Ales_Utovko

Executive Summary

Incorporated in 1993, Immersion Corporation (NASDAQ:IMMR) is one of the leading developers and licensors of haptic technology. Haptic technology is one that allows users to “feel the experience” by creating a sensation through force, vibration and motion when users interact with haptic devices. For e.g. joystick vibration when your in-game car hits an object. It is primarily utilized in the automotive, mobile and gaming space today but may have broader use cases in other industry verticals and consumer experiences in the future. Some of its licensees include Microsoft (MSFT), Sony (SONY), Vishay Intertechnology and Motrex. Haptic technology is in the early stages of development but has potential to grow in tandem with the secular tailwinds in virtual reality and experiences.

While the technology is exciting and holds promise, Immersion as a company is less so. I have concerns around the viability of Immersion’s business model, its historical and forward financial performance, as well as the number of lawsuits it has accumulated over the years. Even at a relatively cheap valuation of 9.5x FWD P/E and 0.5x FWD PEG, I would not consider investing in the company as I do not believe that it is a sustainable business for years to come. I rate Immersion as a SELL.

Business model

Immersion makes a significant majority of its revenue from royalties and license. From its latest 1Q23 financials, royalties and license fees comprise 99% of Immersion’s total revenue. For instance, Immersion has recently signed a license agreement with Motrex to incorporate its haptic technology within Motrex’s automotive interfaces. The benefits of licensing are clear – Immersion does not need to be concerned about producing, marketing and packaging its technology to end consumers. Also, by working with different licensees, it is able to build a brand name for itself in different segments and geographies faster than it would if it had developed the products itself. This is why unlike most growth tech stocks, Immersion is able to generate enviable profits at its scale. As of 1Q23, Immersion had 46% EBIT margins and 117% net margins (mostly due to a tripling of net interest income vs 1Q22 which is likely to be one-off) on a $7m quarterly revenue.

On the flipside, there are also considerable disadvantages in a licensing model. Firstly, Immersion is entirely reliant on its licensees to commercialise its technology. As we know, haptic technology is still in a relatively nascent adoption and development stage. Hence, there is no certainty that Immersion can collect a significant amount of royalties in the future, especially as patents expire over time. Secondly, there is a heightened risk of intellectual property (“IP”) theft where Immersion loses partial or full control over its innovation to its licensees. Where disputes occur, additional legal costs may also be incurred to fend off these attacks.

