marketlan

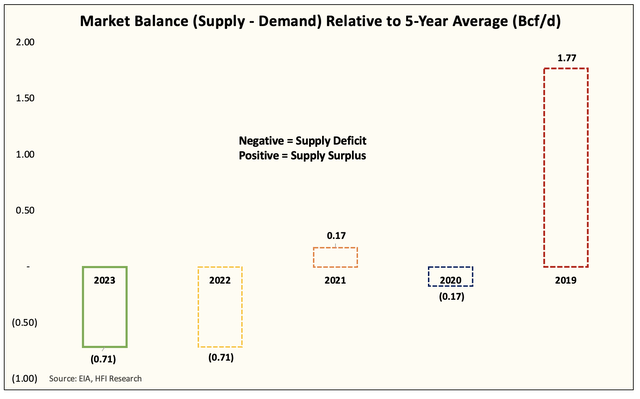

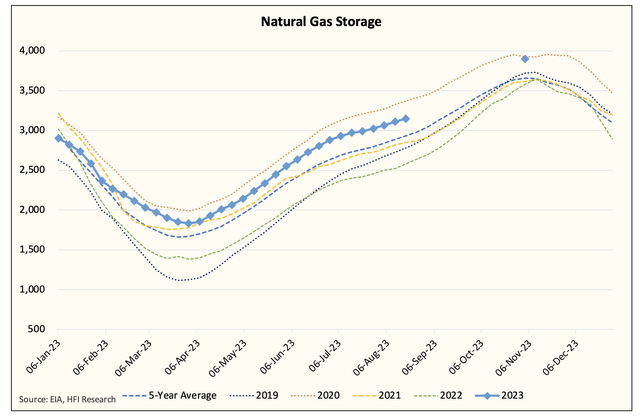

The natural gas (NG1:COM) market is finally starting to tighten, with our implied balance showing a deficit of 0.71 Bcf/d vs. the 5-year average. For natural gas bulls, this means that the prospects of storage hitting the maximum has greatly diminished. But it’s not all rainbows and puppies just yet; because storage levels remain bloated, bulls should expect natural gas to trade between the $2.5 to $3.25 range until the end of injection season.

EIA, HFIR

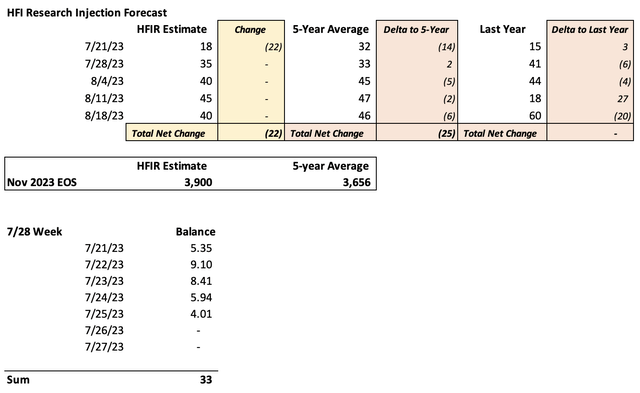

Looking at our latest storage projections, you can see that we are expecting injections to be below that of the 5-year average.

HFIR

For this week’s report in particular, we are seeing balances being far lower than expected. We are seeing an injection of 18 Bcf vs. the 5-year average of 32 Bcf. EOS has decreased to 3.9 Tcf, which is still higher than the 5-year average of 3.656 Tcf.

EIA, HFIR

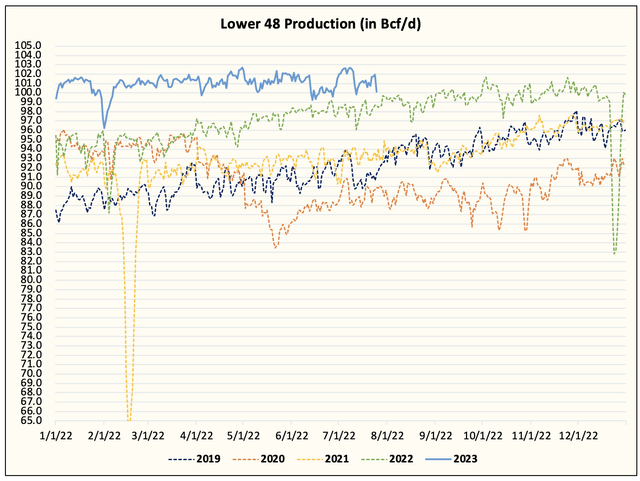

On the supply side, Lower 48 gas production remains constrained. Part of this is related to the receipt restrictions on Transcontinental Gas Pipeline. IHS estimates 7 Bcf was restricted in the month of July because of this.

