imaginima

A few days ago, I read about Vertex Energy (NASDAQ:VTNR) selling its first load of renewable diesel. The news caught my attention: I was unfamiliar with this company, which deals in both traditional and sustainable refined petroleum products.

I began to delve deeper into this stock, immediately struck by the fact that many analysts on Seeking Alpha have written very optimistically about this company. After completing my due diligence, I disagree with these theses and argue that Vertex shares are not as attractive as they may appear.

The two central points of my analysis are:

-

Refinery margins are rapidly declining after a record period, and Vertex is one of the companies least capable of generating profits from refining;

-

There are at least three companies operating in the same sector that present a more attractive valuation in terms of multiples, as well as a greater ability to withstand a decline in the crack spread.

Honestly, I wouldn’t want to invest in the refining sector in general at this moment. The decline in the crack spread is leading to a significant decrease in margins, and the price of oil continues to struggle, between the Chinese economy still in difficulty and the real possibility of a recession in Europe. However, if I had to invest in refining, I would prefer stocks other than Vertex.

Vertex Energy: Business Model

The first thing to know about Vertex is that it is a company dedicated to the refining and marketing of petroleum derivatives. Until 2021, the company managed a modest portfolio of plants dedicated to re-refining: for those unfamiliar with the term, this involves collecting and processing used motor oil to obtain new oil with characteristics very similar to those of virgin motor oil.

In mid-2022, the company saw a boom in its numbers thanks to the acquisition of a large oil refinery that belonged to Shell and is located in Mobile, Alabama. Thanks to an advantageous purchase price, the company began to record the best financial data in its history. After selling the Heartland re-refining plant for $90 million in cash, the only remaining re-refining plant is in Marrero, Louisiana. This is a plant with a rather small weight on Vertex’s total revenue.

Essentially, the vast majority of results depend on the Mobile refinery, which conducts two types of operations:

-

For the most part, it is a plant that produces refined petroleum products in a traditional way;

-

Since the beginning of the current quarter, a second unit of the plant has been activated capable of producing renewable diesel from organic feedstocks. Renewable diesel is different from biodiesel, as it has exactly the same chemical characteristics as diesel produced from crude oil.

The company has already started marketing the renewable diesel and estimates it can produce 8,000 barrels of oil per day in this initial phase of the project; a second phase of the project is then planned, which should bring the production of renewable diesel to 14,000 barrels per day. Overall, by the end of 2023, it is estimated that Vertex’s product mix will be 19% renewable diesel.

Limitations of The Sum-of-the-Parts Approach

An excellent article written by Atlas Equity Research presents a bullish thesis, later echoed by other analysts, based on a sum-of-the-parts approach. This valuation model calculates the value of a company by summing up the value of the assets and business units in its portfolio.

In this analysis, a value of $1.1 billion stands out, attributed to the Mobile plant, calculated as 6x the forecast EBITDA for 2023. This is a rather optimistic assumption, considering that the EBITDA for 2023 is tainted by record profit levels for the oil refining business.

In my view this isn’t a good approach for valuing Vertex today, and we cannot even refer to historical data. Indeed, the size of the company has grown significantly only in the second half of 2022, when refining sector margins were even higher than current levels. Moreover, I tried to apply the same valuation model to the companies that I will present later as alternatives to Vertex Energy: the result is that all would be undervalued, and even noticeably so.

The illusion of the crack spread and margins

The crack spread represents the price difference between oil and refined products. There are different ways to calculate it, depending on the product mix of a refinery; Vertex normally uses the 2-1-1 as a benchmark, representing the theoretical margin of those who refine two barrels of oil into one barrel of gasoline and one barrel of diesel.

The crack spread represents the margin that a refinery could obtain if it transformed oil into derivative products without incurring any other cost. Obviously, operating a refinery requires expenses for maintenance, wages, and so on. For this reason, a good way to compare refining companies is the percentage of the crack spread that they manage to capture with their operations.

Moreover, this margin varies over time. A quarter before Vertex’s financial results began to be impacted by the Alabama refinery, the spread between oil and refined products started to take off. This is why the company appears to show an attractive valuation which, however, is the result of a pure illusion when juxtaposed with its main trading comparables.