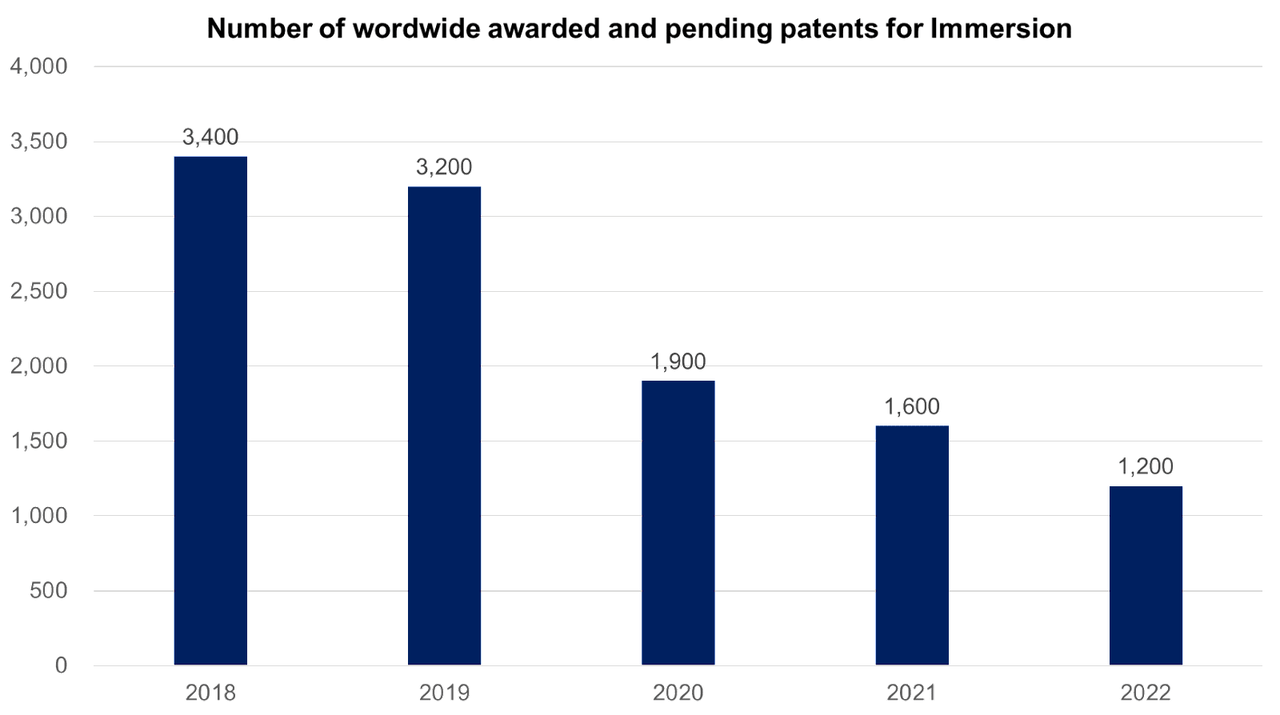

Lastly and most importantly, Immersion is highly reliant on its patents and IP to be successful in its core markets since it does not sell products directly to end consumers. I am concerned about this dependency on 3 folds. Firstly from Immersion’s FY18 to FY22 annual reports, the number of awarded and pending patents have been on a declining trend. While not disclosed, it is likely that some of the patents have not been successfully awarded or have expired.

Author’s representation using data from Immersion’s annual reports

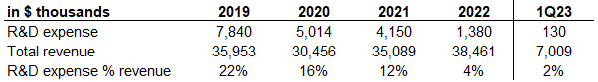

Secondly, Immersion’s revenue is distributed globally. Based on its full year FY22 revenue, it makes 62% of its revenue in Asia (mostly Japan and Korea), 28% in North America and 10% in Europe. In the event of any infringements, Immersion would need to fight long drawn out legal battles across multiple jurisdictions. This is not far-fetched because Immersion has been fighting numerous lawsuits over the years. Lastly, Immersion has been dialing back on its R&D expense over the years. This makes it increasingly harder for Immersion to come up with innovative solutions in the haptic technology space and it would need to rely on its earlier innovative efforts and patents to continue charging licensees.

Author’s representation using data from Immersion’s annual reports

The combination of a dependency on licensees to commercialise its technology and a lack of continued investment to drive innovation makes me concerned about the sustainability of Immersion’s business model in the long-term.

Financial performance overview

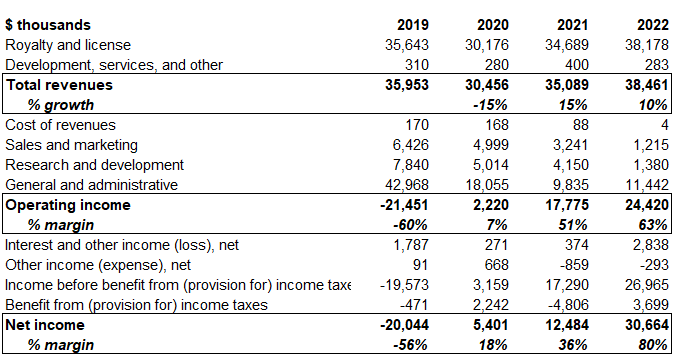

Author’s representation using data from Immersion’s annual reports

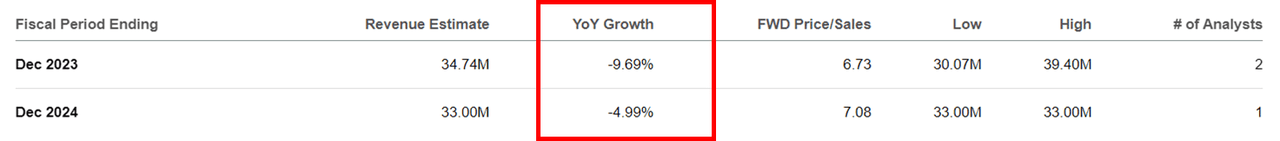

Seeking Alpha

Starting with Immersion’s top-line, Immersion has barely grown its revenue since FY19. Based on analysts revenue estimates, this is further expected to decline in the next 2 years to $33 million, implying zero top-line growth up till FY24. With the haptic technology space expected to grow by 11.6% CAGR from 2023 to 2032, I found the lack of revenue growth to be a major red flag. This implies that Immersion is bleeding market share to competitors and its technology and/or licensing business model is losing appeal in the market.

