctuations in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

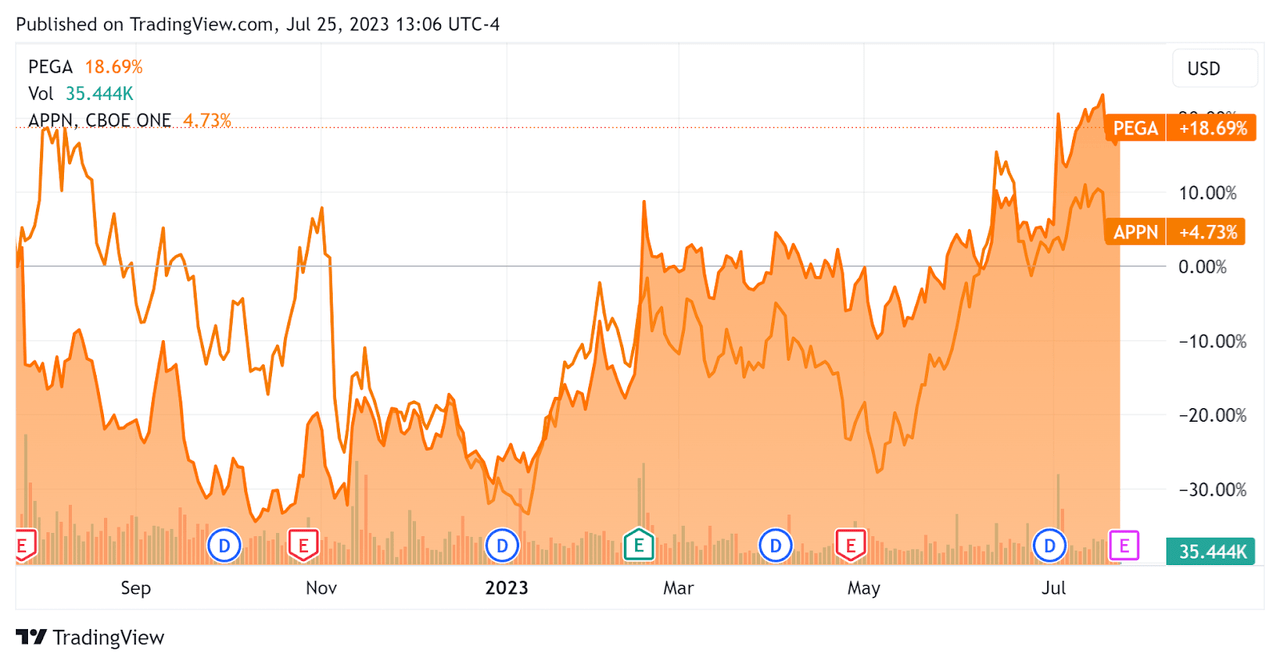

In the past 12 months, PEGA’s stock price has risen 18.69% vs. that of Appian Corporation (APPN) growth of only 4.73%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

Pegasystems ended the quarter with $323.9 million in cash, equivalents and short-term investments and $561.7 million in total debt, none of which was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $35.1 million, during which capital expenditures were a hefty $40.2 million. The company paid $136.5 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Pegasystems

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.8 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

3.5 |

|

Revenue Growth Rate |

-0.6% |

|

Net Income Margin |

-28.9% |

|

EBITDA % |

-8.5% |

|

Net Debt To Annual EBITDA |

-2.2 |

|

Market Capitalization |

$4,520,000,000 |

|

Enterprise Value |

$4,850,000,000 |

|

Operating Cash Flow |

$75,330,000 |

|

Earnings Per Share (Fully Diluted) |

-$4.49 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be low-code company Appian; shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

Appian |

Pegasystems |

Variance |

|

Enterprise Value / Sales |

7.3 |

3.8 |

-47.5% |

|

Enterprise Value / EBITDA |

NM |

NM |

–% |

|

Revenue Growth Rate |

23.9% |

-0.6% |

–% |

|

Net Income Margin |

-33.7% |

-28.9% |

-14.2% |

|

Operating Cash Flow |

-$111,210,000 |

$75,330,000 |

–% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PEGA’s most recent unadjusted Rule of 40 calculation was negative (9.1%) as of Q1 2023’s results, so the firm’s performance has worsened sequentially, per the table below.

|

Rule of 40 Performance (Unadjusted) |

Q4 2022 |

Q1 2023 |

|

Revenue Growth % |

8.8% |

-0.6% |

|

EBITDA % |

-5.2% |

-8.5% |

|

Total |

3.6% |

-9.1% |

(Source – Seeking Alpha)

Commentary On Pegasystems

In its last earnings call (Source – Seeking Alpha), covering Q1 2023 results, management highlighted the interest the firm is receiving from clients regarding the use of AI technologies.

So, the firm seeks to educate customers and prospects about its integration of AI into its various products and its plans to develop generative AI technologies in the future.

Pega aims to enable its clients to incorporate AI capabilities via their own API permissions into its Pega Infinity platform, like plug-in modules, increasing the level of customization available to customers.

Management didn’t disclose any company, customer, or revenue retention rate metrics.

Total revenue for Q1 2023 dropped 13.5% year-over-year while gross profit margin fell 6.7% YoY.

Selling, G&A expenses as a percentage of revenue rose by 0.5 percentage points YoY and operating income fell sharply into negative territory.

The company’s financial position is moderate with significant liquidity offset by long-term debt; free cash flow was positive.

PEGA’s Rule of 40 performance has worsened sequentially into negative territory.