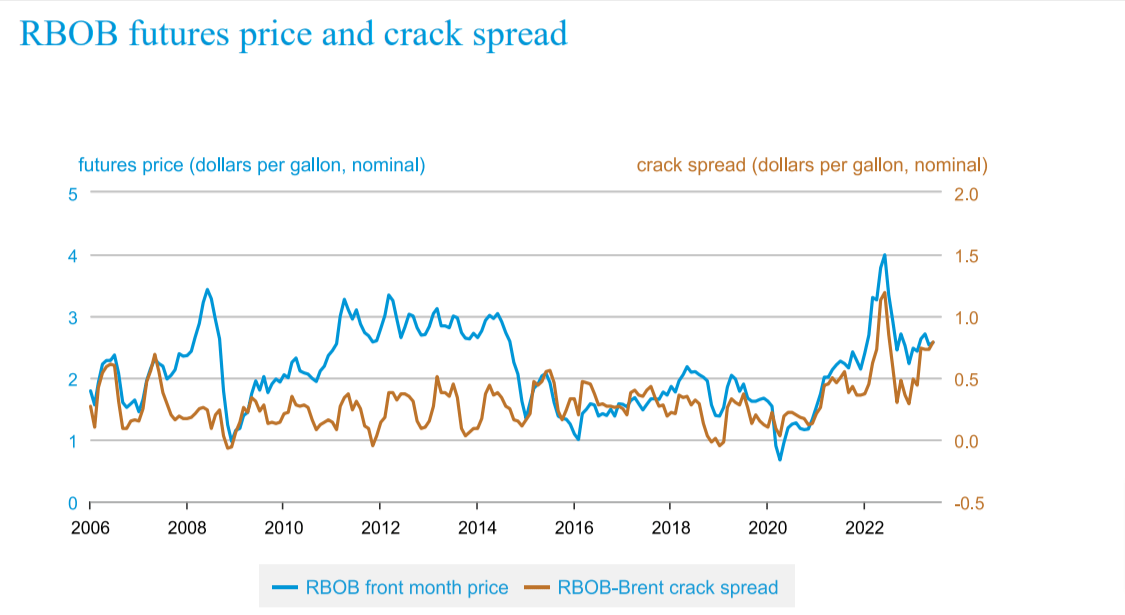

EIA – https://www.eia.gov/finance/markets/products/prices.php

Historically, the crack spread has been about half that of Q1 2023 and less than half compared to the two previous quarters. As a consequence, Vertex’s gross profit per barrel went from $20.5 in Q4 2022 to $16.17.

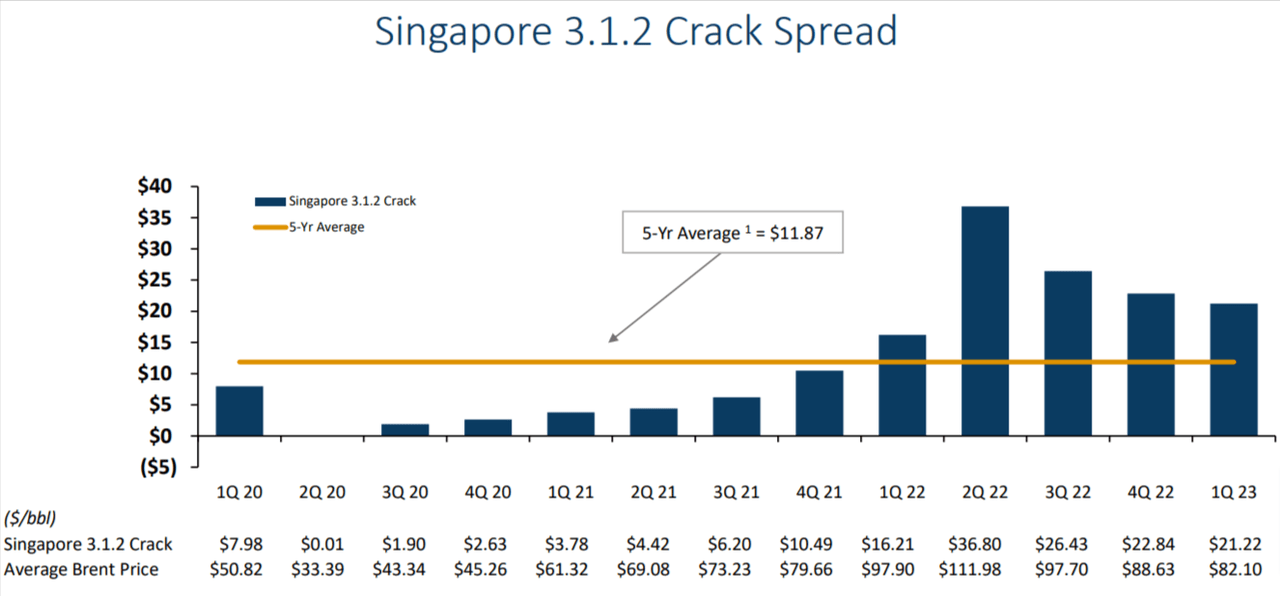

A clearer graph is the one below, taken from Par Pacific’s Q1 2023 data presentation. It refers to the crack spread based on Singapore quotations, but it is very useful for observing the evolution of this variable on a quarterly basis.

Par Pacific – June 2023 Investors Presentation

The trend is clearly bearish. With the market adjustment in the post-pandemic, the margins of oil refining are rapidly decreasing. Faced with this data, an investor essentially has two options:

-

Take profits obtained by investing in companies that refine oil in this particularly favorable year and a half, looking elsewhere;

-

Maintain exposure to the sector, aiming to invest in the best possible stocks.