Moving onto profitability, I am impressed that Immersion has been able to steadily improve its operating margin from -60% to 63% and net margin from -56% to 80% in a short span of 3 years from FY19 to FY22. This is no easy feat as most tech companies have struggled to stay profitable. I believe that this is a positive trade-off from adopting the licensing model since Immersion can save costs from producing, marketing and packaging its technology to end consumers. This is supported by the declining sales and marketing costs from $6.4m in FY19 to $1.2m in FY22.

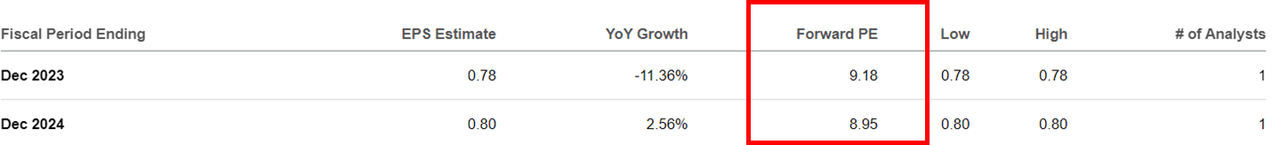

However, I do not believe that the high margins that Immersion has enjoyed over the past 2 years are sustainable in the long-run due to the sharp decline in R&D expenses, which could erode its pricing ability over time. Also, there is a considerably high chance that Immersion could rack up sizable litigation expenses given its dependency on the licensing model and patents. Long drawn out legal disputes such as the one they are having with Meta (META) since 2022 could not only distract management but also hurt margins if they do not at least reach a settlement. The decline in margins is also anticipated by 1 analyst who is projecting a 11.4% decline in EPS (higher than the 9.7% decline in revenue) in FY23.

Seeking Alpha

A few other items in the P&L also caught my eye. Firstly, Immersion has a fairly sizable stock-based compensation expense of $3.4 million in FY22 which represents ~24% of total operating expenses. To reiterate, this is ~2.5x the amount that management is willing to spend on R&D. Secondly, the company has a significant amount of interest and other income of $2.8 million which is ~7% of total revenue. This is due to the $150 million worth of cash and investments sitting on its balance sheet as of FY22. While I applaud the company for maintaining a robust balance sheet, I found it strange that the company has chosen to invest in US treasuries and marketable securities rather than in the company itself. This made me question if the company is positioning itself as a short-term target for M&A instead of a company that is positioned to win in the haptic technology space in the long run.

History of legal lawsuits

Since the early 2000s, Immersion has been involved in numerous legal lawsuits with high profile companies such as Microsoft, Sony, Apple (AAPL), Meta Platforms and Valve, just to name a few.

|

Year |

Company |

Summary |

Outcome |

|

2002 – 2007 |

Immersion sued Sony and Microsoft for patent infringement related to the use of vibration functions in their game console controllers |

Sony paid $150 million while Microsoft paid an undisclosed amount |

|

|

2018 |

Immersion sued Apple for patent infringement related to the use of haptic feedback in the iPhone 6s |

Apple paid an undisclosed amount |

|

|

2022 |

Immersion sued Meta for patent infringement related to the use of force-feedback technology in the Meta Quest 2 headset |

Ongoing case |

|

|

2023 |

Immersion sued Valve for 7 patent infringements related to the use of vibration functions in the Steam Deck and Valve Index gaming hardware |

Ongoing case |

|

|

2023 |

Immersion is seeking injunction against Xiaomi in Germany, France and India for infringing its patents pertaining to use of haptic effects in Xiaomi’s phone |

Ongoing case |

While Immersion managed to reach a settlement with most of these players, it is not certain that Immersion can continue to do so in the future. A noteworthy point is that most of these players are headquartered in the US while the majority of Immersion’s revenue comes from Asia (mostly from Japan and Korea). Across other legal jurisdictions, there are few cases that Immersion has launched and almost no track record of it achieving success. Furthermore, as I have elaborated above, I have doubts over Immersion’s business model and its attempts to increase the number of patents in order to “force” other tech companies to enter into partnerships or settlements with it. This is neither a commendable nor sustainable way to increase profits.