Looking ahead, management had previously guided top line 2023 full-year revenue of $1.4 billion, for a growth rate of 6.2%.

If achieved, this would represent a reduced growth rate versus 2022’s growth rate of 8.76% over 2021.

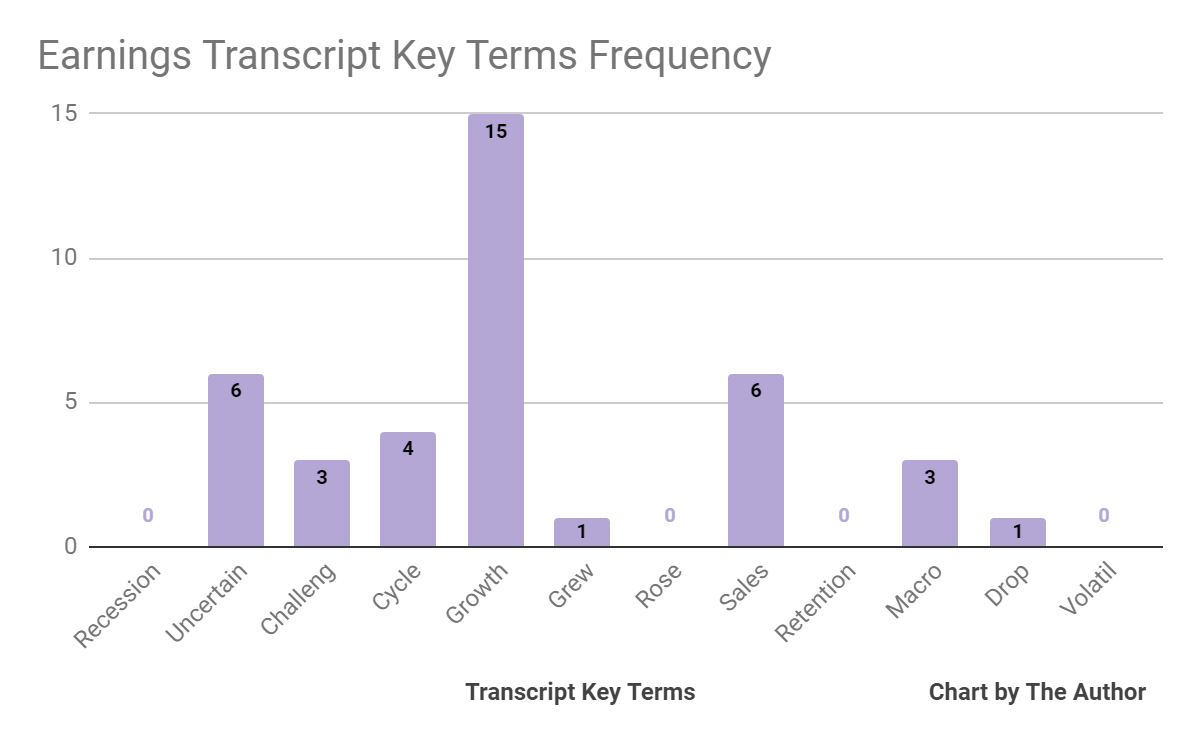

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Uncertain” six times, “Challeng[es][ing]” three times, “Macro” three times and “Drop” once.

Analysts questioned company leadership about lengthening of sales cycles, to which management responded by saying that it is seeing greater “economic concern” and a kind of “timidity” by customers and prospects.

Regarding valuation, in the past twelve months, the firm’s EV/Sales valuation multiple has risen from the bottom of 2.33x in October 2022 to its current level of 3.79, for a rise of 62.6% off the low, as the chart from Seeking Alpha shows below.

EV/Sales Multiple History (Seeking Alpha)

The primary business risk to the company’s outlook is slowing growth due to lengthened sales cycles as Pegasystems seeks to continue to transition to a subscription revenue model.

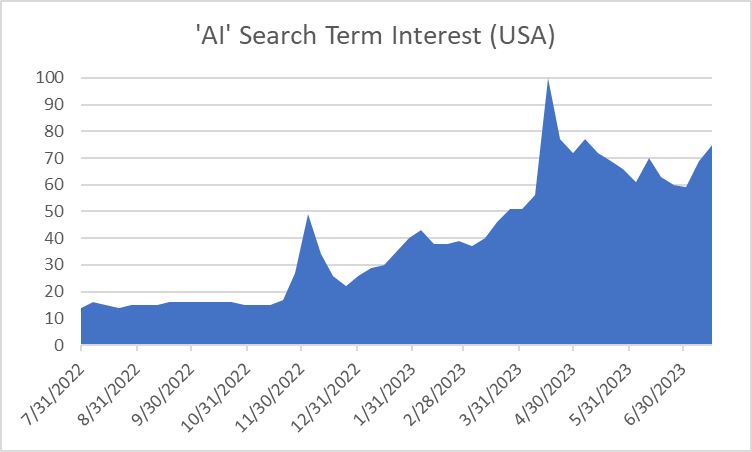

Potential upside to the firm’s fortunes could include capitalizing on the strong interest in AI-enhanced technologies.

In fact, with revenue guidance for 2023 indicating slower growth than 2022’s growth over 2021, most of the stock’s rise has been driven by a rise in its price multiple and, I suspect, from the narrative surrounding AI in process automation.

Can the stock continue to rise? Of course, the AI hype may continue, although this search term history shows some drop in interest in recent months:

AI Search Term Interest – USA (Google Trends)

While Pegasystems may have some potential for an upside surprise, given known macroeconomic softness and a slower forward revenue growth rate, I’m Neutral [Hold] on PEGA in the near term.