If you exit the market, it is not clear why Vertex shares are less convenient than others. In the next step of the analysis, we will see what are the better alternatives for those who want to remain exposed to pure-player refining and marketing of petroleum products.

3 Better Stocks Than Vertex Energy Right Now

My thesis is that three companies operating in the same market as Vertex Energy are more attractive under the three most important valuation parameters:

- The stocks are cheaper, i.e., valued with lower multiples;

- The economic prospects of these companies are better, as the profitability of their refining processes is higher;

- They are less indebted than Vertex in relation to the profits they generate.

Starting with the first point, here’s an analysis of the two main multiples of the companies in question.

|

Price/Book |

P/E |

|

|

Vertex Energy |

2.33 |

10.15 |

|

PBF Energy (PBF) |

1.07 |

1.7 |

|

Marathon Petroleum (MPC) |

2.01 |

3.79 |

|

Par Pacific (PARR) |

1.77 |

2.39 |

Note that Marathon Petroleum should reasonably be a more expensive stock compared to the others, since the larger size of the company makes it a less volatile and less risky investment.

Below, I report Vertex Energy’s data on debt and profitability for the last four quarters, i.e., since the stock is directly comparable to the other three.

|

Vertex Energy |

||||

|

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

|

|

Revenue |

1,065.00 |

810.2 |

876.3 |

691.1 |

|

Gross profit |

34.3 |

59.7 |

97.8 |

71.8 |

|

Gross profit margin |

3.22% |

7.37% |

11.16% |

10.39% |

|

EBITDA |

-12.5 |

25.4 |

59.9 |

29.8 |

|

Net Debt |

303.8 |

280.5 |

260.7 |

321.2 |

|

Net Debt / EBITDA |

-24.30 |

11.04 |

4.35 |

10.78 |

Here are the same data for Par Pacific:

|

Par Pacific Holdings |

||||

|

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

|

|

Revenue |

2,106.30 |

2,056.30 |

1,808.90 |

1,685.20 |

|

Gross profit |

297.40 |

413.70 |

234.70 |

396.20 |

|

Gross profit margin |

14.12% |

20.12% |

12.97% |

23.51% |

|

EBITDA |

199.6 |

309.1 |

130.7 |

291 |

|

Net Debt |

681.9 |

436.8 |

381.5 |

229.4 |

|

Net Debt / EBITDA |

3.42 |

1.41 |

2.92 |

0.79 |

Moving on to PBF Energy:

|

PBF Energy |

||||

|

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

|

|

Revenue |

14,077.70 |

12,764.60 |

10,846.30 |

9,295.00 |

|

Gross profit |

2,059.60 |

1,701.30 |

1,106.20 |

718.3 |

|

Gross profit margin |

14.63% |

13.33% |

10.20% |

7.73% |

|

EBITDA |

1,915.00 |

1,541.10 |

943.8 |

664.9 |

|

Net Debt |

1,800.70 |

752.30 |

438.30 |

529.20 |

|

Net Debt / EBITDA |

0.94 |

0.49 |

0.46 |

0.80 |

Finally, Marathon Petroleum:

|

Marathon Petroleum |

||||

|

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

|

|

Revenue |

53,860.00 |

45,787.00 |

39,813.00 |

34,864.00 |

|

Gross profit |

8,820.00 |

7,185.00 |

6,343.00 |

5,647.00 |

|

Gross profit margin |

16.38% |

15.69% |

15.93% |

16.20% |

|

EBITDA |

1,915.00 |

6,256.00 |

5,358.00 |

4,748.00 |

|

Net Debt |

14,725.00 |

16,761.00 |

16,139.00 |

17,090.00 |

|

Net Debt / EBITDA |

7.69 |

2.68 |

3.01 |

3.60 |

Overall, if I had to invest in just one of these four companies, I would choose Par Pacific. If I were to add a second one, it would be Marathon Petroleum; the third would be PBF Energy, and only last would I consider Vertex.

Note: On June 3, Vertex announced the conversion of $79 million of its convertible bond issue due in 2027. This theoretically lowers the company’s debt, although it is not yet reflected in the latest quarterly data. The next earnings call will be on August 9.

Conclusion and Final Thoughts

Vertex Energy certainly deserves credit for successfully transforming its business, changing the scale at which the company operates over the past year. It has also demonstrated the ability to bring ambitious projects to fruition, such as the new renewable diesel production plant, which could offer interesting prospects in the long term.

That being said, the market is seeing contracting margins – albeit still high – for those involved in oil refining. Consequently, it is not a particularly attractive time to invest in the sector; if you decide to do so, it’s important to look for companies that manage to obtain above-average sector margins and show low indebtedness.

While Vertex shares are certainly not the worst stock I’ve analyzed over the course of 2023, the fact that there are at least three better alternatives in the same sector is enough to set a SELL rating.