Valuation

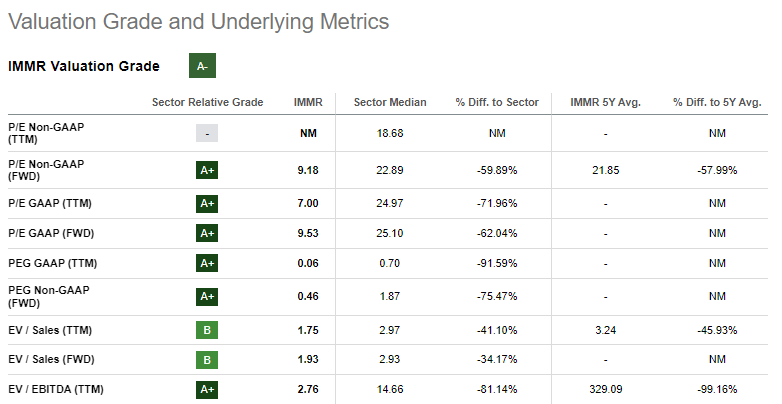

Seeking Alpha

From a valuation perspective, Immersion looks fairly cheap. It is trading at a forward P/E of 9.5x and forward PEG of 0.5x. Seeking Alpha has assigned a A- grade for Immersion’s valuation grade. With EPS forecasted to fall in FY23 and FY23, its forward P/E is expected to be even cheaper at today’s price.

Seeking Alpha

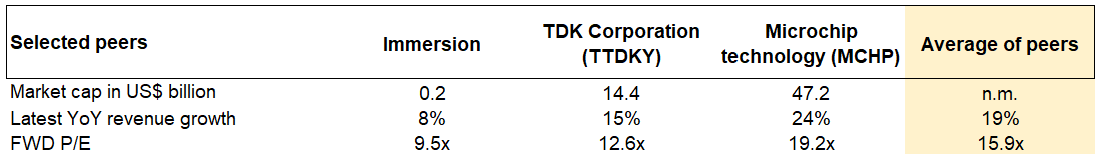

Due to the volatility of Immersion’s operating margins and future free cash flow, I have decided to use peer multiples to evaluate Immersion instead. As the haptic technology space is relatively niche, it is challenging to shortlist true peers to Immersion. As such, I have chosen key players that incorporate haptic technology in their solutions and products. They are TDK Corporation (OTCPK:TTDKY) and Microchip Technology (MCHP). This is an imperfect peer set as the peers are much larger than Immersion and their business model is not entirely focused on haptic technology.

Author’s representation using data from Seeking Alpha

As a point of reference, both of these peers are trading at a ~50% higher valuation in terms of forward P/E than Immersion (average of 15.9x FWD PE) but they also exhibit >2x revenue growth rates than Immersion (average of 19% YoY revenue growth). As such, notwithstanding an imperfect peer set, I believe that Immersion is slightly undervalued at today’s price.

Conclusion – Is Immersion a BUY, HOLD or SELL?

While Immersion has exhibited strong profitability metrics in the last 2 years and looks slightly undervalued when compared against its peers, I am not convinced that it is a long-term buy. I am concerned about the sustainability of its business model, history of lawsuits and stagnating growth. With no growth expected in both top and bottom-line in the next 2 years, I am struggling to find a silver lining for Immersion.