IHS, HFIR

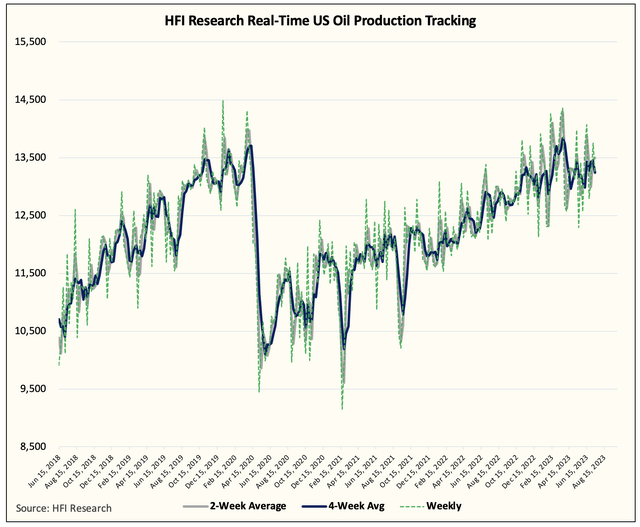

In addition, Lower 48 gas production is likely to remain flat through the end of the year as associated gas production slows. U.S. shale oil producers continue to shed rigs and with servicing cost inflation starting to bite into capex budgets, we believe more rigs will be slashed.

And looking at our real-time U.S. oil production proxy, we see downward pressure on U.S. oil production going forward.

HFIR

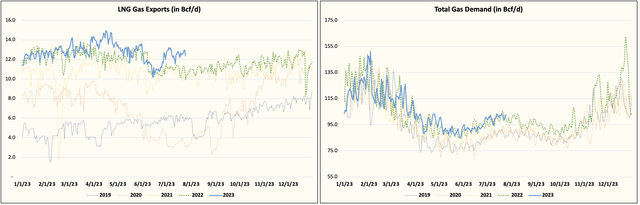

This means that for the natural gas market, the slower production will prove to be a tailwind just as demand starts to outpace 2022. LNG gas exports will be a big swing factor going forward and as demand outpaces supply growth, we think markets should tighten into the end of the injection season.

IHS, HFIR

All of this means that natural gas has an upside until a certain point. Given the bloated storage still, we see an upside to $3.25/MMBtu, but that’s about it.

EIA, HFIR

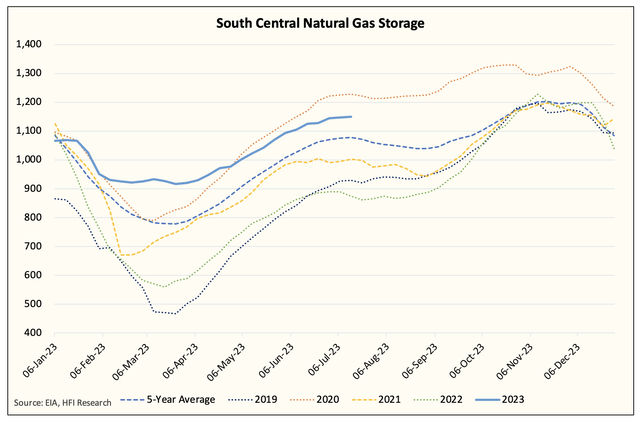

One of the main limiting factors continues to be the bloated South Central gas storage levels we see. While we will avoid another 2020 scenario by November, traders will still see no incentive to bid prices well beyond $3.25.

For readers debating between allocating capital to oil and natural gas producers, we continue to advocate for oil names. Please see our trade alerts yesterday.

For now, the natural gas market is in a comfort zone. Storage injections over the next few weeks will come in below the 5-year average, fundamentals are tightening, but because overall storage levels remain bloated, prices will be capped. The dark days are definitely behind us, but we still have ways to go before the bulls can celebrate much higher prices ahead.