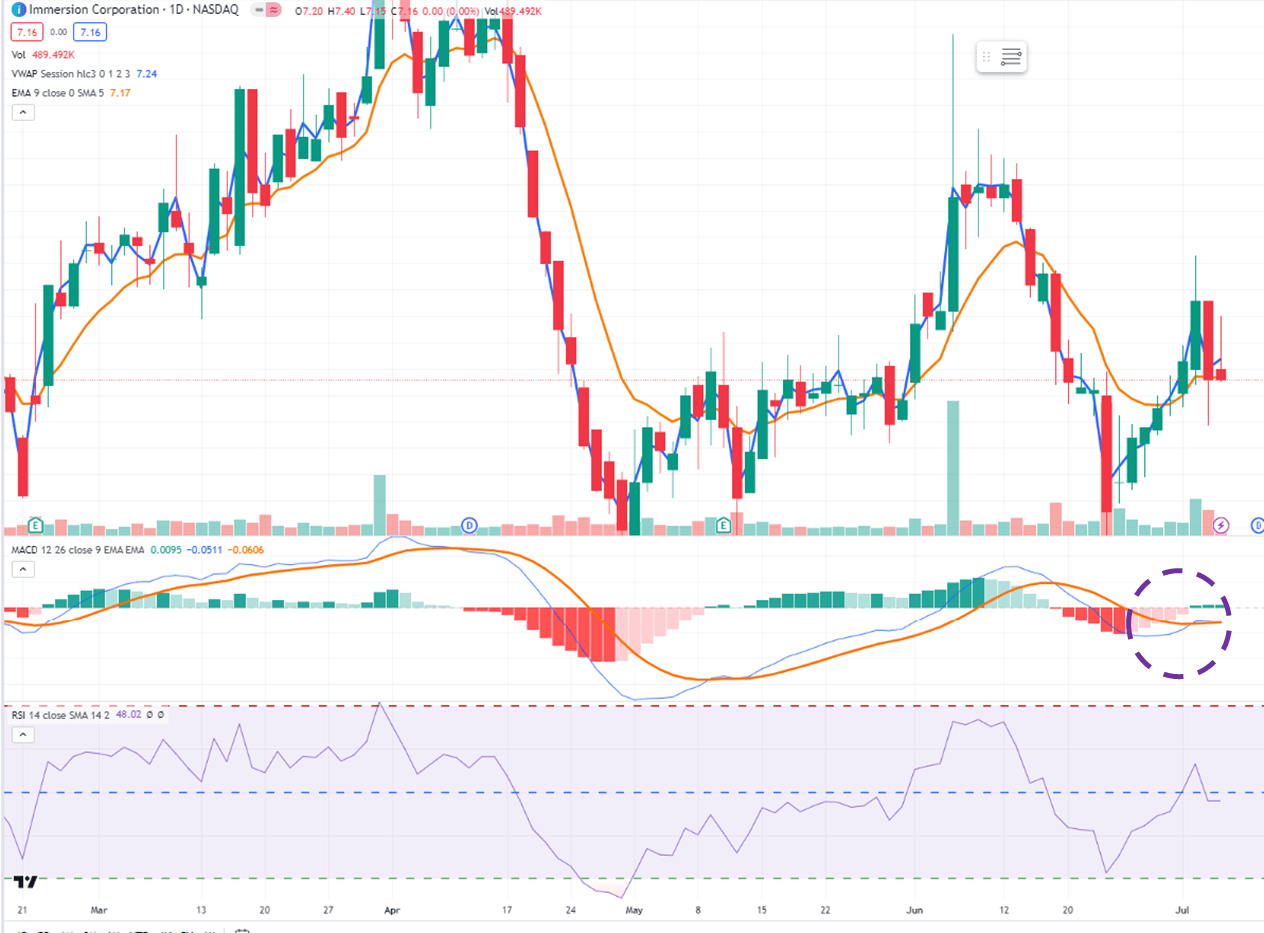

With that in mind, I would consider Immersion as a stock to trade and not for investment especially if you are a long-term growth investor. With pending patent lawsuits that Immersion may likely get to a settlement given its track record, I would not be surprised if Immersion share prices react positively to those news. From a technical perspective, the MACD line has recently barely crossed the signal line below the 0 line, albeit low volumes on the daily chart. There might be some bullish momentum in the horizon.

Tradingview

In closing, I reiterate my SELL rating on Immersion. Unless there is a significant improvement in top-line performance and renewed focus by management towards R&D investments, I do not see myself revising my rating anytime soon.